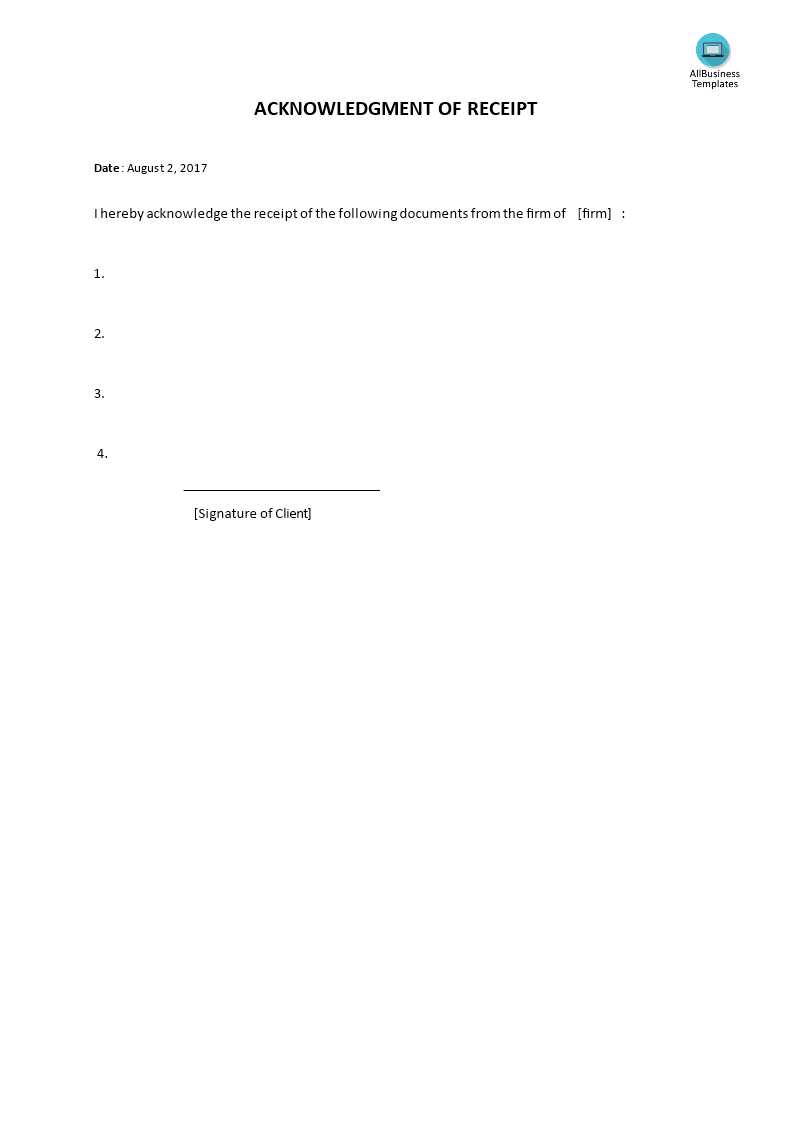

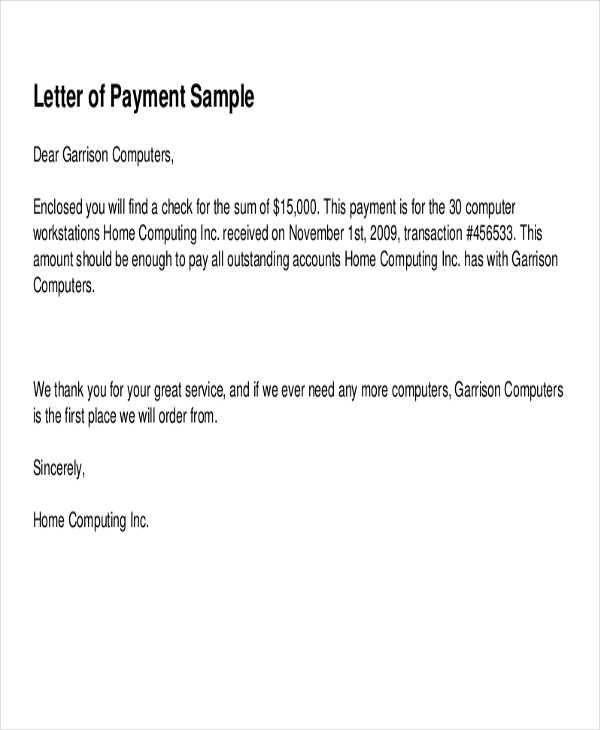

Use this simple template to create a formal letter of receipt for any goods or services received. This document helps confirm the transfer and ensures both parties have a written record of the transaction. It’s ideal for businesses and individuals who need to acknowledge receipt of materials, payments, or any other types of goods or services.

