For a seamless transaction process, ensure your invoice receipt template is clear, concise, and compliant with Australian regulations. Use the correct format to avoid any legal issues or confusion down the line.

Include all necessary details. A receipt should feature the business name, ABN (Australian Business Number), the date of transaction, description of the goods or services, total amount paid, and payment method. This keeps everything transparent and easily verifiable for both parties.

Provide accurate tax information. Make sure to include GST (Goods and Services Tax) if applicable. If you are registered for GST, show the tax amount separately on the receipt. This helps clients keep track of their own tax obligations while maintaining clear documentation for tax reporting.

Using a template that incorporates these components simplifies invoicing, making it easier for you and your customers to handle financial records. Consider creating or downloading a template that fits your needs, whether you prefer a digital or printed version for different types of transactions.

Here is the corrected version, where the same word is repeated no more than 2-3 times:

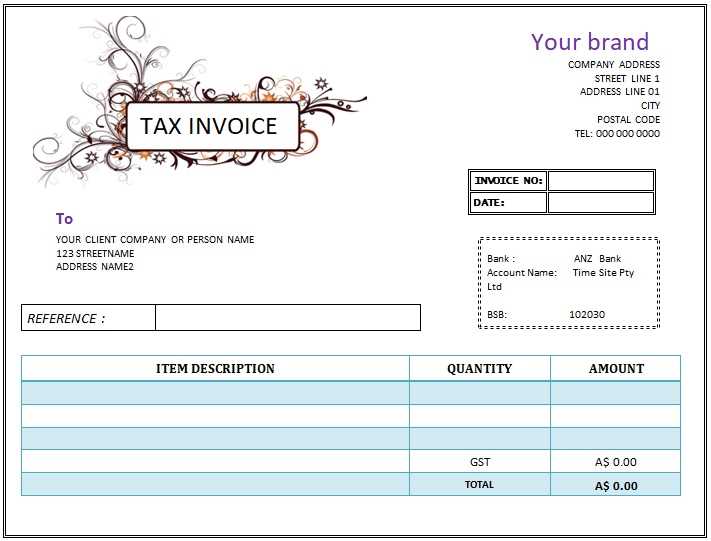

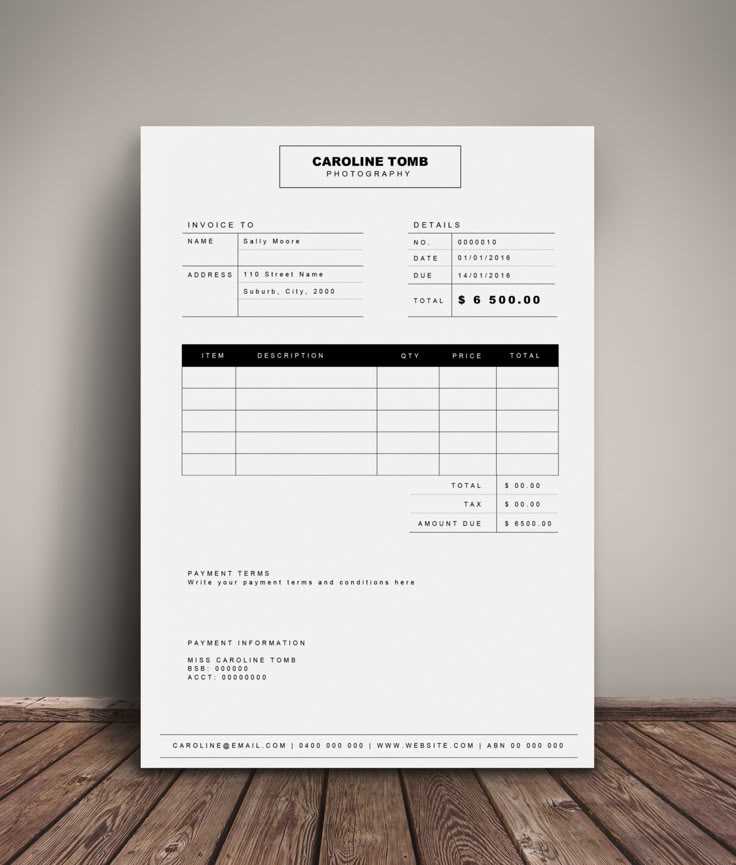

Keep your invoice receipt template clear and concise. Focus on presenting the most relevant information while avoiding redundancy. Make sure to include the key details such as the seller’s name, buyer’s name, transaction date, total amount, and a breakdown of items or services provided. Ensure that the tax amount and payment terms are also highlighted.

