Creating a receipt for earnest money is straightforward but requires careful attention to detail. This document serves as proof that a buyer has made a deposit to secure their interest in a property or transaction. A well-structured receipt ensures both parties–buyer and seller–are clear on the terms of the agreement.

The template should include key details such as the names of both parties, the amount paid, the purpose of the payment, and the date the payment was made. It’s important to specify whether the earnest money is refundable or non-refundable, as this can impact the transaction. Also, make sure to add any relevant conditions tied to the earnest money, such as contingencies or timelines for refund or application to the purchase price.

For clarity, consider including a section for both parties to sign, confirming the agreement’s terms. This additional step helps avoid misunderstandings and ensures both parties are on the same page. Use clear, concise language to avoid confusion, and always double-check the accuracy of the information provided.

Here are the revised lines with reduced repetitions:

To create a more concise and efficient receipt for earnest money, focus on simplifying the language while maintaining clarity. Remove unnecessary details and keep the structure straightforward.

Key Elements to Include:

- Transaction Date: Clearly state the date of the transaction.

- Amount Paid: Mention the exact amount of earnest money given.

- Parties Involved: Identify both the buyer and the seller in the transaction.

- Property Details: Provide a brief description or address of the property in question.

- Terms: Briefly outline the conditions under which the earnest money will be refunded or applied.