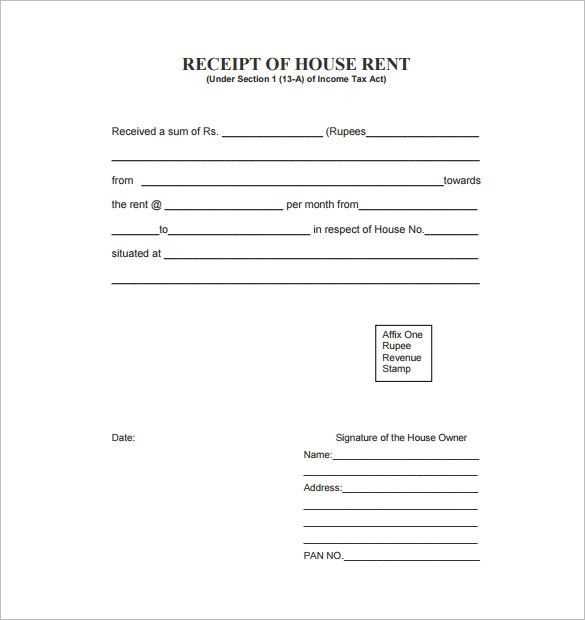

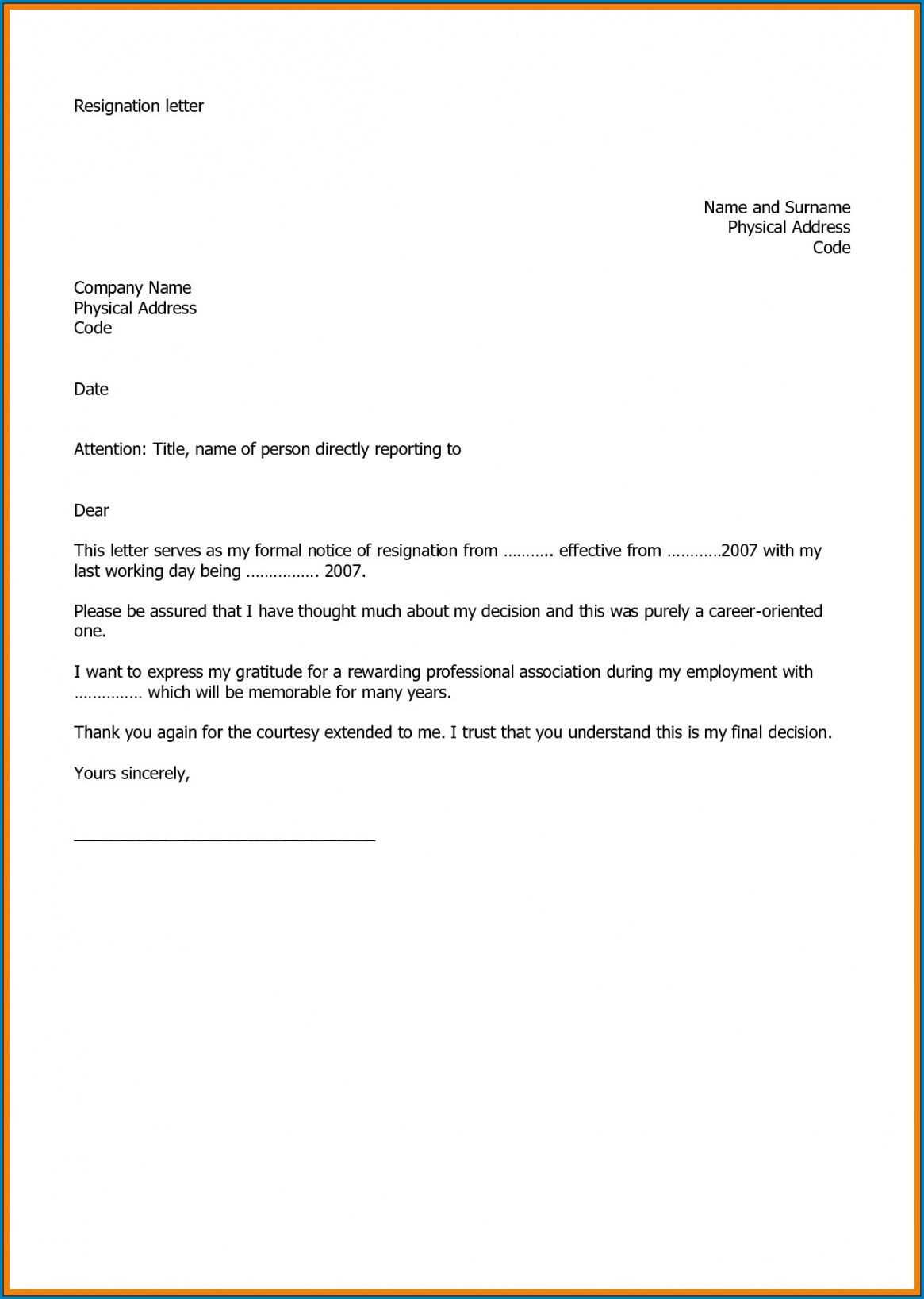

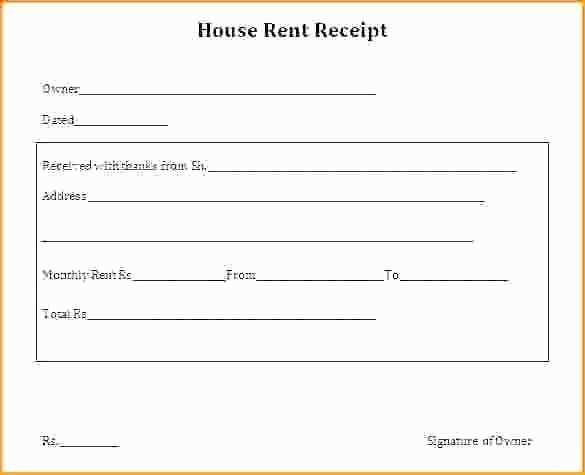

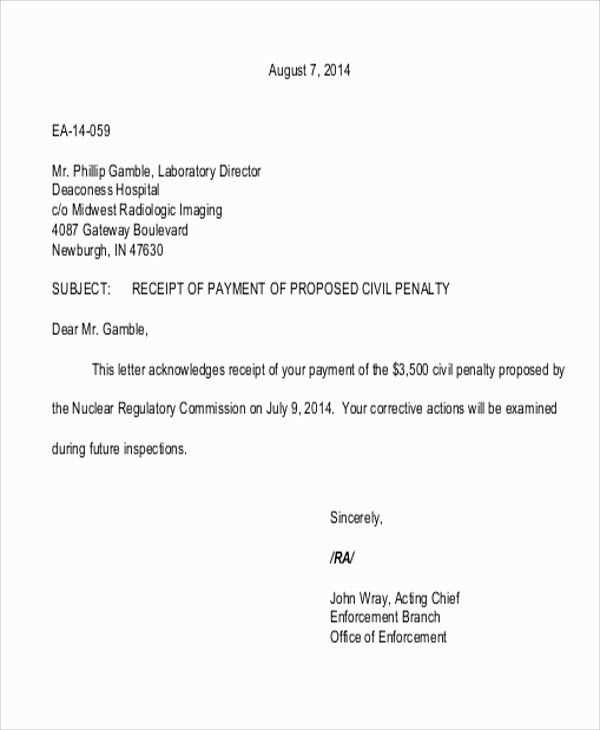

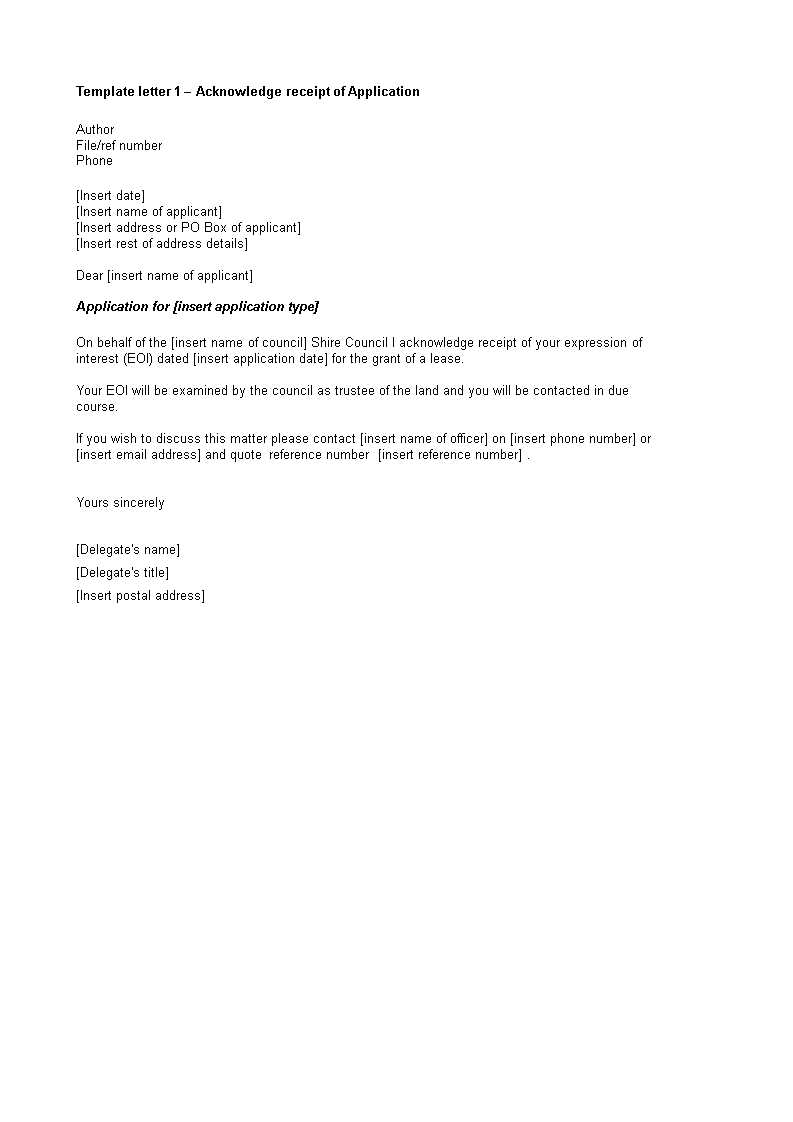

Start with the recipient’s information: Begin by