Key Elements of an Invoice Receipt

The template should be structured so that it’s easy to read. Use bold formatting for the headings such as “Invoice Number,” “Due Date,” and “Amount Due.” This allows the recipient to quickly find the necessary details without searching through the document. Place important fields like the tax rate and total amount prominently.

Formatting Tips

Avoid repeating words like “invoice” or “receipt” in every line. Use variations when needed, and keep your sentences fluid to maintain readability. For example, instead of repeating “total” multiple times, use “final amount” or “amount due.” This ensures the template remains professional and uncluttered.

- Invoice Receipt Template Australia

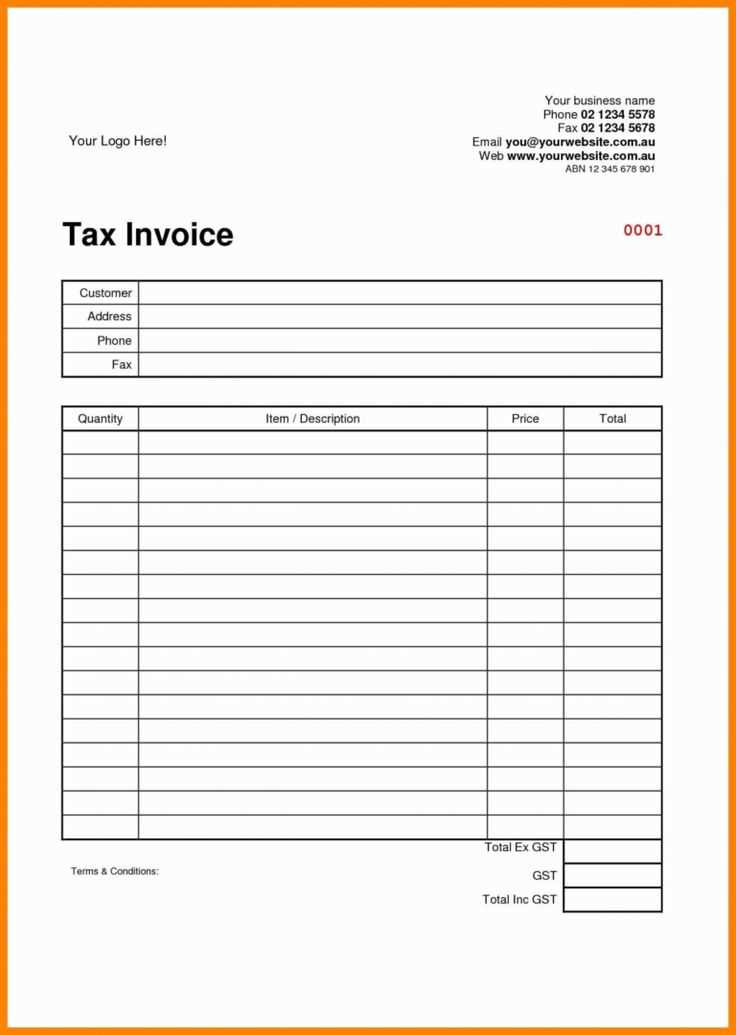

For an accurate invoice receipt template in Australia, ensure the following fields are clearly outlined:

1. Business Information: Include your business name, address, phone number, and Australian Business Number (ABN). This establishes your identity and legitimacy.

2. Client Details: Record the customer’s name, address, and contact details. This ensures proper communication and traceability.

