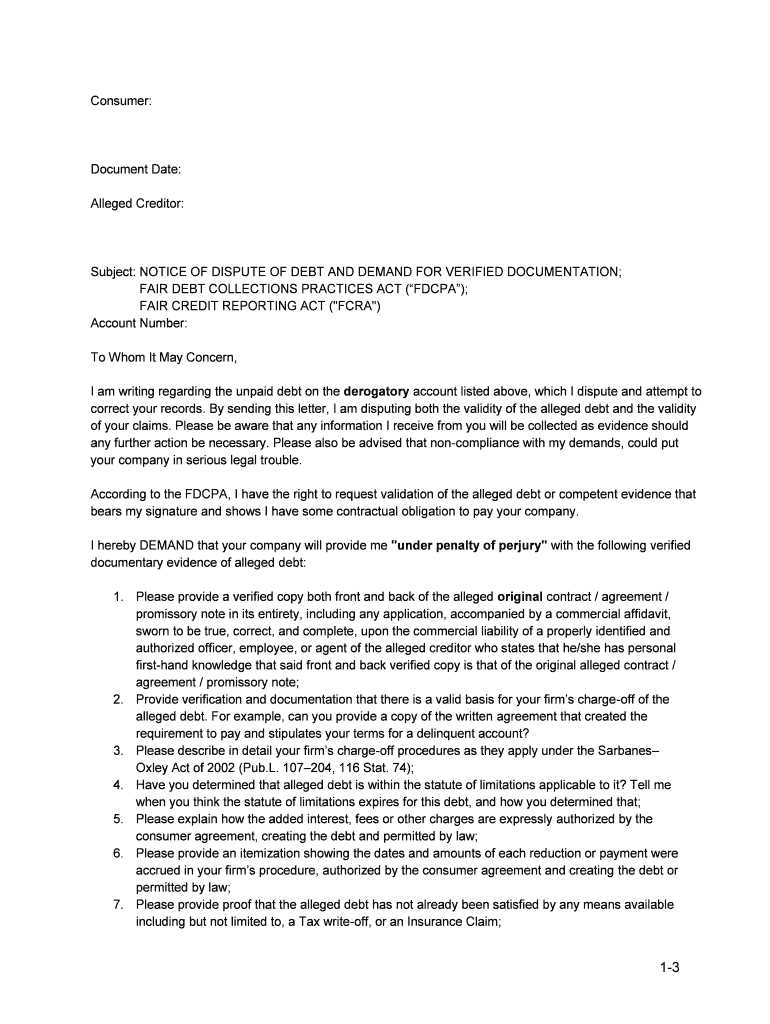

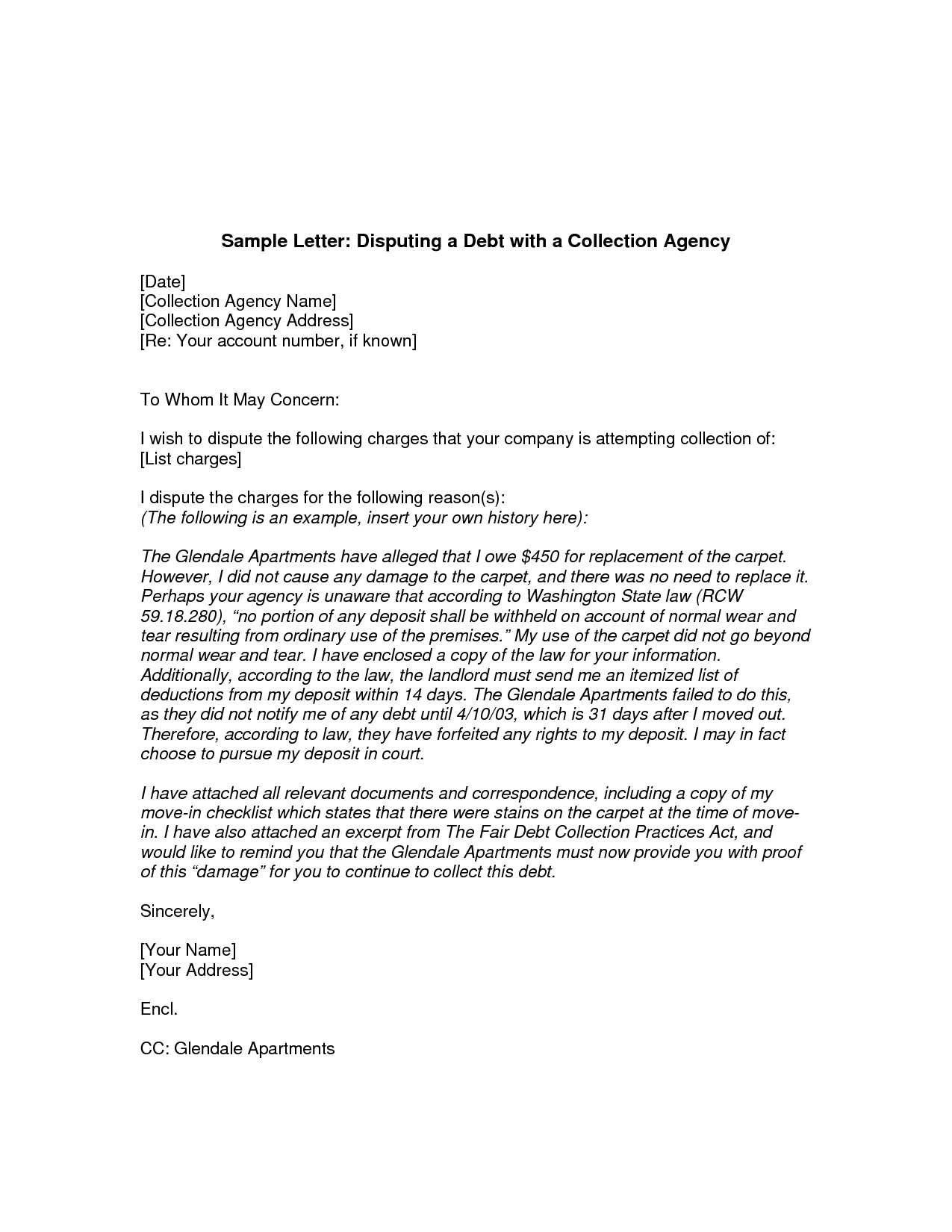

If you find yourself disputing a debt collection due to the non-receipt of a debt letter, it’s crucial to respond swiftly and clearly. Begin by requesting a formal written verification of the debt from the collection agency. This can help clarify whether the debt is legitimate and whether the notice was sent according to legal requirements. Many collection agencies are required by law to send a debt validation letter within five days of their first contact, and if this process was not followed, you may have grounds to dispute the claim.

Next, prepare a debt letter dispute template. This letter should outline your concerns in detail and clearly state that you did not receive the original debt notification. Include specific information about the debt and your communication attempts with the agency. Be sure to ask for documentation to prove that the debt is valid and that proper notification procedures were followed. Keep a copy of the letter for your records and send it via certified mail to ensure proof of receipt.

If the agency fails to respond or provide the necessary documentation, you can escalate the issue by filing a complaint with the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general office. Taking these steps helps protect your rights and ensures that the collection process adheres to legal standards.

Here are the corrected lines based on your request:

