If you’re looking to streamline your tax receipt process, using a free template is a great way to get started quickly. These templates are designed to help you generate clear, professional receipts for your transactions, whether for personal use or business purposes. With the right format, you can ensure that all the necessary details are captured, making tax filing easier.

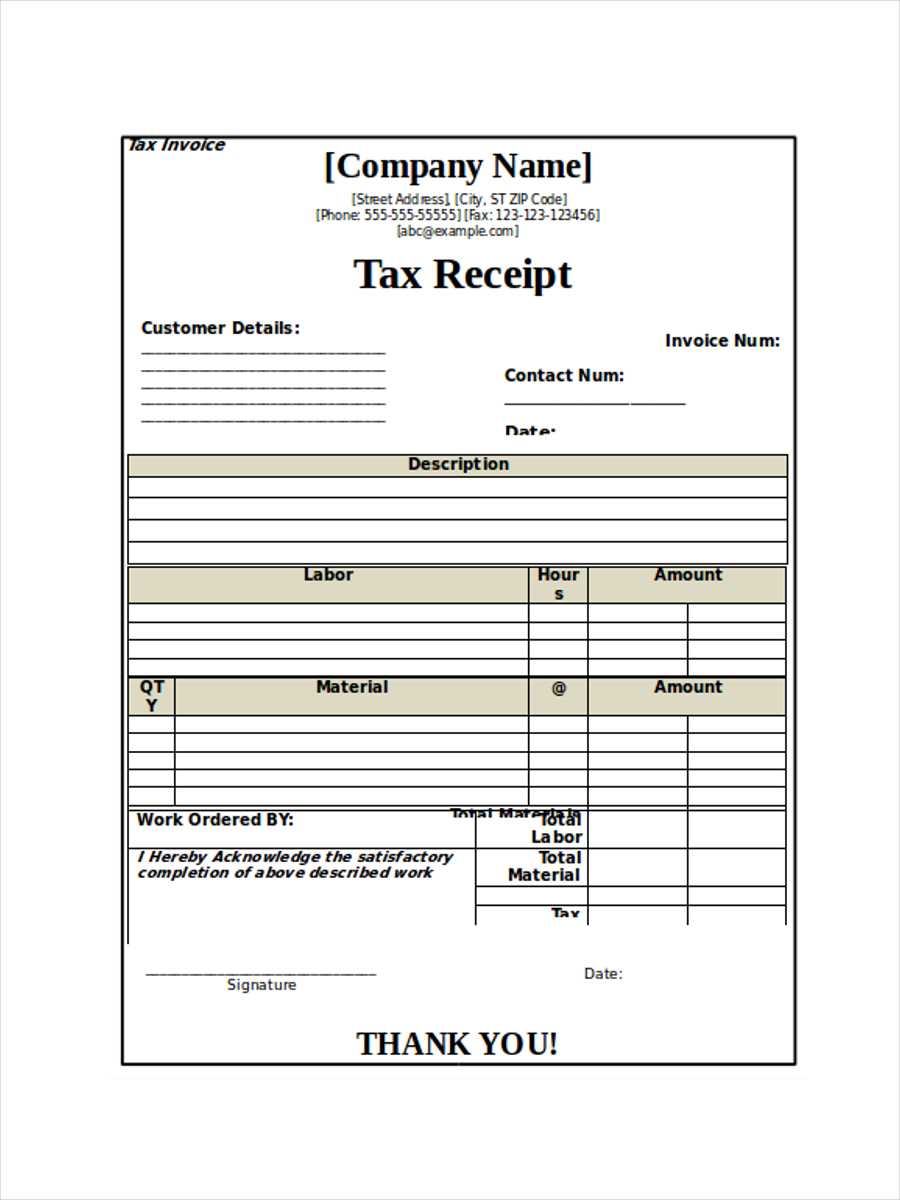

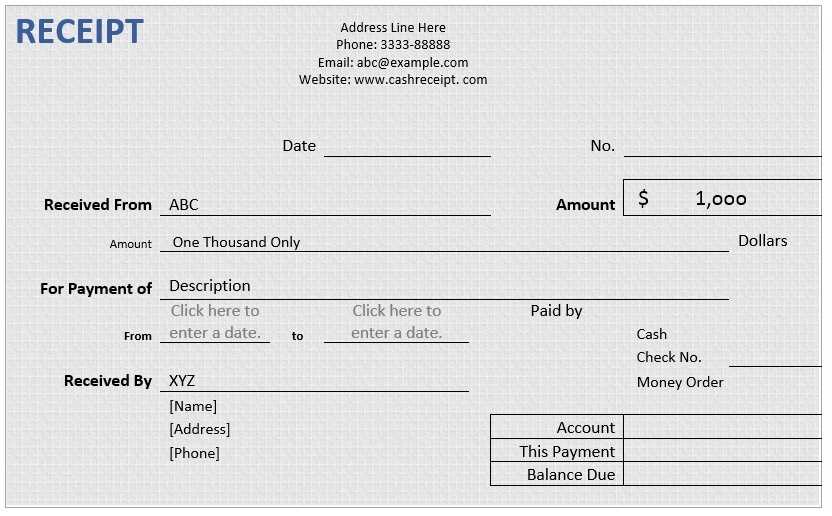

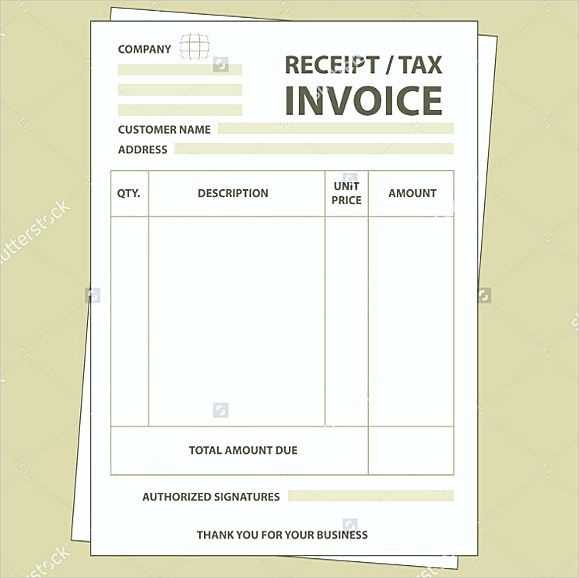

A well-structured tax receipt should include the date of the transaction, the amount paid, the payer’s information, and the nature of the payment. You can find several