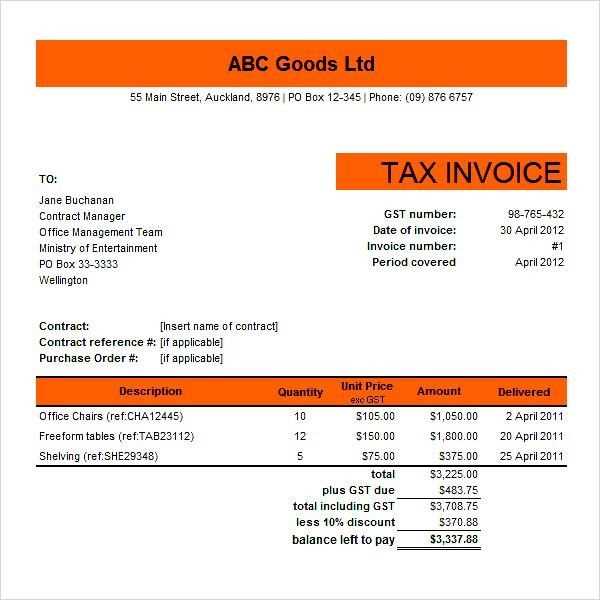

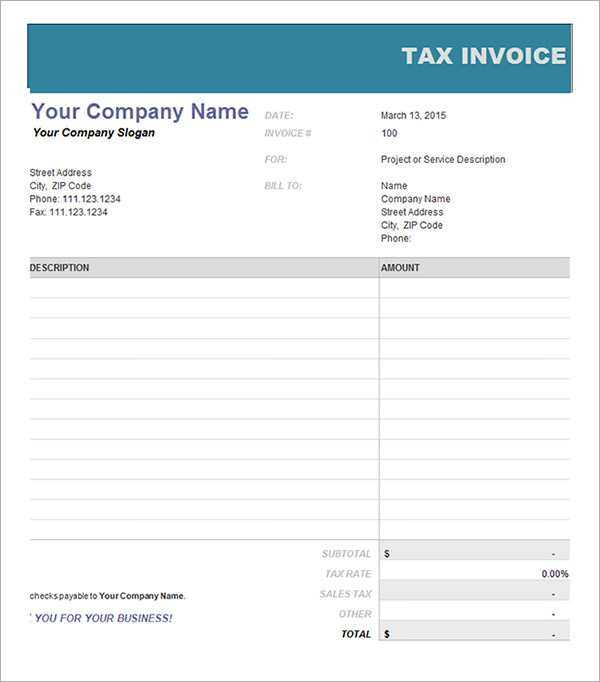

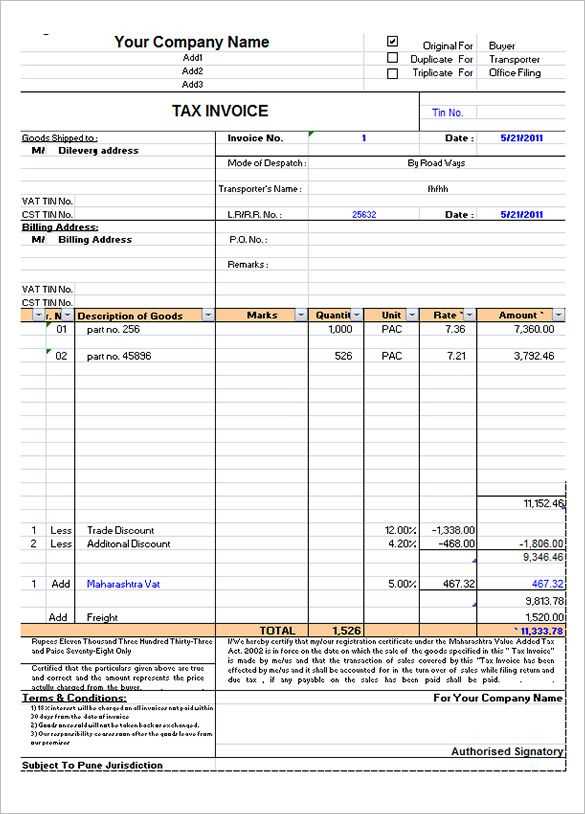

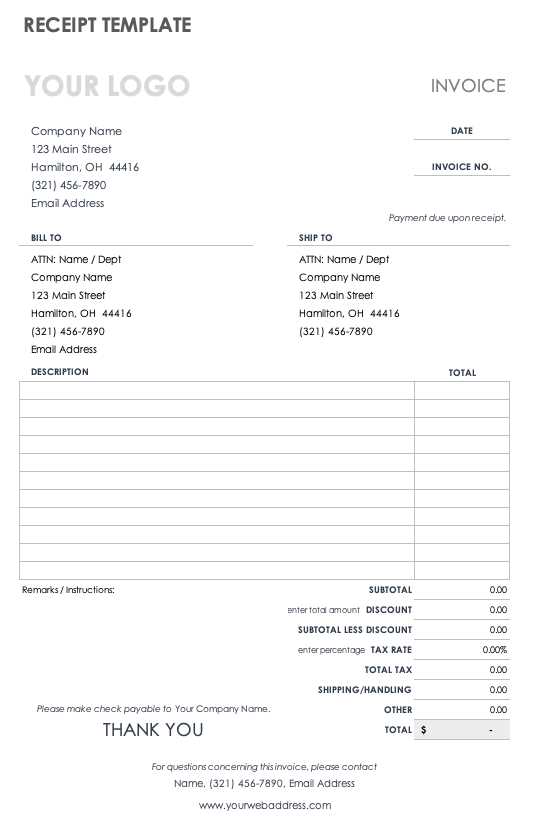

Creating a tax invoice receipt template can simplify the billing process, ensuring accuracy and compliance. The template should include fields for the seller’s and buyer’s details, item descriptions, prices, applicable taxes, and total amounts. Each section must be clearly defined to avoid confusion.

Start by including the business name, address, and tax identification number at the top. This helps the receiver identify your business quickly. Next, ensure there’s a distinct invoice number and date field. This allows both parties to track and reference the document easily in the future.

Include a breakdown of each product or service, showing the quantity, unit price, and any applicable taxes. The tax rate should be clearly stated to avoid any ambiguity. Be transparent with the total amount due, highlighting taxes separately to ensure clarity. End with payment instructions, including methods and deadlines, for a seamless transaction.

Here are the corrected lines with minimal repetition:

Focus on reducing redundancy in the language of your tax invoice template. Here’s how to refine the structure:

Adjusting Key Fields

Remove repetitive terms in item descriptions, and streamline pricing details to ensure clarity and consistency. For example, instead of repeatedly stating “taxable amount,” use “net amount” where appropriate.

Simplifying Invoice Breakdown

Limit repeated references to “total” in itemized sections. Use a single “total” line to summarize amounts and taxes, improving readability without losing necessary details.

| Line Item | Net Amount | Tax | Total |

|---|---|---|---|

| Product A | $100.00 | $20.00 | $120.00 |

| Product B | $150.00 | $30.00 | $180.00 |

By tightening the phrasing and reducing overlap, the invoice will become more straightforward and user-friendly.

- Tax Invoice Receipt Template

To create a tax invoice receipt template, focus on clarity and structure. Begin with your business name, address, and contact information clearly at the top. Include the date of issue and the unique invoice number for easy reference.