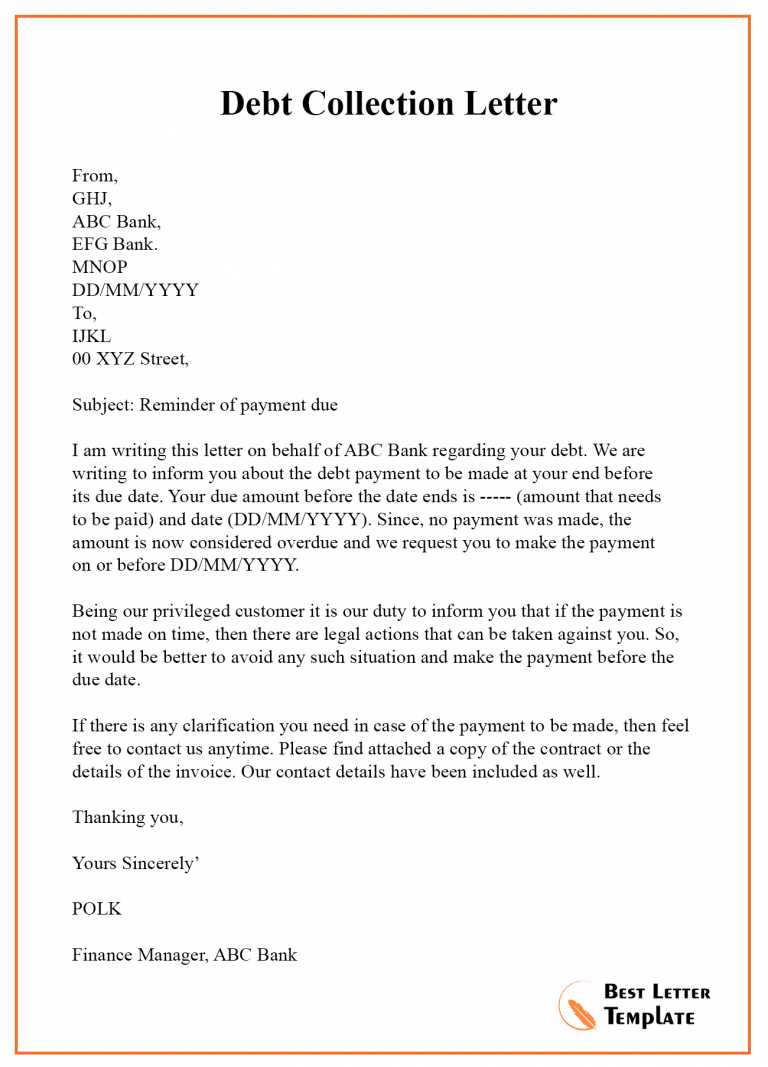

1. Clarify the exact amount owed: Make sure the debt letter includes the specific amount the debtor owes. Avoid vague statements like “the total balance” and be clear about the figure. This reduces confusion and strengthens your case.

2. Specify the due date: Include the precise due date for payment. A clear deadline motivates quicker action and avoids misinterpretation. This is particularly crucial if the debt has accrued interest.

3. Outline the next steps: Detail what actions the debtor should take if they disagree with the amount. Provide contact details for disputes, and specify any documents they must provide. Make the process simple and transparent.

4. Mention possible legal actions: Politely but firmly state that if the debt is not settled, you may pursue legal action. This sets clear expectations while maintaining professionalism. Avoid threatening language, but make the consequences known.

5. Include payment options: Offer clear instructions for paying the debt, such as bank details or online payment options. This ensures there’s no confusion about how to make the payment.

6. Address communication preferences: State how you prefer the debtor to communicate with you (email, phone, etc.). This makes it easier to keep track of interactions and maintain clarity.

7. Request confirmation of receipt: Politely ask for acknowledgment of the debt letter, whether it’s through email or a signed receipt. This can serve as a record that the debtor has been informed and received the communication.

