Creating a money receipt is simple yet crucial for keeping accurate financial records. The template should be clear and concise, ensuring all important details are included. Below is a straightforward template for a money receipt that can be adapted for various needs.

Key Components of a Money Receipt

- Date: The exact date of the transaction.

- Receipt Number: A unique identifier for the transaction.

- Payer Information: Name or business name of the person making the payment.

- Receiver Information: The name of the person or business receiving the payment.

- Amount Paid: The total amount of money received, in both numeric and written form.

- Payment Method: Cash, check, bank transfer, etc.

- Description of the Transaction: A brief note explaining the reason for the payment (e.g., services rendered, goods sold).

- Signature: Signature of the person receiving the payment for validation.

Money Receipt Template Example

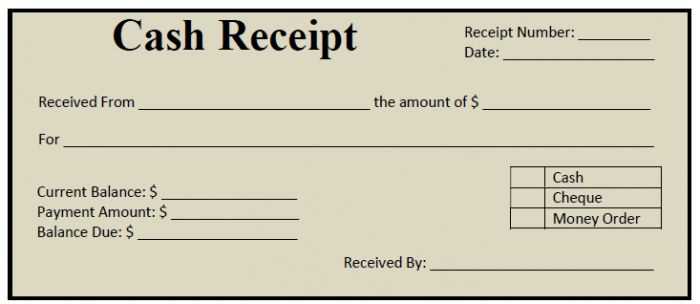

Below is a basic template for a money receipt:

Receipt No: ________ Date: ________ Received from: ______________________ (Payer's Name) Amount: ______________________ (Numeric Form) Amount in Words: ______________________ (Written Form) Payment Method: ______________________ (e.g., Cash, Bank Transfer) Description: ______________________ (Reason for Payment) Received by: ______________________ (Receiver's Name or Business Name) Signature: ______________________ (Receiver's Signature)

Customizing Your Receipt Template

Modify this template to suit your specific needs. Add or remove sections depending on the type of transaction. For example, if you issue receipts for a business, include your company logo or tax identification number to make the receipt official. Always ensure the payer and receiver have all the necessary details clearly displayed.

Having a reliable money receipt template helps maintain transparency and prevents any confusion in financial dealings. It also simplifies record-keeping for both personal and business purposes.

Template of Receipt for Money

Key Elements to Include in a Receipt

How to Format a Receipt for Business Transactions

Customizing a Receipt for Different Payment Methods

Legal Requirements for Receipts in Various Jurisdictions

Common Mistakes to Avoid When Issuing Receipts

Using Digital Tools for Creating and Managing Receipts

Begin with the date of transaction and receipt number. These provide clarity and trackability for both parties. The payer’s name and address should be clearly mentioned, along with the recipient’s details, especially if it is a business transaction.

Key Elements to Include

List the goods or services purchased, with clear descriptions and corresponding amounts. Include the payment method used–whether cash, credit card, or bank transfer. The total amount paid should be prominently displayed, and any taxes applied must be clearly broken down.

Formatting for Business Transactions

For business transactions, include your business name, address, and registration number. Specify terms and conditions, particularly any return policies or warranties. A well-structured layout ensures easy reading and understanding of the information provided.

Customize receipts to reflect various payment methods. For instance, if payment is made by cheque or cryptocurrency, specify this method along with relevant transaction details. This ensures the payer has a complete record of the payment method used.

Receipts should meet local legal requirements, which can vary by jurisdiction. For example, some regions may require a tax identification number or specific language for legal compliance. Always check the local laws to ensure your receipt template adheres to them.

Avoid common mistakes, such as not providing sufficient detail or not having a clear payment breakdown. Mistakes like incorrect dates or missing contact information can lead to confusion and disputes.

Digital tools streamline the process of creating and managing receipts. Software and online platforms can automate calculations, ensure compliance with legal requirements, and maintain organized records. This saves time and reduces errors, especially for businesses handling multiple transactions daily.