Creating a clear and well-structured invoice receipt is key to maintaining transparent financial records. A standardized template simplifies this process, ensuring all necessary details are included and easy to understand for both the company and the client.

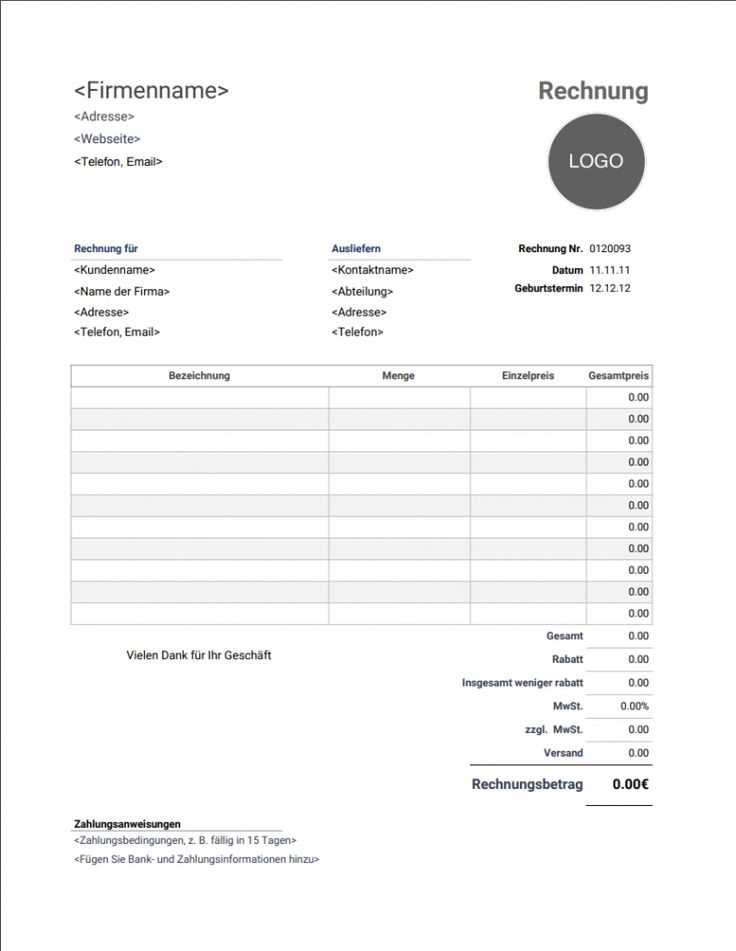

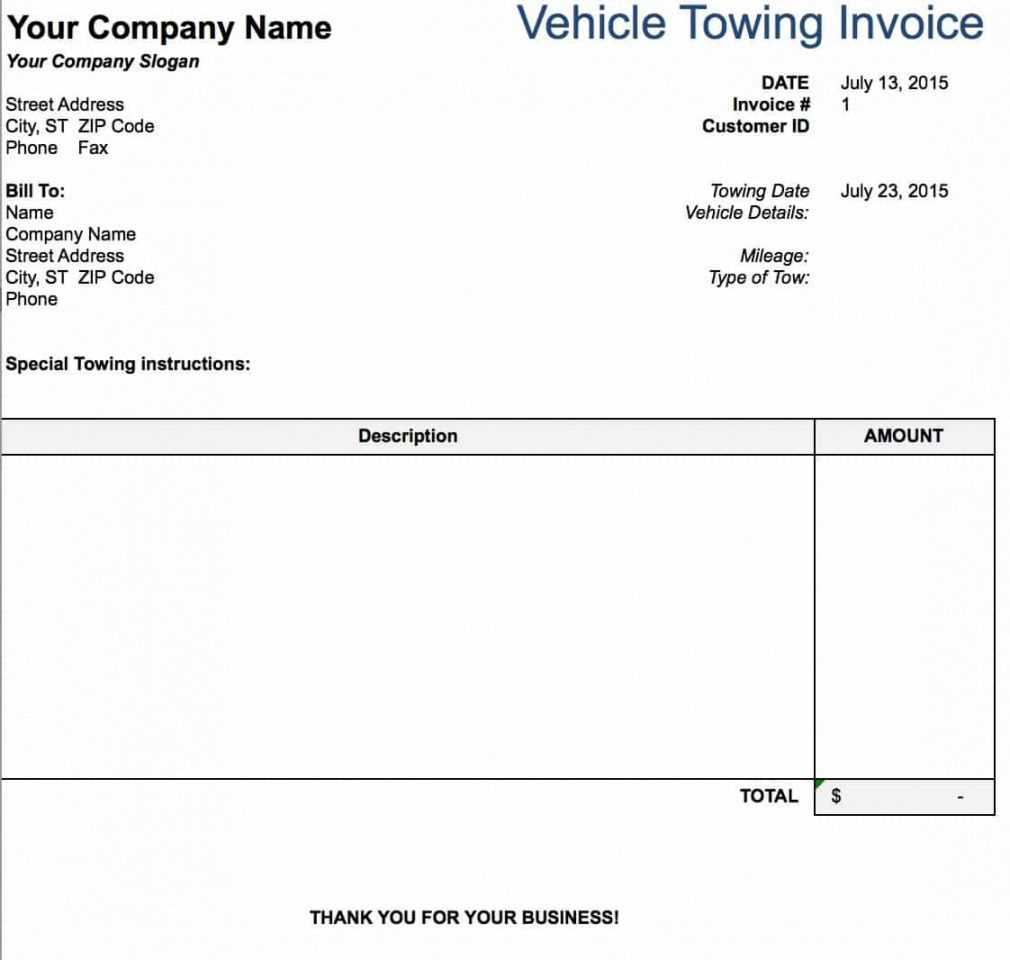

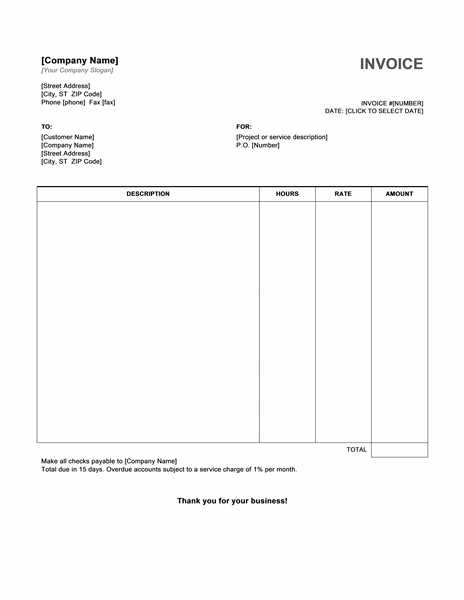

The template should begin with the company’s name, contact details, and logo at the top, followed by the invoice number and date. This makes it easy to track transactions and provides immediate context to the client. Including a brief description of the products or services provided, along with the agreed price, is vital for clarity. If applicable, specify payment terms, taxes, and any discounts offered.

For better organization, group the items with clear labels for quantity, unit price, and total cost. This ensures there is no confusion regarding individual charges. Finally, close the invoice with payment instructions, including methods accepted, due date, and any penalties for late payment. Using a consistent and professional template can streamline the invoicing process and help avoid errors.

Here’s the revised version, where word repetition is reduced:

Ensure your company invoice template is clear and professional by simplifying repetitive phrases. Instead of repeating similar terms like “amount due,” “total due,” or “balance,” consolidate them into a single section. For instance, you could list “Total amount” and avoid multiple references to payment information scattered throughout the document.

Instead of restating “invoice number” multiple times, display it once in the header and refer to it only when necessary. Similarly, instead of reiterating “due date” on every line, place it prominently in the invoice summary and avoid redundancy in the body.