including the full name, address, and contact details of the party acknowledging the receipt. This section should be followed by the date of receipt, which is crucial for record-keeping purposes.

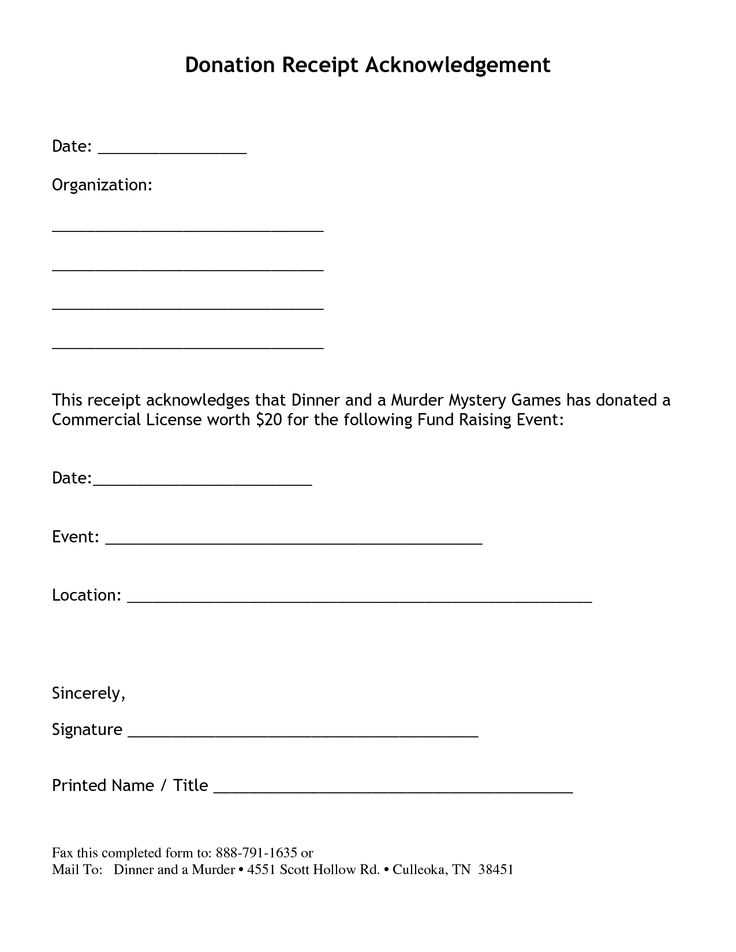

Describe the item or service: Clearly identify what has been received. Include detailed descriptions, quantities, and any relevant serial or identification numbers. This makes it easier to verify the accuracy of the transaction later. Be precise and concise to avoid misunderstandings.

