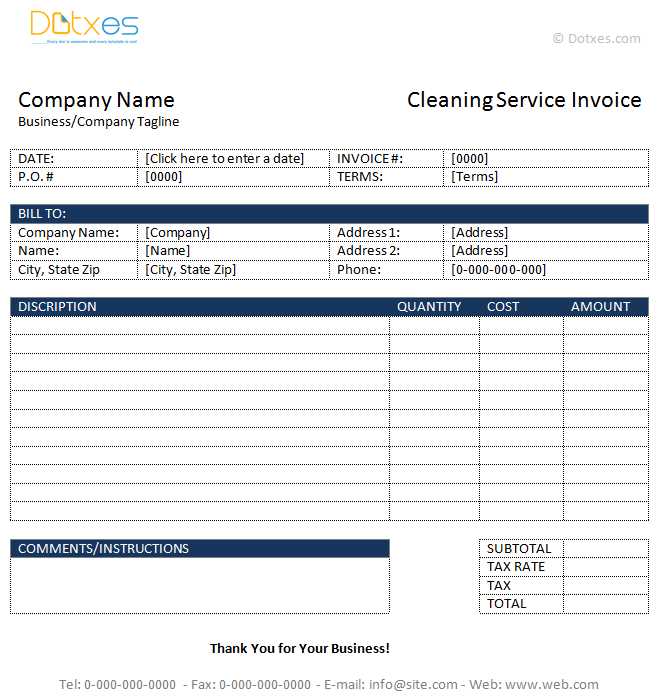

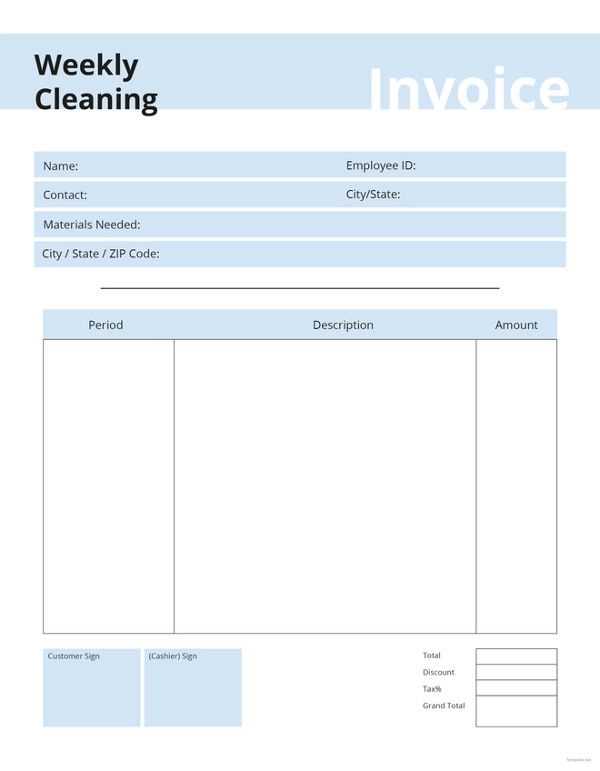

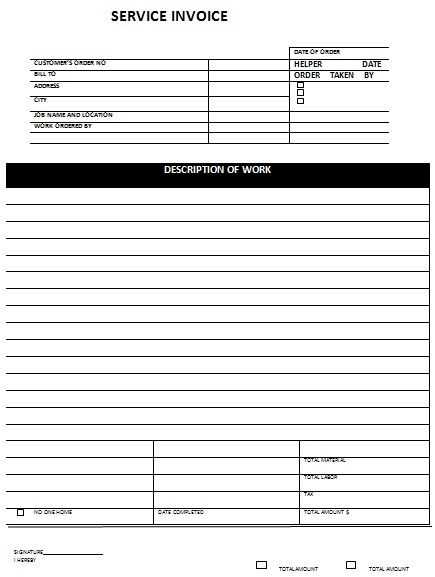

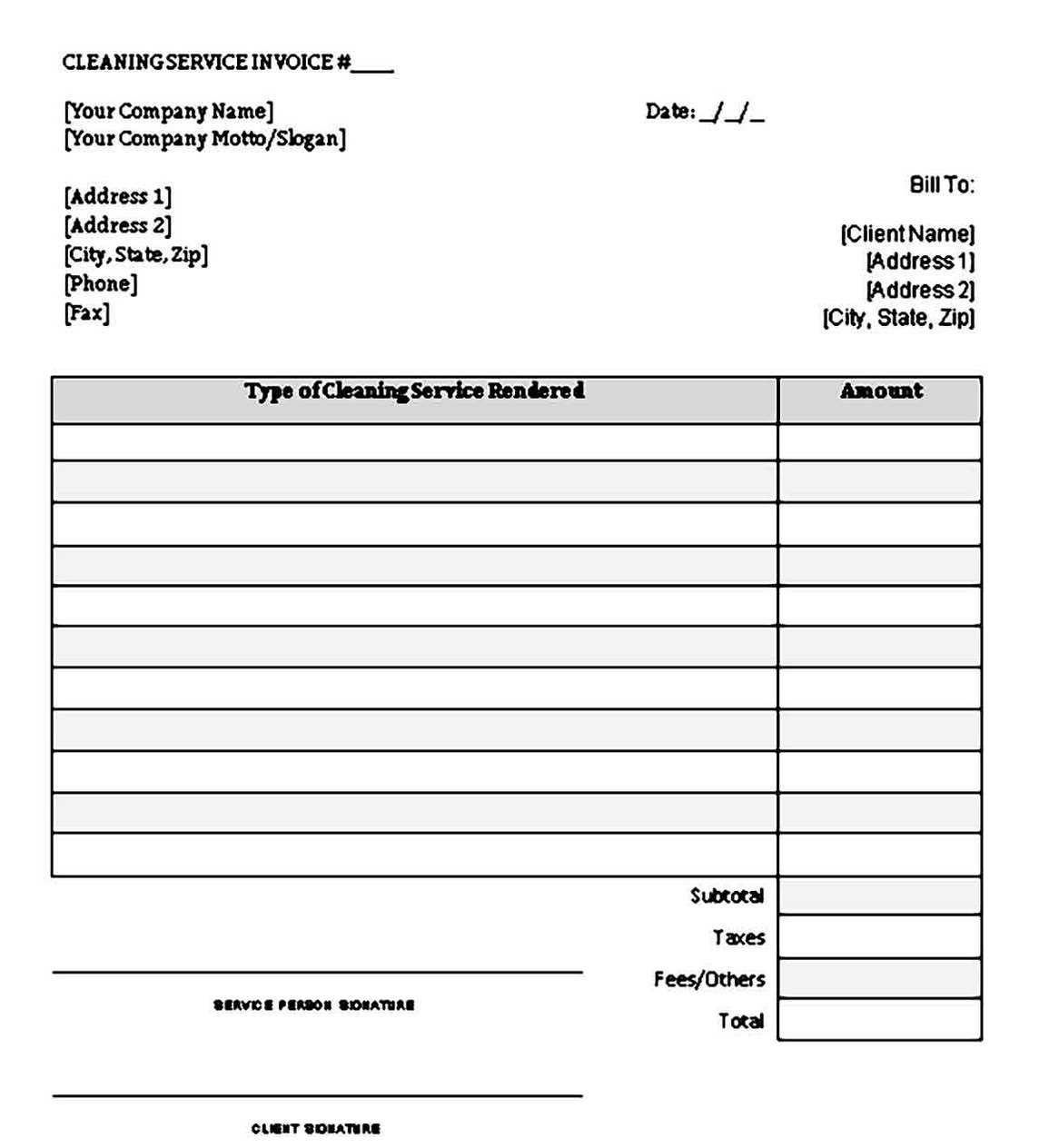

Use a clear and structured invoice receipt template to ensure smooth transactions between cleaning service providers and clients. A well-designed template saves time, prevents misunderstandings, and establishes professionalism in your billing process.

Include essential details such as the service date, client information, and itemized charges. Specify the cleaning tasks performed, hourly rates or fixed fees, applicable taxes, and total amount due. A structured format eliminates confusion and speeds up payment processing.

Ensure your template provides space for payment terms, including due dates and accepted payment methods. Adding a section for special notes allows you to highlight discounts, warranties, or any additional service agreements.

Digital templates in PDF, Word, or Excel formats offer flexibility. Customizable fields let businesses tailor invoices to their branding, while automation tools simplify recurring billing for regular clients.

Using a standardized invoice receipt template enhances transparency and reinforces trust with clients. A polished, professional format ensures your cleaning business maintains a reliable and credible image.

Here’s a version with redundancy removal:

