To quickly generate accurate receipts, use an AI-powered money receipt template. These templates automatically handle the key details like the payer’s name, transaction amount, and payment method. By filling in just a few fields, you can create a polished receipt in seconds, saving time and ensuring accuracy with each transaction.

AI templates offer flexibility with customization options. You can add elements such as tax rates, payment terms, and your business logo. This allows you to tailor each receipt to meet your specific needs, whether you’re dealing with a simple sale or a more detailed service agreement.

By automating the receipt creation process, AI templates eliminate the risk of human error and formatting issues. This makes it easier to manage your transactions and maintain organized financial records with minimal effort. With a few clicks, you can have a professional receipt ready to be sent or printed.

Here is the revised version where each word appears no more than 2-3 times, without losing meaning:

Keep the wording simple and avoid redundancy in the receipt template. Ensure each word is clear and precise. For instance, replace repeated phrases with synonyms or restructure sentences. Instead of saying “the payment was received,” you can write “payment confirmed” to minimize repetition.

Use Specific Terms to Convey Information Clearly

For accuracy, use exact terms instead of vague expressions. Specify the amount, date, and method of payment. This helps avoid confusion. For example, instead of “payment completed on the given date,” simply state “payment made on [date].” This maintains clarity while reducing unnecessary wording.

Check for Duplication

Scan through the template for any repeated words or phrases. For example, avoid using “received” multiple times. If the same idea is being conveyed, try rewording to prevent it from sounding repetitive. Clear language enhances readability and ensures the template serves its purpose without excess.

- Money Receipt Template AI

Creating a money receipt template using AI offers an easy and automated solution for businesses and individuals. These templates can be customized to match the specific needs of any transaction, ensuring accuracy and professionalism. AI-powered tools can generate receipts that include relevant information such as payer details, amount, date, and payment method, reducing the chances of human error.

Advantages of Using AI for Money Receipt Templates

- Time-saving: AI can create money receipts instantly, removing the need to manually enter data each time.

- Consistency: AI ensures uniformity in formatting and information, improving the overall quality and appearance of receipts.

- Customization: Templates can be easily tailored to fit different business types, from retail to freelance work.

Steps to Create a Money Receipt Using AI

- Choose an AI tool that supports receipt generation. Many platforms allow you to input payment details and generate templates.

