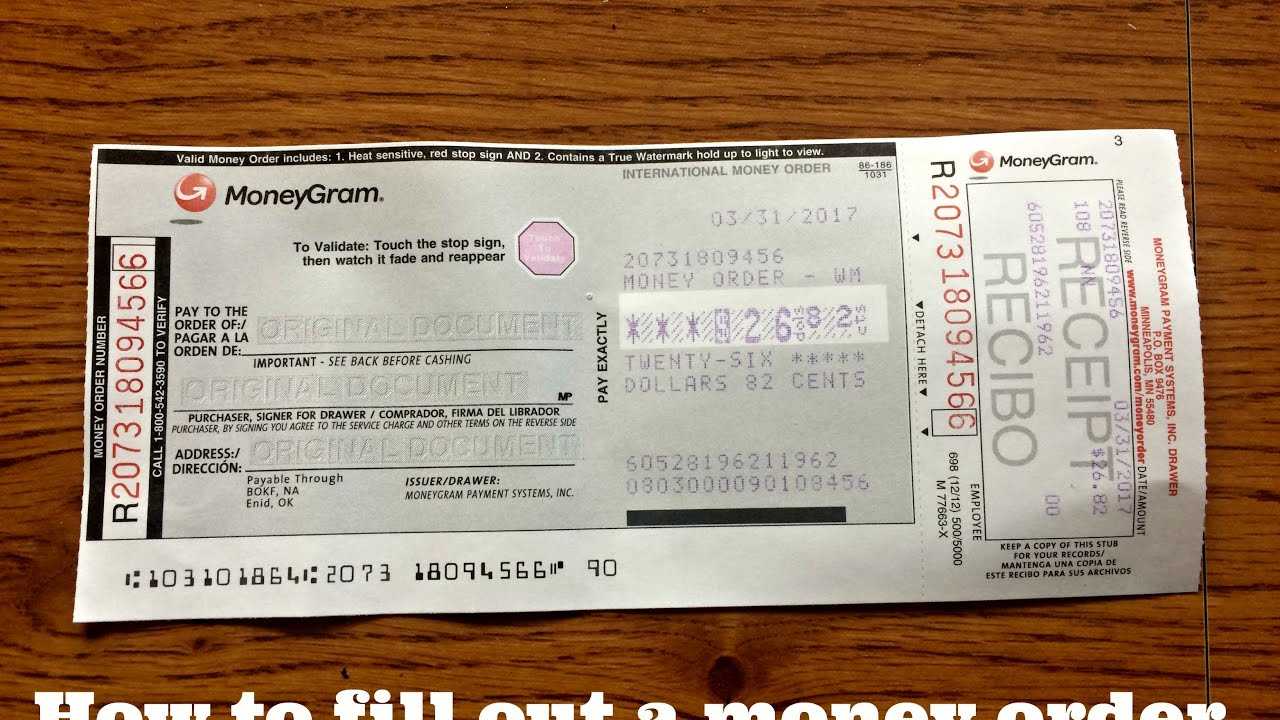

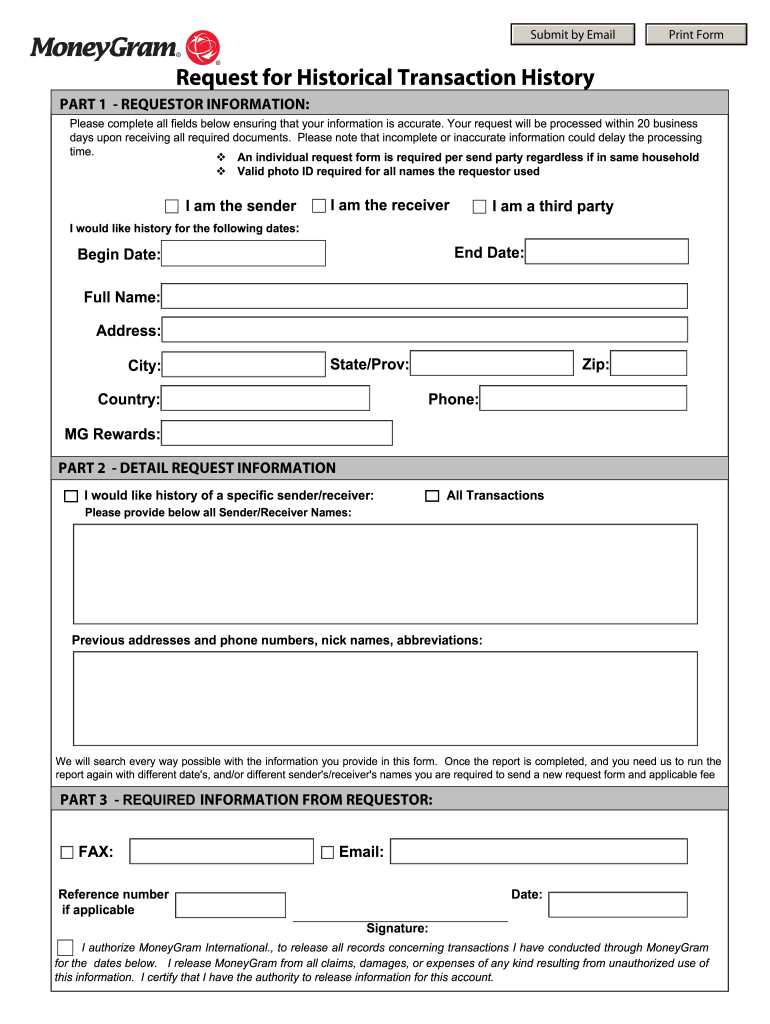

To create a Moneygram receipt template, ensure all critical information is clearly outlined. Start with the sender’s and recipient’s full names, addresses, and contact details. Then, specify the transaction amount, the currency used, and the purpose of the transaction. These details should be easy to locate and formatted clearly to avoid confusion.

Include the Moneygram transaction reference number prominently. This helps to verify the transaction and makes tracking easier. The date and time of the transfer must also be listed, as this information is necessary for record-keeping and future inquiries.

Lastly, include the sender’s and recipient’s signatures for verification purposes. Ensure there is enough space for both parties to sign and that the area is clearly marked. This makes the receipt legally binding and ensures both parties agree to the transaction’s terms.

Sure! Here’s the updated version with repetitions reduced:

To create a Moneygram receipt template, ensure that it contains the necessary fields: transaction number, sender’s name, recipient’s name, date, and amount. Keep the layout simple yet informative. Make use of clear labels for each section and leave enough space for details. Include a section for additional notes, if required. Customize the design with a professional font, ensuring readability. Focus on user experience by placing important details where they’re easily visible, such as at the top of the receipt. Keep the color scheme minimal and use icons where appropriate for visual clarity. If the template includes a barcode, ensure it’s placed towards the bottom to avoid cluttering the key details. Test the template on various devices to ensure it prints well and remains legible. Adjust spacing for consistency and uniformity across receipts.

- Moneygram Receipt Template

To create a Moneygram receipt template, focus on clarity and simplicity. Begin with including the sender’s and recipient’s details like names, addresses, and contact information. Make sure to clearly indicate the amount sent and received, along with the currency type.

