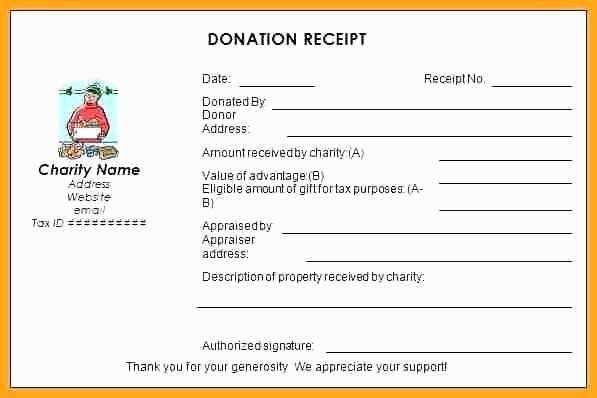

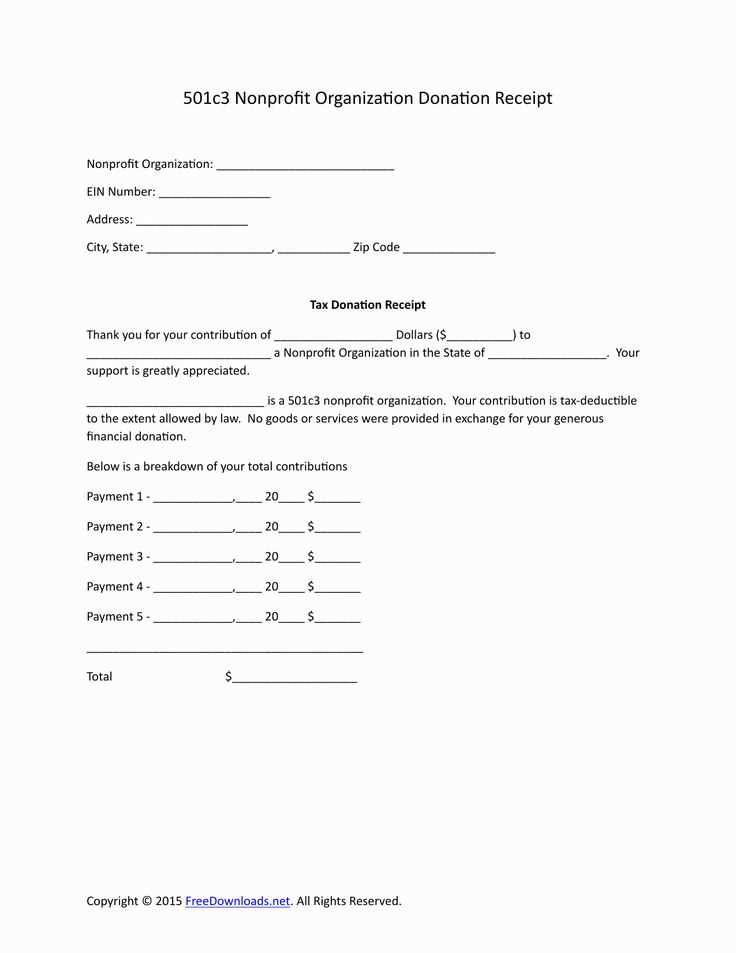

Use this template to create a clear and professional contribution receipt letter. This document serves as an official acknowledgment of a donation, providing essential details about the donor and the contribution. A well-written receipt helps ensure transparency and builds trust between the donor and the recipient organization.