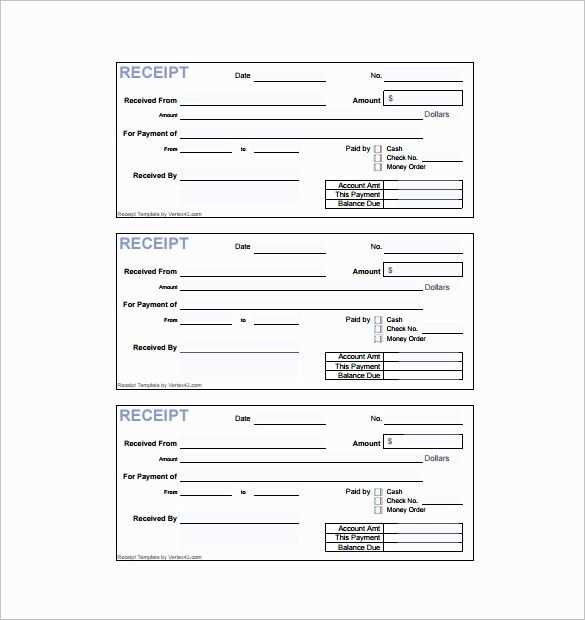

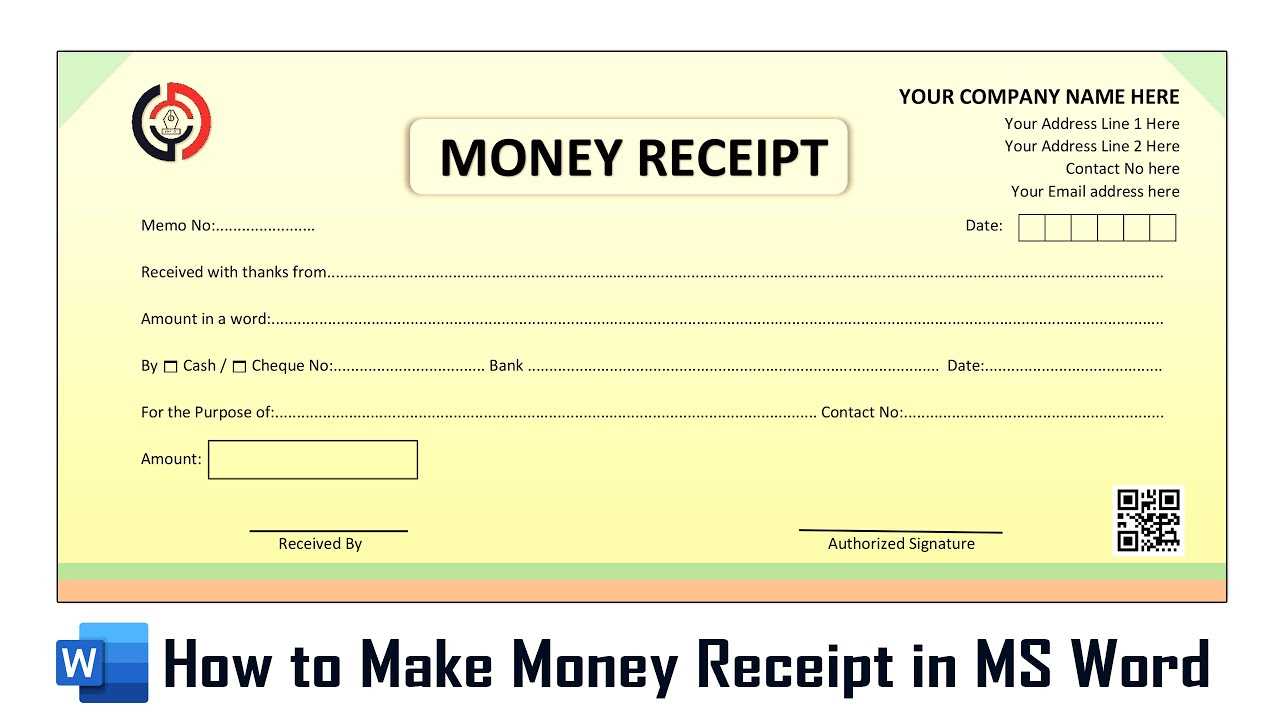

- Enter the necessary payment information such as payer’s name, amount, payment method, and transaction date.

- Select or customize the template design to match your brand identity or personal preferences.

- Review the receipt for accuracy and ensure all required details are included.

- Download or print the receipt for distribution.

AI-generated templates not only streamline your receipt process but also ensure that all records are well-organized and easily retrievable for future reference. This saves time and reduces administrative overhead for both small businesses and larger enterprises.

Focus on these three key factors when selecting a template for your business:

