Key Elements to Include

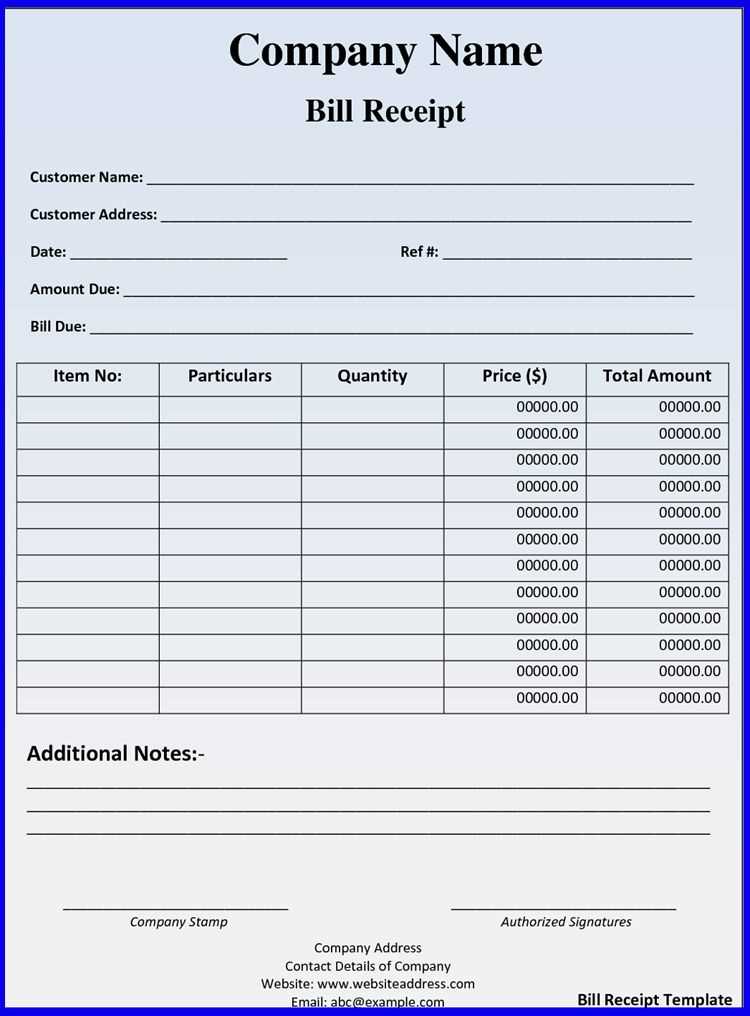

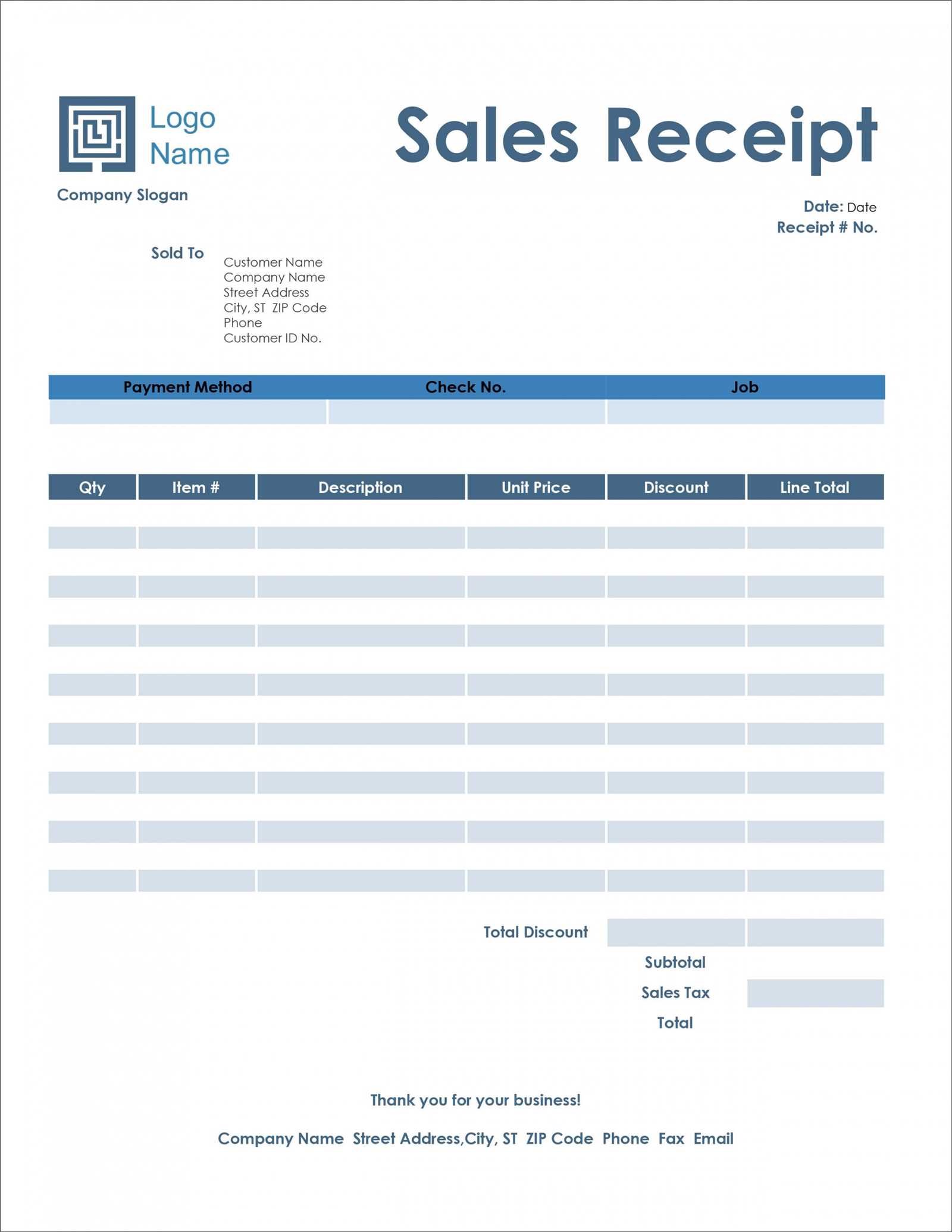

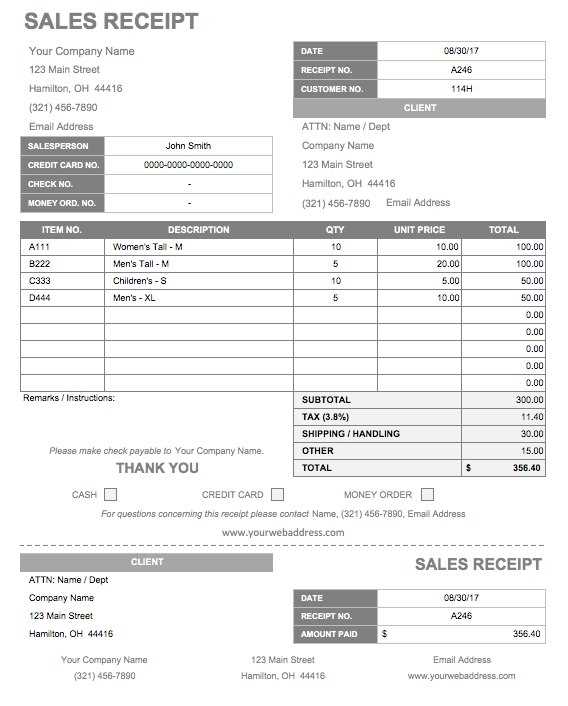

A law office receipt template should cover all necessary details to ensure transparency and accountability. Include the following components:

- Law Firm Name: Clearly display the firm’s name and contact details at the top of the receipt.

- Receipt Number: Generate a unique number for each receipt to help with future references and organization.

- Date of Payment: Always indicate the exact date the payment was made.

- Client’s Information: List the client’s full name, address, and contact information.

- Services Provided: Clearly describe the legal services rendered, including the dates of service, the nature of the service, and the hourly rate if applicable.

- Total Amount Paid: Include the total payment made, along with any taxes, fees, or discounts applied.

- Payment Method: Note how the payment was made–whether by check, credit card, or cash.

Formatting Tips

Ensure your receipt is organized and easy to read. Use bold for section headers, like “Payment Method” and “Services Provided,” and italicize any special notes or disclaimers. Consistency in font size and style helps maintain professionalism.