- Collections Dispute Regarding Receipt of Debt Letter Template

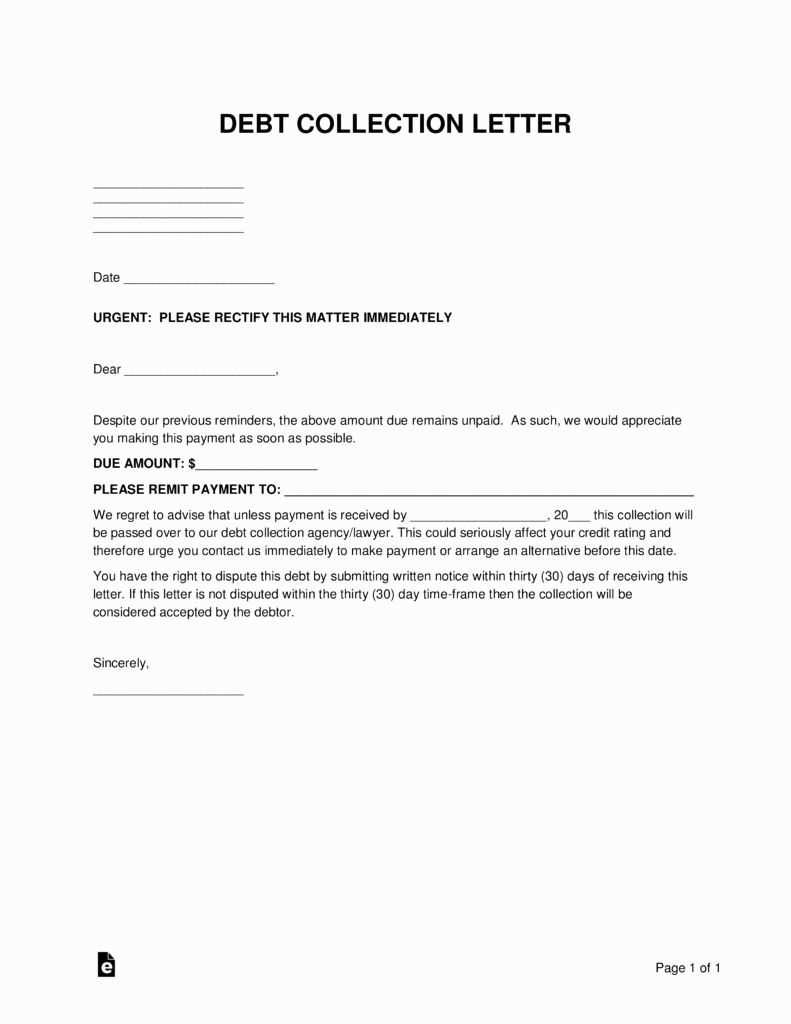

If you have received a debt collection letter and dispute its validity, it’s crucial to act promptly. The first step is to formally request proof of the debt. This can be done using a debt dispute letter template, which helps ensure your request is clear and legally compliant. The goal is to ask the creditor to verify the debt in question, including details such as the original creditor and the amount owed. Below is a simple template for disputing a debt collection letter.

Debt Dispute Letter Template

Dear [Creditor Name],

I am writing in response to a debt collection letter I received from your office regarding the alleged debt of [insert amount]. Please be advised that I dispute the validity of this debt. As per my rights under the Fair Debt Collection Practices Act (FDCPA), I request that you provide written verification of this debt, including the following:

- Proof that you are authorized to collect this debt.

- The name of the original creditor.

- The amount of the debt, including an itemized breakdown of the charges.

- Any documentation that proves this debt belongs to me.

I kindly ask that you send me this information within 30 days. Until I receive verification, I will not make any payments or take further action regarding this debt. Please note that if you fail to respond with the requested documentation, I will consider the debt invalid and take appropriate steps to protect my rights.

Thank you for your attention to this matter. I look forward to receiving the requested documentation soon.

Sincerely,

[Your Name]

[Your Address]

[Your Contact Information]

Key Points to Include in Your Debt Dispute Letter

When writing a debt dispute letter, ensure it includes these key points:

- Your personal information (name, address, and contact details).

- The date of the debt letter you received.

- Clear request for validation or proof of the debt.

- A request for itemized details on the debt amount.

By sending this letter, you will create a formal record that you disputed the debt. This can protect you from unnecessary legal actions and ensure you are not liable for an invalid debt.

To verify whether a debt notification is legitimate, examine the sender’s contact information. Genuine debt collectors will use official contact details, including a physical address and a company name. Cross-check these details with records from the original creditor or relevant authorities.