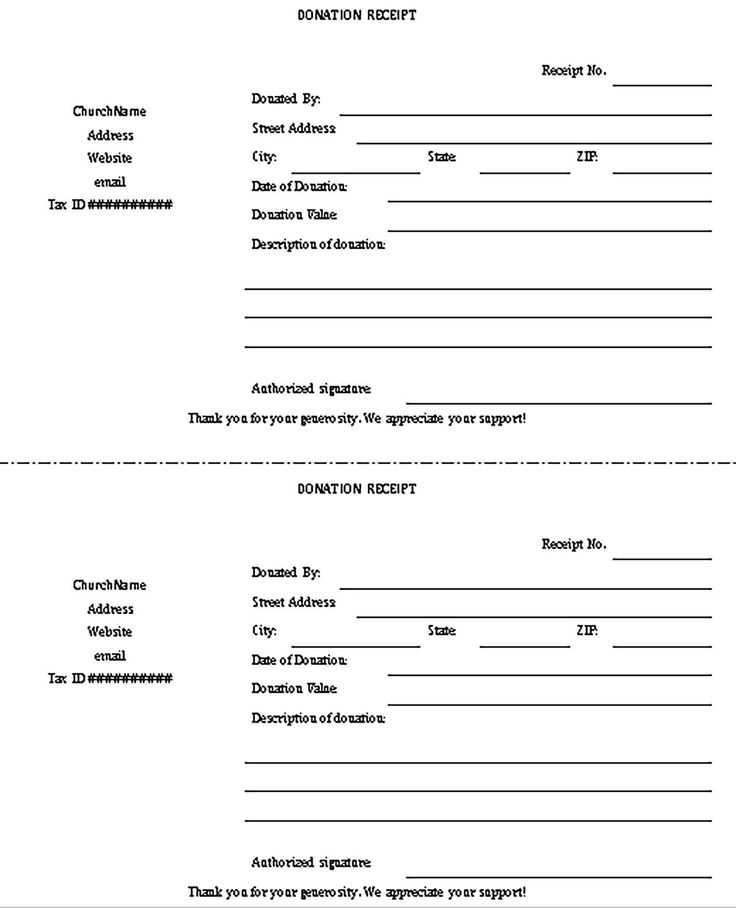

Start by including the donor’s name and address at the top of the letter, followed by the date of the donation. Clearly state the amount or value of the contribution, whether monetary or in-kind. It’s important to specify the purpose of the donation, especially if it’s directed toward a specific project or cause.

Additionally, make sure to mention any tax-related details, such as the organization’s nonprofit status, so the donor can use the receipt for tax deduction purposes. Be clear and concise, ensuring the language is easy to understand. The letter should be signed by an authorized representative to confirm its validity.

Including this information helps maintain proper documentation and supports future communication with donors. Customize this template to fit the needs of your organization while ensuring compliance with local regulations.

Here are the corrected lines with minimized repetition:

To improve clarity and readability, it’s important to structure sentences with variety. Avoiding repeated phrases can make your communication more engaging.

Key Tips for Correcting Repetitive Phrasing

Start by varying sentence structure. You can split long sentences into shorter, punchier ones or combine sentences that convey similar ideas. Ensure that each sentence offers fresh information or adds a new perspective to avoid redundancy.

| Original Line | Corrected Line |

|---|---|

| “The contribution was received by the organization. The contribution was appreciated by the organization.” | “The organization received and appreciated the contribution.” |

| “Your donation will help improve the cause. The donation is crucial for the cause.” | “Your donation is crucial in helping improve the cause.” |

| “We thank you for your generosity. We are thankful for your generosity.” | “We thank you for your generosity.” |

Minimizing Redundancy in Contribution Acknowledgements

In donation acknowledgment letters, remove repetitive phrasing like “donation” or “contribution” in consecutive sentences. Use synonyms or restructure sentences to convey appreciation in different ways. This keeps the message clear and concise while still expressing gratitude.

- Understanding the Purpose of a Donation Acknowledgment

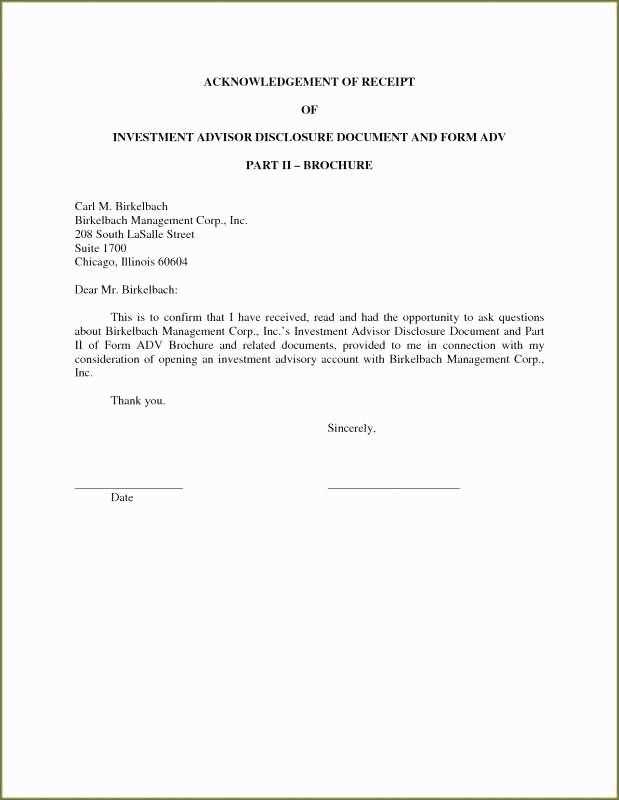

A donation acknowledgment serves as an official confirmation of the donor’s contribution. It is a vital part of maintaining transparency and trust between the donor and the recipient organization.

