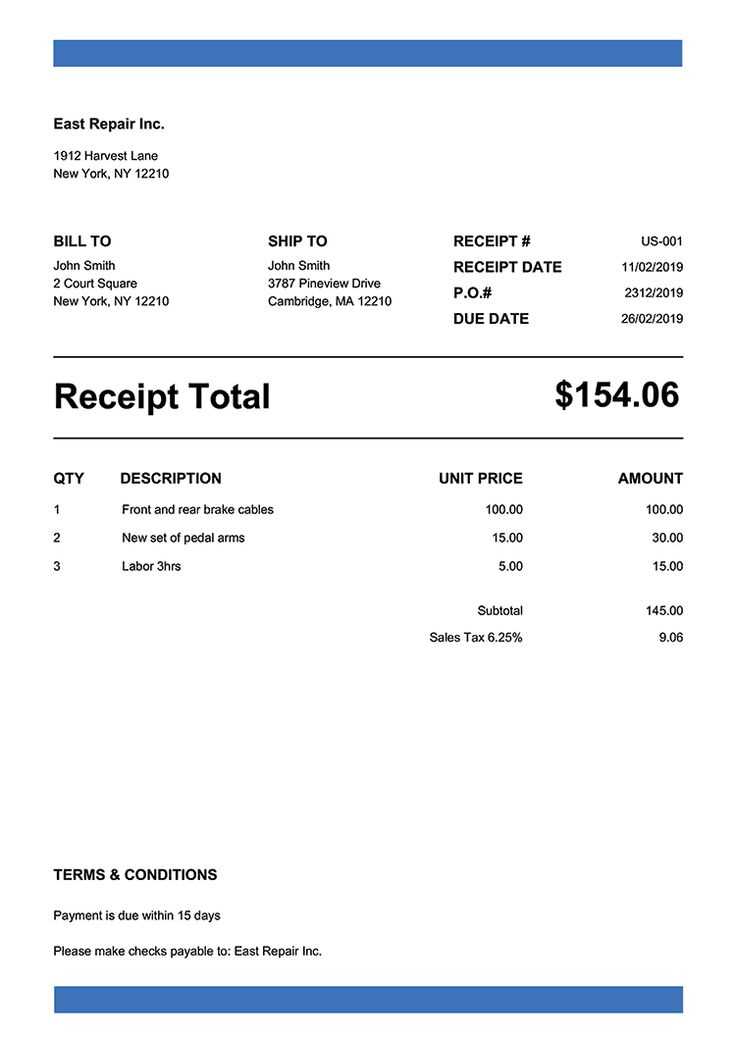

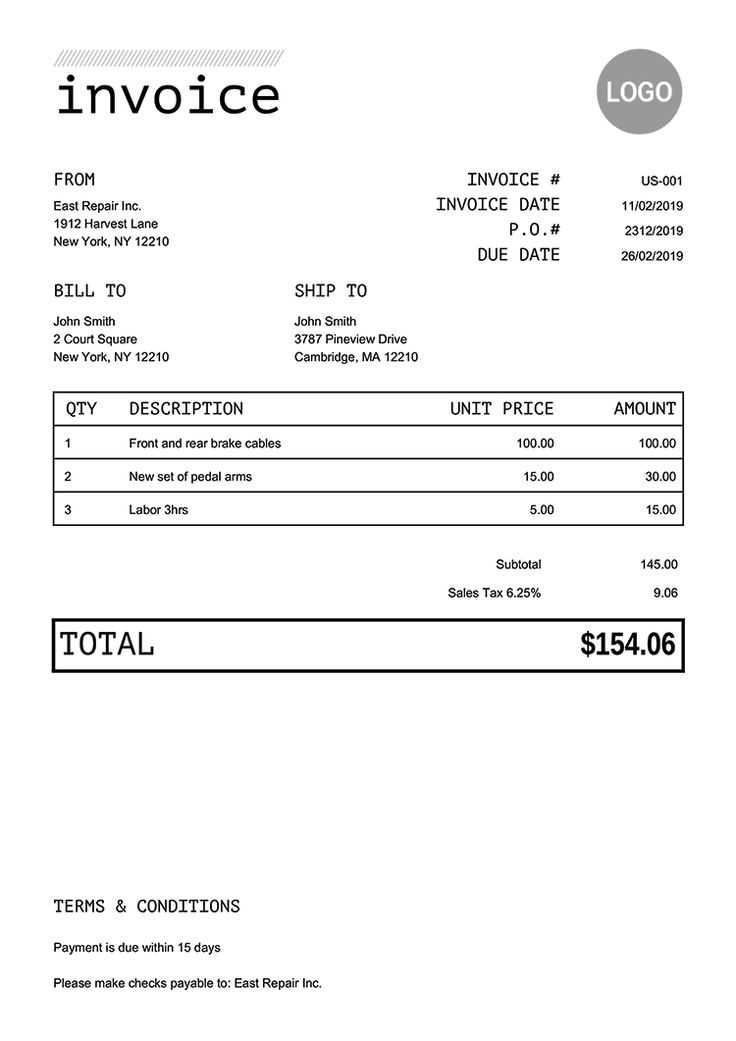

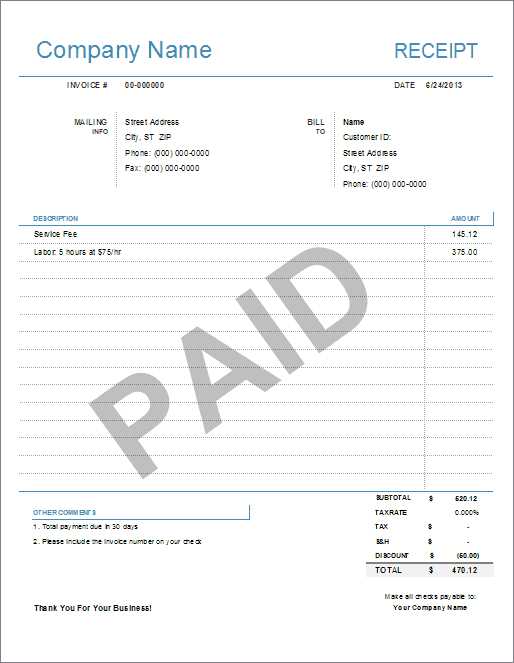

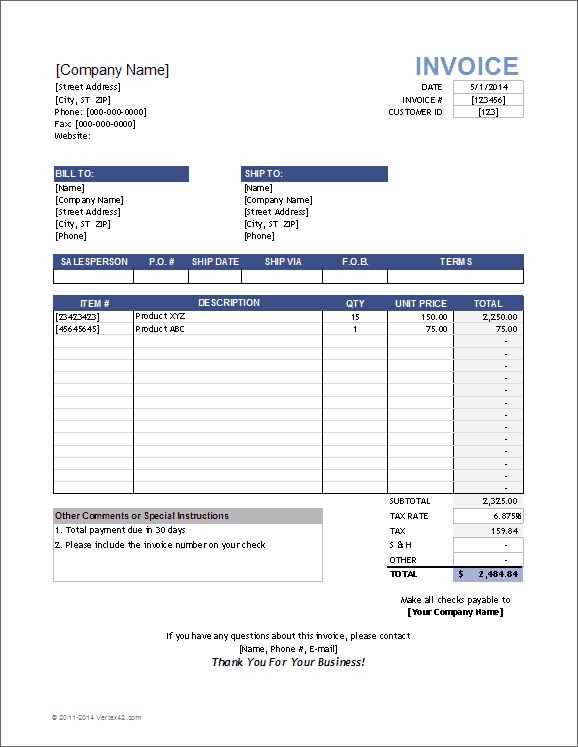

Creating a clear and professional receipt or invoice can streamline your business operations and avoid any confusion. Start with including basic elements like the seller’s contact information, transaction date, and a unique invoice or receipt number. This ensures that both parties have easy access to important details if any follow-up is needed.

Make sure to include itemized lists for the products or services provided. This helps the customer easily identify what they are being charged for. Include the quantity, unit price, and any applicable taxes or discounts. This breakdown not only keeps things transparent but also prevents any misunderstandings during payments or audits.