Next, look for the presence of specific details such as the original debt amount, the creditor’s name, and the date the debt was incurred. A legitimate notice should include a breakdown of the debt, showing the original amount and any additional fees or interest applied. If this information is unclear or missing, the notification might not be authentic.

Another key indicator is the tone and language used in the letter. Authentic debt letters avoid using threats, aggressive language, or alarming terms. The message should remain professional, offering clear steps on how to dispute or resolve the debt.

Make sure the letter includes instructions on how to verify the debt. Genuine notices will provide information on how to request documentation proving the debt is yours. A reputable collector should be willing to provide validation upon request.

Lastly, check for inconsistencies or discrepancies. Look for mismatched names, incorrect addresses, or unfamiliar companies. If something feels off, investigate further by contacting the creditor directly or seeking legal advice.

| Red Flags | What to Check |

|---|---|

| Unfamiliar Sender | Verify contact information and company details. |

| Lack of Debt Breakdown | Ensure all debt details, including the original creditor and amount, are listed. |

| Aggressive Language | Legitimate notices should not use threats or urgency. |

| No Debt Validation Information | Check if the letter provides a way to request proof of the debt. |

| Discrepancies in Personal Information | Compare the details with your records and the creditor’s information. |

First, carefully review the debt collection notice. Ensure the details, such as the amount, creditor name, and dates, are correct. If something seems off or unfamiliar, it’s crucial to verify the accuracy of the information.

Next, request written verification of the debt from the collector. Under the Fair Debt Collection Practices Act (FDCPA), you have the right to challenge the debt. Send a letter requesting the collector provide documentation that proves the debt is yours, including the original creditor’s information.

Keep all communication with the collector in writing. This ensures there’s a paper trail of your interactions. If you speak over the phone, make detailed notes of the conversation and follow up with a written summary.

If the debt is not yours or if you believe there’s a mistake, dispute the debt with the credit bureaus. They must investigate and respond within 30 days. Submit a clear explanation and any supporting documents that prove the debt is incorrect or belongs to someone else.

If the collector continues to pursue the debt without proper verification, file a complaint with the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general office. Keep records of your complaint and any actions taken.

| Step | Action |

|---|---|

| 1. Review Debt Notice | Ensure all details are accurate and familiar. |

| 2. Request Debt Verification | Send a letter requesting proof of the debt. |

| 3. Communicate in Writing | Keep all correspondence documented. |

| 4. Dispute with Credit Bureaus | File a dispute with evidence of an error. |

| 5. File a Complaint | If necessary, file a complaint with regulatory agencies. |

By following these steps, you can effectively dispute a debt collection notice and protect your rights. Keep copies of all documents related to the dispute for your records.

Include your full name, address, and contact information at the beginning. This ensures the creditor can easily identify your case. Next, reference the specific debt in question, including the account number, date of the notice, and the amount listed in the collection notice.

State clearly that you are disputing the debt and request validation. Mention that you need proof that the debt is yours, such as a signed agreement or a statement showing the debt’s history. Specify the time frame within which you expect a response, usually 30 days.

List any supporting evidence you have, such as payment records, bank statements, or communication logs, to back up your claim. Be concise but specific about why you believe the debt is inaccurate or invalid.

End the letter by reiterating your request for validation and note that you are exercising your rights under the Fair Debt Collection Practices Act (FDCPA) or relevant local laws. This adds a legal weight to your dispute, ensuring the creditor understands that you are aware of your rights.

Finally, sign the letter and keep a copy for your records. Use certified mail to ensure the creditor receives it and you have proof of delivery.

If you receive several debt collection notices regarding the same issue, take a systematic approach to handle them effectively. Start by reviewing each notice carefully. Compare the dates, amounts, and details in all communications to ensure the debt is not being duplicated or reported incorrectly.

