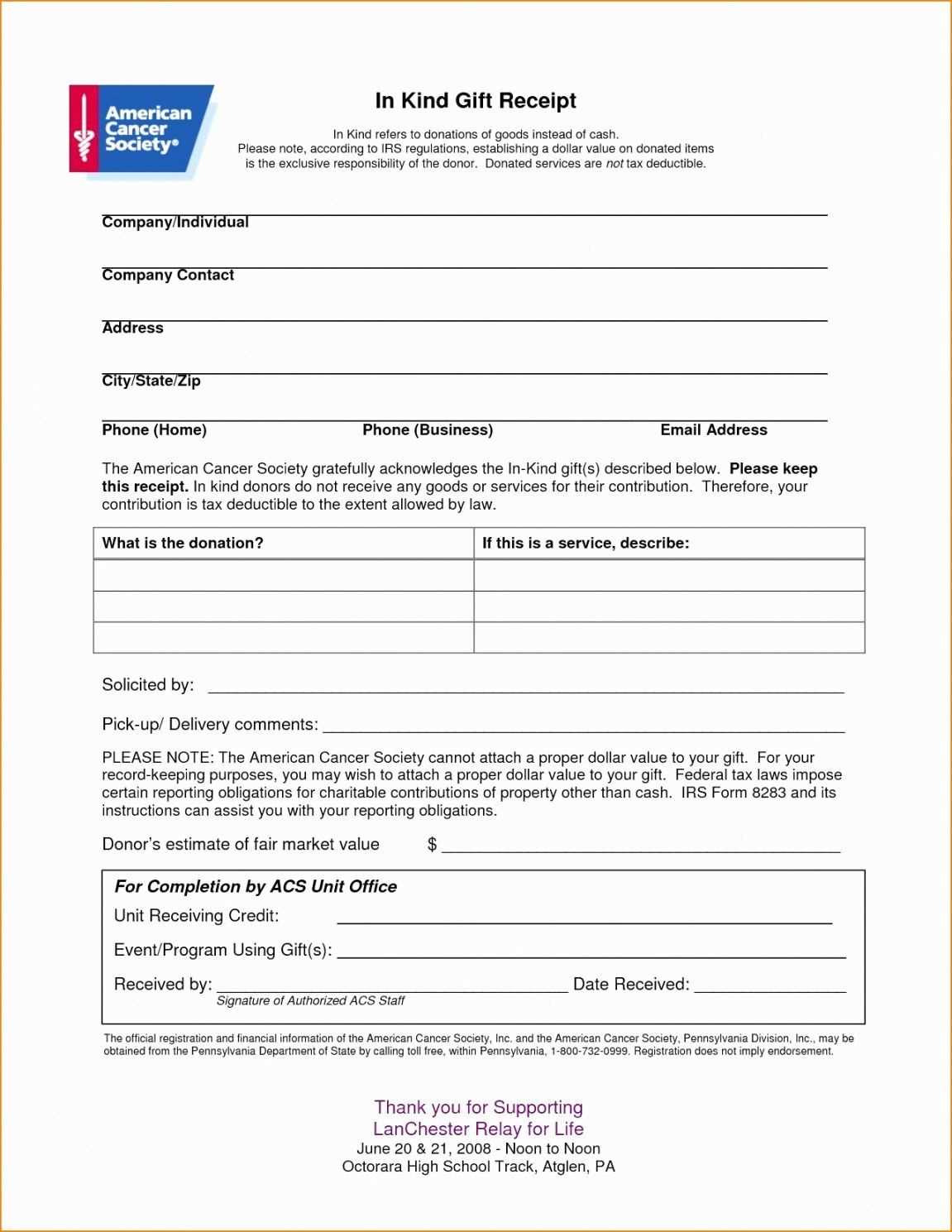

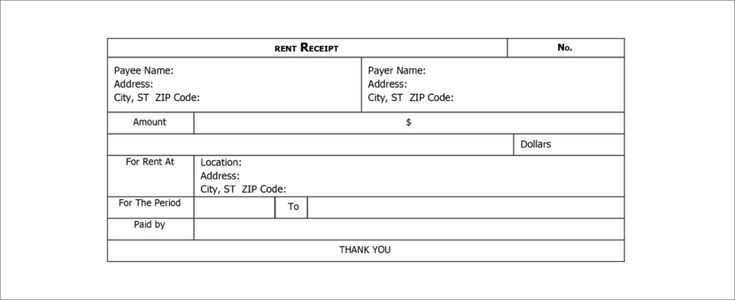

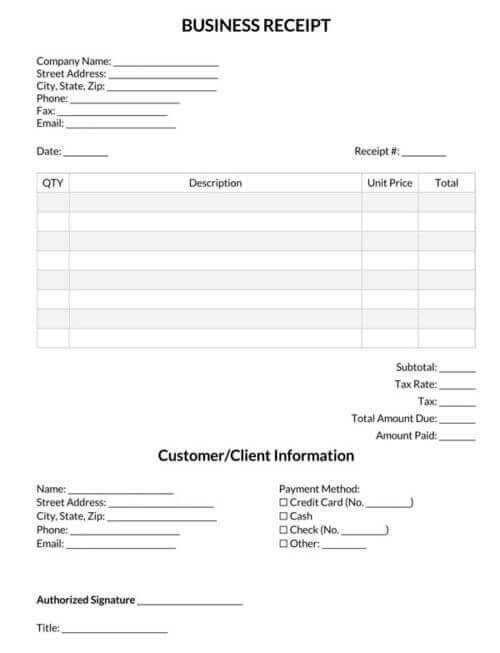

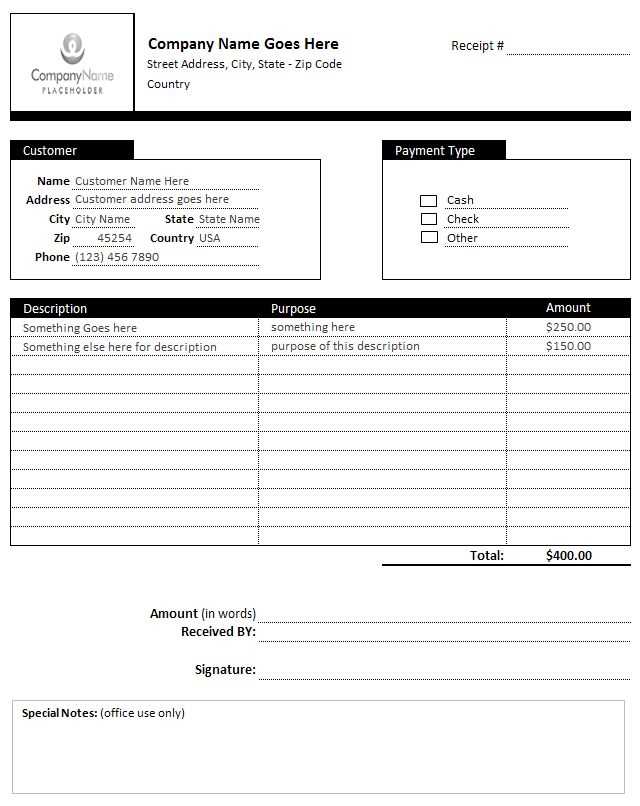

To create a functional office receipt template, make sure to include all necessary transaction details clearly. Start with spaces for the date, receipt number, and contact information for both the buyer and the seller. A simple, organized layout with distinct sections helps users quickly locate important information.