free templates online that meet these criteria and can be easily customized to fit your needs. Make sure the template you choose includes spaces for both the payer and payee information, payment method, and a detailed description of the service or goods provided.

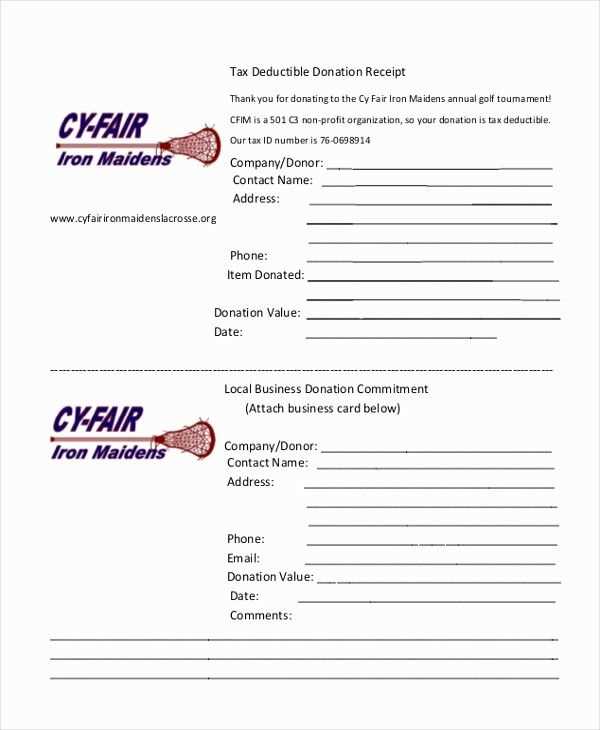

Using a template saves time, reduces errors, and ensures consistency across your receipts. Instead of creating each receipt manually, you can simply fill in the relevant fields. Whether you’re issuing receipts for donations, freelance work, or other services, a free template is a simple, no-cost solution to keep your records organized and compliant with tax laws.