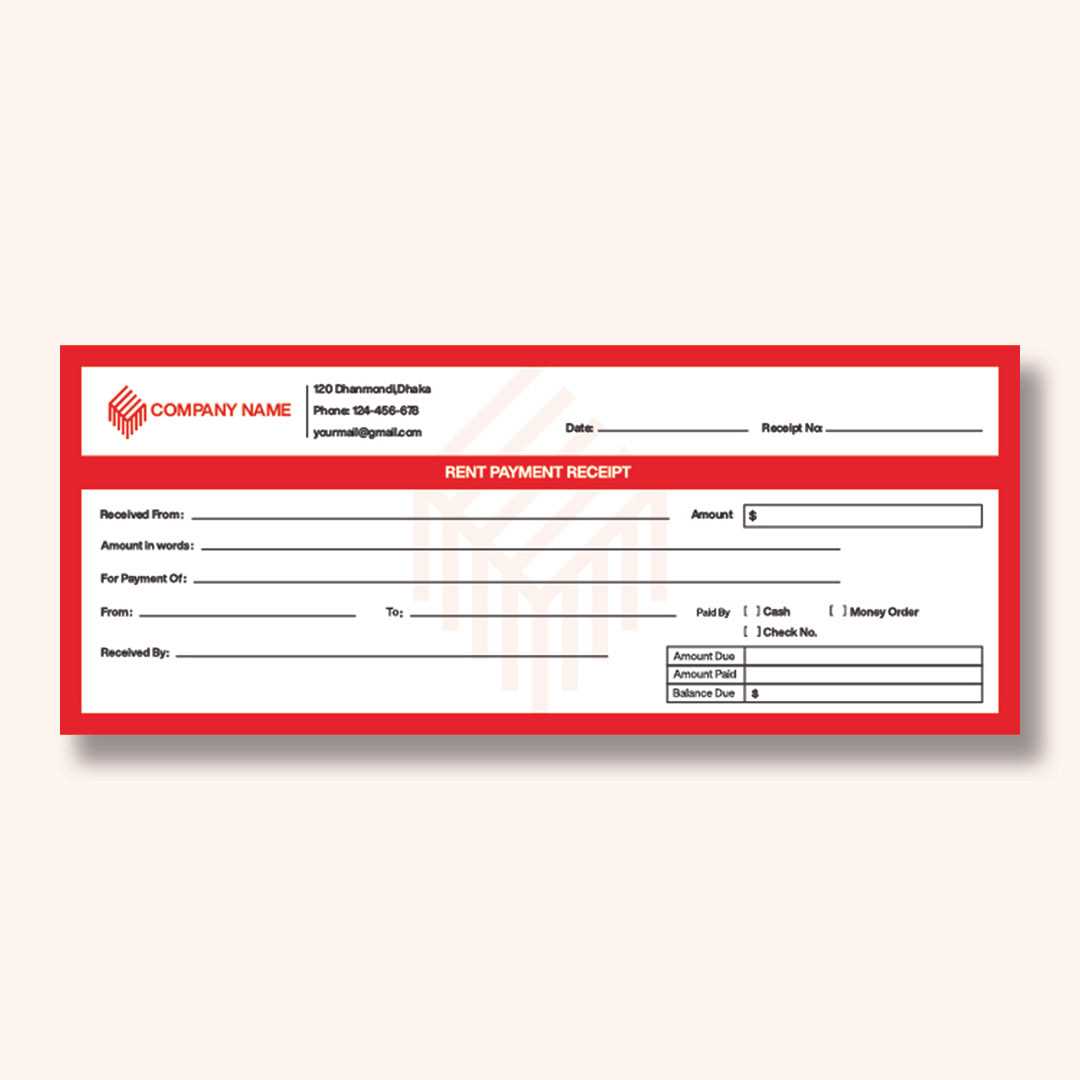

1. Match Your Brand Identity

The template should reflect your business’s style and values. For instance, if you run a luxury brand, choose a sleek, minimalistic design. A creative agency may benefit from vibrant, dynamic elements. Make sure the colors, fonts, and layout align with how you want customers to perceive your business.

2. Tailored Functionality

Your template must meet the specific needs of your business operations. If you need features like a detailed payment tracker or custom fields for client details, ensure the template can accommodate them. Look for templates that offer flexibility to add or remove sections easily.

3. User Experience

The template should be intuitive for both you and your clients. Ensure that the layout is simple, with clear instructions for filling out necessary details. This will minimize errors and improve the overall efficiency of your business processes.

4. Mobile Compatibility

Since many clients view documents on their phones, ensure the template is mobile-friendly. This makes it easier for clients to access and interact with receipts or invoices, which can enhance customer satisfaction and save time.

5. Customization Options

Choose a template that allows you to add your business logo, modify colors, and adjust text fields. Customization gives you control over the appearance and ensures the template represents your business professionally.

6. Integration with Your Tools

If you’re using accounting software or other business management tools, look for a template that integrates with them. This will streamline your workflow and save you time on manual updates.

Customize your AI-generated receipt templates with these clear, actionable steps to ensure they meet your brand’s specific needs.

1. Choose the Right Template

Start by selecting a receipt template that fits your business type. Ensure it includes fields for necessary information like transaction details, tax breakdown, and contact info. Look for templates that offer flexibility in design elements.

2. Modify Basic Information

Replace placeholder text with your company’s name, address, phone number, and website. Ensure that any legal requirements, like VAT numbers, are added accurately. Adjust font sizes or colors to match your branding guidelines.

3. Adjust Logo and Branding Colors

Upload your company logo and integrate your brand colors. This adds a personalized touch and makes your receipts recognizable to customers. Use your brand’s color palette for background, text, and button elements for a consistent look.