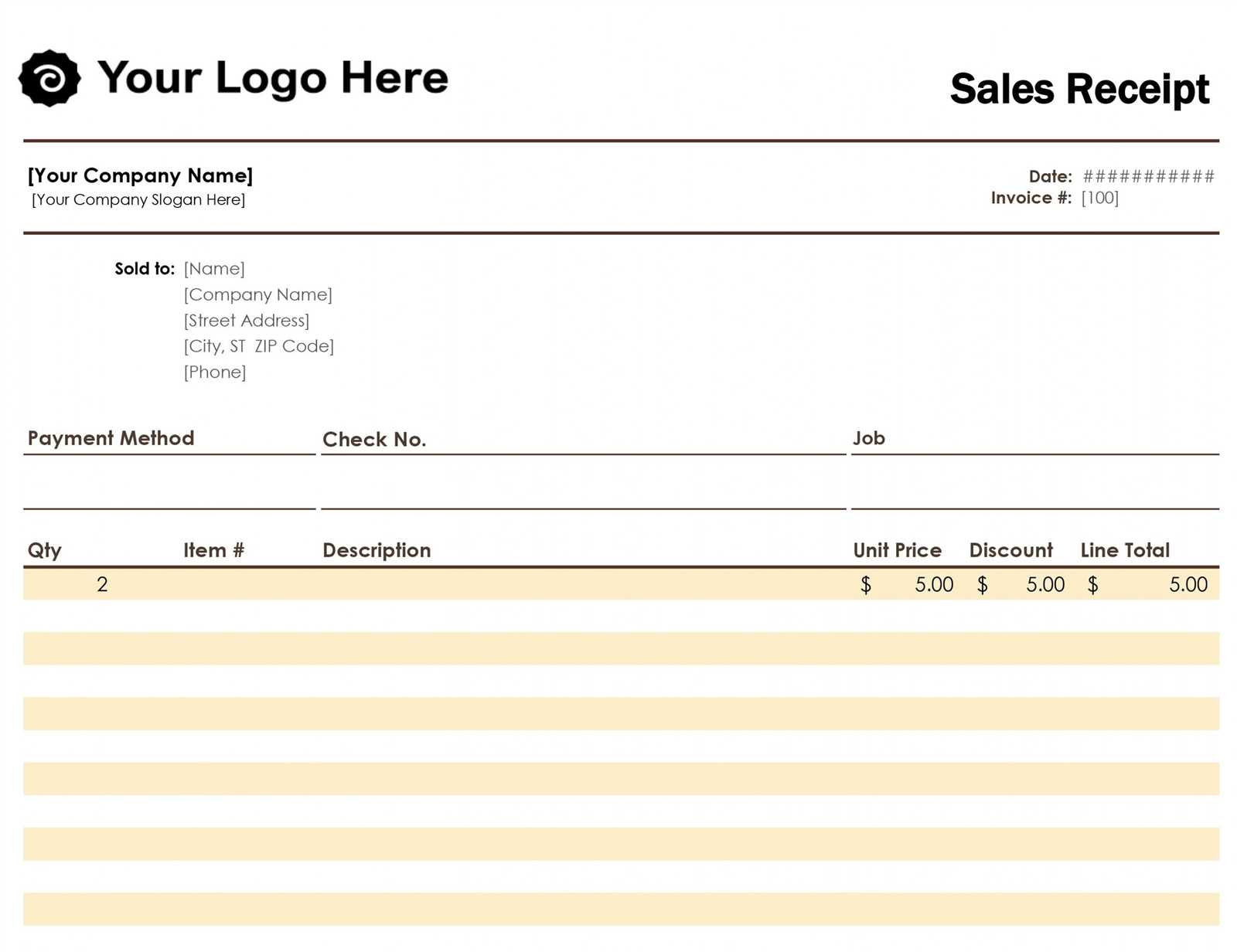

Sample Template

Here’s a simple structure for a law office receipt:

- Law Firm Name and Contact Information

- Receipt Number: 12345

- Date of Payment: February 10, 2025

- Client Information: John Doe, 1234 Main St, City, State, 12345

- Services Provided: Legal Consultation (January 2025), 2 hours at $200/hour

- Total Amount Paid: $400

- Payment Method: Credit Card

- Additional Notes: Payment received in full

Why Use a Template?

Using a receipt template saves time and ensures consistency across all client interactions. With a standardized format, you reduce the chances of missing key information, which helps with organization and financial tracking. Templates also add to the professionalism of your practice, building trust with your clients.

