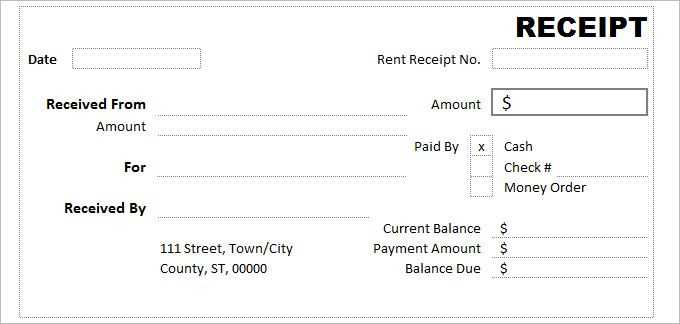

Every money transfer should be properly documented, and a well-structured receipt template ensures clarity for both sender and recipient. A reliable template includes key details such as transaction date, sender and recipient names, transferred amount, payment method, and reference number. These elements help track payments, resolve disputes, and maintain accurate financial records.

For business transactions, a detailed receipt template should also include the company’s name, contact information, and tax identification number. If international transfers are involved, specifying the currency, exchange rate, and any applied fees is essential. A clear format with distinct sections makes it easier to read and verify the transaction.

To create a professional receipt, use a structured table or aligned text fields, ensuring readability. Many businesses and individuals prefer digital templates in PDF or Excel formats for easy storage and sharing. Adding an electronic signature field can further enhance security and authenticity.

Whether for personal or business use, a standardized money transfer receipt simplifies financial tracking and ensures transparency. Choose a format that best suits your needs, and keep a record of every transaction for future reference.

- Money Transfer Receipt Template

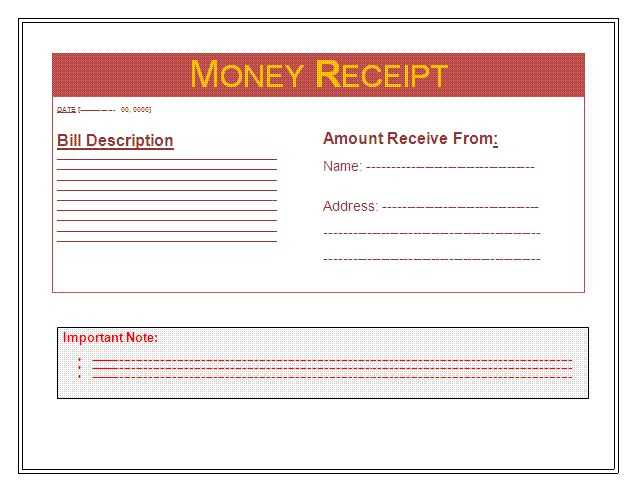

A well-structured money transfer receipt template ensures clear documentation of transactions. It should include key details for transparency and record-keeping.

- Sender and Receiver Details: Full names, addresses, and contact information.

- Transaction ID: A unique reference number for tracking.

- Transfer Date and Time: Exact timestamp for verification.

- Amount and Currency: Clearly specify the transferred sum and currency used.

- Payment Method: Bank transfer, credit card, or digital wallet.

- Exchange Rate (if applicable): Necessary for international transactions.

- Fees: Breakdown of any transaction charges.

- Confirmation Statement: A note verifying the transaction’s completion.

- Authorized Signature or Stamp: Validates authenticity, especially for physical receipts.

Using a standardized format minimizes errors and simplifies record-keeping. Digital templates with auto-fill options save time and reduce inconsistencies.

- Transaction ID: A unique reference number that helps track and verify the payment.

- Sender and Receiver Details: Full names, contact information, and account numbers or wallet IDs.

- Transfer Amount: Clearly stated sum, including currency and any applicable exchange rate.

- Fees and Deductions: Breakdown of any charges applied to the transaction.

- Payment Method: Whether the transfer was made via bank, credit card, digital wallet, or another service.

- Date and Time: Exact timestamp to confirm when the transaction was processed.

- Confirmation Status: Indication of whether the payment was successful, pending, or failed.

- Notes or Reference: Space for optional comments, invoice numbers, or additional details.

Ensure all details are accurate to prevent disputes and simplify record-keeping. A well-structured receipt enhances transparency and trust between parties.

Begin with the sender’s and recipient’s names, along with the date of the transaction. Place these at the top for easy reference.

Use a clean layout with clear labels for each section. Include the amount transferred, payment method, and any relevant fees in distinct rows or columns.