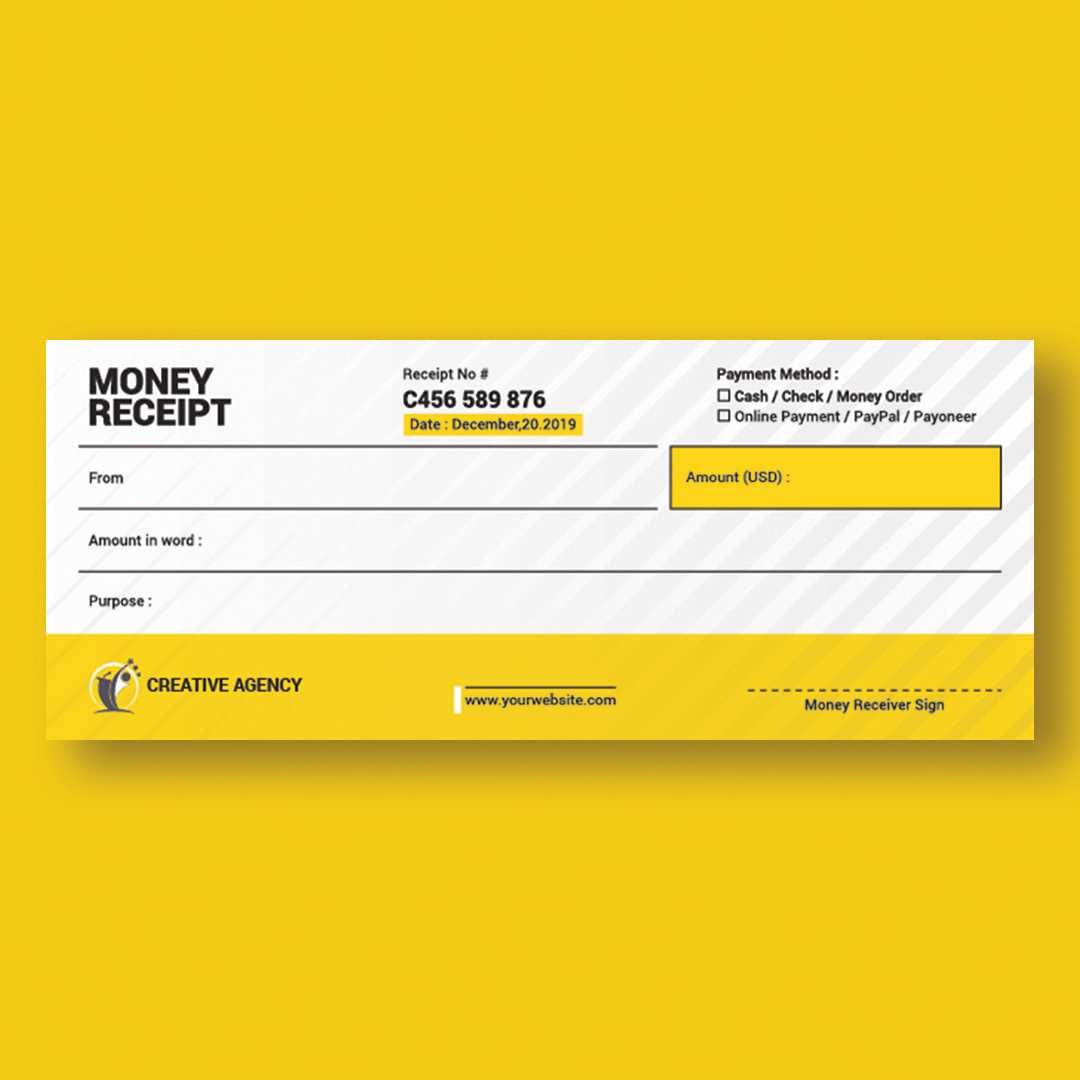

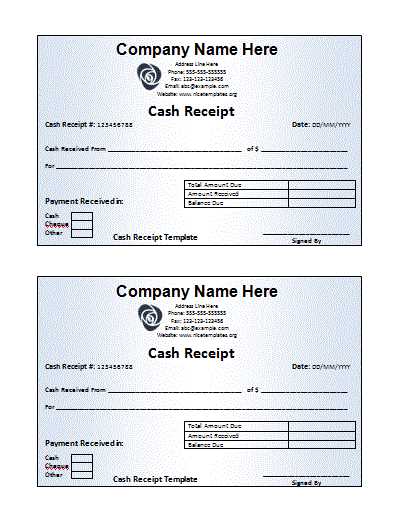

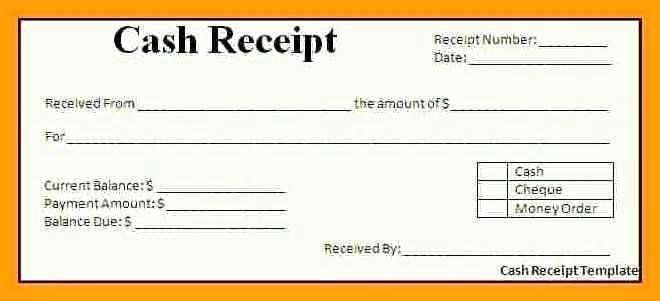

Example Receipt Template:

- Received from [Buyer Name] the sum of [$Amount] as earnest money for the purchase of the property located at [Property Address].

- This amount will be applied towards the purchase price unless otherwise specified in the contract.

- Signed by [Seller Name] and [Buyer Name], on [Date].

By streamlining the details and avoiding repetition, the receipt becomes more professional and easier to understand for both parties involved.

- Receipt for Earnest Money Template

A receipt for earnest money should clearly outline the amount paid, the purpose of the payment, and the details of the parties involved. The document serves as confirmation that the buyer has provided earnest money as part of a real estate transaction or agreement. Below is a simple template for creating an earnest money receipt:

Receipt for Earnest Money

This is to confirm receipt of earnest money as follows:

Received From: [Buyer’s Full Name]

Received By: [Seller’s/Agent’s Full Name]

Amount: $[Amount in Words and Numbers]

Date of Payment: [MM/DD/YYYY]

Payment Method: [Cash/Check/Bank Transfer]

Transaction Reference: [If applicable, such as check number or transaction ID]

Purpose of Payment: This payment represents earnest money provided as part of the agreement to purchase the property located at [Property Address]. The earnest money is to be held in escrow and applied toward the purchase price or refunded according to the terms of the agreement.

Terms of Refund: If the transaction is completed as per the agreement, this earnest money will be applied to the final purchase price. If the transaction does not proceed due to [Buyer’s/Seller’s] actions as outlined in the agreement, the earnest money will be [forfeited/refunded according to the contract].

Signatures:

Buyer: ___________________________

Seller/Agent: ___________________________

This receipt acknowledges the payment and the terms of the earnest money agreement.

Begin by clearly identifying the parties involved: the buyer and the seller. Include their full names, addresses, and contact information. This ensures the document is tied to specific individuals and reduces any ambiguity.

Key Elements to Include

Next, specify the date the earnest money is being received. This establishes the timeline and can be important in case of disputes over deadlines or terms. Clearly state the amount of earnest money being given, with the exact number written out in words to avoid confusion.

Describe the method of payment–whether it’s via check, wire transfer, or cash. This helps confirm the transaction was completed and helps avoid misunderstandings later. If applicable, include any details about the check, such as the check number and bank information.

Details on the Earnest Money Terms

Include a statement explaining the conditions under which the earnest money may be refunded or forfeited. This provides clarity on how the earnest money will be handled based on the outcome of the deal. For example, “This earnest money is refundable if the buyer’s loan is not approved, but forfeited if the buyer decides to cancel the contract without valid reason.”

Finally, include a section for signatures. Both the buyer and the seller should sign to confirm that the transaction is legitimate and that they agree to the stated terms. Make sure to leave space for the date each party signs.

