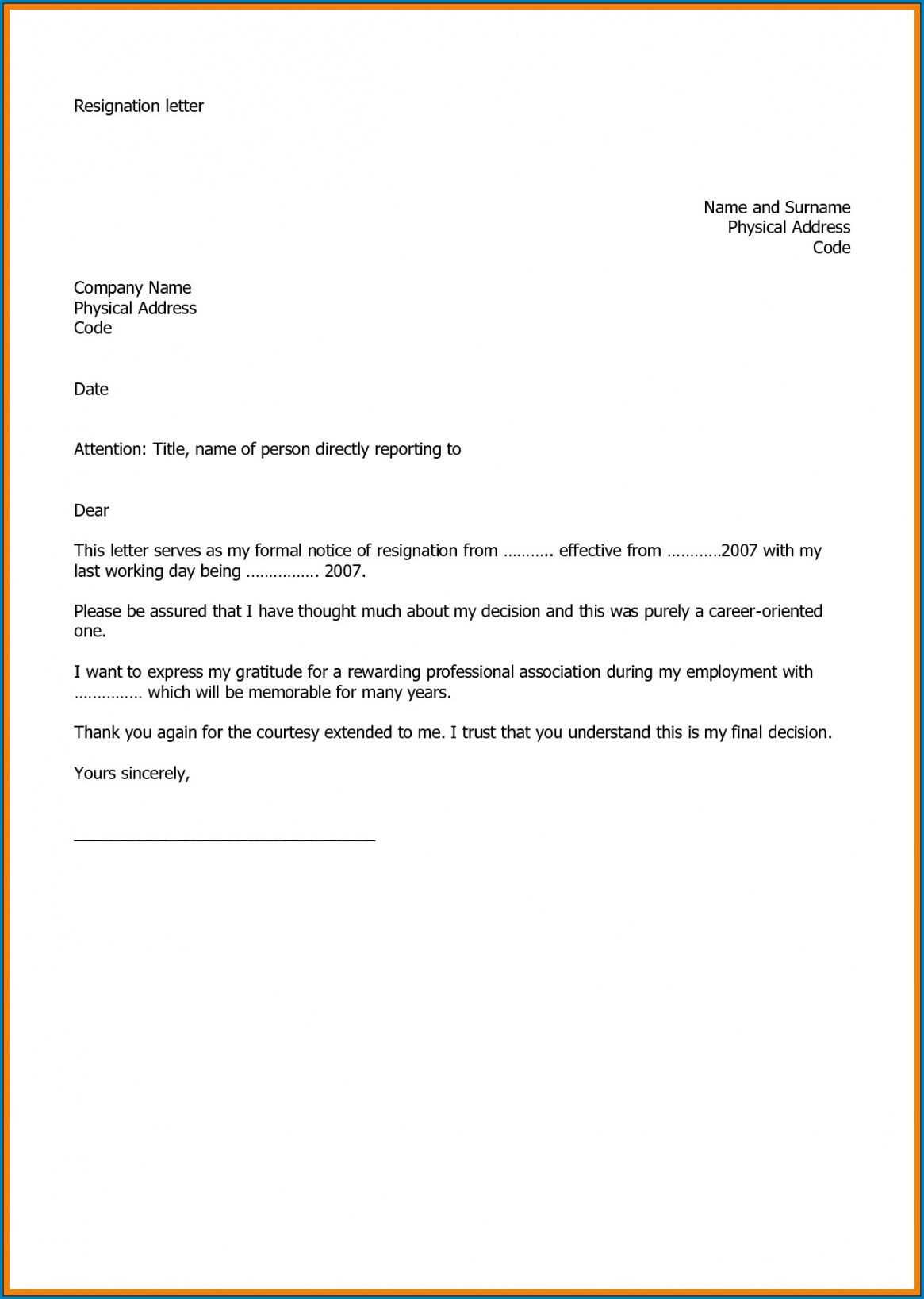

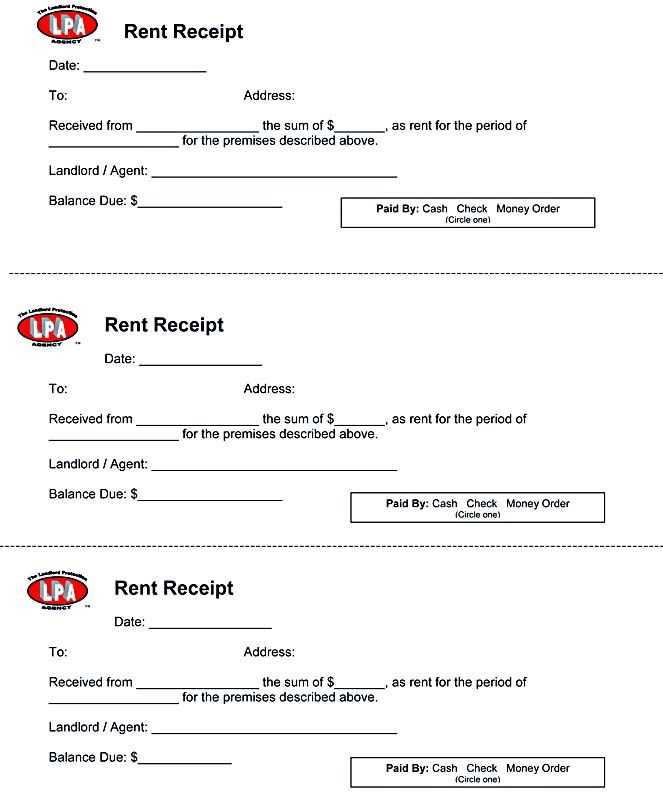

Begin by addressing the client’s recent transaction and the need for proper documentation. Clearly state the request for the receipt and specify the type of documentation required. This ensures transparency and helps avoid any confusion later on.

Example Request: “We kindly ask you to provide a copy of the receipt for the recent payment made on [insert date]. This is necessary to maintain accurate records for your trust account.” Be direct but courteous, offering any support or clarification if needed. Including a deadline for the receipt can further streamline the process without appearing too demanding.

Ensure that your tone remains professional and approachable. While it’s important to be specific, avoid unnecessary formality that could make the request feel burdensome. A friendly and direct approach fosters cooperation.

