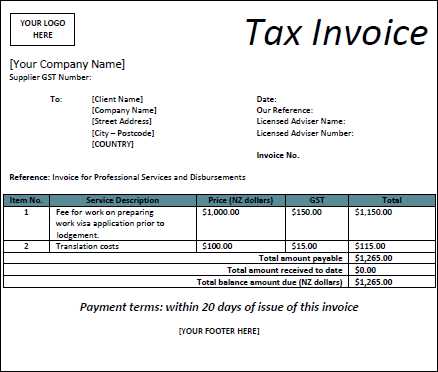

Key Components of a Tax Invoice

To create a tax invoice, include the following information:

- Seller’s Details: Include the business name, address, and tax identification number (TIN).

- Buyer’s Information: Provide the buyer’s name, address, and contact details.

- Invoice Number: Assign a unique number for easy reference.

- Invoice Date: Clearly state the date the invoice is issued.

- Payment Terms: Mention the payment due date and any late fees.

- List of Goods/Services: Detail the items purchased, quantities, unit prices, and total amount for each item.

- Tax Breakdown: Indicate the tax rate applied and the total tax amount.

- Total Amount: Include the final total, with taxes added.

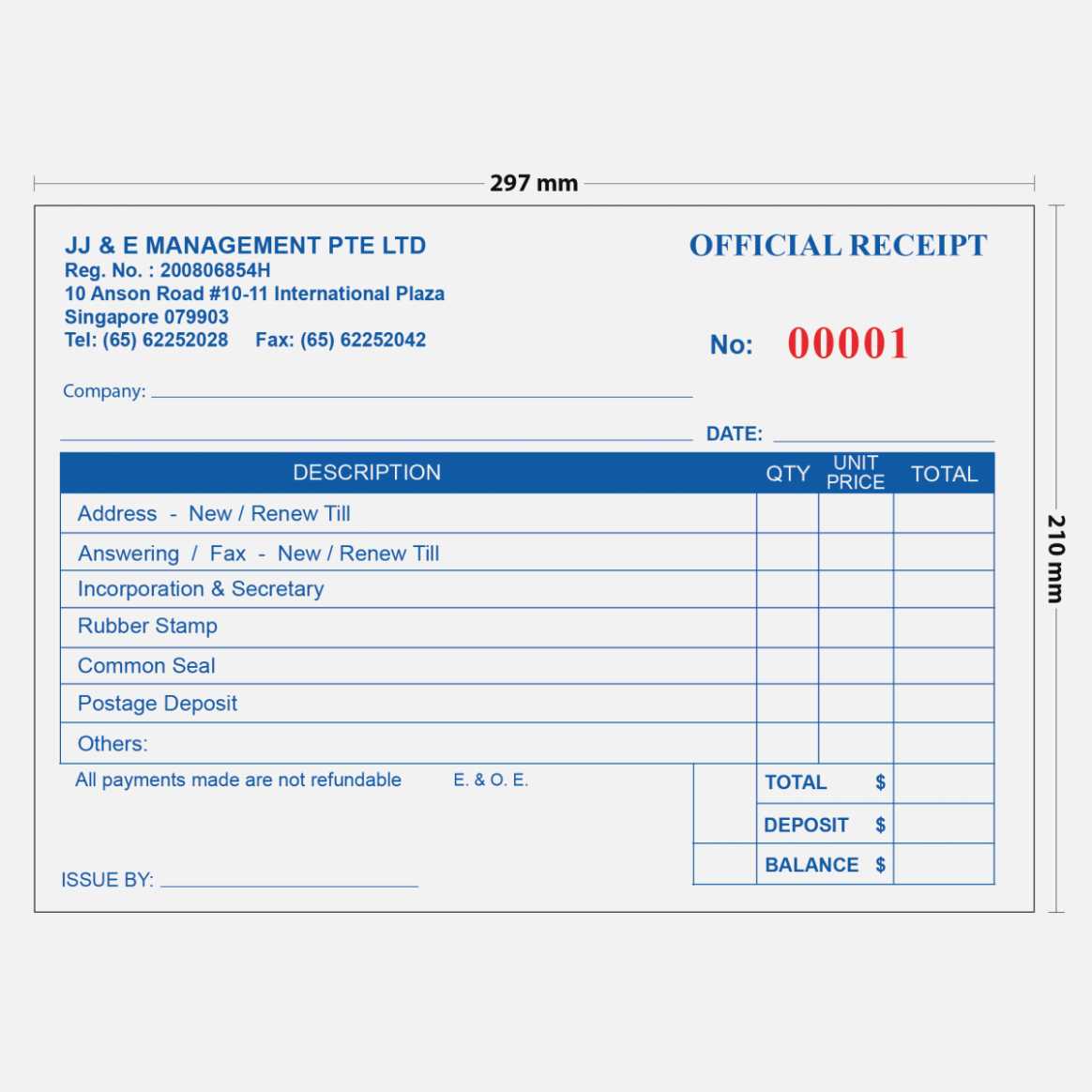

Receipt Template Details

A receipt serves as proof of payment. When designing a receipt template, include:

- Receipt Number: Assign a unique number for tracking.