3. Date of Issue: Clearly state the issue date of the receipt. This helps track transaction timelines and assists in accounting processes.

4. Invoice Number: Assign a unique invoice number for each transaction. This simplifies tracking and referencing invoices for both parties.

5. Description of Goods/Services: Include a detailed list of products or services provided, along with their respective costs. This transparency prevents misunderstandings and ensures all items are accounted for.

6. Total Amount: Clearly list the total amount due, inclusive of taxes where applicable. Australian businesses often use GST-inclusive or GST-exclusive pricing, so make it clear which method is used.

7. Payment Terms: Specify the payment method (e.g., bank transfer, credit card) and due date. Clearly stating these terms helps prevent payment delays.

8. GST Breakdown: If applicable, break down the GST (Goods and Services Tax) component separately. This is a legal requirement for GST-registered businesses.

9. Signature: If needed, add a space for both parties to sign. While not mandatory in many cases, it can serve as additional confirmation of receipt.

10. Footer: Include a footer with any other relevant details, such as your payment terms or refund policy. This ensures the customer is fully informed about the transaction.

By including these elements, you create a receipt that’s both legally compliant and easy to understand, promoting smoother transactions with your clients.

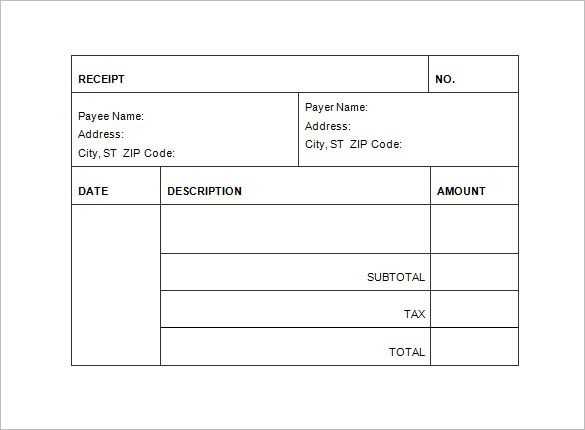

A straightforward receipt template helps ensure accurate financial records for small businesses. Follow these steps to create a basic but functional design:

1. Include Basic Information

Your receipt should clearly identify your business and the transaction details. Include the following elements:

- Business name and contact details (address, phone, email)

- Receipt number for tracking

- Transaction date and time

- Buyer’s name (if applicable)

2. List Products or Services

Specify the purchased items or services, along with their corresponding prices. A simple table structure can help maintain clarity:

| Item Description | Unit Price | Quantity | Total |

|---|---|---|---|

| Product A | $10.00 | 2 | $20.00 |

| Service B | $50.00 | 1 | $50.00 |

| Subtotal | $70.00 | ||

| Tax (10%) | $7.00 | ||

| Total | $77.00 | ||

This layout ensures clarity and provides a transparent breakdown of the transaction. Adjust the table based on your business needs, whether for physical goods or services.

Finally, add a section for payment details such as the method of payment (cash, credit, etc.) and the total amount received. Include a thank-you note or a reminder about return policies, if relevant.

In Australia, businesses must adhere to specific legal requirements for issuing invoice receipts. The ATO (Australian Taxation Office) mandates that invoices meet certain criteria to be considered valid for tax and accounting purposes. This applies to both GST-registered businesses and those that aren’t required to register for GST.

Key Invoice Requirements

For an invoice receipt to be legally compliant in Australia, it should contain the following information:

– The seller’s name and ABN (Australian Business Number)

– The buyer’s name or business name (if applicable)

– The date of the invoice

– A clear description of goods or services provided

– The total amount charged, including GST if applicable

– A statement indicating whether GST is included or excluded (for GST-registered businesses)

Retention of Records

Businesses are legally obligated to retain invoices for a minimum of five years. This is crucial for tax purposes and to ensure compliance with the ATO’s record-keeping requirements. The invoices should be stored in a way that they are easily accessible if needed for audits or verification processes.