Here’s an option with minimized repetition:

To create a tax receipt that is clear and easy to read, focus on including only the necessary details. Include the date of the transaction, the amount, and a breakdown of the goods or services provided. Limit redundant information, such as repeating business addresses or payment terms. Keep your formatting consistent for a clean presentation.

Key Sections to Include

Start with the business name and contact information at the top, followed by the recipient’s details. Then, list the items or services purchased with the corresponding prices. Add the total amount, taxes applied, and the method of payment used. Finish with a thank-you note or any other relevant details, keeping each section distinct and non-repetitive.

Final Tips

Use clear headings and bullet points for easy reading. Avoid using complex language or unnecessary wording. Make sure that the layout is simple and accessible on both digital and printed formats.

Tax Receipt Template Free

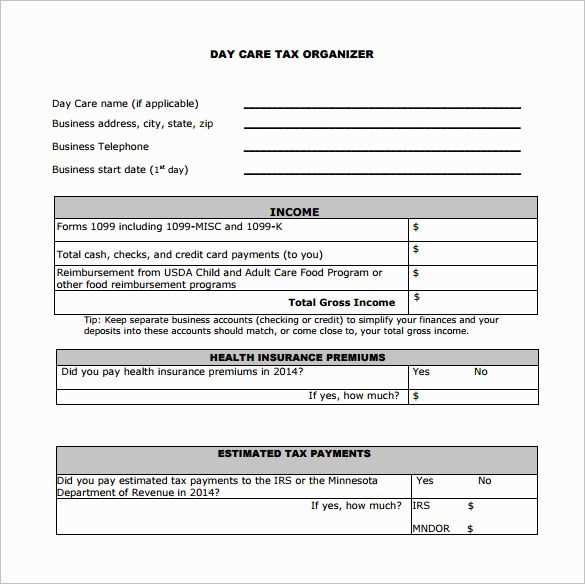

Creating a tax receipt template for your business doesn’t need to be complicated. Use clear and simple information that your clients will recognize. A good tax receipt should include the following key details: the name of your business, date of the transaction, description of the service or product provided, the amount paid, and the tax rate applied. Adding a unique receipt number helps with tracking. Additionally, ensure that the receipt includes contact information for your business and any applicable business identification number.

How to Create a Custom Tax Receipt for Your Business

When designing a custom tax receipt, you can use tools like Microsoft Word or Google Docs to create one from scratch. If you prefer a more structured approach, use Excel or Google Sheets to add columns for each piece of required information. Make sure the layout is clean, easy to read, and clearly differentiates between different sections, such as product details, taxes, and totals. For a professional touch, include your logo and branding to make the receipt recognizable and aligned with your company’s image.

Where to Find Reliable Free Tax Receipts Online

If you’re looking for a free tax receipt template, several websites offer customizable options. Websites like Template.net, Invoice Generator, and Canva provide downloadable templates that can be personalized to suit your business needs. Simply search for “free tax receipt template” and select one that matches your requirements. These sites often allow you to input your details directly into the template, making it quick and easy to generate a professional receipt.

Always ensure that the templates you download are legally compliant with local tax regulations, and double-check that the information fields match your specific needs before using them regularly for your business transactions.

Key Elements for Accurate Documentation in a Tax Receipt Template

Accurate documentation is essential for both your records and your client’s reference. In addition to the basics like date, amount, and tax rate, include a brief description of the product or service sold. For businesses with a physical location, the address and phone number should be on every receipt. Don’t forget the method of payment (cash, card, etc.), and if applicable, any additional fees such as shipping or handling charges. Properly documenting these details will help you stay organized and avoid any potential tax issues down the road.