For creating a money receipt, choose a template that simplifies the process while ensuring all key details are included. This is especially important for financial records and transactions. A well-structured receipt serves as proof of payment and protects both the payer and payee.

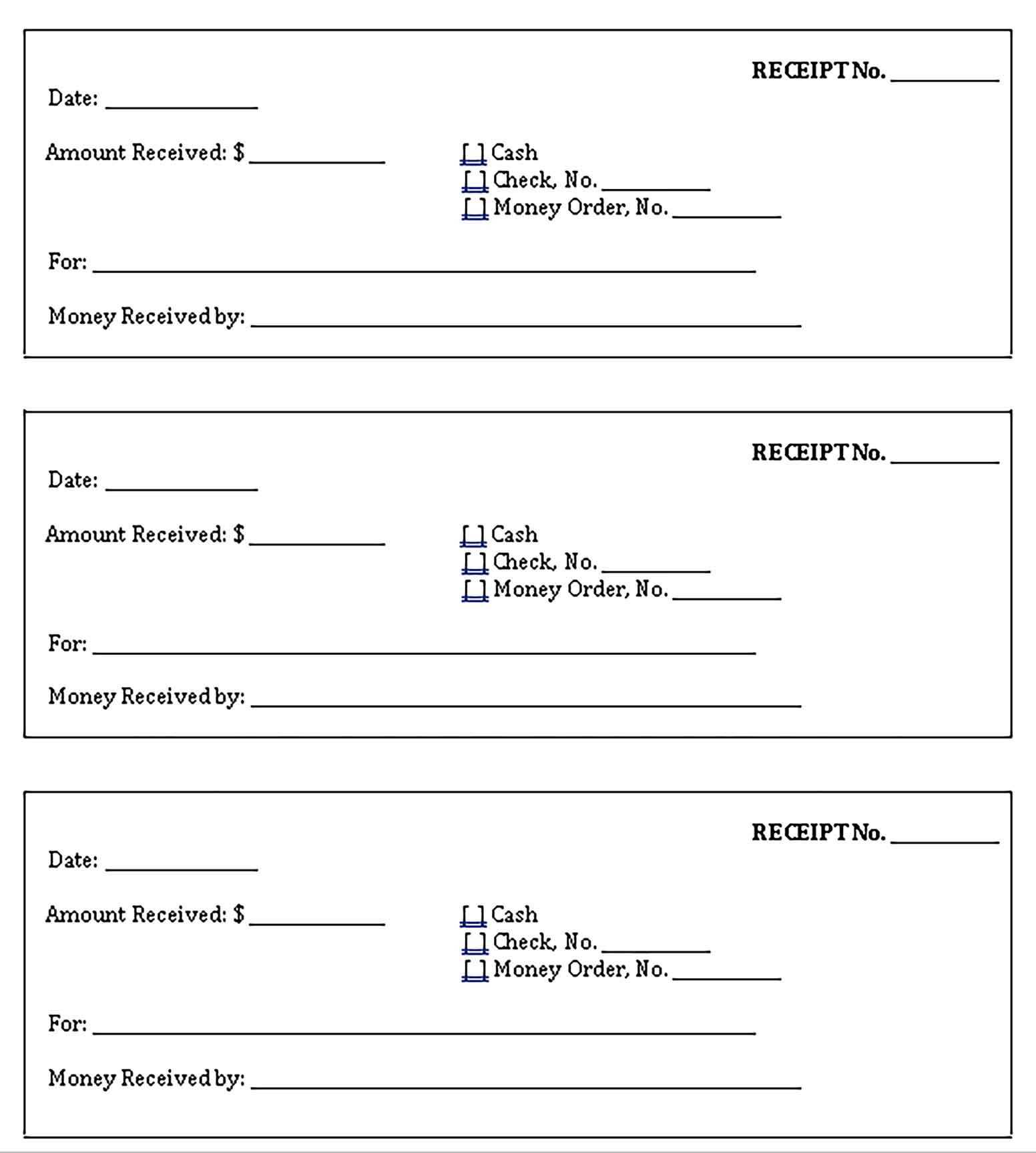

When selecting a template for a money receipt, ensure it covers the date of the transaction, payer and payee details, amount received, and payment method. These elements are non-negotiable for clarity and accuracy. Customizing the template to suit your needs will save time in the long run, especially for frequent transactions.