Next, list the customer’s details, including their full name or business name, address, and contact number. This will help with accurate record-keeping.

Include a table or a list of the goods or services provided. Each entry should have a brief description, the quantity, price per unit, and total price for each item. The table should be easy to read with clear column headings such as “Description”, “Quantity”, “Unit Price”, and “Total Price”.

Clearly state the tax rate applied and the total tax amount. This should be in a separate section or row so it’s easily distinguishable from the itemized list.

Finally, include the total amount due, which should be the sum of the item totals plus the tax amount. Ensure the payment terms are clear, whether immediate or due by a specific date, and include acceptable payment methods or instructions.

Ensure your template complies with local tax regulations, such as including your tax registration number if required in your country.

A tax invoice receipt template must clearly present critical details to comply with tax regulations. Start with the business’s name and contact details. This should include the company name, address, phone number, and email address, ensuring customers can reach the business for any queries.

1. Invoice Number and Date

Assign a unique invoice number for tracking purposes. This should be sequential and include a clear date to avoid confusion and to establish a proper record for tax reporting. The date on the invoice should reflect the actual transaction date.

2. Customer Information

Include the customer’s full name, address, and contact details. This identifies the purchaser and aligns the transaction with their tax records. For businesses, include the company name and registration number if applicable.

3. Itemized List of Goods/Services

Provide a breakdown of the items or services sold, including descriptions, quantities, and unit prices. This ensures transparency and allows both parties to verify the transaction.

