Creating a money order receipt template is a quick way to ensure smooth transactions. This document acts as proof of payment, protecting both the sender and recipient. A well-structured receipt helps eliminate confusion and serves as a record of the transaction for future reference.

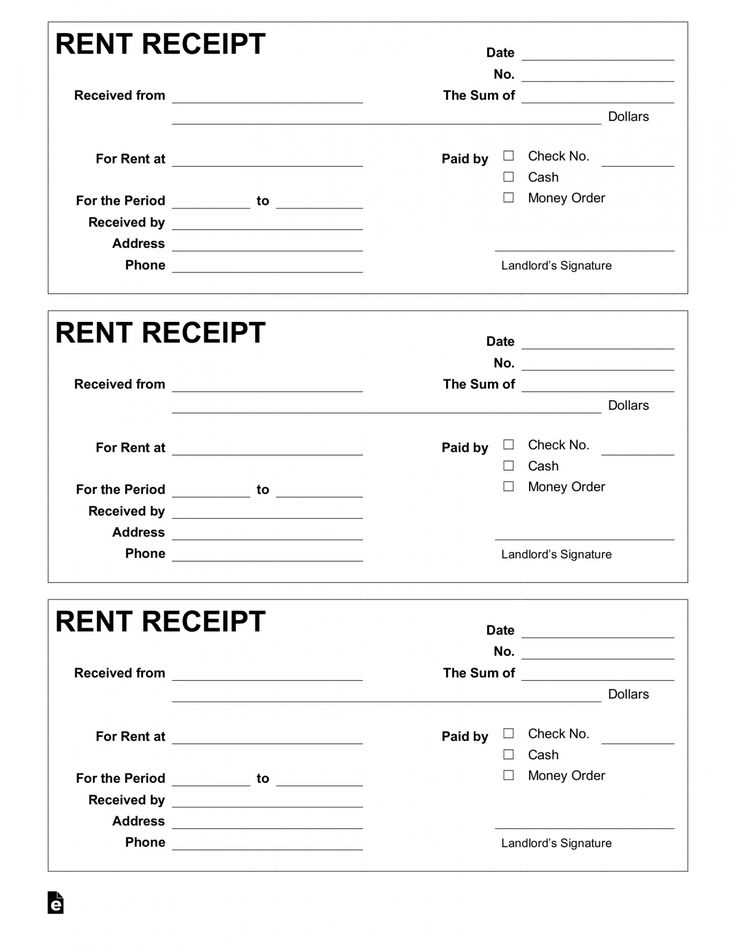

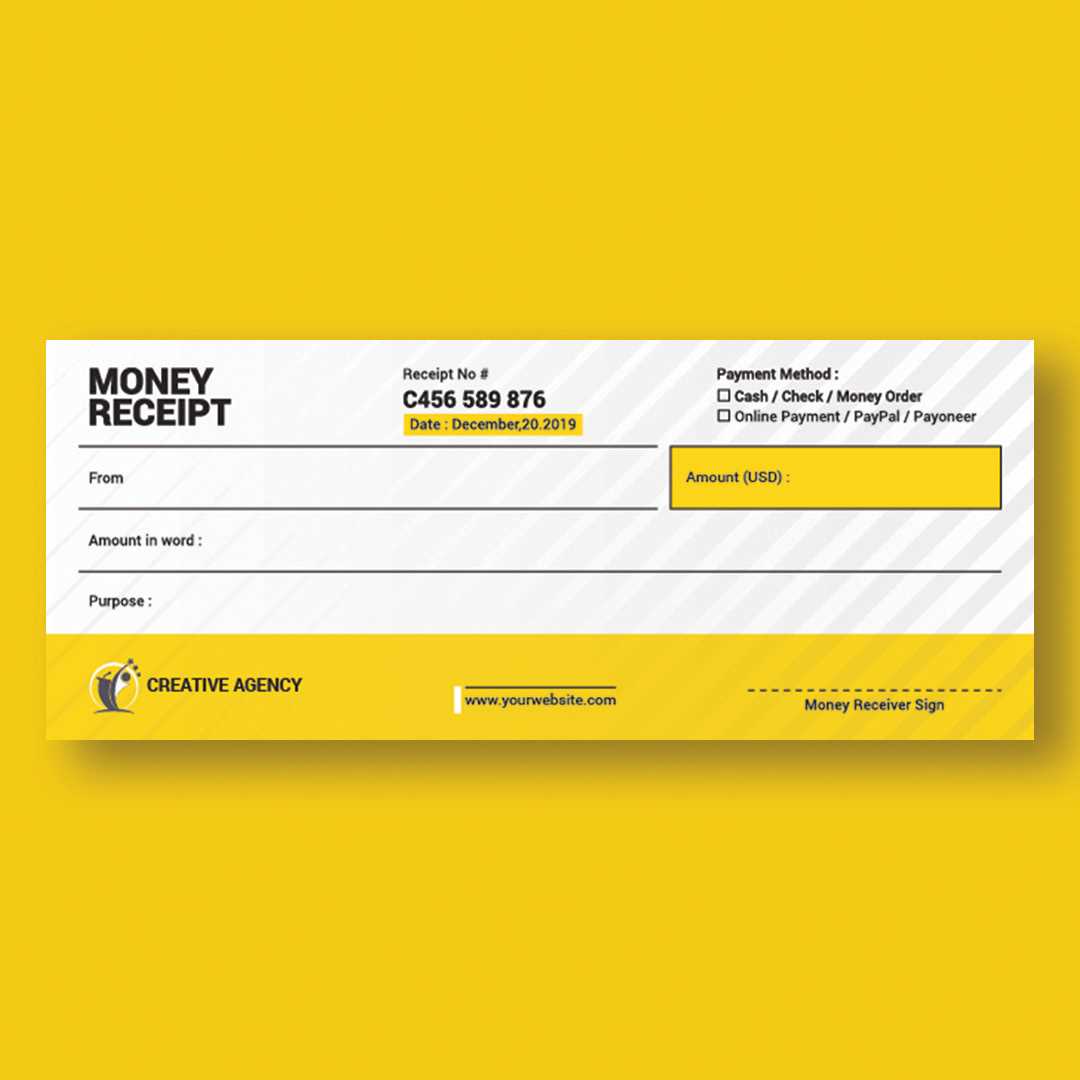

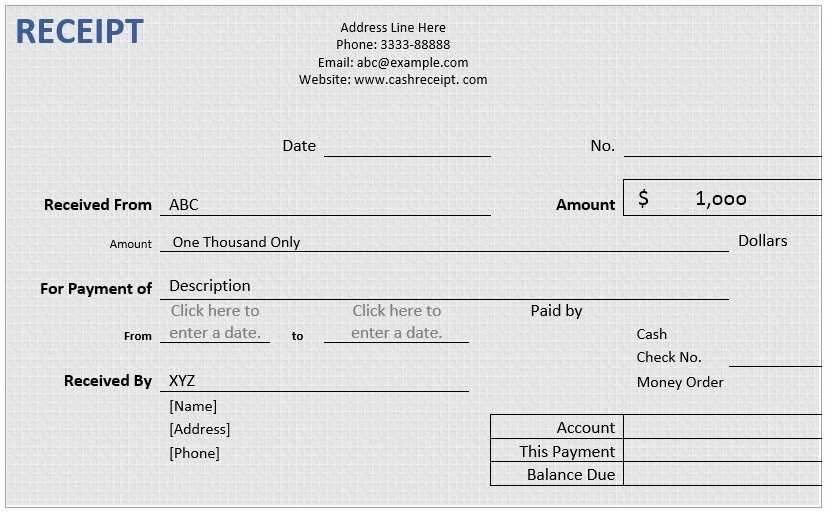

To craft a professional money order receipt template, include key details: the sender’s name, recipient’s name, money order amount, and transaction date. You should also add a unique reference number for easy tracking. A space for signatures from both parties confirms the transaction’s validity.

The format should be clear and easy to read, with each section separated appropriately. By including these details in a template, you can avoid miscommunication and ensure the document fulfills its purpose as an official receipt. You can customize this template to suit different situations, whether for personal or business use.

Here’s the revised version:

To create a money order receipt, include the sender’s and recipient’s full names, addresses, and phone numbers. Make sure to list the money order number, date of issuance, and the amount paid. Additionally, provide a clear space for any reference notes or transaction IDs that may be relevant for future tracking.

Ensure the receipt includes space for the issuer’s signature, as well as any additional stamps or marks that may authenticate the transaction. Include a section where the recipient can sign, confirming they have received the funds. A printed version of this receipt should be given to both parties, with one copy retained by the issuer for records.

Use clear fonts and bold the most critical information, like the amount and money order number, for quick identification. For enhanced security, consider adding a watermark or using specialized paper to prevent forgery.

Lastly, keep your records organized by assigning a unique number or code to each transaction for easy reference in case of any disputes or inquiries.