Ensure the total amount is prominently displayed, making it easy to spot. Break down additional charges, such as taxes, separately to avoid confusion.

Opt for a simple, readable font like Arial or Helvetica, and maintain ample spacing between sections. This ensures the information is easy to follow.

Conclude with a statement like “Payment Received,” and include any necessary contact details for inquiries. If applicable, provide a digital or handwritten signature for verification.

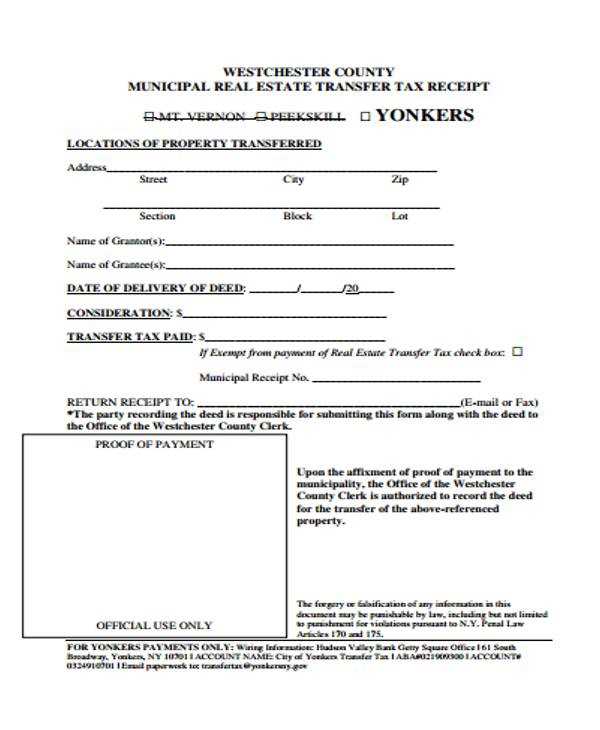

Ensure that your receipt includes all required legal information, such as the date and amount of the transaction. Accurately list the names of both the sender and the recipient, along with any relevant transaction reference numbers or identifiers. This is crucial for verifying the legitimacy of the transfer and resolving any potential disputes.

Be clear about the nature of the transaction. Whether it is a gift, payment for goods or services, or a loan, specify this to avoid confusion. Some jurisdictions may require receipts for specific types of payments, so make sure the information complies with local tax laws or regulations.

If applicable, include any tax-related information. This may involve specifying whether tax has been applied to the amount or including the tax ID of the business or individual involved. This transparency helps in avoiding future tax complications.

Always store copies of receipts for record-keeping. Depending on the nature of the transaction, legal requirements may dictate how long receipts must be kept, particularly for business transactions. Be familiar with retention policies in your jurisdiction.

Lastly, double-check that the receipt is signed or otherwise verifiable if necessary. Some contracts or agreements require receipts to be signed by both parties to confirm the transaction. This adds an extra layer of legal validity and protection for both parties involved.

For the smoothest user experience, PDF is the most popular format for both printable and digital receipts. PDFs maintain consistent formatting, ensuring that the layout remains intact across different devices and printers. This format is perfect for keeping your receipts professional and easy to read.

PDF files are ideal for receipts because they preserve fonts, images, and layout exactly as intended. They are universally accessible and can be opened on almost any device without requiring special software. PDFs also allow for the inclusion of hyperlinks, making it possible to link directly to relevant payment or transaction details.

PNG and JPEG

If you need a more visual approach, PNG and JPEG formats can be useful for receipts that contain logos or images. These formats are widely supported, lightweight, and work well for digital storage or sharing via email. However, they lack the versatility and precise control over text formatting that PDF files offer.

For receipts that require flexibility in design or high-quality prints, PDF remains the best option. For quick, image-based receipts or those that don’t need detailed formatting, PNG or JPEG can work well in digital environments. Always ensure that the format you choose matches the intended use of the receipt to ensure clarity and accuracy.