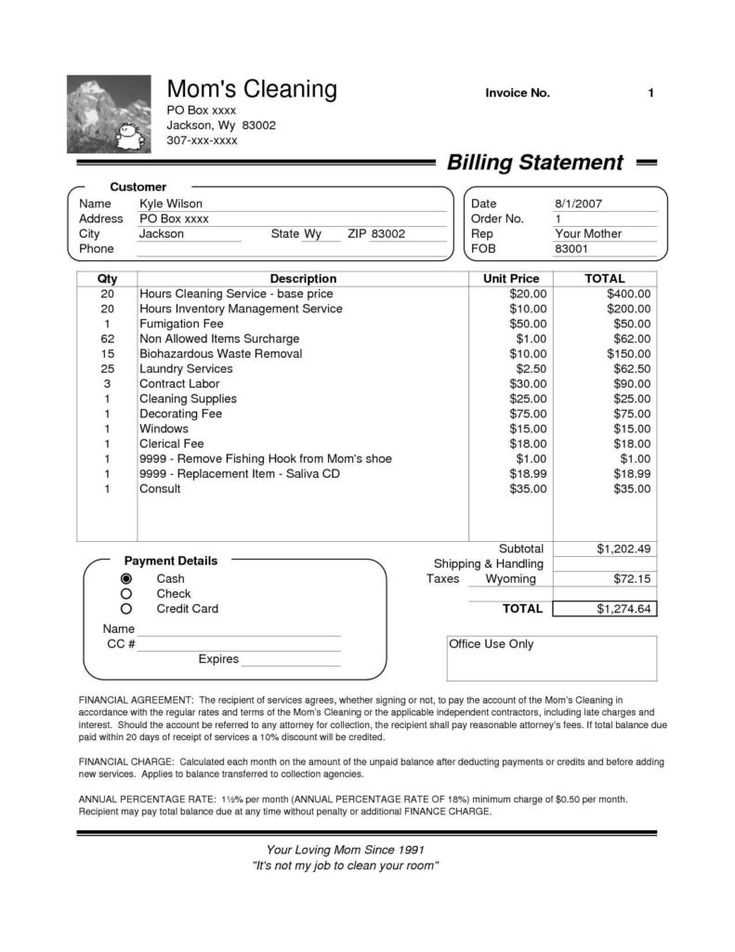

To streamline your office cleaning invoice receipt template, focus on simplifying language and removing unnecessary repetitions. Start by listing only the most relevant services. For example, instead of repeating “office cleaning” multiple times, specify the type of cleaning and include all related details in one concise line, such as “Complete office cleaning: dusting, vacuuming, and surface sanitizing.” This keeps the receipt clear and professional.

Next, group similar items together. For instance, instead of separate line items for “restocking paper towels” and “restocking soap,” combine them into one: “Restocking supplies (paper towels, soap, etc.).” This reduces clutter without losing any important information.

Lastly, eliminate generic phrases like “invoice receipt” or “payment received,” which can be assumed from the context. Stick to specifics: “Total due for office cleaning services” or “Amount paid for office maintenance.” The goal is to make the receipt easy to read, while ensuring all details are accurate and relevant.

- Office Cleaning Invoice Template

Creating a clear and precise office cleaning invoice template helps streamline billing and ensure accurate payments. Include key details such as service date, office location, and the hourly or flat rate for cleaning services. Specify the scope of work completed, like vacuuming, dusting, and restroom sanitation. This transparency helps both parties avoid misunderstandings.

Key Elements to Include

- Client Information: Clearly list the company name, address, and contact details.

- Service Description: Outline the cleaning tasks performed, with specific breakdowns for each service.

- Pricing: Mention the rate per hour or flat rate, along with total charges.

- Payment Terms: State due dates and acceptable payment methods.

- Invoice Number: Assign a unique invoice number for easy tracking.

Having this structure ensures professionalism and helps maintain clear records for both the cleaning service provider and client.

Include the following details to ensure your cleaning invoice is clear and professional:

1. Client and Company Details

List the client’s name, address, phone number, and email. For businesses, include the company name, address, and contact person. Your company’s name, address, and contact information should also be present for identification.

2. Invoice Number and Date

Assign a unique invoice number and note the issue date. This helps with tracking and provides a reference for future communication.

3. Services Provided

Clearly describe the cleaning services rendered, specifying tasks like dusting, vacuuming, window cleaning, or restroom sanitation. Include the quantity (e.g., number of hours) or area cleaned (e.g., square footage), so the client can easily understand the scope.

4. Payment Terms

State the due date for payment, preferred payment methods (e.g., bank transfer, check, or online payment), and any late fees if applicable. These terms should be clear to avoid confusion.

5. Price Breakdown

Provide a detailed breakdown of the charges, including any hourly rates, flat fees, or additional costs (e.g., for supplies or travel). This helps clients see exactly what they’re paying for.

6. Total Amount Due

Show the total amount due, including taxes or discounts applied, in a prominent location for easy reference.

7. Special Instructions or Notes

If there are any special conditions, such as follow-up services, agreements on future cleaning schedules, or discounts, mention them here. You can also add any additional comments that clarify the invoice.

| Item Description | Hours/Quantity | Rate | Amount |

|---|---|---|---|

| Office Cleaning | 5 hours | $25/hour | $125 |

| Supplies | N/A | $15 | $15 |

| Total | $140 |

These details will make your cleaning invoice clear and easy for clients to understand, while also helping with your record-keeping and follow-up.

Use clear, legible fonts like Arial or Helvetica in a size that’s easy to read, such as 10-12pt. Avoid overly stylized fonts, as they can make the receipt hard to interpret.