Don’t forget to specify the payment terms clearly. Mention the due date, accepted payment methods, and any late fees if applicable. This can help set expectations and encourage timely payments from clients. Finally, end the document with a professional closing statement and payment instructions to make the process smooth for both parties.

Receipt and Invoice Template Guide

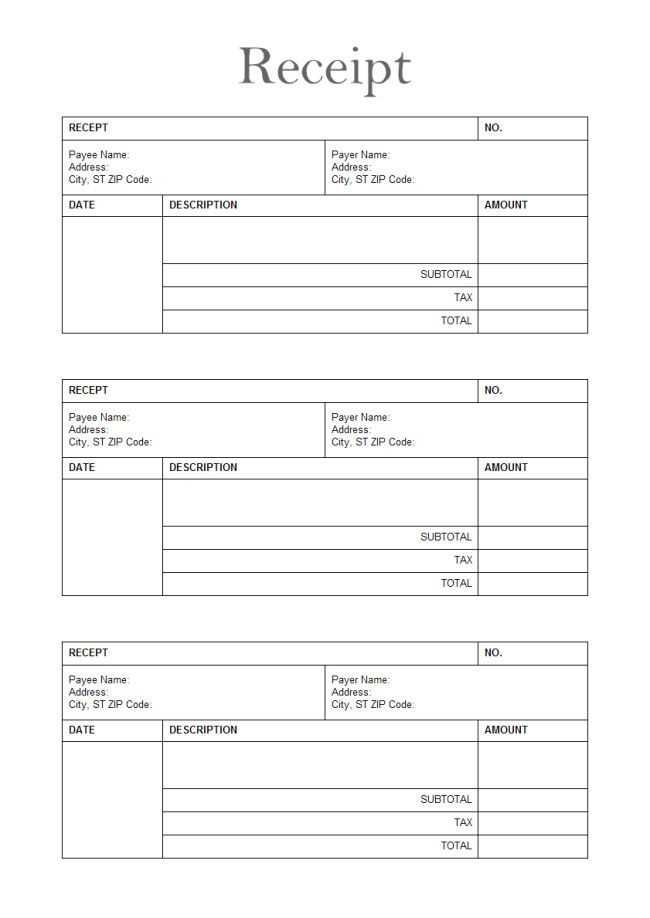

Choose a template that suits your needs. A well-structured document simplifies tracking and ensures clarity. Below are key elements to include in your template.

- Header: Include your business name, address, and contact details. This provides immediate recognition.

- Recipient Information: Clearly list the client’s name, address, and contact details. Accuracy matters here.

- Invoice Number and Date: Assign a unique invoice number and the date of issue. This helps with organization and tracking.

- Description of Goods or Services: List items or services provided with clear, concise descriptions and the corresponding quantities.

- Pricing Details: Break down the cost of each item or service, applying any discounts or taxes as necessary.

- Payment Terms: Specify when payment is due and accepted methods, such as bank transfer, check, or credit card.

- Total Amount: Clearly state the total amount due, including all taxes and fees.

Ensure your template is user-friendly, clean, and easily customizable to reflect different billing scenarios. Consistency in design and layout promotes professionalism.

Customizing Template Fields for Specific Transactions

Adjust the fields in your receipt or invoice template based on the nature of each transaction. This allows for a more accurate representation of the details, enhancing clarity for both parties involved. Customize the following sections for optimal results:

Transaction Type

Specify whether the transaction is a purchase, refund, or exchange. This distinction can help customers easily understand the nature of the document. Include relevant fields such as “Refund Reason” for returns or “Exchange Item” for swaps, if applicable.