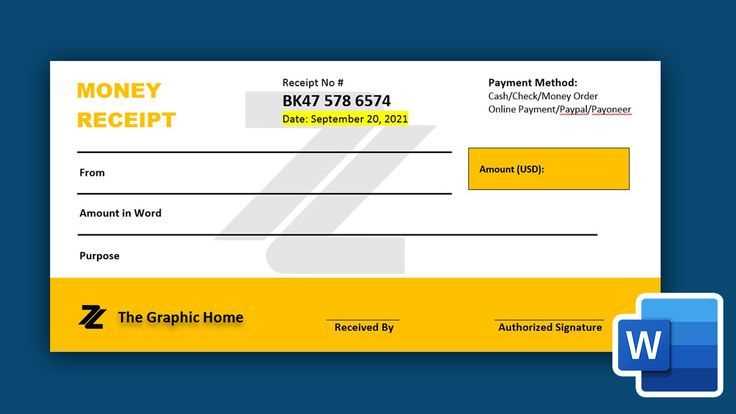

Keep the layout simple and clean. Avoid overcrowding the template with unnecessary fields. The goal is to make the receipt easy to understand, with quick access to essential information. Use bold text for key areas, such as the amount received and transaction number, to highlight the most important details.

Remember to adjust the template for specific types of payments, such as cash, cheque, or bank transfer. This ensures that all relevant details, such as cheque number or transaction reference, are captured accurately. Properly maintaining these receipts helps streamline bookkeeping and makes audits much easier.

Here’s a refined plan for an informational article on the topic “Money Receipt Template BD,” with 6 practical and specific headings in HTML format:

Understanding the Purpose of a Money Receipt

A money receipt serves as confirmation that a transaction has occurred. It provides both the payer and the recipient with proof of payment. In Bangladesh, money receipts are typically used in various business and personal transactions to ensure transparency and accountability. The receipt should clearly indicate the amount paid, the date, and the purpose of the payment.

Essential Elements of a Money Receipt Template

A well-designed receipt template should include key elements such as the name of the business or individual receiving the payment, payment amount, transaction date, mode of payment (e.g., cash, cheque, online transfer), and details of the goods or services exchanged. A reference or receipt number can also be helpful for record-keeping.

Legal Requirements for Money Receipts in Bangladesh

According to Bangladeshi law, money receipts must contain accurate and clear information to be legally valid. It is important to ensure the correct date, recipient details, and payment information to avoid disputes. A receipt can be used in legal contexts, such as tax audits or when resolving payment-related issues.

How to Customize a Money Receipt Template

Customize the template by adding your business logo and contact details to create a professional appearance. You can also add specific fields based on the nature of your business, such as a customer ID or transaction reference. Most money receipt templates are editable, allowing you to tailor them to your needs.

Best Tools for Creating Money Receipts

Various online tools and software applications can be used to create money receipt templates. These tools typically offer user-friendly interfaces with pre-designed templates that can be customized. Tools like Google Docs, Microsoft Word, and specialized invoicing software are popular choices for creating professional-looking receipts quickly.

Common Mistakes to Avoid When Issuing a Money Receipt

Ensure all information is accurate before issuing a receipt. Common mistakes include missing details, incorrect payment amounts, or unclear transaction descriptions. It is also important to use legible fonts and format the receipt consistently for clarity. Avoid issuing receipts without a proper record system for tracking purposes.

Choosing the Right Template

Select a money receipt template that suits your specific needs. Consider the structure and layout–make sure it clearly displays all relevant transaction details, such as amounts, dates, and payer information. Avoid templates cluttered with unnecessary fields or too complex formatting. A simple, clean design enhances clarity and reduces the chances of errors.

Key Elements to Look For

- Transaction Details: Ensure the template includes sections for both the payer and recipient’s names, payment method, date, and amount.

- Clear Layout: A well-organized template will help you quickly find the information you need. Check for easy-to-read fonts and logical placement of key sections.

- Customization: Choose a template that allows easy editing, especially for your company’s branding, such as logo or contact details.

- Compliance: Verify that the template complies with your local or industry-specific regulations, ensuring it contains all necessary legal disclaimers if needed.

Additional Tips

- Look for templates that include an option for digital signatures or payment verification, adding authenticity to the document.