Keep your layout simple. Organize the information logically: start with your business details, followed by the services provided, costs, taxes, and total. Use consistent spacing to keep everything neat.

Incorporate headers and bold text to distinguish key sections, like “Services Rendered,” “Amount Due,” and “Payment Method.” This creates a clear structure for the reader to follow.

Include itemized lists for services and charges, so clients can easily see what they’re paying for. Be specific in descriptions to avoid any confusion.

Ensure the date, invoice number, and payment details are prominently displayed. This makes it easier for both you and your client to reference the transaction later.

Consider including your payment terms, such as due dates or late fees, in a clearly marked section to avoid misunderstandings.

To ensure clarity and transparency in your office cleaning invoice, break down service charges in a detailed manner. Itemized billing helps clients understand exactly what they are paying for, enhancing trust and minimizing disputes.

Define Each Service Charge

List each cleaning task individually with its corresponding price. For example, separate charges for dusting, vacuuming, mopping, and bathroom cleaning. This will give clients insight into how the total cost is calculated.

Include Time or Area-Based Charges

- Hourly Rate: If your service is priced by the hour, state the number of hours spent per task.

- Area-Specific Fees: For larger spaces or additional areas, mention the square footage and the rate applied for cleaning those specific areas.

By presenting the charges clearly and separately, you give your clients the ability to review each item, which can lead to better communication and smoother transactions.

Make sure to include all required information on your invoices to comply with legal standards and tax regulations. This will help avoid future disputes and ensure proper tax reporting.

Required Information on Invoices

- Invoice number – A unique identifier for each invoice.

- Issue date – The date the invoice is created.

- Due date – The date by which the payment is expected.

- Detailed description of services provided – Clearly list the cleaning services rendered.

- Amount charged – The total sum, including taxes, if applicable.

- Tax identification number – Your business’s tax ID or VAT number.

- Payment terms – Specify accepted payment methods and terms (e.g., net 30 days).

Tax Responsibilities

- Ensure the correct application of sales tax, if required by your jurisdiction. This can vary based on location and type of service provided.

- Keep accurate records of all invoices for tax reporting purposes, especially for quarterly or annual returns.

- If you operate in multiple states or countries, be aware of differing tax rates and regulations that may affect the amount of tax applied to each invoice.

Failure to include required tax information or charge the proper amount of tax can lead to penalties. Keep your invoices clear and compliant to avoid legal issues down the line.

Choosing between digital and paper formats depends on your business needs, workflow, and sustainability goals. Digital invoices are easily accessible, stored securely, and can be shared instantly, making them ideal for businesses that need quick and remote processing. They also reduce paper waste, which appeals to environmentally conscious companies.

Digital Invoices

Digital invoices are versatile and can be integrated into accounting software for streamlined operations. They can be stored in cloud systems, ensuring safe backups and easy retrieval. Digital records also allow for faster processing, tracking, and payment. However, you’ll need reliable devices and internet access, as well as secure systems to protect sensitive data.

Paper Invoices

Paper invoices provide a tangible record that can be useful for businesses that operate in industries where physical documentation is still common or legally required. They can be easier to store for companies not yet equipped for digital infrastructure. However, they can be costly in terms of printing, storing, and mailing, and may delay the payment process due to slower delivery and handling times.

Consider your current operations, the volume of invoices, and the technology available when deciding on the format. If speed and convenience are key, digital is the better option. If you prioritize physical records and a more traditional workflow, paper may still be the right choice.

Tailoring your office cleaning invoice receipt template to match your company’s branding helps create a cohesive and professional image. Customizing fonts, colors, and logos makes the invoice feel like an extension of your business identity. Here’s how to personalize it effectively:

Colors and Fonts

Select brand-specific colors and fonts to match your company’s identity. Using the same colors from your logo or website ensures consistency. Opt for clear, readable fonts that align with your brand style–whether it’s modern, traditional, or minimalist.

Incorporating Your Logo

Place your company logo at the top of the invoice for immediate brand recognition. It’s not just for aesthetics–logos enhance credibility and promote your business with each transaction.

Adjusting these elements makes invoices not just functional but also reflective of your company’s personality, leaving a lasting impression on clients.

Meaning is preserved, and repeated words are minimized.

Ensure your invoice receipt template is clean and simple. Avoid unnecessary jargon or redundancy that could confuse the reader. Focus on clarity by using precise language and listing only the most relevant details. Organize the information logically, with a clear structure that guides the recipient through the document without repeating key terms.

Each section of the receipt should serve a specific purpose: header for company and client details, itemized list for services rendered, and a summary of total costs. By eliminating repetitive phrases and sticking to essential information, your template will maintain professionalism and readability. It’s crucial to avoid clutter that could detract from the main message.

Test your template for clarity and conciseness. When reviewing, ask yourself if each word or phrase adds value. A clean, straightforward layout helps your clients quickly find the information they need without distractions.