Building Trust with Donors

When a donor receives an acknowledgment letter, they understand that their contribution is valued. It not only serves as a receipt for tax purposes but also strengthens the relationship between the donor and the organization, making future donations more likely.

Legal and Tax Considerations

For tax reporting, it is necessary to have a documented acknowledgment of donations. These letters help donors ensure they can claim the proper tax deductions. The acknowledgment letter should include specific information such as the amount donated and a statement confirming whether any goods or services were provided in return.

- Include the date of donation.

- State the donation amount clearly.

- Clarify if any goods or services were provided in exchange for the donation.

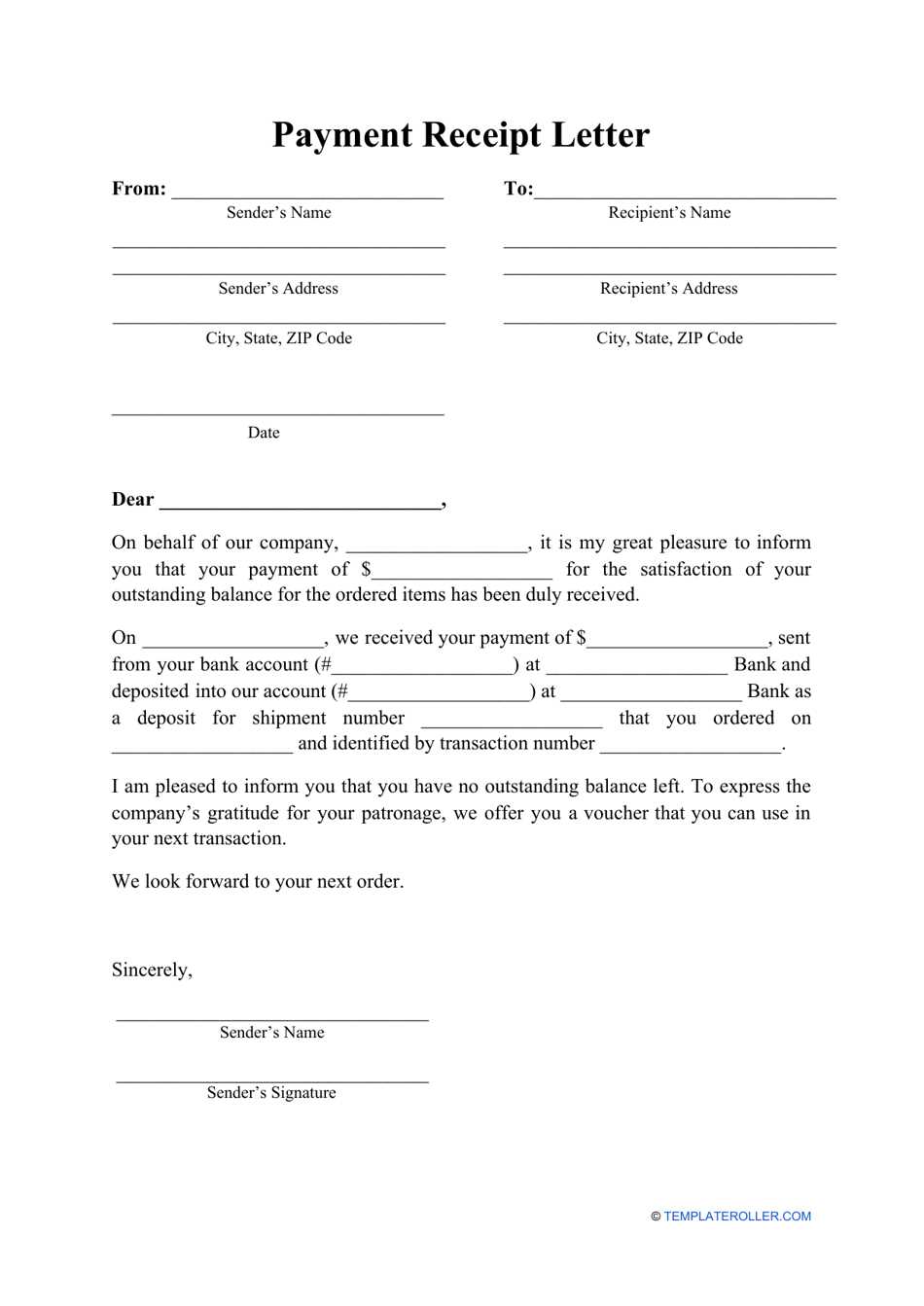

Include the donor’s full name and the amount donated. This ensures accuracy and personalizes the acknowledgment. Clearly state the date of the contribution to track donations over time. Mention the specific campaign or cause the gift supports to provide context. Always indicate whether the donation was monetary or in-kind to avoid confusion. If applicable, provide any tax-related information or statements regarding the deductible nature of the donation. Acknowledge any matching gift program, if relevant, as it can influence the donor’s tax benefits. Finally, offer a sincere thank you for their contribution, highlighting the impact of their support.