Acknowledge the terms of receipt: State whether the goods or services were in satisfactory condition or note any discrepancies. If applicable, mention any warranties or agreements related to the items received.

End with a closing statement: Sign the document and provide a space for the sender to do the same. This formal conclusion strengthens the validity of the letter.

Here is the revised text, minimizing word repetition:

To streamline communication, avoid overusing similar phrases. Focus on clarity by choosing precise terms. For example, replace common expressions with more specific alternatives to keep the message concise. For instance, instead of “as stated earlier,” use “as outlined.” This approach prevents redundancy and ensures the text remains direct and engaging.

Consider breaking long sentences into shorter ones to increase readability. Refrain from repeating the same word within a paragraph, unless it’s necessary for emphasis. If you must use the same term, vary its structure or context to maintain flow without sounding repetitive.

By following these guidelines, your text will feel more polished and professional, allowing your message to stand out without the distraction of unnecessary repetition.

- Letter of Receipt Template

When drafting a letter of receipt, it’s key to include the details that confirm the receipt of a specific item, payment, or document. Focus on clarity and accuracy to avoid confusion.

Begin with the date, followed by the name of the person or organization receiving the item. Specify what is being received, including a description and any relevant identification numbers, such as invoice or order numbers. If applicable, note the condition of the received item or document.

Conclude the letter with a polite acknowledgment, such as “Thank you for your attention to this matter” or “We appreciate your cooperation.” Be concise and professional, ensuring the recipient knows exactly what was received and in what form.

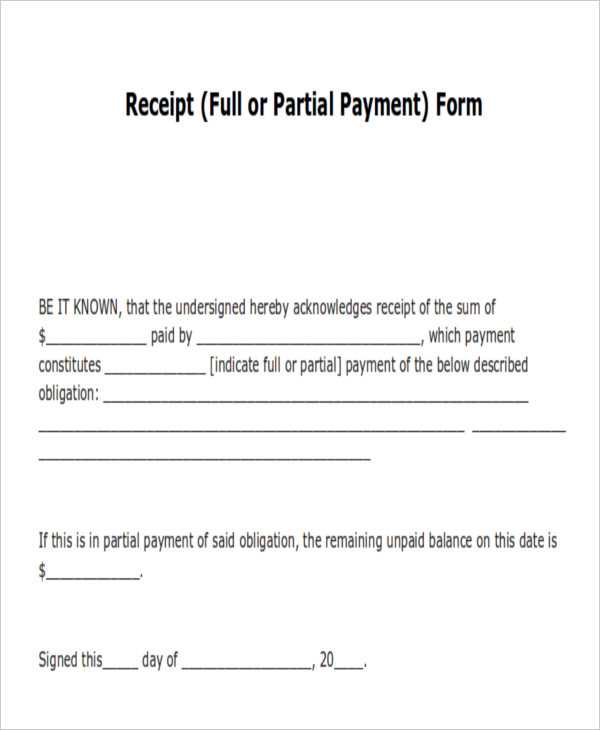

A receipt serves as a formal acknowledgment that a transaction has taken place. It provides a detailed record of the exchange, outlining the goods or services received, their price, and the terms of the sale. This documentation can be used for personal tracking of expenses, warranty claims, or disputes that may arise after a purchase. Keeping receipts allows individuals and businesses to maintain accurate financial records and serves as proof of payment when needed.

For businesses, providing a receipt enhances transparency and builds trust with customers. It confirms that the transaction is legitimate, ensuring both parties are clear on the terms. A well-structured receipt also supports proper accounting practices, helping organizations manage taxes and audits more effectively.

Include the business name and contact details. This establishes who is issuing the receipt and provides a way for the customer to reach out if necessary.

Clearly state the date of the transaction. This helps track the exact time when the exchange took place, which is useful for both the customer and the business for future reference.

Provide a unique receipt number. This ensures each transaction is identifiable, allowing for easy record-keeping and preventing confusion with other transactions.

List the items or services purchased. Be specific, including quantity, price per unit, and total cost. This helps the customer understand exactly what they are being charged for.

Include the total amount paid. This should reflect any discounts or taxes applied, and it ensures transparency in the transaction process.

Specify the payment method. Whether the payment was made in cash, credit card, or through another method, this helps clarify how the transaction was completed.

Show any applicable taxes separately. If tax is involved, clearly itemize it so the customer can see how much they were charged for tax purposes.