For payment instructions, use concise language. A single sentence explaining acceptable payment methods is sufficient. Avoid listing them repeatedly throughout the invoice unless there’s a specific need for clarity.

In summary, a streamlined, clear layout will reduce unnecessary repetition and create a more user-friendly invoice template that’s easier to read and understand.

- Template for Company Invoice Receipts

A well-structured invoice receipt template ensures clarity in business transactions. Keep it straightforward and professional. Here’s a basic structure that can be customized to suit your company’s needs:

| Element | Description |

|---|---|

| Company Name | Include your business name, logo, and contact information. |

| Invoice Number | Assign a unique invoice number for easy tracking. |

| Date Issued | Include the date the receipt was issued to the customer. |

| Customer Details | List the customer’s name, address, and contact details. |

| Description of Products/Services | Provide a clear list of products or services, including quantities and prices. |

| Amount Paid | State the total amount paid for the products/services. |

| Payment Method | Include details on how the payment was made (e.g., credit card, bank transfer, etc.). |

| Terms and Conditions | If applicable, provide any terms related to refunds, warranties, or payment deadlines. |

| Signature | Space for your signature or the representative’s signature for verification. |

Use this format as a template and adjust the content according to your business needs. It will simplify record-keeping and make the invoicing process more transparent for both you and your clients.

Choose a clean, simple layout that highlights key details without clutter. Organize the information logically with clear headings and sections for each type of data, such as the company name, contact information, client details, invoice number, date, and payment summary.