Law Office Receipt Template

Mandatory Elements of a Legal Receipt

Structuring Payment Details for Services

Compliance with Legal and Tax Regulations

Customizing for Different Legal Cases

Digital vs. Paper Receipts: Pros and Cons

Best Practices for Storing and Managing Receipts

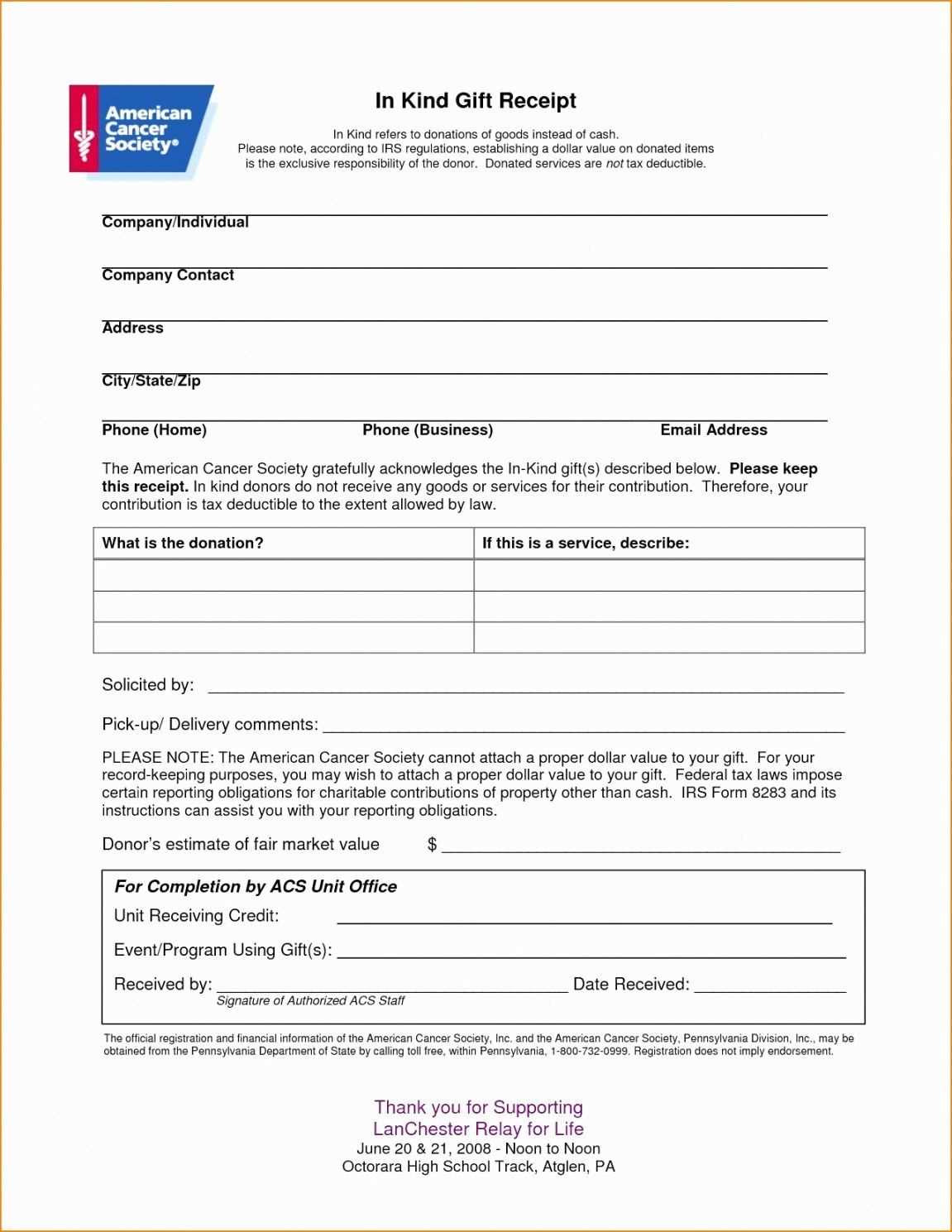

A legal receipt must include several key elements to ensure transparency and compliance. These include the client’s name, the law office’s details, a clear breakdown of services provided, payment method, and the date of the transaction. The total amount paid should also be listed, along with any applicable tax or VAT, if required by law.

For structuring payment details, it’s best to clearly separate the cost of services rendered and any additional fees. This helps both parties understand what is being paid for and reduces the chance of confusion later on. If payments are made in installments, specify the amount paid and any remaining balance.

To comply with legal and tax regulations, make sure that the receipt meets all local requirements. This might include specific tax codes or business registration numbers. The receipt should also reflect the correct tax rate, ensuring that the law office is adhering to all tax reporting obligations.

Legal cases vary widely, so it’s important to customize receipts to fit the specifics of the case. For example, a real estate transaction might involve additional documentation or separate fees, such as title searches or court filings. Receipts should be tailored to reflect these variables while maintaining clarity.

When deciding between digital and paper receipts, consider the convenience and legal validity. Digital receipts can be easily stored, shared, and retrieved, but paper receipts may still be preferred in certain situations, especially for clients who are not comfortable with digital formats. Both types should contain the same mandatory information and be securely stored.

To manage receipts efficiently, store them in a centralized, secure location. If using paper receipts, consider scanning them for backup. For digital receipts, use cloud-based storage systems with encryption to ensure privacy and accessibility. Regularly review stored receipts for proper organization and compliance with retention schedules set by law.