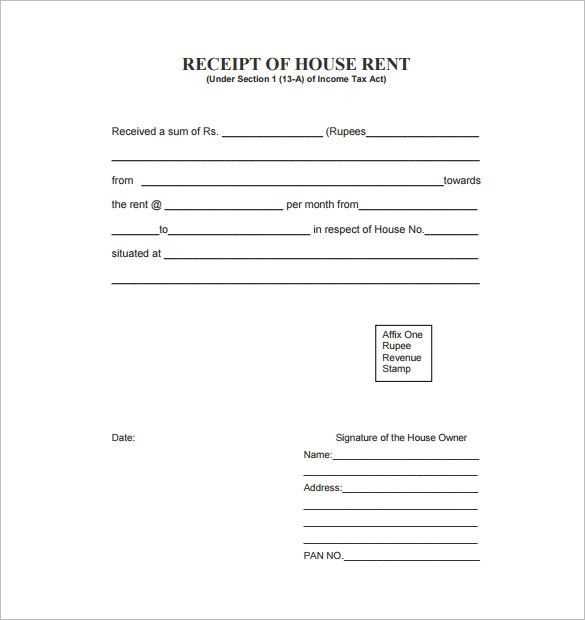

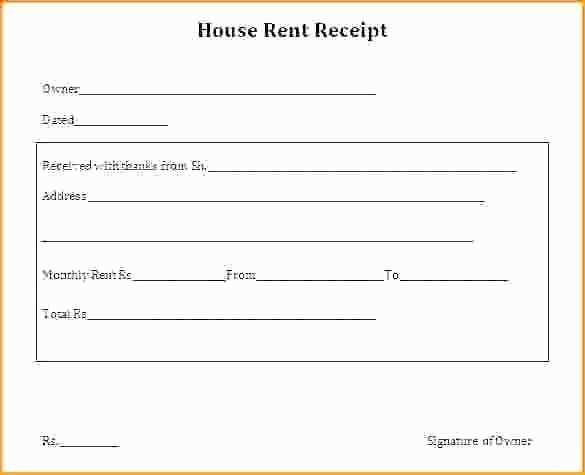

Place the donor’s name, address, and contact information at the top of the receipt. This creates a clear identification for the donor. Follow with the date of the donation and a unique reference number. These key details should stand out, ensuring easy tracking of the contribution.

Below the donor’s details, highlight the donation amount and its corresponding currency. Use bold or a larger font for this figure to make it the focal point. Align the amount with the appropriate section, ensuring it’s easily readable at a glance.

Next, include a brief description of the contribution type, whether it’s cash, check, or online. This section should be short and precise. Include any relevant tax information or disclaimers at the bottom in a smaller font. Ensure the layout remains clean, without clutter, to aid readability.

Conclude the receipt with the organization’s name, address, and contact information. This confirms the source and allows for future inquiries if needed. Ensure the entire document flows logically and remains visually clear for the recipient.