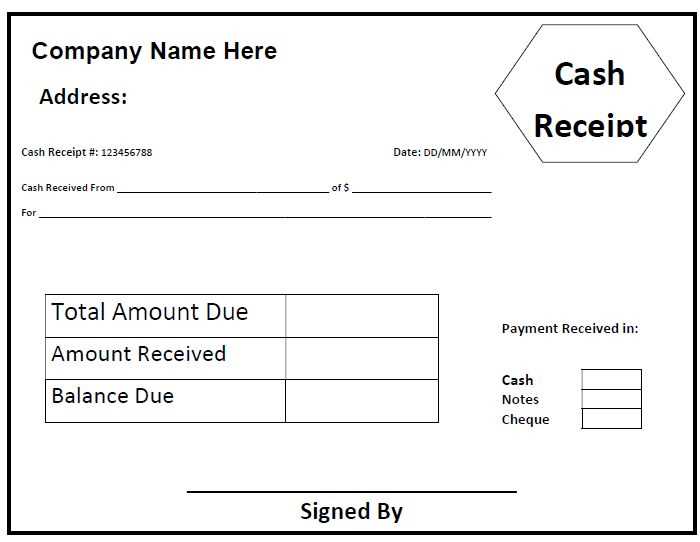

Begin by listing the buyer’s and seller’s full legal names. This makes it clear who is involved in the agreement. Add the date the earnest money was received, as this sets the timeline for the transaction.

Include the amount of earnest money being deposited. It is vital to state this clearly, specifying the currency or check type (if applicable), to avoid any confusion.

Transaction Details

Next, note the property details, such as the address or legal description. This ensures both parties are on the same page regarding the property under consideration.

Specify the conditions under which the earnest money may be refunded or forfeited. This protects both parties, laying out scenarios like the cancellation of the sale or unmet contingencies.

Payment Method

Include information on how the earnest money was paid: whether by check, wire transfer, or cash. This provides a clear record of the transaction and method of payment.

Finally, both the buyer and seller should sign the receipt. This confirms their agreement with the terms outlined in the document.

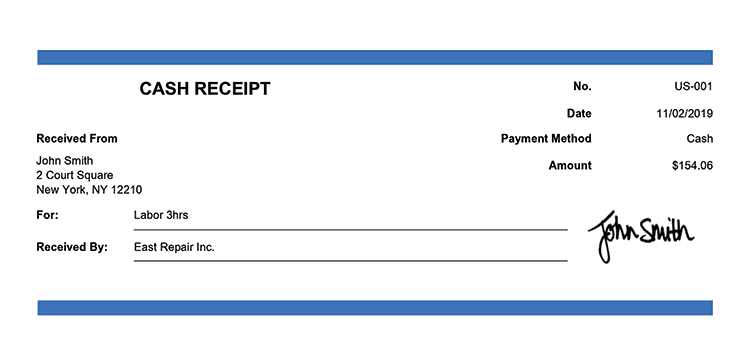

To avoid mistakes when drafting an earnest money receipt, always double-check the details provided. One common error is failing to accurately specify the amount of earnest money. Ensure the amount is written clearly and in both words and numbers to eliminate any confusion.

Incorrect Dates

Make sure the date the earnest money is received is clearly indicated. Mistakes in dating can lead to issues with timelines in the contract. This is especially important when it comes to setting deadlines for the transaction or confirming the validity of the agreement.

Lack of Clear Identification of Parties

Do not omit full names and addresses of the buyer and seller. Using vague references such as “the buyer” and “the seller” without clear identification can create confusion and lead to future legal issues. Ensure that the full legal names and contact information of both parties are provided.

Avoid ambiguity about the property involved. Always include the property address or a detailed description, so there’s no doubt about which property the earnest money is tied to. Incomplete or unclear property details could invalidate the agreement.

Finally, confirm that the receipt includes the agreed-upon terms of the earnest money: whether it’s refundable, what conditions would apply, and if there’s any additional context or clauses tied to it. Omitting this information can lead to disputes later on. A well-crafted receipt serves as a clear reference in case issues arise in the future.

Now Repeated Words Appear No More Than Two to Three Times

To maintain clarity and readability in your earnest money receipt, avoid overusing the same words. Repeated words can make the document sound redundant, reducing its professional tone. Limit the repetition of key terms to two or three occurrences, ensuring that the language remains concise and clear. This approach improves the overall flow, making the content easier for all parties to understand.

For example, if you repeatedly mention “earnest money,” consider using synonyms like “deposit” or “funds” to avoid redundancy. This small adjustment keeps the document engaging and direct.

| Original Text | Revised Text |

|---|---|

| Receipt for earnest money paid as a deposit. | Receipt for deposit made as earnest funds. |

| The earnest money has been paid as a guarantee. | The deposit has been paid as a guarantee. |

Be mindful of your language, especially in legal or financial documents. A well-crafted earnest money receipt can enhance the professionalism of your transaction while maintaining the document’s clarity.