- Payment Date: Indicate when the payment was made.

- Payment Method: Specify whether the payment was made via cash, card, or other methods.

- Amount Paid: Clearly state the amount paid, excluding taxes.

- Seller’s Information: Include the same details as on the invoice.

- Buyer’s Information: Ensure the buyer’s contact details are present.

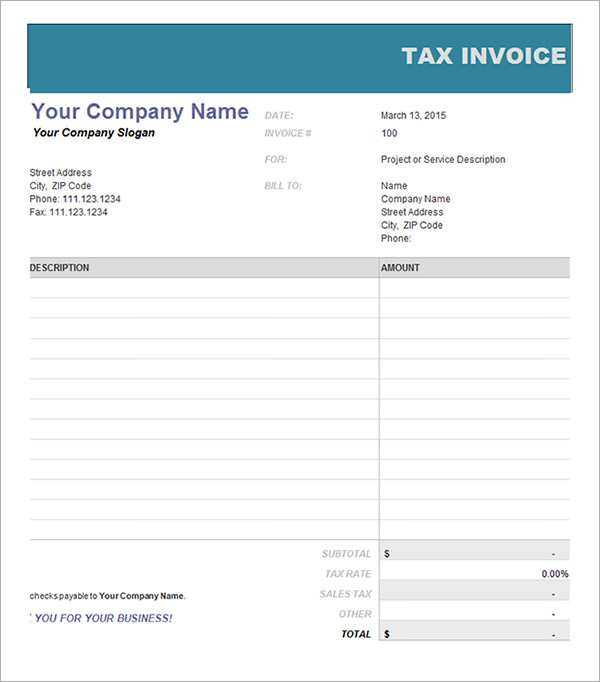

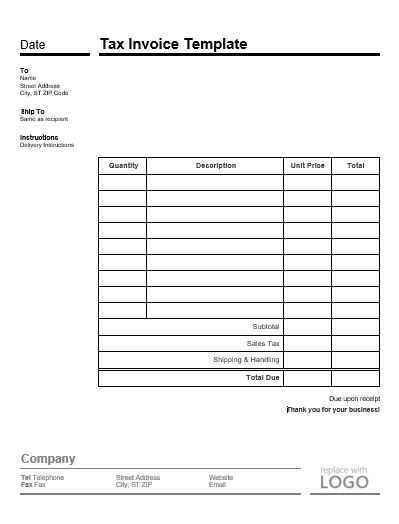

Designing a Template

When designing templates for both tax invoices and receipts, ensure the layout is simple, organized, and professional. Make use of tables to display itemized information and clearly distinguish between taxable and non-taxable items. Opt for a clean font, appropriate spacing, and clear section headings.

Ensure both the tax invoice and receipt are easy to read and understand, reflecting the transaction accurately and professionally.

Tax Invoice and Receipt Template

Choosing the Right Template for Your Business

Understanding the Key Elements of a Tax Invoice

How to Customize Your Template for Different Payment Methods

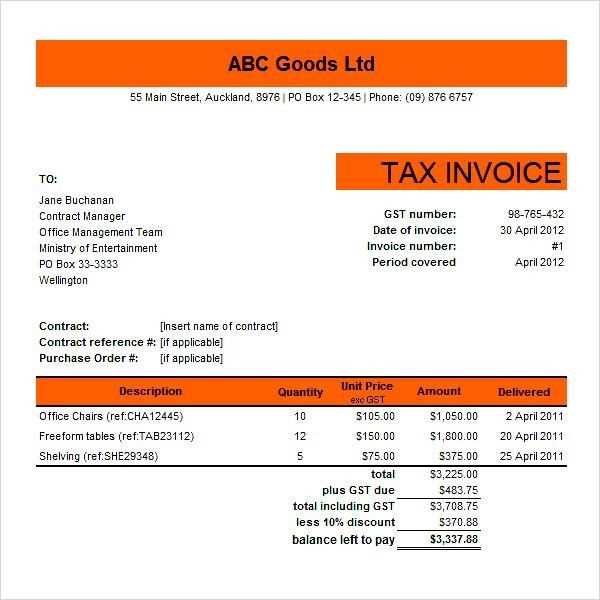

Ensuring Compliance with Local Tax Laws in Your Invoice

Steps to Add Discounts, Taxes, and Additional Charges on Your Invoice

Best Practices for Storing and Managing Records of Invoices and Receipts

Choose a tax invoice template that aligns with your business needs. Look for templates that allow for easy editing and customization. A professional appearance, clear sections for services or products, and spaces for tax details are essential. Make sure the template supports all required fields, such as invoice number, company information, and payment instructions.