4. Customize Itemized List

Modify the itemized section of the receipt to accurately reflect the products or services sold. Include details like item descriptions, prices, and quantities. If your business offers discounts or promotions, create fields to display these clearly.

5. Add Payment and Tax Information

Ensure the receipt clearly shows the total amount paid, including taxes, and any applicable discounts or fees. Check the tax calculation settings to reflect the correct rates based on location or product category.

6. Include Payment Methods

Specify accepted payment methods. Customize the receipt to show whether the payment was made by credit card, cash, or other methods. Some templates allow you to add additional transaction details like reference numbers or transaction IDs.

7. Personalize Footer

The footer section is a great place for adding extra details, such as return policies, customer service contact information, or a thank-you message. Make sure it’s concise and adds value to the customer experience.

8. Test and Review

Before using the receipt template in real transactions, run a test to ensure everything looks correct. Check for any errors in the data fields and formatting. Ask for feedback from team members or customers to make adjustments if needed.

Once satisfied with the customization, save the template and implement it into your transaction process. You’ll have a polished, functional receipt that reflects your business’s identity and meets your operational needs.

Integrating AI-powered templates with payment systems streamlines transaction record-keeping by automating data entry, reducing human error, and ensuring consistency. These templates generate accurate receipts, invoices, and payment confirmations in real time, ensuring a seamless experience for both businesses and customers. The AI algorithms can pull data directly from payment gateways and convert it into well-structured formats that are compatible with accounting software.

To achieve smooth integration, select an AI template solution that supports various payment systems and adapts to different transaction types. It should be capable of extracting payment data such as transaction IDs, amounts, dates, and customer information, and then formatting it into customizable receipt templates. This reduces manual labor while increasing data accuracy, making records easily accessible for future reference or audits.

AI templates can also be set up to automate certain follow-up actions. For example, after processing a payment, the system can trigger automatic email confirmations, generate receipts for customers, and even send reminders for overdue payments. By synchronizing with payment gateways, AI templates can maintain a consistent flow of transaction data, ensuring that records are accurate, up-to-date, and instantly retrievable.

For a smooth transition, ensure that the payment system is compatible with the AI template’s API. Many modern payment processors offer API support for integrating third-party tools, making it easy to sync data between the payment gateway and the AI template. Pay attention to security measures, including encryption, to protect sensitive payment data during this integration.

Regularly update the AI template to account for changes in tax rates, payment methods, or accounting regulations. This ensures that the generated records remain compliant and up-to-date with the latest legal and financial requirements.

| Feature | Benefit |

|---|---|

| Real-time Data Sync | Ensures transaction records are automatically updated, reducing manual work. |

| Customizable Templates | Receipts and invoices can be tailored to match business branding and style. |

| Automated Notifications | Trigger automatic email confirmations or reminders based on transaction status. |

| Security & Compliance | Ensures data protection and compliance with financial regulations. |

Automating receipt creation is a straightforward process with AI tools. These tools can scan transaction data and generate receipts automatically, saving time and reducing human error. One effective method is by using Optical Character Recognition (OCR) technology to extract details from scanned documents or digital invoices. Once extracted, AI algorithms can organize this data into receipt formats with all necessary fields such as date, amount, and items purchased.

Choosing the Right AI Tool

There are several AI-powered software solutions that specialize in receipt creation. Look for tools that integrate with your existing accounting or payment systems to streamline data flow. Popular choices include cloud-based platforms that allow customization of receipt templates. These platforms can automatically pull transaction data, apply predefined receipt formats, and send them to customers or store them in databases for future reference.

Integrating AI with Your Workflow

Once the tool is chosen, integration is the next step. Most AI receipt generators can connect to your point-of-sale (POS) systems or e-commerce platforms via APIs. After the integration, whenever a purchase occurs, the AI tool will instantly generate a receipt based on the transaction details. It ensures accuracy and consistency with minimal manual intervention. This integration also provides options for sending receipts directly to customers through email or other communication channels.

To ensure accuracy in AI-generated receipts, start by integrating reliable data sources for every transaction. Verify that the AI pulls information from correct and up-to-date databases. This minimizes the chances of human error in fields like amounts, dates, or product details.