Verify the Debt and Respond in Writing

If you suspect multiple notices are for the same debt, contact the debt collector directly. It’s best to do this in writing to keep a record of your communication. Request clarification on the specifics of the debt and ask for documentation proving they are indeed separate claims or that one is a mistake. Document the conversations, especially if you dispute the validity of the claims.

Check for Errors in Reporting

Double-check your credit report to ensure that no additional errors or duplicate entries have been made. If multiple collection agencies are involved, it may indicate a mix-up in reporting or a failure to mark the debt as paid. Dispute any inaccuracies with the credit bureaus and alert them about the duplicate notices you’re receiving.

By keeping detailed records, responding promptly, and ensuring all parties involved have accurate information, you can resolve any confusion quickly and prevent further unnecessary notices.

If you receive a debt notification that seems invalid or incorrect, you have specific rights to address the situation. First, you should immediately review the letter for errors such as incorrect amounts, missing or inaccurate creditor details, or claims for debts you do not recognize.

Take the following steps:

- Contact the creditor or debt collector to request clarification. You have the right to ask for proof of the debt, such as a detailed statement or original agreement.

- If the debt collector does not provide adequate verification, you are not obligated to pay the debt. They must provide documentation within a reasonable timeframe to prove that the debt is valid.

- If the notification is still unclear or incorrect, send a written dispute letter within 30 days of receiving the debt notice. This is your legal right under the Fair Debt Collection Practices Act (FDCPA). Ensure your dispute is clear and specific, citing errors in the information provided.

Under the FDCPA, if the debt collector continues to pursue the debt without verification or harasses you after you dispute it, you have the right to file a complaint with the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general office.

Keep records of all communication, including any correspondence sent and received. If the error persists, consult with a consumer attorney who specializes in debt collection practices to explore further legal action.

If a collection agency ignores your dispute, take the following steps to address the situation:

1. Review Your Dispute Documentation

Ensure that you have proof of your dispute. Check that your letter was sent using certified mail or another trackable method. This ensures that you have documentation showing the agency received your dispute.

2. Send a Follow-Up Letter

If the agency hasn’t responded within 30 days, send a follow-up letter. Refer to your original dispute and request acknowledgment of the issue. Include any tracking numbers or evidence that proves the dispute was sent.

3. Report the Situation to the Credit Bureaus

If the collection agency continues to ignore your dispute, contact the credit bureaus (Equifax, Experian, and TransUnion). Dispute the entry directly with them and provide supporting documentation that the collection agency is not adhering to the dispute process.

4. File a Complaint with Regulatory Authorities

Submit a formal complaint with the Consumer Financial Protection Bureau (CFPB) or your local state attorney general’s office. They can assist in holding the collection agency accountable and investigate further actions.

5. Consider Legal Action

If the collection agency fails to respond after multiple attempts, you may need to consult with a lawyer. Legal action could be necessary to ensure the debt is properly handled or to seek compensation for any violations of your rights.

Now there are fewer repetitions, but the meaning remains!

When dealing with collections disputes over receipt of debt letters, it’s crucial to ensure clarity and precision. Ensure your response clearly addresses the issue without unnecessary reiteration. Use concise language to present your case and avoid restating points you’ve already made. Here’s how you can proceed:

- Review the debt letter carefully to identify any inconsistencies or inaccuracies.

- Provide supporting documentation that clarifies your position and refutes any errors in the debt claim.

- Respond promptly to avoid any escalation in the collection process.

- If needed, request additional evidence from the creditor to substantiate the debt claim.

Reducing repetition doesn’t mean omitting key details. Present relevant facts clearly and succinctly, and focus on the key points that support your stance. This approach will make your dispute easier to understand and more likely to be resolved favorably.

Maintain clear and focused communication

Keep your language direct, highlighting any mistakes made by the creditor. Avoid adding unrelated information that could dilute your position. Stick to the facts and remain professional throughout the dispute process.

Consider legal assistance if necessary

If the issue persists, consulting with a lawyer or debt advisor may provide further guidance. They can assist in drafting a formal response that strengthens your case and helps avoid future misunderstandings.