Creating an invoice receipt template simplifies your workflow and keeps your financial records organized. With a clear and structured format, you can ensure accurate tracking of transactions and payments. A simple yet professional template allows you to streamline the process of issuing receipts, saving you time while maintaining consistency.

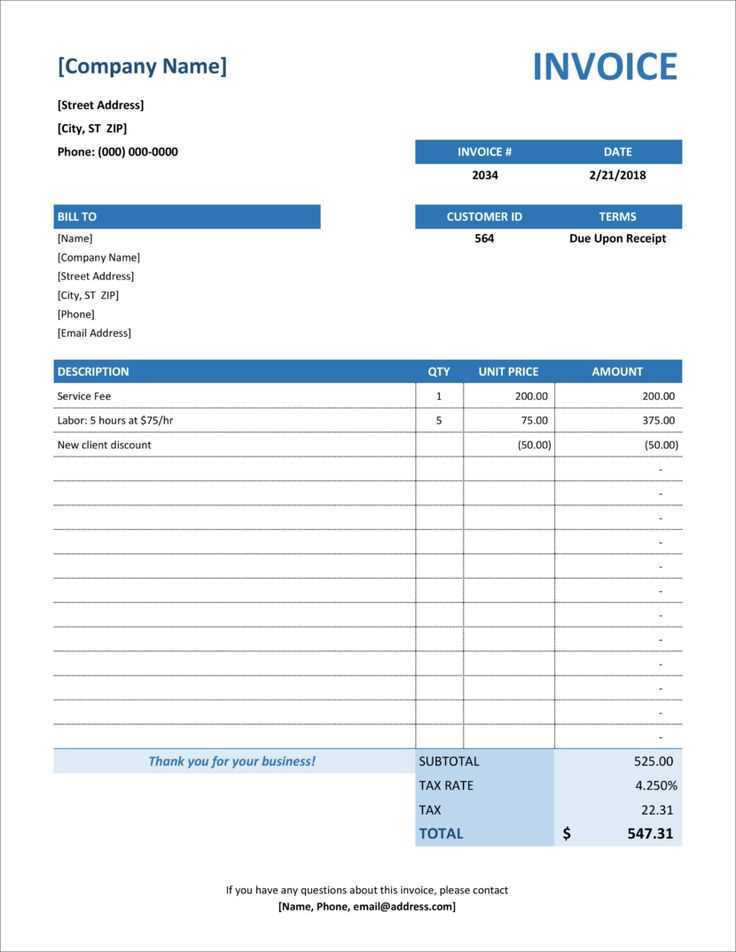

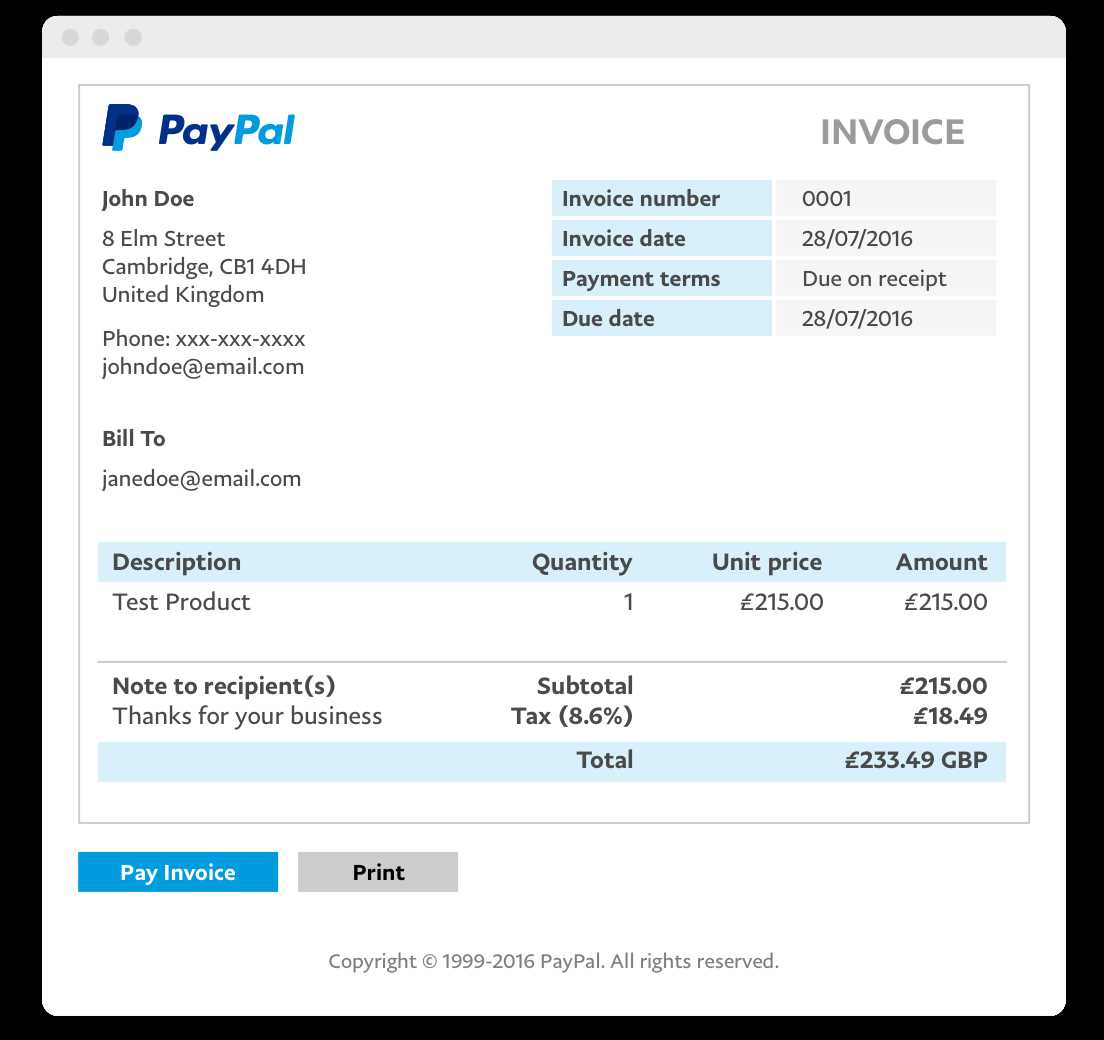

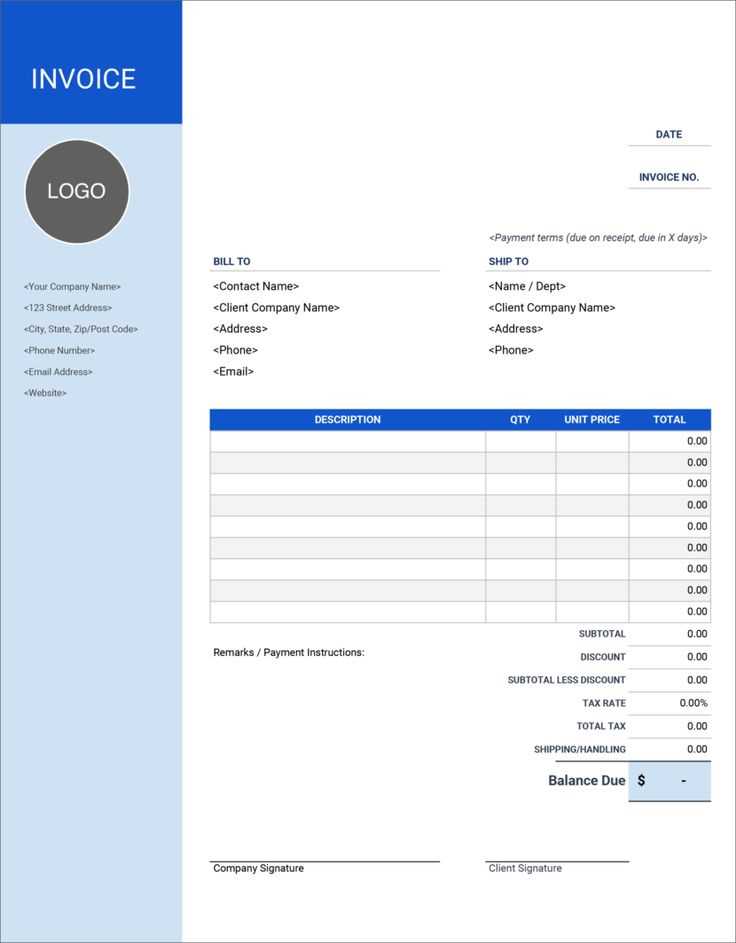

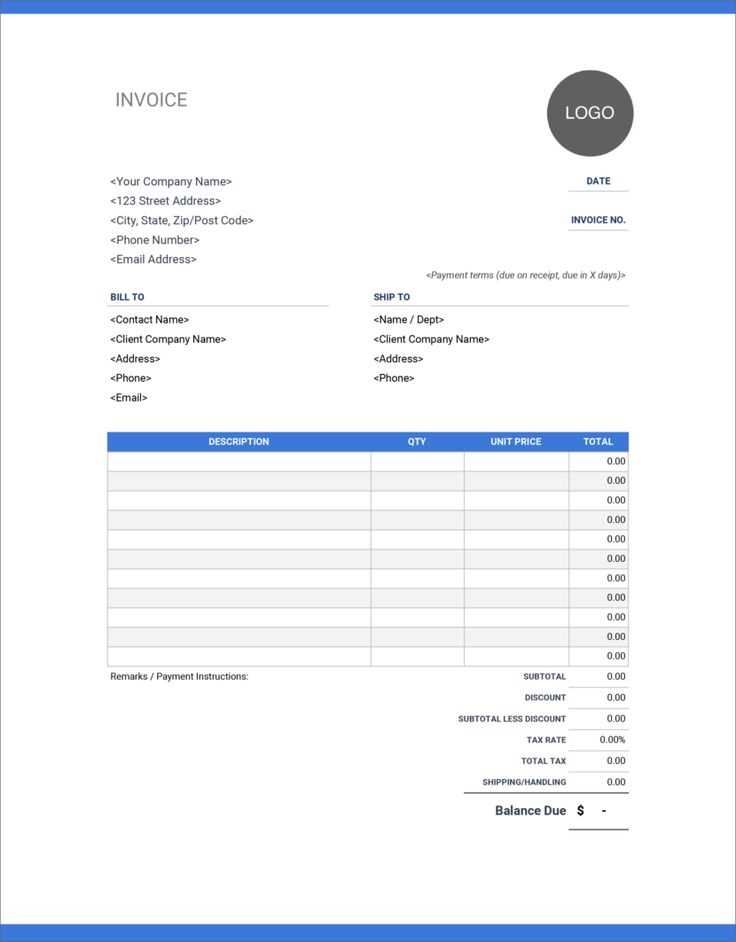

The template should include key details such as invoice number, date of issue, customer details, and a breakdown of the amount paid. Including payment methods and transaction references ensures that all necessary information is captured. A concise design helps prevent confusion and provides a clear overview for both parties.

Incorporate clear headings and logical sections to improve readability. Make sure to include a payment due date if applicable and space for additional notes or terms. You can customize the template to suit different types of transactions, whether it’s for a one-time service or a recurring agreement. This flexibility allows for seamless integration into various business models.

How to Create a Legally Valid Invoice Receipt

Include the legal name and business address of the seller. This ensures the transaction is traceable to a specific entity. Provide the buyer’s details as well, such as their name or company name and address. This helps confirm the parties involved in the exchange.

List the products or services provided, including the quantity, description, and unit price. This clarifies what was delivered or completed during the transaction. Make sure to add the total amount due, including any applicable taxes or fees, in a separate line to avoid confusion.