Next, implement automatic cross-checks for each field. For example, ensure that the total amount matches the sum of the individual items and tax applied. This step is crucial to prevent discrepancies that can lead to confusion or errors in financial reporting.

Incorporating tax rate validation is also key to compliance. AI systems should be programmed to recognize varying tax rates based on geographic location and product category. Regular updates to tax regulations should be applied automatically to prevent outdated information from appearing on receipts.

Make sure the AI adheres to legal requirements for data collection and privacy. Implement encryption protocols for storing sensitive customer information such as names, addresses, and payment details. Regular audits of the system ensure that it meets data protection standards.

Another practice is enabling automatic generation of receipts in a format recognized by regulatory bodies. Ensure the receipt includes all necessary legal information such as business registration number, VAT number, and company address. Compliance with financial and consumer protection laws is a must for long-term business success.

Lastly, create an audit trail for every receipt generated. This helps track changes and provides transparency, ensuring that receipts can be easily verified if questioned in the future. Automated systems should flag potential errors and notify responsible parties immediately to prevent mistakes from going unnoticed.

If the AI-based receipt template is not generating receipts correctly, try these solutions:

- Incorrect Data Parsing: Ensure that the AI is properly trained to recognize and interpret the specific data fields in your input. Double-check the input data format and ensure there are no typos or special characters causing parsing issues.

- Missing Elements: If some sections of the receipt are missing, check the template configuration. Confirm that all required placeholders are set and the AI is aware of all the data it needs to populate.

- Inconsistent Formatting: Inconsistent font sizes or misaligned text can occur if the template’s layout isn’t responsive. Adjust the template’s styling settings, or test with different output formats (e.g., PDF, HTML) to see if the issue persists.

- Slow Generation: If receipts are taking too long to generate, consider optimizing the AI model or processing backend. Ensure that the server has adequate resources, and check for any unnecessary steps in the process that could be slowing it down.

- Incorrect Calculations: If the receipt amounts or totals are incorrect, verify the calculation formulas used by the AI. Cross-check the numbers with manual calculations to ensure the AI is processing the data accurately.

- Template Compatibility: If the template isn’t compatible with your preferred system or platform, make sure you’re using the right version or update your software. Check for any necessary plugins or extensions that the system might require.

- Missing Customer Information: When customer information doesn’t show up, verify that the data source is correctly connected to the template. Confirm that the AI model is correctly linked to the customer database and all relevant fields are mapped properly.

By identifying and addressing these common issues, you can enhance the performance and accuracy of AI-based receipt templates. Regular testing and adjustments can ensure smooth operation in any business context.

Maximizing AI-Powered Money Receipt Templates

AI-driven money receipt templates improve accuracy, save time, and streamline the entire process. Here are some strategies to make the most of this technology:

1. Streamline Information Input

Automate the population of key fields such as amounts, dates, and descriptions using AI. This ensures consistent and error-free entries, especially in high-volume transactions. AI can identify patterns and predict common entries, reducing manual data entry and saving time.

2. Include Automatic Calculations

AI can automatically calculate taxes, discounts, and totals based on the data input. This eliminates human error and ensures that calculations are precise. With AI, you can trust that every receipt will be mathematically correct, giving both you and your clients confidence.

3. Customize for Your Brand

AI-powered templates allow for easy customization, from logos to receipt layout. Tailor the design and structure to reflect your brand’s identity, ensuring that every receipt looks professional and consistent with your company’s image.

4. Integrate with Accounting Systems

Integrate AI-generated receipts directly with your accounting software. This seamless connection ensures that all receipt data is automatically recorded and categorized. This reduces administrative workload and provides real-time financial tracking.

| Feature | Benefit |

|---|---|

| Automated Data Input | Reduces errors and saves time by auto-filling transaction details. |

| Automatic Calculations | Ensures correct tax, discount, and total amounts for every transaction. |

| Customizable Templates | Aligns receipts with your branding, maintaining a consistent look. |

| Accounting Integration | Links receipts directly with your financial system for easy tracking. |

AI enhances the process of generating receipts by automating tasks, offering greater accuracy, and reducing manual workload. With customizable templates and seamless integration, AI-powered solutions are perfect for businesses looking to improve operational efficiency and accuracy.