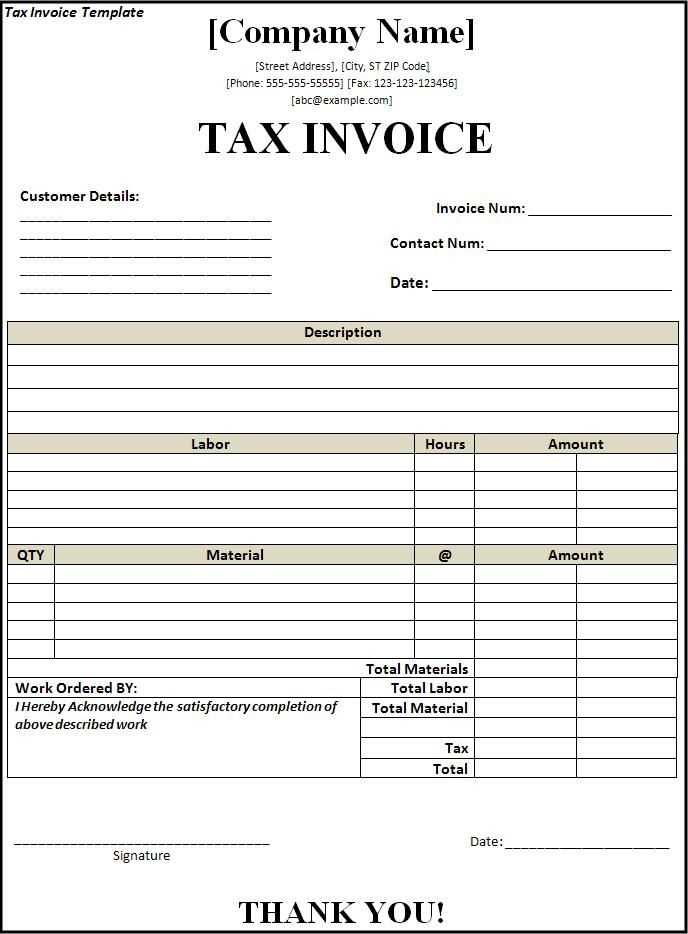

Customize receipt templates by focusing on industry-specific needs. For retail businesses, include product details, taxes, and applicable discounts. Use a clean layout to highlight items purchased, prices, and total amounts. In the hospitality industry, add sections for service charges, tips, and special promotions. For healthcare providers, list services rendered, insurance details, and patient information securely. Construction companies should ensure their templates account for job details, labor, materials, and subcontractor costs. Each industry benefits from templates tailored to specific legal or financial requirements, helping to avoid errors and streamline operations.

For restaurants, ensure your receipt template includes a breakdown of food items, beverages, and any add-ons. The template should be clear for both customer reference and accounting purposes. For beauty salons or spas, include session types, products used, and stylist details. This customization improves clarity and trust with customers. For service-based businesses like auto repair shops, include labor hours, parts used, and estimated future maintenance. Make sure each receipt meets legal standards, such as including GST or VAT where necessary. This ensures both compliance and professionalism across industries.

Invoice Receipt Template for Australia

For an accurate invoice receipt template in Australia, ensure the following components are included:

- Business Name and ABN: Clearly display your business name along with your Australian Business Number (ABN) for compliance.

- Invoice Number: Assign a unique invoice number to each receipt for tracking purposes.

- Date of Issue: Include the exact date the invoice was issued for clear documentation.

- Detailed Description: List the goods or services provided with relevant descriptions and quantities.

- Total Amount: Clearly state the total amount payable, including tax if applicable. Use a clear breakdown of charges.

- GST Details: If registered for GST, include the GST amount separately or indicate the total price inclusive of GST.

Formatting Tips

Maintain a clean, professional layout with clear headings and itemized lists. This helps both you and your client track payments easily. Use fonts that are legible and keep spacing consistent for readability.

Additional Recommendations

- Payment Methods: Specify accepted payment methods (e.g., bank transfer, credit card, PayPal).

- Terms and Conditions: Include any payment terms, such as due dates or late fees.