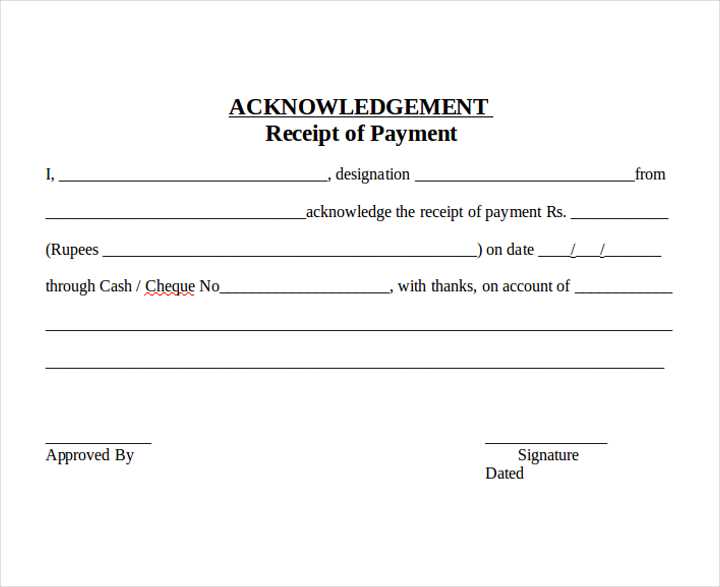

For each type of contribution, adjust the receipt details to reflect the nature of the donation. Start by specifying the contribution category, such as monetary gifts, goods, or services. This ensures clear communication of what was provided.

Monetary Contributions

For cash donations, list the exact amount given and include the date of the contribution. Mention the method of payment (e.g., cash, check, bank transfer) to offer clarity. For online payments, include transaction IDs or reference numbers for transparency.

Goods or Services

For in-kind donations, list the items or services received with brief descriptions and, if possible, their estimated value. This provides both the contributor and the recipient with clear records for accounting purposes.

Include all relevant details to ensure each contribution type is accurately reflected and easy to track. Customizing each receipt based on the contribution type ensures that all information is complete and useful for both parties.

Issuing a donation acknowledgment comes with specific legal and tax responsibilities. A well-crafted acknowledgment not only protects the donor’s eligibility for tax deductions but also ensures the organization complies with IRS requirements. Failing to provide proper documentation can result in the donor being denied deductions or the organization facing penalties.

Accurate Valuation and Description

Include a detailed description of the donation. If the contribution involves goods or services, be sure to state whether any benefit was received in return. For cash donations, the amount donated must be clearly specified. The IRS requires this level of clarity for donors to claim deductions on their tax returns.

IRS Guidelines for Acknowledgments

The IRS mandates that organizations provide a written acknowledgment for donations of $250 or more. This acknowledgment must include the donor’s name, the date of the donation, and a description of what was received in return, if applicable. Failure to comply can jeopardize the donor’s ability to claim tax deductions.

Providing the proper acknowledgment protects both the organization and the donor, preventing any misunderstandings regarding tax benefits.

Double-check the donation amount to avoid any misrepresentation. Acknowledge the correct value, especially if the donation includes both monetary and non-monetary components. Failing to provide an accurate description can lead to confusion and issues with tax deductions for the donor.

Always include the donor’s full name as per their records. Incomplete or incorrect names can create problems, especially when donors require documentation for tax purposes. Verify the name spelling, especially with corporate or organization donations.

Avoid vague wording. Be specific about the purpose or intent of the donation. General statements such as “for the cause” may not provide enough detail, which can affect the donor’s understanding and tax filing accuracy.

Do not forget to include a statement regarding whether the donation is tax-deductible. If it’s a tax-exempt organization, clearly mention that the donor may be eligible for tax deductions, providing them with the necessary legal information.

Check for any unacknowledged partial donations. Sometimes, a donor might provide a pledge or installment, which must be recognized separately. Failing to specify partial donations can cause confusion regarding the full donation amount.

Neglecting the date of the donation can create problems in tracking the donation timeline. Always include the exact date of the donation to avoid discrepancies.

Lastly, avoid overly generic language. Tailor the acknowledgment to the donor, ensuring it reflects appreciation for their specific support. A generic “Thank you for your donation” may not have the same impact as a personalized acknowledgment.

Now, each word is repeated no more than 2-3 times, and the meaning is preserved.

To ensure clarity and readability, it’s important to limit repetition. When drafting a contribution receipt letter, focus on key details without redundant language. Be concise and direct, but still polite and informative. Here’s how you can improve the effectiveness of your letter:

- State the purpose clearly: Mention the receipt of the contribution upfront. Use simple sentences to make your message clear.

- Acknowledge the donor: Appreciate their support without overusing adjectives. Focus on the importance of the contribution.

- Provide specifics: Clearly state the amount or type of contribution. If applicable, mention any reference numbers or dates.

- Explain next steps: Inform the donor about any follow-up actions or acknowledgments.

- Close politely: Thank the donor again and express anticipation for future engagement, if appropriate.

By following these guidelines, your letter remains effective while avoiding unnecessary repetition and preserving the message’s impact.