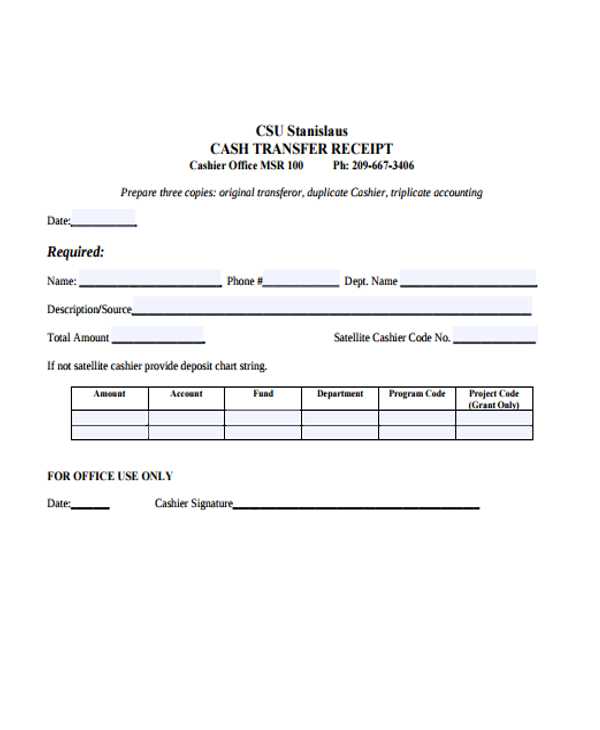

Each payment method requires specific details to ensure accurate documentation. Adjust your template to capture the necessary information depending on whether the payment is made via credit card, bank transfer, or an online platform like PayPal or Venmo.

Credit Card Payments

For credit card transactions, include fields such as the cardholder’s name, card type (Visa, MasterCard, etc.), the last four digits of the card, and the authorization code. This information helps confirm the transaction’s legitimacy. You may also want to add a section for the card’s expiry date to reduce any potential confusion regarding payment timelines.

Bank Transfers

For bank transfers, the template should include the sender’s account details, transfer reference number, and the bank’s name. It’s also useful to include the date and time of the transfer to track payments more efficiently. If the transfer was international, you might need to add the SWIFT/BIC code of the bank for clarity.

Customizing these fields based on the payment method ensures clarity for both the sender and recipient, making record-keeping and future reference straightforward.

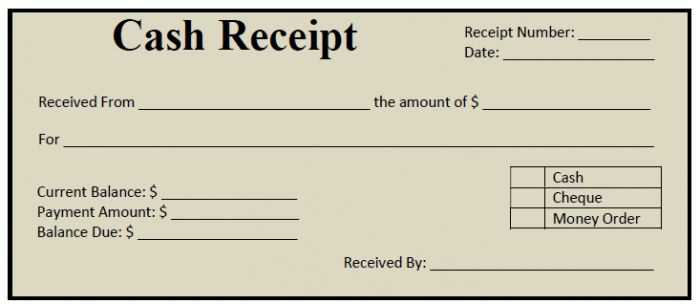

Ensure all recipient details are accurate. Incorrect names, addresses, or bank account numbers can lead to confusion and delays. Double-check the spelling of names and verify account numbers before finalizing the transfer receipt.

Another frequent issue is the omission of transaction details. Be specific about the transaction amount, currency, and the date of transfer. Incomplete records may complicate any future inquiries or disputes.

Common Errors to Watch For

| Issue | Consequences | Fix |

|---|---|---|

| Incorrect recipient information | Funds may be sent to the wrong account or cause delays | Verify all details before issuing the receipt |

| Missing transaction references | Tracking the transfer can become difficult | Always include a unique reference number |

| Unclear transfer purpose | May lead to confusion for the recipient | Clearly state the purpose or reason for the transfer |

| Invalid or missing signature | Legal issues may arise if the receipt isn’t signed | Ensure the authorized individual signs the receipt |

Final Checkpoints

Before finalizing the receipt, confirm the transaction amount and its accuracy. Avoid using vague descriptions. A detailed transfer receipt protects both the sender and the recipient and helps resolve any issues quickly if they arise.

Designing a money transfer receipt template requires clarity and ease of understanding. Keep the layout simple and structured. Begin with the date and reference number at the top. This provides quick identification of the transaction.

Transaction details should be presented clearly, including the sender’s name, recipient’s name, the amount transferred, and the payment method. Align these sections in a clean, readable format, making sure the details stand out.

Include a transaction fee section, if applicable. This helps both parties understand the cost associated with the transfer. It’s best to break it down into clear line items, so the fee isn’t hidden within the total amount.

For added security, include a unique transaction ID and a confirmation number. This helps to cross-reference the transaction with the service provider in case of any issues.

Finish with a disclaimer or a brief note stating the terms of the transfer. This ensures transparency and reduces confusion, especially for international transactions.