Use Clear Typography

Select easy-to-read fonts for both headers and body text. Avoid using more than two different fonts to maintain consistency. Stick to standard fonts like Arial, Helvetica, or Times New Roman, which are universally legible and professional.

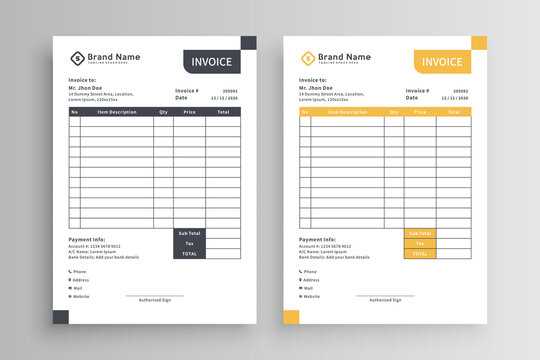

Incorporate Branding Elements

Include your logo and use your brand’s color scheme to create a cohesive identity. This strengthens the professional image of your business and makes your invoice receipts immediately recognizable. Keep the design minimal, focusing on your logo and brand colors without overwhelming the reader.

Ensure that the itemized details of the invoice are clearly separated, possibly by using lines or shaded boxes to break up different sections. This allows for easier reference and improves the document’s readability.

Lastly, leave space for a thank-you note or payment instructions at the bottom, ensuring it remains professional but personal. This encourages positive client relations and can be a subtle reminder about the importance of timely payments.

Every invoice receipt should provide clear, concise details that protect both the seller and the buyer. Here’s what to make sure you include:

- Invoice Number – A unique reference number helps to track and organize invoices, making it easier to find and reference later.

- Invoice Date – The date the invoice was issued is crucial for establishing payment terms and tracking timelines.

- Seller’s Details – Include your business name, address, phone number, and email. This provides a way for the buyer to reach out if needed.

- Buyer’s Information – The buyer’s full name or business name, along with their contact details, ensures the invoice is linked to the correct party.

- Itemized List of Goods or Services – Include a description of what was sold, quantity, unit price, and total cost. This provides clarity and transparency for both parties.

- Tax Information – If applicable, list any taxes charged (e.g., sales tax, VAT), including the tax rate and the total tax amount.

- Total Amount Due – Clearly state the full amount owed. This includes the cost of goods/services and taxes, with any discounts applied.

- Payment Terms – Specify the payment due date, any late fees, and accepted payment methods (e.g., bank transfer, credit card).

- Payment Instructions – Include relevant payment details like bank account number, PayPal info, or other payment platform specifics to facilitate smooth transactions.

Additional Elements to Consider

- Purchase Order Number – If the transaction was linked to a purchase order, it’s helpful to reference this for cross-checking purposes.

- Terms & Conditions – If applicable, briefly outline your company’s terms and conditions, especially around returns or disputes.

Adjust your invoice template based on the unique requirements of your business. For example, service-based companies often need detailed descriptions of the services provided, while product-based businesses may focus more on product names, quantities, and prices. Consider adding fields like SKU codes, service hours, or project milestones where applicable.

If your business deals with international clients, include a currency selector and ensure the correct tax rates are applied based on the client’s location. You can add country-specific fields for VAT numbers or other region-specific legal requirements. This ensures your invoices are compliant no matter where you do business.

For subscription-based services, it may be helpful to include billing cycles, next payment dates, or subscription renewal reminders. A recurring charge section with clear itemization of past payments and balances due will also help avoid confusion for customers.

If your business offers discounts or promotional offers, create fields that let you easily apply these deductions. These can be listed with a clear breakdown on the invoice to ensure full transparency for clients. This feature will also help you track how often such discounts are applied.

Lastly, tailor the design and branding to match your company’s identity. Custom colors, logos, and fonts make your invoices reflect your brand image. A professional, cohesive look builds trust and can set your business apart from competitors.

Choose a clean, minimal layout. Avoid clutter by leaving enough white space around text and sections to enhance readability.

- Use a consistent font style, size, and color throughout the template. Keep the font size between 10px and 14px for the main content, with slightly larger text for headings.

- Align text to the left or center, but avoid right-aligning important details like totals or contact information. Left alignment is easier to follow.

- For itemized lists, ensure each product or service is clearly separated by lines or spaces. This prevents confusion when reviewing the details.

Focus on visual hierarchy. Make the most critical information stand out with larger or bolded fonts. This includes company name, total amount due, and payment method.

- Highlight totals and key sections in a darker or bolder font to differentiate them from other details.

- Use bullet points or numbered lists for item descriptions to ensure each item is easy to locate and read.