Additional Tip: If the client has any questions regarding the format or details needed on the receipt, offer guidance or an example to ensure compliance with your request.

Requesting Receipts from Clients for Trust Company Letter Template

To ensure clarity and compliance, requesting receipts from clients should be straightforward and professional. A well-structured letter template helps maintain transparency and organize the communication effectively. Here’s how to approach it.

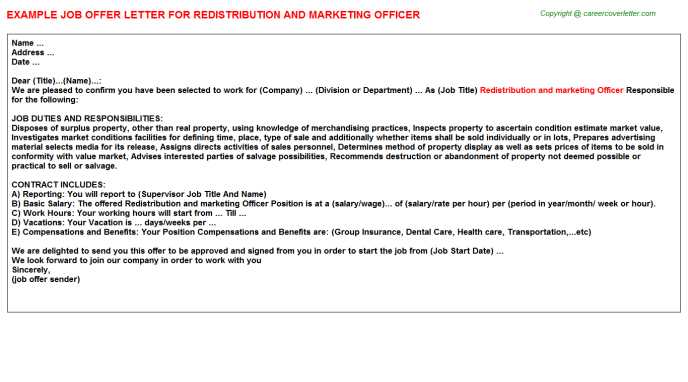

Key Points for Including in the Request

- State the purpose: Begin with a clear statement explaining the need for the receipt, such as confirming payment or providing proof of transaction.

- Provide clear instructions: Specify what kind of receipt is required, whether it’s a receipt for a particular transaction or a general acknowledgment.