Tax Identification Number

Incorporate the seller’s tax identification number (TIN) if required by local laws. This confirms the business’s legitimacy and allows proper reporting to tax authorities. Some regions may require the buyer’s TIN as well, particularly in B2B transactions.

Invoice Date and Payment Terms

Include the issue date of the invoice and clearly state the payment terms. Specify the due date and any penalties for late payment. This provides both parties with a clear understanding of the timeline and avoids potential disputes.

Common Mistakes to Avoid When Filling Out an Invoice Receipt

Double-check the details before finalizing your invoice receipt. Here are some common mistakes to avoid:

1. Missing or Incorrect Contact Information

- Ensure both your business and the recipient’s details are accurate, including addresses, phone numbers, and email addresses.

- Verify that the recipient’s information matches the one provided in the initial agreement or transaction.

2. Incorrect Invoice Date

- Double-check the date on your receipt. An incorrect date could cause confusion or delay in payment.

- If you’re working with recurring invoices, ensure the correct billing cycle is indicated.

3. Not Including Payment Terms

- Clearly state the payment due date and any applicable late fees for overdue payments.

- Specify accepted payment methods to avoid any misunderstandings.

4. Failing to List Itemized Charges

- Break down the products or services provided with individual prices. This helps the recipient understand exactly what they are paying for.

- Ensure that the quantities and pricing are accurate, with no omissions.

5. Leaving Out Tax Information