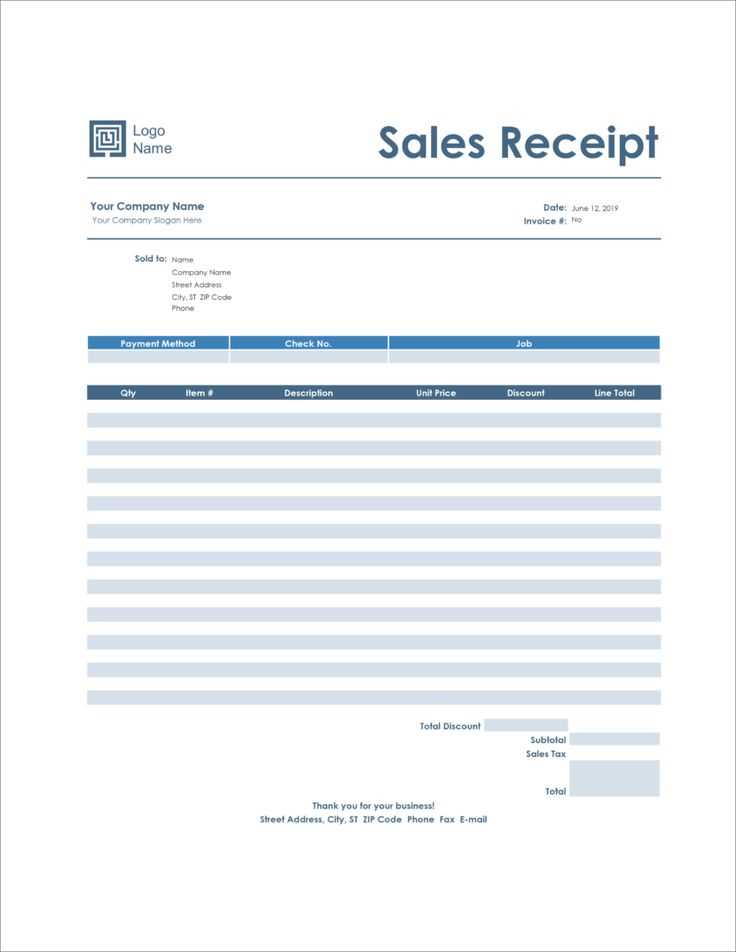

Include an itemized list to specify products or services purchased, along with their individual prices. Don’t forget to add a section for taxes, discounts, and the total amount due. Using separate fields for each item creates a clean, readable structure.

Design the template with flexibility in mind. Whether printed or used digitally, ensure it’s easy to fill out and modify. Compatibility with word processors or spreadsheet software makes it convenient for daily use in any office setting. Make sure to save the template in an accessible format, such as PDF or DOCX, for easy sharing or printing.

Office Receipt Template: A Practical Guide

To create an office receipt template, focus on clarity and simplicity. Start with the company name, address, and contact information at the top. This ensures that the receipt clearly identifies where it’s coming from.

Include a unique receipt number for each transaction. This will help you track and organize receipts for future reference. Follow this with the date of the transaction to ensure a proper record.

For the itemized section, list the products or services provided. Include a brief description, quantity, and price for each item. Ensure that the total amount is clearly visible, with any taxes or discounts applied if necessary. This transparency helps avoid confusion.

Don’t forget payment details. Specify the payment method–whether it’s cash, credit, or bank transfer. If applicable, include any relevant transaction numbers or confirmation codes for digital payments.

Finally, include space for the customer’s signature or a note confirming the receipt of the goods or services. This small step adds an extra layer of professionalism to the document.

By following these guidelines, you’ll create a functional and straightforward office receipt template that will be easy to use and understand.