- Money Order Receipt Template Guide

A money order receipt is a vital document that serves as proof of payment. It includes details like the payer’s name, the payee’s name, the amount paid, and the date of the transaction. To create a professional and clear money order receipt template, focus on the following key elements:

- Payer’s Information: Include the full name and contact details of the person who issued the money order.

- Payee’s Information: List the full name and address of the person or business receiving the funds.

- Amount: Clearly state the total amount of the money order, including the currency. Ensure accuracy to avoid confusion.

- Payment Date: Specify the exact date the payment was made. This helps verify when the transaction occurred.

- Money Order Number: Assign a unique reference number for tracking purposes. This number is crucial for both the sender and the recipient.

- Issuer’s Information: Include the name of the financial institution or agency that issued the money order. This could be a bank, postal service, or other authorized entity.

- Signature: Space for the payer’s or issuer’s signature ensures authenticity of the transaction.

- Transaction Fee: If applicable, include any fees charged for processing the money order.

Ensure the template has a clean layout with all fields clearly labeled. This will make it easier for both parties to understand the document and keep a record for future reference. You can also include a disclaimer or note at the bottom of the receipt explaining any terms or conditions related to the money order. Keep the format simple and professional, avoiding unnecessary details.

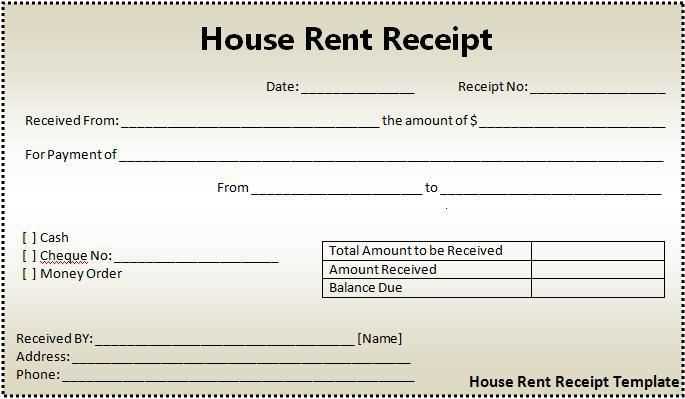

To customize a money order receipt for your business, focus on including key details relevant to both your customer and your operations. Start by incorporating your business name, address, and contact information. This ensures the receipt is traceable back to your business. Next, include a unique receipt number for easy tracking of transactions.

Key Information to Add

Ensure you list the following details on each receipt:

| Field | Description |

|---|---|

| Business Name and Contact | Your company’s name, address, phone number, and email address. |

| Receipt Number | A unique number for each transaction to facilitate tracking and reference. |

| Transaction Date | The exact date of the transaction. |

| Payer Details | Name of the person making the payment (optional based on your preferences). |

| Amount Received | The exact amount received in the money order. |

| Money Order Number | The identifying number of the money order for reference. |

Customizing for Your Brand

Adjust the design and layout of your receipt to match your brand’s visual identity. Add your company’s logo at the top of the receipt. Choose colors, fonts, and a layout that reflect your business’s personality. Ensure the design is professional and easy to read. A well-designed receipt helps build customer trust and gives your business a polished look.

Finally, make sure that your receipt includes clear instructions on how to contact your business for inquiries or disputes. This adds transparency and enhances customer satisfaction.

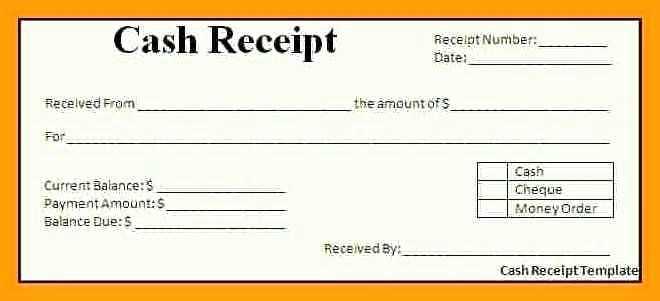

Ensure that the receipt includes the buyer’s full name. This helps confirm the person who made the transaction and links them to the money order. It’s also useful for reference if the money order needs to be traced later.

Record the money order number. This unique identifier is necessary for tracking and resolving any issues with the payment. Make it easy to locate on the receipt, as it may be required for claims or inquiries.

Include the recipient’s name. This ensures that the payment was intended for the right person or business. If any discrepancies arise, it will be easier to verify the transaction.

Indicate the payment amount in both figures and words. This avoids any confusion and confirms the exact value of the money order. It’s also a helpful safeguard against any alterations.

List the date and time of the transaction. The timestamp verifies when the money order was issued, which is especially useful for record-keeping or potential refund requests.