- Clearly show the tax rate applied to the total, and ensure it’s in compliance with local regulations.

- If the transaction is tax-exempt, mention that explicitly on the invoice receipt.

6. Not Including Invoice Number

- Assign a unique invoice number for easy reference and tracking.

- Ensure this number follows a consistent pattern for organization purposes.

Customizing Your Invoice Receipt Template for Different Business Needs

Adjust your template to align with the specifics of your business, whether you’re in retail, service, or subscription-based industries. Tailor the design by adding relevant fields like item descriptions for product-based businesses or service details for consultancy firms.

For businesses offering subscriptions, include recurring billing dates, payment cycles, and renewal information. Make sure to highlight the service terms or subscription details clearly for customers’ reference. Add a section for discounts, taxes, and shipping fees to make invoices transparent and easy to understand.

If you provide services rather than physical goods, consider removing itemized descriptions and instead focus on labor hours, hourly rates, or project milestones. This will make the receipt more suitable for clients who need detailed information about the work performed.

For businesses with different pricing tiers, incorporate a customizable pricing section. This can reflect varying rates for different customer categories or offer promotional pricing details, ensuring each customer receives an accurate breakdown.

Finally, ensure that your contact information, payment terms, and refund policies are included and easily accessible, reflecting your business’s specific practices. Keep the design simple yet informative, focusing on what your customer needs to know without cluttering the layout.