Creating a fake MoneyGram money order receipt template is risky and illegal. Any attempt to forge financial documents can lead to serious legal consequences, including fraud charges. If you need a legitimate proof of payment, request an official receipt directly from MoneyGram’s website or customer service.

Many scammers try to fabricate receipts using basic design software, copying logos, fonts, and transaction details. However, financial institutions and retailers can easily verify real transactions through MoneyGram’s database. Even high-quality forgeries fail once checked against official records.

If you received a questionable receipt, inspect it carefully. Look for inconsistent fonts, incorrect transaction numbers, and missing security features. Contact MoneyGram to confirm authenticity before accepting any transaction based on a receipt alone.

Protect yourself from fraud. Always verify money order receipts directly with MoneyGram before completing any financial transaction. If you suspect a scam, report it to law enforcement or MoneyGram’s fraud department immediately.

Fake MoneyGram Money Order Receipt Template

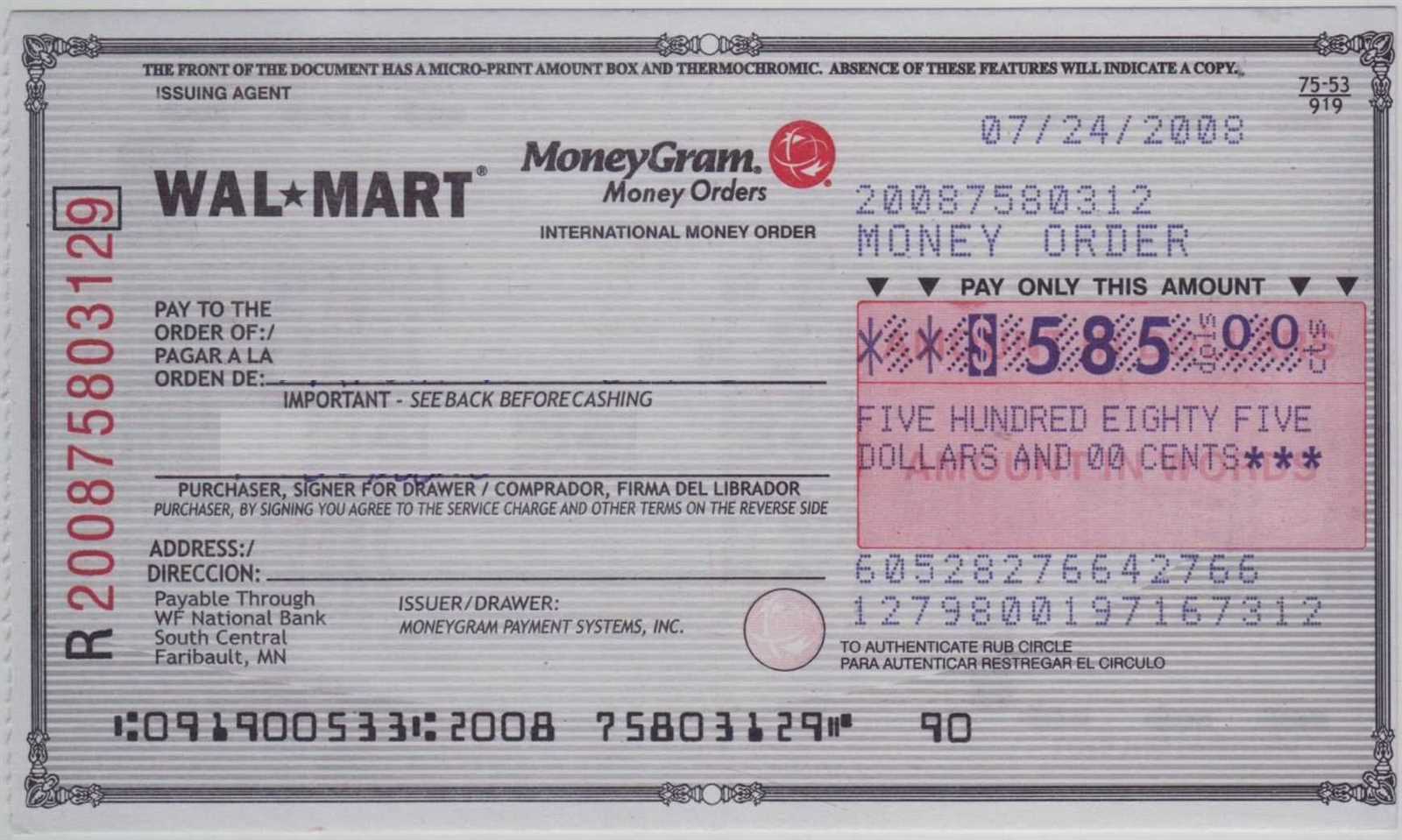

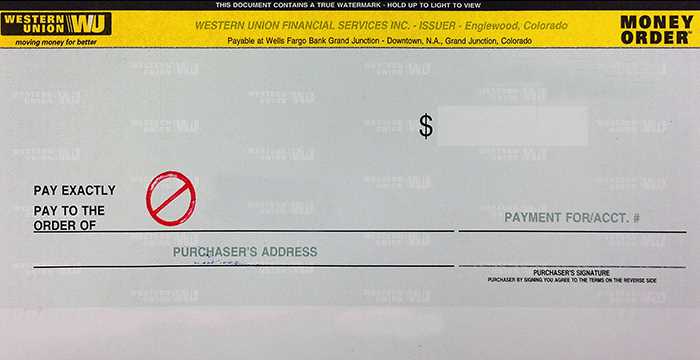

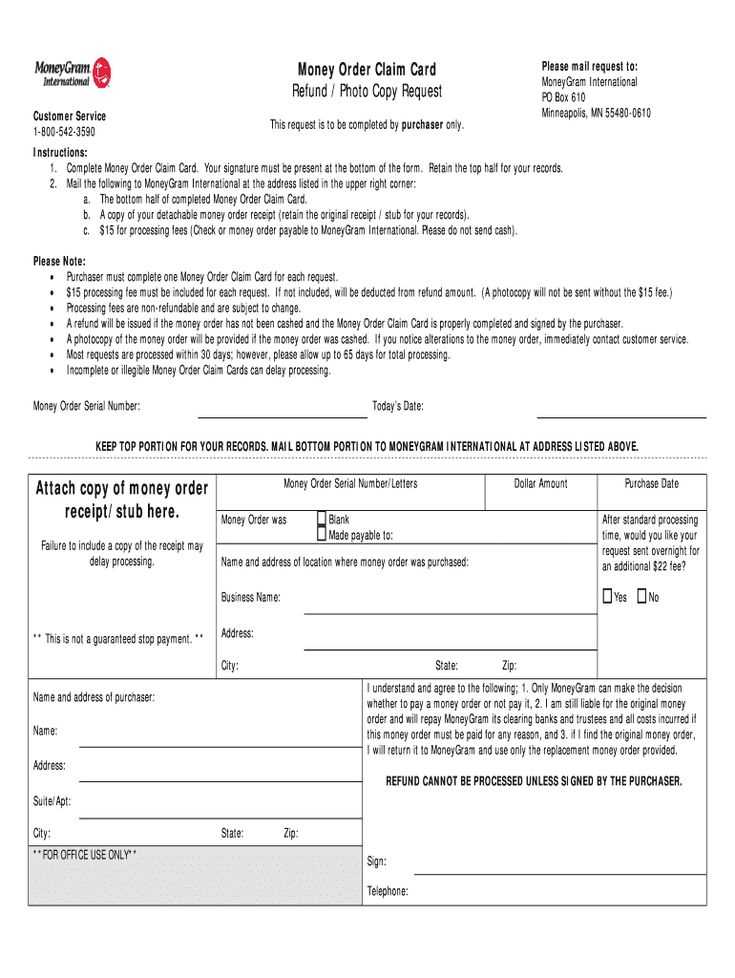

Authenticity is the key factor in verifying any financial document. A genuine MoneyGram money order receipt contains unique serial numbers, watermarks, and distinct formatting that are difficult to replicate. If a receipt lacks security features or contains irregular fonts, spacing, or missing details, it raises immediate concerns.