Don’t forget to include the issuing institution’s name. Whether it’s a postal service or bank, the issuer’s name offers credibility and allows for easier resolution in case of disputes.

Finally, ensure a clear indication of the fees. If there was a service charge, list it explicitly to avoid misunderstandings about the total amount paid.

Inaccurate or missing information can lead to issues. Double-check that all required fields, like the payer’s and payee’s names, payment amount, and date, are included. Failure to properly format these details could cause delays or rejections.

Overcomplicating the Design

Keep the template clean and simple. Adding too many elements, such as unnecessary graphics or overly detailed sections, can make the document harder to read and increase the chances of errors. Stick to a basic layout that focuses on key information.

Using Ambiguous Terminology

Avoid vague terms or unclear instructions. Labels should be straightforward to prevent confusion for anyone filling out the template. For example, use “Payee Name” instead of just “Name” to avoid ambiguity.

Not Allowing Room for Signatures

Make sure there’s enough space for both the payer’s and payee’s signatures. Without proper space, the form might be considered incomplete, invalidating the money order.

Forgetting to Include a Payment Reference Number

A reference number is crucial for tracking and verifying transactions. Not including this number can complicate the process if there’s a need for follow-up or troubleshooting.

Failing to Update the Template

Money order templates should be periodically reviewed and updated to reflect any changes in legal or financial requirements. Templates based on outdated information can lead to compliance issues.

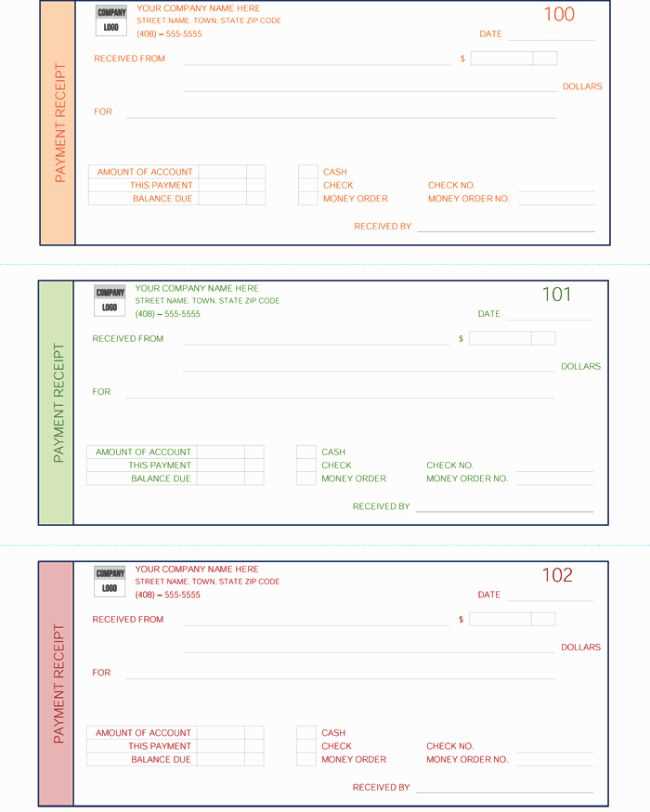

Money Order Receipt Template

To create a clear and professional money order receipt, include the following key elements:

1. Receipt Number

Assign a unique receipt number to track the transaction. This number should be displayed prominently at the top of the receipt.

2. Date and Time

Record the exact date and time the money order was issued. This helps in referencing the transaction in case of future inquiries.

3. Sender’s Information

Include the full name and address of the sender. This ensures that the origin of the transaction is clear.

4. Receiver’s Information

Clearly mention the name and address of the receiver. If applicable, include a contact number for both parties.

5. Amount

State the exact amount of money being transferred, including both numerical and written forms. This eliminates any ambiguity regarding the sum.

6. Payment Method

Indicate that the payment was made by money order, specifying the money order type if needed (e.g., postal money order, bank money order).

7. Transaction Fees

If there are any processing fees involved, list them separately. Include the fee amount and any taxes that apply to the transaction.

8. Signature

Include a line for both the sender and the issuer (e.g., clerk or cashier) to sign. Signatures provide authenticity and accountability for the transaction.

9. Notes or Additional Information

If needed, allow space for any additional notes, instructions, or transaction references that may be relevant.

10. Contact Information

Provide contact details for inquiries or issues regarding the transaction. Include the customer service number or email address of the issuing organization.

Make sure to keep a copy for both the sender and receiver for record-keeping purposes. A well-organized receipt ensures clarity and serves as proof of the transaction.