Include a transaction number to help track the payment. This number should be prominently placed at the top of the receipt. Add the date and time of the transaction to verify its authenticity. A line indicating the sender’s method of payment (cash, card, etc.) will help clarify how the transaction was processed.

List any applicable fees or charges associated with the transaction, as well as the total amount the recipient receives after fees are deducted. Make sure these are itemized to avoid confusion.

Finally, include a confirmation section where both the sender and recipient can verify the details and sign. If relevant, offer a space for the agent’s signature as a final confirmation.

- Sender’s Name and Contact Information

- Recipient’s Name and Contact Information

- Transaction Number

- Amount Sent and Received

- Date and Time of Transaction

- Transaction Fees

- Method of Payment

- Agent’s Signature (if applicable)

The most important details to include on a receipt are the transaction date, sender and receiver information, amount sent, fees, and the transaction reference number. These elements verify the transaction and make it traceable.

Transaction Date

The date of the transaction is key for record-keeping and helps ensure accuracy in financial tracking. Make sure the date is clear and formatted correctly for easy reference.

Sender and Receiver Details

Both parties’ names, addresses, and contact details are necessary for identification. This makes the receipt more secure and helps resolve any potential issues in the future.

Additionally, including transaction fees is important as it ensures transparency and helps the customer understand the cost breakdown. Make sure this section is clearly marked and easy to follow.

Finally, always include the transaction reference number. This unique identifier is crucial for tracking the transaction if any problems arise or if the customer needs to request further assistance.

Begin by clearly stating the transaction’s purpose. Indicate the amount, the date, and the parties involved. A simple breakdown like “Paid [Amount] for [Service/Product]” will help keep it clear.