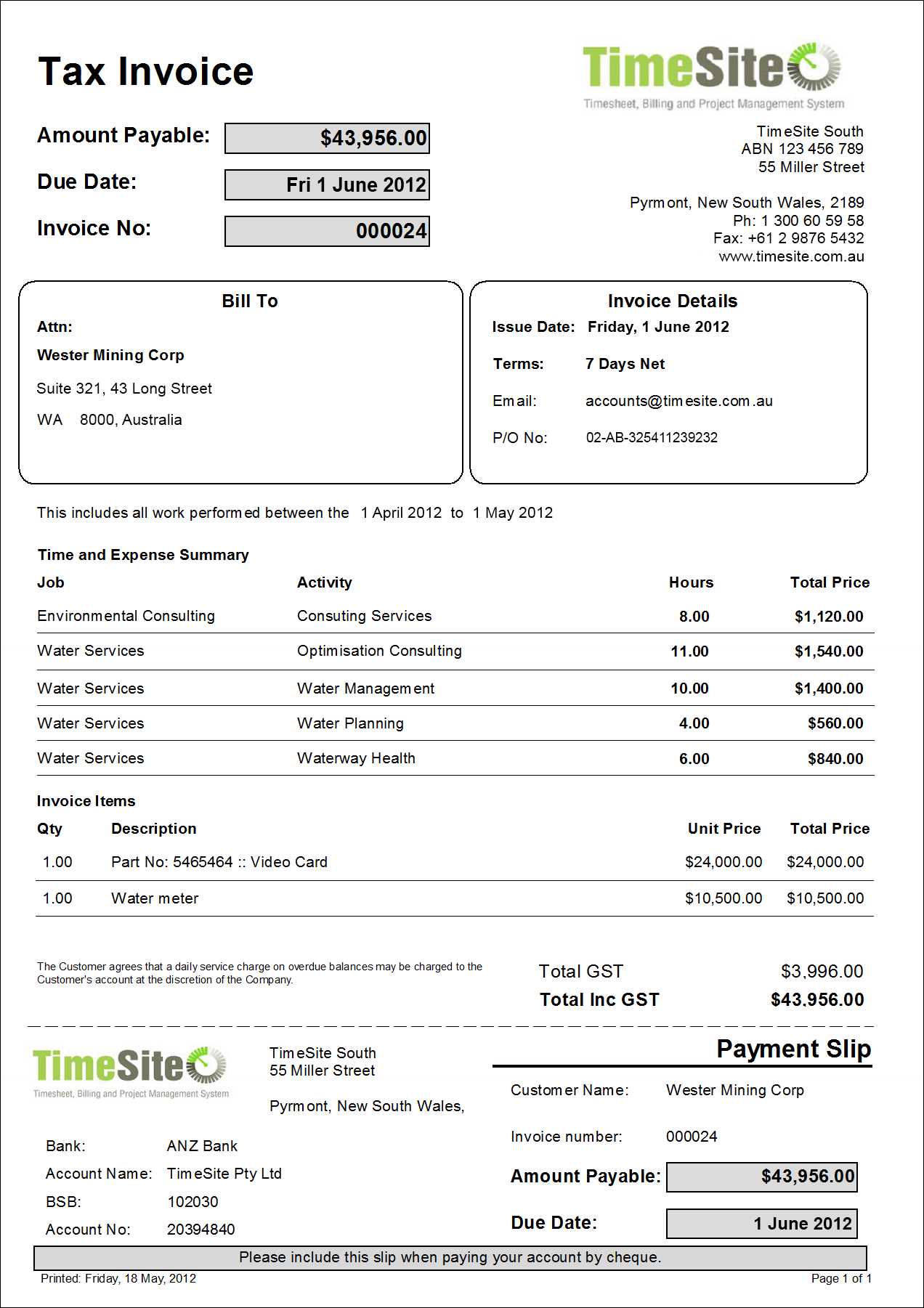

A tax invoice must include key details: your business name and contact, the customer’s information, a unique invoice number, the date of issue, and a breakdown of items or services with individual prices. Also, include the tax rate applied and the total amount due. Always ensure the accuracy of these details to avoid confusion or legal issues.

To cater to various payment methods, tailor your template by adding specific sections. For example, if accepting credit card payments, include fields for card information or reference numbers. For bank transfers, provide your banking details. This makes it easier for clients to process payments according to their preferences.

Ensure your template complies with local tax laws by including the correct tax rates and regulatory information. Verify that your tax calculations follow local guidelines to prevent errors. Check whether your invoice needs to include any specific language or disclaimers based on the jurisdiction where your business operates.

To add discounts, taxes, or additional charges, adjust the template to include relevant fields for each. Clearly label any discounts offered and ensure taxes are calculated automatically. For added charges, such as shipping or handling fees, ensure there are separate line items to avoid confusion. This promotes transparency in your billing process.

Store and manage your invoices and receipts efficiently by keeping digital records organized. Use cloud storage or a dedicated invoicing system to track all transactions securely. Ensure that all invoices are numbered sequentially and easy to retrieve for future reference or audits.