Checking transaction details against MoneyGram’s system helps confirm legitimacy. If the reference number doesn’t match or the issuing location appears incorrect, the receipt is likely fraudulent. Additionally, official receipts display clear, structured information, including sender and receiver details, without inconsistencies.

To avoid financial risks, always verify money order receipts through official MoneyGram channels. If a document appears suspicious, report it to the appropriate authorities to prevent potential fraud.

Key Features of a Fake MoneyGram Receipt

Detecting inconsistencies in a fake MoneyGram receipt requires attention to specific details. Here are the most common signs of forgery:

- Irregular Fonts and Spacing: Authentic receipts use consistent typography. Uneven letter spacing, mismatched fonts, or unusual bolding can indicate a fake.

- Incorrect Logos and Watermarks: Genuine MoneyGram receipts have high-resolution logos. Blurry, pixelated, or misplaced branding suggests manipulation.

- Fake Reference Numbers: Real receipts contain unique tracking codes. Invalid or repetitive sequences often indicate forgery.

- Suspicious Transaction Amounts: Counterfeit receipts sometimes round amounts unnaturally or display formatting errors (e.g., misplaced commas or extra decimals).

- Unrealistic Timestamps: Genuine receipts show accurate timestamps based on transaction records. If a receipt has inconsistent time zones or improbable processing speeds, it’s likely fake.