- If you handle multiple currencies, choose a template that supports currency symbols and conversion rates to avoid confusion.

Customizing Your Receipt

Adjust your receipt template to reflect the specifics of your transaction. Include key details like the business name, contact information, and transaction ID for clear identification.

Modify Layout and Design

Customize the layout to suit your brand. Use your logo, adjust fonts, and choose colors that align with your company’s style. The goal is a professional, cohesive look that matches your business identity.

Add Relevant Fields

Incorporate essential fields that apply to your transactions. Depending on your business type, consider adding:

- Date and time of the transaction

- Payment method used

- Itemized list of purchased goods or services

- Discounts or promotions applied

- Total amount paid

Be sure to tailor these fields based on what is relevant for your customers and business operations.

Common Fields to Include

Receiver’s Name: Always include the full name of the person receiving the payment. This helps ensure clarity in the transaction and prevents any confusion later.

Amount Received: Clearly state the exact amount of money being received. It’s important to write this in both numerical and word form to avoid any misinterpretation.

Date of Transaction: Always mention the date of the payment. This serves as a reference point for future inquiries and is necessary for record-keeping.

Payment Method: Indicate how the money was received, whether it was through cash, cheque, bank transfer, or another method. This provides transparency and helps track payment sources.

Purpose of Payment: Specify the reason for the payment, such as a service, product purchase, or loan repayment. This makes the receipt more informative and justifies the transaction.

Sender’s Details: Include the name or business details of the sender. This provides a full picture of the transaction and can be useful for both parties in case of any disputes.

Signature: The signature of the recipient adds a level of authenticity to the receipt. It’s a final confirmation that the payment has been received and accepted.

Formatting and Organizing Information

Begin with a clear layout that helps users quickly locate key details. Place the date, receiver’s name, and amount in distinct sections. Highlight critical data with bold formatting to make it stand out. A straightforward, easy-to-read font like Arial or Times New Roman enhances clarity.

Group similar information together. For example, ensure the payment method and transaction details are close to each other. Use tables to organize numerical data like amounts, discounts, or tax information. This makes the content digestible and improves overall readability.

Use bullet points for additional details, such as payment terms or special notes, to break down complex information. Keep text concise and avoid unnecessary descriptions. This method allows quick scanning without overwhelming the reader.

Align text and numbers consistently. Amounts should be right-aligned, while names and dates should be left-aligned. This creates a professional appearance and prevents misinterpretation of data.

Lastly, ensure proper spacing between sections for a clean and organized look. Adequate white space prevents the form from appearing cluttered and enhances visual appeal.

Legal Requirements for Receipts in BD

In Bangladesh, receipts must meet certain legal standards to be valid. All receipts issued by businesses, regardless of size, must contain specific details that protect both the buyer and the seller.

Key Information on Receipts

A valid receipt in Bangladesh should include the following information:

- Business name and address

- Taxpayer Identification Number (TIN) of the business

- Date of the transaction

- Description of the goods or services purchased

- Total amount paid, including taxes

Tax Compliance

Receipts must reflect the correct value-added tax (VAT) or other taxes applicable to the sale. The VAT must be clearly indicated, along with the tax identification number of the business.

| Required Field | Description |

|---|---|

| Business Details | Full name, address, and TIN number |

| Transaction Date | The exact date the transaction was made |

| Goods/Services | Clear description of the items or services sold |

| Amount | Total payment with taxes, if applicable |

Businesses should keep receipts for a minimum of five years to comply with audit requirements. Failure to comply with these legal requirements may result in penalties or fines from the tax authorities.

Printing and Sharing the Document

To print the money receipt, ensure the template is formatted correctly. Use the “Print” option in your PDF viewer or word processor. Choose a suitable paper size, such as A4, and ensure the document fits within the printable area. Double-check the details before confirming the print job.

Sharing the Document Digitally

For sharing the receipt electronically, convert it into a PDF file if it isn’t already. Email it directly to the recipient or upload it to a secure file-sharing service. If sending via email, use a concise subject line and include any necessary instructions in the message body.

Ensuring Accessibility

Make sure the document is accessible to the recipient by considering their preferences. For those who prefer physical copies, provide clear printing instructions. For digital sharing, ensure the file is compatible with their devices and easy to open.