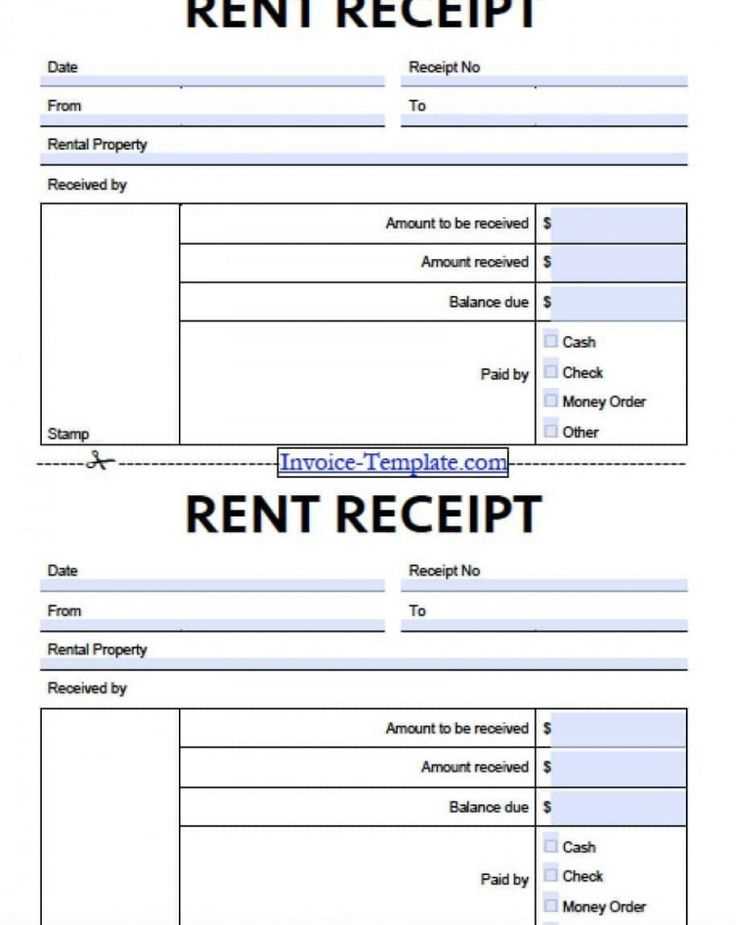

Payment Method

Customize the payment method section to reflect the transaction’s payment mode. Whether it’s credit, cash, or bank transfer, ensure these details are clear. For online transactions, include additional fields like transaction ID or payment gateway details.

By modifying the fields to match transaction types, you not only streamline your records but also provide greater transparency for customers.

Incorporating Tax and Discount Calculations

To calculate taxes and apply discounts correctly, begin by identifying the applicable tax rate and discount percentage. For tax calculation, multiply the item price by the tax rate. Ensure that the tax amount is calculated based on the subtotal before any discounts are applied. After calculating the tax, apply any discounts to the subtotal. Discounts can be a flat amount or a percentage, and should be deducted from the subtotal before tax is added.

For example, if a product costs $100, and the tax rate is 10%, the tax amount would be $10. If a 15% discount is applied, the discount is $15, reducing the subtotal to $85. The tax would then be calculated on the new subtotal ($85 x 10% = $8.50). Finally, add the tax to the discounted subtotal ($85 + $8.50 = $93.50).

Make sure to account for any rounding rules that might apply. If the tax or discount results in fractional cents, round to the nearest cent to ensure accuracy in the final amount. This will help prevent any discrepancies and ensure that the invoice reflects the correct total amount.

Ensuring Template Compliance with Legal Standards

Ensure your receipt and invoice templates align with local legal standards by including mandatory information such as the business registration number, tax identification, and correct formatting for transaction dates. Failure to comply can lead to legal penalties.

Check the following key elements for compliance:

| Legal Requirement | Action to Ensure Compliance |

|---|---|

| Business Identification Information | Include the business’s legal name, address, and registration number on all receipts and invoices. |

| Tax Information | Clearly state the VAT or tax rate applied to the transaction, including the total amount with tax breakdown. |

| Transaction Details | Ensure that all items, services, and prices are listed correctly with their respective quantities and totals. |

| Date and Time of Transaction | Include both the date and the time of the transaction, in formats required by local regulations. |

| Payment Method | Indicate the method of payment used (e.g., cash, credit card, bank transfer). |

Confirm these elements meet the requirements in your jurisdiction by consulting local business laws or seeking legal advice. Adjust your templates accordingly to avoid non-compliance issues.