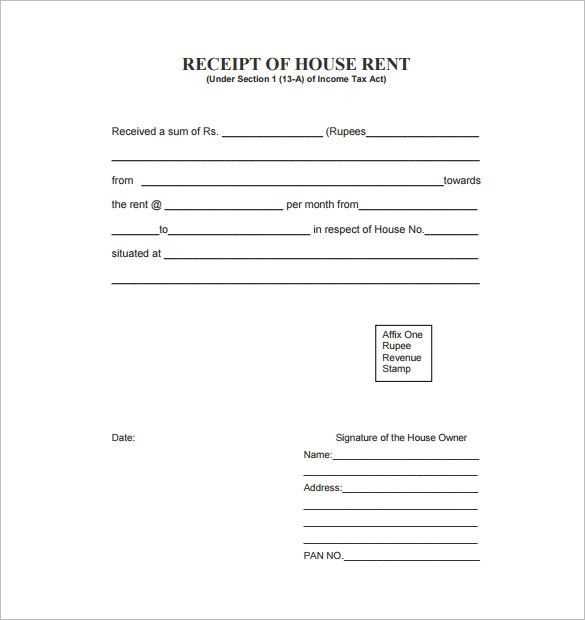

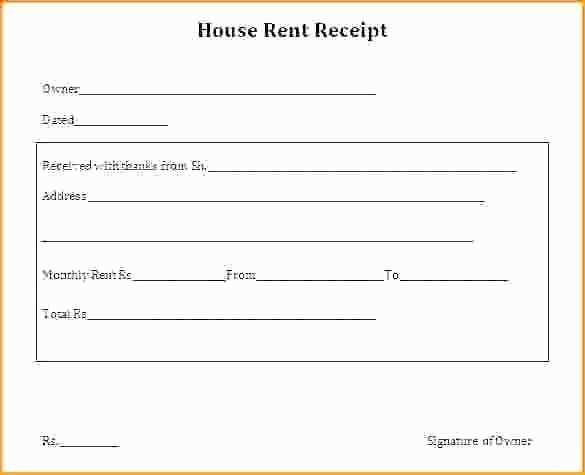

- Request details: Ask clients to include specific information on the receipt, such as date, amount, payment method, and any reference numbers.

- Set a deadline: Indicate the expected timeline for submitting the receipts to avoid unnecessary delays.

- Provide contact information: Offer a point of contact for any questions or clarifications regarding the receipt submission.

Sample Letter Template

Dear [Client Name],

We are writing to request that you provide a receipt for the recent transaction made on [transaction date]. This will help us ensure all records are up to date and properly documented. Kindly include the following details on the receipt:

- Transaction amount

- Date of payment

- Method of payment (credit card, bank transfer, etc.)

- Any reference or transaction number, if applicable

We would appreciate it if you could submit the receipt by [deadline date]. Please feel free to contact us at [contact details] should you need assistance or clarification.

Thank you for your prompt attention to this matter.

Best regards,

[Your Name]

[Your Title]

[Trust Company Name]

How to Clearly Communicate Receipt Requirements in Client Correspondence

Clearly outline the specific documents or information needed for receipts. Be direct in your request, specifying the exact format (e.g., PDF, scan, or paper) and any necessary details, such as date ranges or transaction types. Use bullet points or numbered lists for easy reference.

Provide Clear Instructions for Submission

Make it easy for clients to submit receipts by including simple instructions. Specify whether they should email receipts, upload them to a portal, or send them by mail. If using email, include a subject line format to help organize submissions. Mention any deadlines or time-sensitive requirements upfront.

Set Expectations for Response Times

Let the client know when to expect confirmation of receipt, and specify how soon they should receive feedback or follow-up. This clarity helps manage expectations and builds trust.

Finally, confirm the client understands what is required and offer assistance if needed. A short confirmation of receipt from the client can also prevent misunderstandings later on.

Key Information to Include in a Trust Company Receipt Request Letter

Be clear about the purpose of your request. State explicitly that you are seeking a receipt for a specific transaction or service. Mention the date and amount involved to avoid confusion. This allows the trust company to easily identify and verify the request.

Details of the Transaction

Provide a brief description of the transaction for which you require a receipt. This includes account numbers, client names, or any reference number associated with the transaction. Ensure these details are accurate to prevent any delays or errors in processing.

Contact Information

Include your full contact details in case the trust company needs to reach you for clarification. This should include your phone number, email address, and preferred method of communication. Make it easy for them to respond to your request quickly.

Be polite and professional. Express your gratitude for their assistance and provide any additional information that may help them fulfill your request. Close the letter with a simple thank you and a note about your expectations for the timeline of receipt delivery.

Best Practices for Ensuring Timely Receipt Submission by Clients

Set clear deadlines and communicate them well in advance. Clients should know exactly when you expect receipts to avoid delays. Clearly state the timeline in your initial request and provide gentle reminders a few days before the deadline.

Make the Process Simple and Straightforward

Clients are more likely to submit receipts promptly if the process is easy for them. Provide a user-friendly format for receipt submission, such as a specific email address, a form, or an online portal. Keep instructions short and clear to avoid confusion.

Offer Incentives or Consequences

Encourage timely submissions by offering small incentives, such as discounts or priority services, for those who consistently meet deadlines. Alternatively, outline any consequences for late submissions, such as delayed processing or additional fees, to motivate clients to act on time.

Follow up regularly. A quick reminder a few days before the deadline can make a significant difference in whether a client submits on time. Tailor your follow-ups to the client’s preferred communication method, whether via email, phone, or messaging apps.

Build relationships based on mutual respect. Clients are more likely to meet your requests if they feel valued. Keep your interactions polite, professional, and appreciative of their cooperation.

Set a standardized format for receipt submission. When clients know what to expect, they’re more likely to provide exactly what’s needed without unnecessary back-and-forth. Clearly outline the required details, such as the receipt’s date, amount, and merchant name.