How to Customize a Receipt Template for Office Use

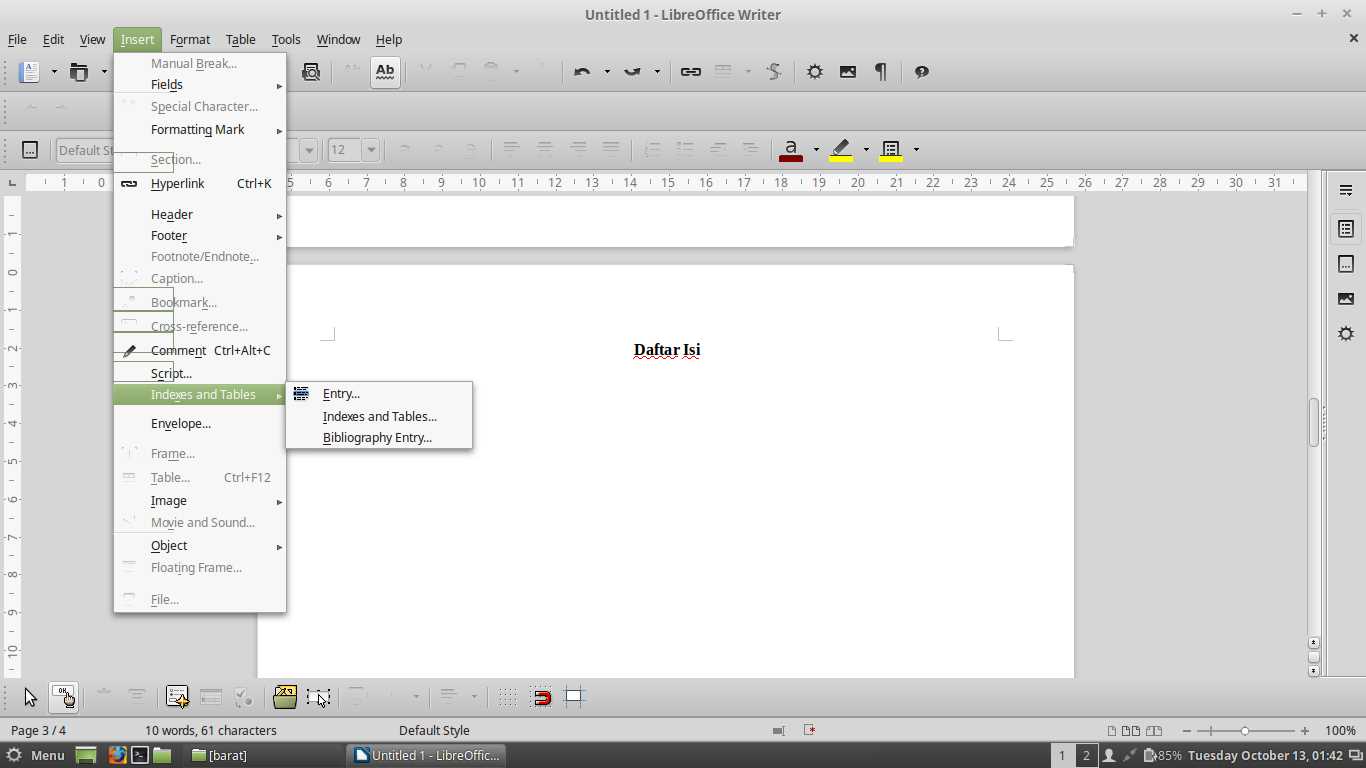

Customizing a receipt template for office use requires focusing on specific details that match your business needs. Adjust the layout to highlight critical information, such as transaction date, total amount, and company details. Follow these steps to tailor your template effectively:

1. Adjust the Layout

- Remove unnecessary fields or sections that aren’t relevant to your office’s needs.

- Position important details like transaction number or payment method in prominent places.

- Consider adding a logo or branding elements for a more professional appearance.

2. Add Custom Fields

- Include a custom field for client or project names if applicable.

- For offices handling multiple departments, create a section for department names or codes.

- Ensure space for tax calculations, discounts, or additional fees if needed.

By adjusting the structure and content, your receipt template will be more aligned with the specific functions and tasks within your office environment. Test the template with real data before finalizing to ensure all necessary fields are easy to understand and fill out.

Integrating Receipt Templates with Accounting Software

Integrating receipt templates with accounting software simplifies financial tracking by automating data entry. Ensure your accounting software supports import options for receipt formats like CSV or PDF. Link fields in the receipt template, such as date, amount, and tax, directly to corresponding fields in the software. This eliminates manual input errors and reduces time spent on administrative tasks.

For smooth integration, choose receipt template tools with built-in export functions compatible with your accounting software. Many accounting platforms offer integration through APIs, allowing automatic syncing of transaction details from receipts to the software. This streamlines the reconciliation process, ensuring data consistency and accuracy.

Test the integration thoroughly before full implementation. Ensure that every detail on the receipt is correctly mapped to the software’s fields, and verify that any discrepancies are flagged for review. Some software platforms may provide customization options to further tailor the receipt data to match your accounting structure, making it easier to categorize and track expenses.

Best Practices for Printing and Storing Office Receipts

Always use high-quality paper for printing receipts to ensure legibility over time. Opt for durable thermal paper for receipts that will be stored for a long period. This type of paper reduces the chances of fading, preserving important details.

Printing Receipts

Set up your printer with proper margin settings to avoid cutting off any critical information. Ensure that the text size is readable, and check for alignment regularly to prevent any information from getting cropped during printing.

Consider using a template with pre-set fields for receipt details like date, time, amount, and payment method. This minimizes errors and streamlines the printing process. Also, test your printer frequently to maintain clarity and ensure the ink or toner levels are adequate.

Storing Receipts

Organize receipts digitally by scanning and saving them in a secure, searchable file format like PDF. Name files with descriptive titles to make them easy to locate when needed.

If you must store physical copies, use a filing system with labeled folders or envelopes. Store receipts in a dry, cool place to prevent them from being damaged by moisture or heat. Avoid folding or crumpling receipts, as this can damage the text and make them unreadable.

For businesses, adopting a consistent system for both digital and physical storage helps maintain organization and ensures quick access to receipts for auditing or expense reporting.