Integrate brand elements like logo or color scheme to reinforce your company’s identity. However, don’t overdo it–subtlety keeps the template professional.

- Place your logo in the top left corner or header section for brand consistency.

- Choose neutral colors that are easy on the eyes. Use brand colors sparingly to maintain balance.

Ensure all important details like company contact information, payment terms, and receipt number are easily identifiable. These help customers find what they need quickly.

- Provide a clear breakdown of items and charges to minimize any potential confusion or disputes.

- Include a line at the bottom for additional notes or disclaimers, making sure it doesn’t overpower the rest of the receipt.

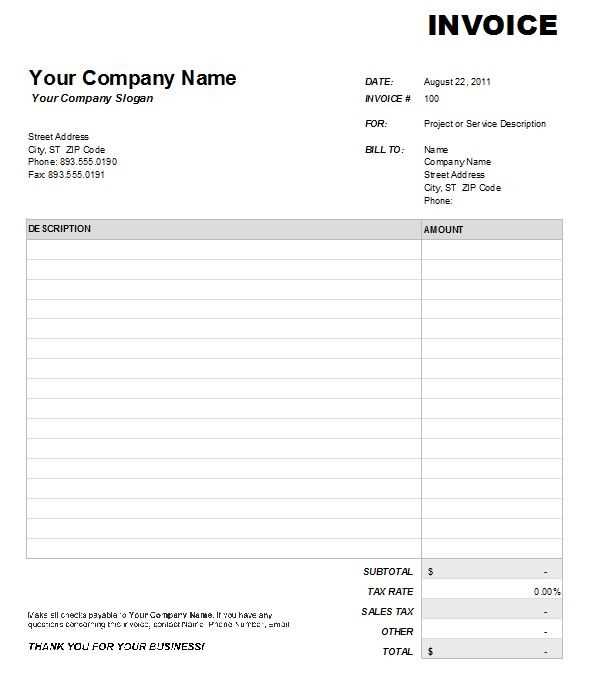

Avoiding clutter is key. Keep the layout clean and simple to make it easy for your clients to read. Overcrowding an invoice with excessive details or unnecessary design elements distracts from the core information–items, prices, and totals. Stick to clear headings and sections.

Inaccurate Information

Verify all details before sending an invoice. A simple mistake, such as a misspelled name, incorrect price, or wrong due date, can lead to confusion and delays. Double-check product descriptions, quantities, and tax rates to ensure everything is accurate.

Missing Contact Information

Ensure your company’s contact details are visible. If clients have any questions or need clarification, provide them with a way to reach you quickly. Include your phone number, email address, and physical address. Missing these could delay payments or create unnecessary back-and-forth.

Don’t forget payment terms. Clearly state the due date and available payment methods. Without this information, clients might hesitate to pay or misunderstand your expectations. Specify whether you accept bank transfers, credit cards, or other payment options.

Keep the design professional. Aesthetics matter, but overly complex designs can make the invoice harder to navigate. Use a legible font and balanced spacing. A clean design helps build trust and makes the document easier to understand.

Set up templates to streamline the receipt creation process. Customize fields for client details, payment amounts, and dates to ensure consistency. Tools like QuickBooks or Zoho Invoice allow you to create templates that auto-fill client information based on past invoices, reducing manual entry.

Integrate your invoicing software with your payment processor. By connecting platforms like PayPal or Stripe, you can automatically update payment statuses and generate receipts as soon as a transaction is completed. This ensures real-time, accurate records without extra steps.

Leverage email automation for delivery. Once receipts are generated, configure your system to automatically send them to clients. Set triggers based on payment completion or due date. This eliminates the need for manual follow-ups and ensures clients receive their receipts promptly.

Consider cloud-based solutions for easy access and backup. With automated syncing, you can store and access invoice receipts from anywhere, making it easier to manage multiple clients and transactions over time.

Test your automated systems regularly. Set up a few trial runs to make sure that all information is being captured correctly, ensuring you avoid mistakes and keep your records reliable.

Creating an Effective Company Invoice Receipt

Use clear and concise headings for each section of the invoice. Include the company name, address, and contact details at the top, followed by the recipient’s information. Provide a detailed breakdown of the products or services rendered, including item names, quantities, prices, and any applicable taxes or discounts.

Layout and Structure

Ensure the invoice has a clean, logical structure. Group related items together and separate different types of charges with clear labels. Use tables to display itemized details, making it easy for the recipient to understand the charges at a glance.

Terms and Conditions

Clearly state payment terms, such as the due date, accepted payment methods, and any late fees. Specify if any other conditions apply to the transaction to avoid confusion.