4. Tax Breakdown

Clearly display the applied tax rate and the total tax amount. Depending on local regulations, this could include VAT, GST, or other applicable taxes. Include both the subtotal and the total amount with tax to ensure clarity.

5. Payment Terms

State the payment method and due date. If the invoice offers a discount for early payment, mention this as well. Payment terms help manage expectations regarding the timeline for settling the bill.

6. Authorized Signatures

If required, add spaces for both the issuer’s and recipient’s signatures to authenticate the transaction. This step can be crucial for legal verification, depending on local laws.

Each industry has its unique requirements when it comes to customizing a tax invoice. Tailoring your invoice ensures compliance and enhances clarity for clients. Here’s how to adapt your tax invoice for various sectors:

1. Retail and E-commerce

For retail businesses, include the itemized list of products or services sold, along with clear descriptions and quantities. Ensure that each product’s price is visible, along with any applicable taxes, such as VAT. Include shipping costs if relevant. E-commerce invoices should also feature the customer’s billing and shipping addresses for transparency.

2. Consulting and Professional Services

Consultants and service providers need to detail the hours worked, the rate charged, and any additional fees for services. List the nature of the work provided, along with a breakdown of time and rates. Make sure your tax rate is clearly shown, especially if the client is in a different region with varying tax laws.

3. Construction and Contracting

In construction, invoices should break down labor and materials separately, with clear descriptions of each component. Include project milestones and specify the portion of work completed at the time of invoicing. It’s also helpful to provide references to the contract or project agreement to avoid disputes.

4. Real Estate

For real estate transactions, tax invoices should include the property address, sale price or rental amount, and any applicable property-related taxes. If the invoice involves agent commissions, those should be itemized. Clarify whether taxes are included in the price or need to be calculated separately.

5. Manufacturing

Manufacturers should outline the raw materials, labor costs, and production charges in their invoices. If items are customized, provide product specifications and quantity breakdowns. Also, include delivery charges, especially if large orders or international shipments are involved.

6. Hospitality

For the hospitality sector, invoices must detail accommodation, food, and service charges. If taxes apply to specific services (e.g., room rental vs. restaurant service), ensure they are listed separately. Any additional fees such as resort charges or parking fees should also be included.

By adjusting your tax invoice to meet industry-specific needs, you streamline your processes and make the transaction clearer for your clients.

Ensure that all essential details are included and accurate to avoid mistakes. Missing or incorrect information can lead to confusion and delays in processing payments or tax filings. Below are the most common errors to watch for:

1. Incorrect or Missing Tax Identification Number

- Verify that the tax identification number (TIN) of your business is correct and included. Omitting it or using the wrong number can lead to compliance issues.

2. Failing to Itemize the Goods or Services

- Always list each item or service provided along with the quantity and price. Vague descriptions or lumping items together makes it hard for both parties to verify the transaction details.

3. Incorrect Invoice Date

- The invoice date should reflect the day the transaction took place. Using the wrong date can create confusion with tax calculations and payment deadlines.

4. Omitting Payment Terms

- Clearly state the payment due date and any applicable late fees. Avoid vague terms like “payment due soon” to prevent misunderstandings with clients.

5. Failure to Include the Correct Tax Rate

- Ensure that the tax rate applied is correct and up-to-date based on the local tax laws. Using the wrong rate could result in legal or financial penalties.

6. Not Including Both Business and Client Contact Information

- Both the business and client’s name, address, and contact details should be clearly listed. This ensures that any issues with the transaction can be easily resolved.

7. Miscalculating Totals or Discounts

- Double-check all calculations, including item totals, taxes, and discounts. Incorrect totals can create disputes and delay payment.

8. Using Unclear or Inconsistent Formatting

- Ensure that the layout is easy to read, with clear headings and aligned figures. Inconsistent formatting can make the invoice appear unprofessional and lead to mistakes.

Tax invoice regulations differ across regions, and each jurisdiction has specific rules on what must be included for an invoice to be legally valid. Understanding these requirements can save businesses from penalties and ensure smooth operations when dealing with tax authorities.

United States

In the U.S., tax invoices, or sales receipts, must include the following details for compliance with state and federal regulations:

- Seller’s name, address, and tax identification number

- Buyer’s name and address

- Invoice date and number

- Detailed description of the goods or services sold

- Quantity and unit price

- Applicable tax rate and total amount due

Specific states may have additional requirements, particularly related to sales tax or exempt goods. Be aware of varying rules for different tax categories, such as interstate sales or exempt items.