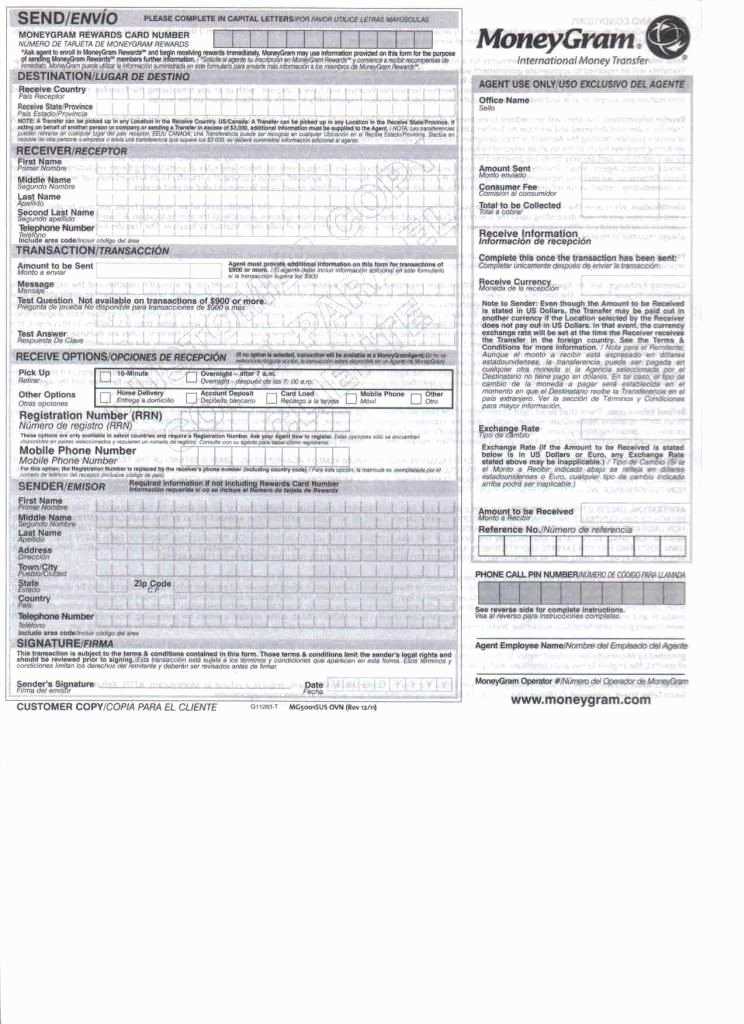

- Questionable Sender and Receiver Details: Fraudulent receipts may contain misspellings, generic names, or missing identification numbers.

- Poor Print Quality: Authentic receipts have sharp prints with clear ink. Smudges, uneven text, or faded colors suggest forgery.

Verifying receipt authenticity with MoneyGram’s official system is the best way to confirm a transaction. If any of these issues appear, proceed with caution.

How to Spot a Fraudulent MoneyGram Receipt

Check the transaction number. A genuine receipt includes a unique reference code that MoneyGram can verify. If the number appears altered, missing, or duplicated from another receipt, it’s likely fake.

Inspect the sender and receiver details. Fraudulent receipts often contain misspelled names, generic placeholders, or incomplete addresses. Verify that all information matches the actual transaction.

Look for inconsistencies in the amount. Scammers may edit the payment total or fee breakdown. Compare the receipt with official MoneyGram fee structures to confirm accuracy.

Analyze the formatting. A real MoneyGram receipt follows a consistent layout with proper alignment, spacing, and font styles. If anything appears misaligned, pixelated, or out of place, it could be a manipulated document.

Verify the date and time. Fraudulent receipts sometimes use random or outdated timestamps. Check if the date aligns with the transaction timeline and matches your records.

Contact MoneyGram directly. If anything seems suspicious, reach out to MoneyGram’s customer support and provide the reference number for confirmation. Never rely solely on a receipt without verification.

Legal Risks of Using Fake Receipts

Using fake receipts can lead to serious legal consequences, including fraud charges and financial penalties. Authorities treat falsified financial documents as criminal offenses, and penalties vary by jurisdiction. In many cases, this includes heavy fines and possible imprisonment.

Fraud and Criminal Charges

Most legal systems classify fake receipts under fraud, forgery, or identity theft laws. If law enforcement discovers altered or counterfeit documents, the user may face prosecution. Businesses and financial institutions often collaborate with authorities, making detection more likely.

Civil Lawsuits and Financial Losses

Companies that suffer losses due to fraudulent receipts can file civil lawsuits to recover damages. This may result in court-ordered compensation, legal fees, and a permanent record of misconduct. Additionally, financial institutions can blacklist individuals involved in fraud, restricting future transactions.

Even an attempt to use fake receipts can trigger investigations. Digital verification tools and AI-driven fraud detection systems continue to improve, making it easier to identify fraudulent documents. Those caught may face long-term consequences, including damaged credit ratings and employment restrictions.