Offer refund or return policy information. This provides clarity on how the customer can address any issues with the purchase.

Be direct and concise. Begin by stating the purpose of your acknowledgment, mentioning what you received and from whom. Avoid unnecessary details and focus on clarity. Use formal yet approachable language to convey respect and professionalism.

1. Start with a Specific Statement

Clearly state the receipt of the item or information. For example, “I acknowledge receipt of the payment of $500, received on February 5, 2025.” This eliminates ambiguity and ensures the recipient understands exactly what is being acknowledged.

2. Include Relevant Details

Provide specific information about what is being acknowledged, such as dates, amounts, or references. These details help prevent confusion and make the acknowledgment more precise. For example, include an invoice number or delivery ID if applicable.

- Payment confirmation (amount, date, and method)

- Document receipt (title, date, and reference number)

- Shipment acknowledgment (tracking number, delivery date)

By offering precise information, you build trust and demonstrate professionalism in your communication.

3. Close with Appreciation

End with a brief expression of gratitude. A simple “Thank you for your prompt payment” or “We appreciate your cooperation” maintains a positive tone without being excessive.

One common mistake is failing to include a clear description of the transaction. Be specific about the items or services exchanged, including quantities and prices. This ensures the receipt accurately reflects the purpose of the exchange.

Another error is neglecting to mention the payment method. Whether it’s cash, credit, or another method, specify how the transaction was completed to avoid confusion later.

Leaving out the date of the transaction can lead to misunderstandings. Always include the exact date to establish a clear record and prevent issues with returns or disputes.

Make sure the receipt includes both the name of the buyer and the seller. This helps in case follow-up is needed or if verification is required in the future.

Don’t forget to add a unique receipt number. This can help track and reference specific transactions, which is particularly useful for business and record-keeping purposes.

Send an acknowledgment immediately after receiving goods or payment to confirm the transaction. This ensures clear communication and builds trust. Ideally, send the acknowledgment within 24 hours of receipt. If it’s a payment, acknowledge it right after processing. For goods, it’s important to verify the contents and condition first, but aim to send the acknowledgment within a day of receiving the shipment. Delays may cause confusion or doubts, so act quickly to maintain smooth business relations.

In cases where there are issues with the goods or discrepancies in payment, make sure to address them in the acknowledgment. Clarify any concerns or offer a solution right away to avoid misunderstandings.

A receipt letter acts as legal proof that goods, services, or payments have been received. It provides a clear record of transactions, which can be used in legal situations, such as disputes or claims. If a receipt letter is signed by both parties, it holds legal weight in court, serving as evidence of the exchange that occurred.

The absence of a receipt letter can complicate legal matters. Without it, proving the completion of a transaction may become challenging, as there is no formal acknowledgment of receipt. In situations where payment or delivery is disputed, a receipt letter can clarify the terms and prevent misunderstandings.

Additionally, a receipt letter can protect both parties in case of fraudulent activity. By detailing the nature of the transaction, it can serve as a defense against accusations of non-payment or non-delivery. The document can also help ensure that warranties or returns are honored, as it verifies the date and condition of the item or service received.

The legal force of a receipt letter depends on its accuracy and the terms it outlines. If the details in the letter are incorrect or misleading, the validity of the document can be challenged. Therefore, it is critical to include accurate and specific information regarding the transaction to avoid potential legal complications.

| Legal Implication | Details |

|---|---|

| Proof of Transaction | Validates that goods or services were received, useful in disputes. |

| Defending Against Fraud | Helps defend against claims of non-payment or non-delivery. |

| Warranties and Returns | Ensures that return policies or warranties are applied correctly. |

| Legal Disputes | Used as evidence in court to resolve transaction disagreements. |

To create a clear and concise letter of receipt, focus on key elements that ensure clarity. Here’s how to structure it:

- Recipient’s Name: Include the full name of the person or organization receiving the item or payment.

- Date of Receipt: Clearly state the exact date the item or payment was received.

- Item Description: Describe the item or payment in detail, including quantity and condition, if applicable.

- Signatures: Both the recipient and the person issuing the receipt should sign for confirmation.

- Unique Identifier: Add a receipt number or reference to distinguish it from other records.

Keep It Simple

Maintain brevity. Avoid unnecessary details or vague wording. Keep the tone formal and precise to prevent misinterpretation.

Final Review

Always double-check for accuracy before issuing the letter of receipt. Mistakes can lead to misunderstandings, so ensure all details are correct.