European Union

In the EU, tax invoices must follow strict guidelines under VAT laws. Each country has additional provisions, but the following elements are universally required:

- Invoice number and date

- Seller’s VAT identification number

- Buyer’s VAT number (if applicable)

- Description of goods or services

- Total value excluding VAT and the VAT rate applied

- VAT amount charged

Invoices within the EU are subject to VAT rules based on the country of the seller, and cross-border transactions require specific adjustments according to each country’s VAT rate and rules.

Australia

In Australia, tax invoices must meet the Goods and Services Tax (GST) requirements under the ATO guidelines. A tax invoice should include:

- Seller’s name and ABN (Australian Business Number)

- Date of the invoice

- Description of the goods or services sold

- Quantity and unit price

- Total amount payable, excluding GST

- GST amount and the total price including GST

If the invoice is for amounts less than AUD 82.50, it’s not mandatory to include GST. However, businesses must still issue a receipt for payments under this threshold.

By staying informed about these region-specific requirements, businesses can avoid complications with tax authorities and ensure their invoices are legally compliant. Each jurisdiction offers clear guidelines that, when followed, simplify both accounting and tax filing processes.

Steps to Automate Tax Invoice Generation

To automate tax invoice generation, follow these steps:

1. Choose an Invoice Automation Software

Select a reliable software that supports tax invoice automation. Look for features like customizable templates, integration with accounting systems, and tax rate management. Make sure it complies with local tax regulations.

2. Set Up Client Information

Input your clients’ details such as name, contact info, billing address, and tax identification number into the software. Set this data to autofill on each new invoice for faster processing.

3. Automate Tax Calculations

Ensure the software automatically calculates the tax based on the applicable tax rate for each region. Configure different tax rates for different product categories or regions if needed.

4. Customize the Template

Adjust the layout and fields of your tax invoice template to match your business needs. Include sections like item descriptions, quantities, unit prices, and taxes to create a professional look.

5. Integrate with Payment Systems

Link your automation tool with your payment gateway to allow clients to pay directly from the invoice. This will also update your records automatically once payment is made.

6. Automate Sending and Storing Invoices

Set the software to automatically email invoices to clients once they are generated. Store all invoices in a cloud system for easy retrieval and record-keeping.

7. Monitor and Review

Regularly check the automated system to ensure tax calculations and invoice formatting are correct. Make adjustments as needed to stay aligned with any regulatory updates.

Double-check the basic details like the company name, address, and contact information to avoid any mistakes. Ensure that all required fields, such as invoice number, date, and payment terms, are consistently filled out correctly.

- Verify client details: Make sure the client’s name, address, and contact details are up-to-date and accurate. Small errors can cause significant delays or issues in processing payments.

- Use clear item descriptions: Each product or service listed should have a clear, concise description, including quantities and unit prices. Avoid abbreviations that could lead to confusion.

- Correct tax calculations: Double-check the tax rate and total tax amount to ensure compliance with local regulations. Many accounting software tools can automatically calculate this for you.

- Check totals and formulas: If your invoice template contains formulas, test them before use. Even a small mistake in a formula can lead to inaccurate totals and cause unnecessary complications.

- Ensure payment terms are clear: Specify the payment due date and any late fees. Be clear about payment methods accepted and any special conditions.

- Review terms and conditions: Confirm that the terms on the invoice match the agreed-upon contract or agreement with the client. Inaccurate terms could lead to misunderstandings or disputes.

Test your template by generating a sample invoice to catch any errors before sending it to a client. If you’re using accounting software, always ensure your template is up-to-date with the latest tax laws and payment regulations.

How to Structure a Tax Invoice Receipt

Ensure your tax invoice receipt contains all required details to avoid issues during audits or transactions. Start by listing your business name, address, and contact details at the top. Next, clearly state the invoice number and date of issue for reference. Include a unique identifier for the transaction, such as an order number or customer ID.

Itemize Purchased Products or Services

Each item sold should be listed with a clear description, unit price, quantity, and total amount. If applicable, include tax rates and the total tax amount for each item. Double-check the accuracy of these calculations to prevent mistakes that could complicate payment or refunds.

Payment Information

At the bottom of the receipt, specify the total amount due, including taxes and any discounts applied. Add payment methods used, such as credit card, cash, or bank transfer. Include payment terms, such as due date or late fees, to clarify any deadlines or additional costs.