Include Payment Method and Details

Specify how the transaction was made, such as cash, bank transfer, or mobile payment. Include any relevant reference numbers, transaction IDs, or account details that might help identify the payment.

Document Additional Information

If there are any terms associated with the transaction, such as delivery dates or payment plans, make sure to include those. This will add clarity and transparency to the receipt.

Ensure the following details are included on a Moneygram receipt for clarity and accuracy:

| Information | Description |

|---|---|

| Sender’s Name | The full name of the person sending the money. |

| Receiver’s Name | The full name of the person receiving the money. |

| Transaction Number | A unique reference number for the transaction. |

| Amount Sent | The total amount of money transferred. |

| Fees | Any service fees associated with the transaction. |

| Currency Type | The type of currency used in the transaction. |

| Location of Transaction | The address or location of the Moneygram agent where the transfer was initiated. |

| Date and Time | The date and time the transaction was processed. |

| Receiver’s Details | Information about how the receiver can pick up the funds, including the location. |

| Moneygram Agent’s Contact | The contact information for the Moneygram agent involved in the transaction. |

Make sure these details are legible and accurately entered to avoid any confusion during the transfer process.

Double-check the details before submitting the receipt. Ensure that all information is clear and accurate, such as the sender’s and receiver’s names, amounts, and transaction reference numbers. Verify the transaction date and any additional details related to the payment. Cross-check the receipt with the payment confirmation for consistency. Mistakes can be easily overlooked, so reviewing each section carefully minimizes errors.

Pay attention to formatting. Use the correct currency symbols and numbers without any discrepancies, especially for international transactions. Double-check the spelling of names, addresses, and other sensitive data to avoid confusion.

Keep track of your receipts for reference. Make sure you save a copy for your records. If there’s an issue with the transaction, having accurate documentation can speed up the resolution process.

Ensure you double-check the recipient’s details before sending funds. A common mistake is misspelling the recipient’s name or entering the wrong address. These errors can lead to delays or even loss of the transaction.

Incorrect Amounts

Double-check the amount you are sending. Sending the wrong amount, either too much or too little, may complicate the transfer. Always verify that the amount matches the intended value before confirming the transaction.

Not Keeping Track of Receipts

Save your receipt after completing the transaction. Not retaining this crucial document can cause issues when tracking the transfer, especially in case of a dispute or need for refund. Always ensure you have a clear reference number for future inquiries.

Use digital storage for your receipts to avoid losing them. Take a photo or scan each receipt and upload it to cloud storage services like Google Drive or Dropbox. This ensures your receipts are easily accessible and organized without the risk of physical deterioration or loss.

1. Categorize Receipts

Create folders for different categories like “Shopping,” “Bills,” and “Travel” to keep receipts organized. Within each folder, consider creating subfolders by month or year for easy retrieval. This simple categorization prevents confusion and saves time when searching for specific receipts.

2. Label Receipts for Easy Identification

Label each receipt with the transaction date and a brief description. For example, label receipts as “Grocery purchase – Jan 15” or “Utility bill – Feb 5.” This way, you’ll quickly recognize and locate receipts without scrolling through dozens of files.

3. Set a Regular Filing Routine

Allocate time weekly or monthly to scan and organize new receipts. Staying consistent with this habit prevents accumulation and clutter. It also helps keep track of important expenses, making tax preparation or refunds easier.

4. Backup Your Receipts

Keep a backup of your digital receipts on an external hard drive or a secondary cloud service. This added layer of protection ensures that even if one storage option fails, your receipts remain safe and accessible.

Details on Moneygram Receipt Template

Ensure all critical information is present on your Moneygram receipt template. Include the sender’s name, address, and contact details. For the recipient, capture the full name, address, and phone number. The transaction details, such as the amount sent, service charges, and any reference number, should be clearly visible. Don’t forget the date and location where the transaction took place.

Key Elements to Include

Ensure the Moneygram logo and any necessary security features are prominently displayed to enhance the authenticity of the document. Be sure to include a unique transaction number for tracking. Additionally, the receipt should show the method of payment (e.g., cash or card) and the expected delivery time for the funds to reach the recipient.

Formatting Recommendations

To maintain clarity, organize all the information in a logical order. Use bold text for headings like “Sender Information” and “Transaction Details.” Make sure there is enough space between sections to avoid clutter. Prioritize legibility by selecting clear, readable fonts and using an appropriate font size for each section.