Creating a Custom Template

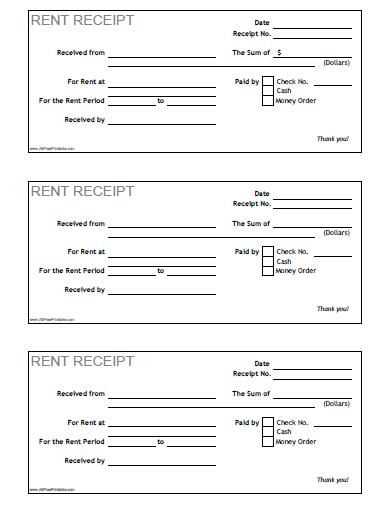

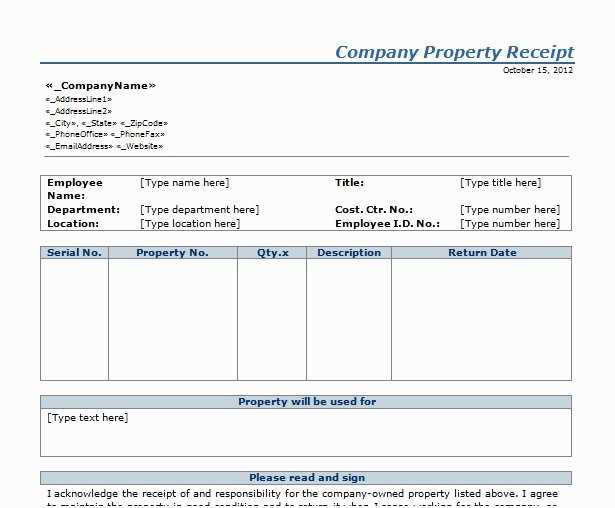

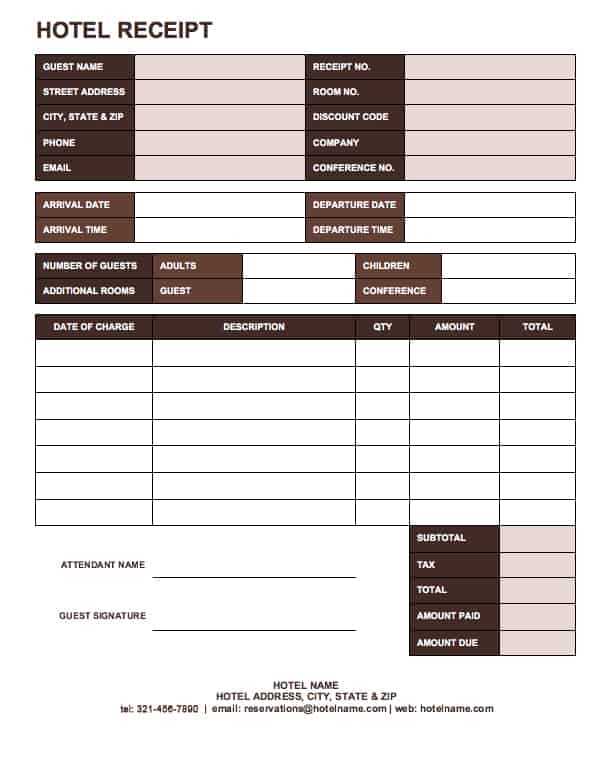

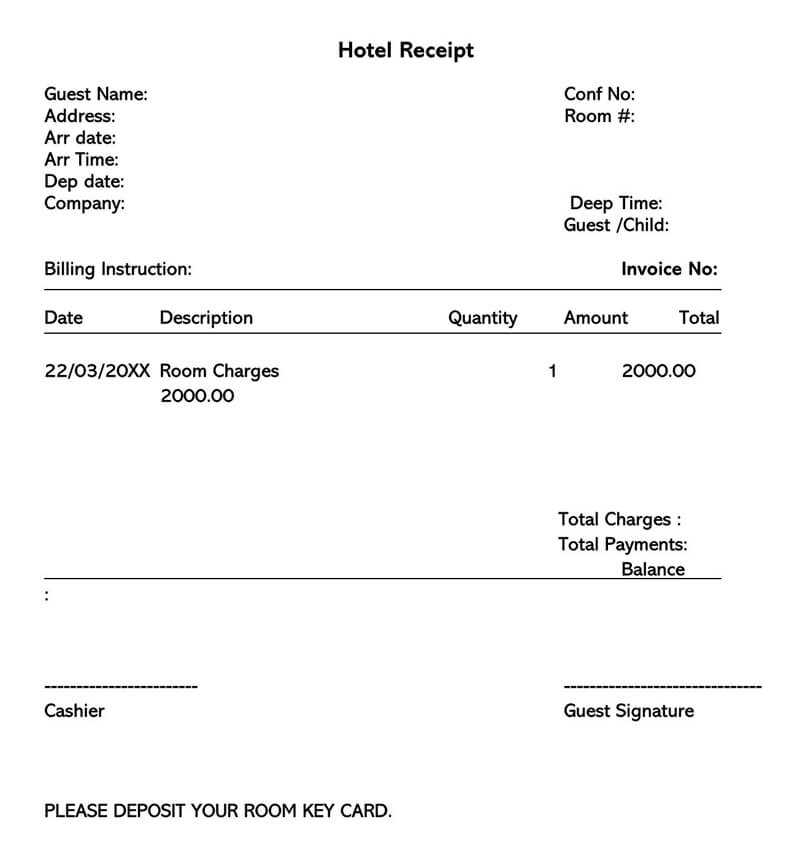

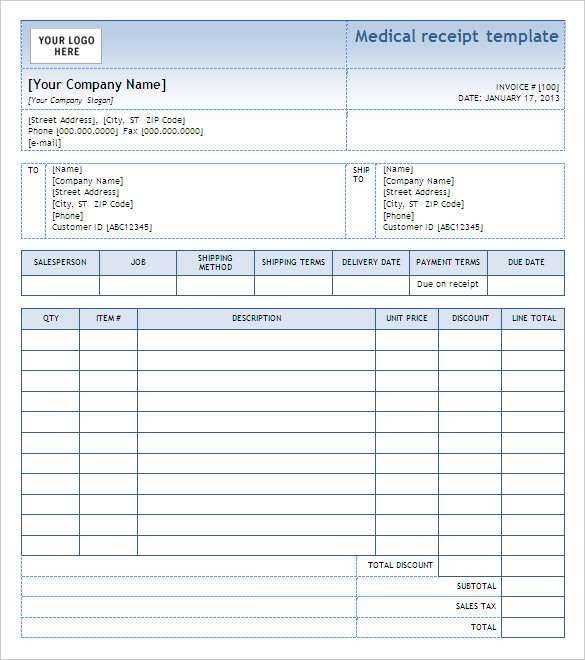

To create a realistic fake online receipt template, focus on the following structure elements that make it credible:

- Header Section: Include the store name, logo, and contact details such as an email address or phone number. Make sure the font is consistent with other receipts from the same company.

- Date and Time: Use a realistic date and time format. Ensure the format

Fake Online Receipt Template: A Practical Guide

How to Create a Realistic Online Receipt

Identifying Key Elements of a Fake Receipt

Common Uses of Fake Receipts in Digital Transactions

Legal Risks and Consequences of Using False Receipts

How to Spot a Fake Receipt in Transactions

Best Practices for Verifying the Authenticity of Receipts

To create a convincing online receipt, focus on design details and layout consistency. Use a formal, professional template that mimics genuine receipts, incorporating essential elements like the business name, transaction number, date, itemized list of purchases, total amount, and payment method. Choose a clear, readable font and align text neatly to avoid a cluttered appearance.

Key Elements of a Fake Receipt

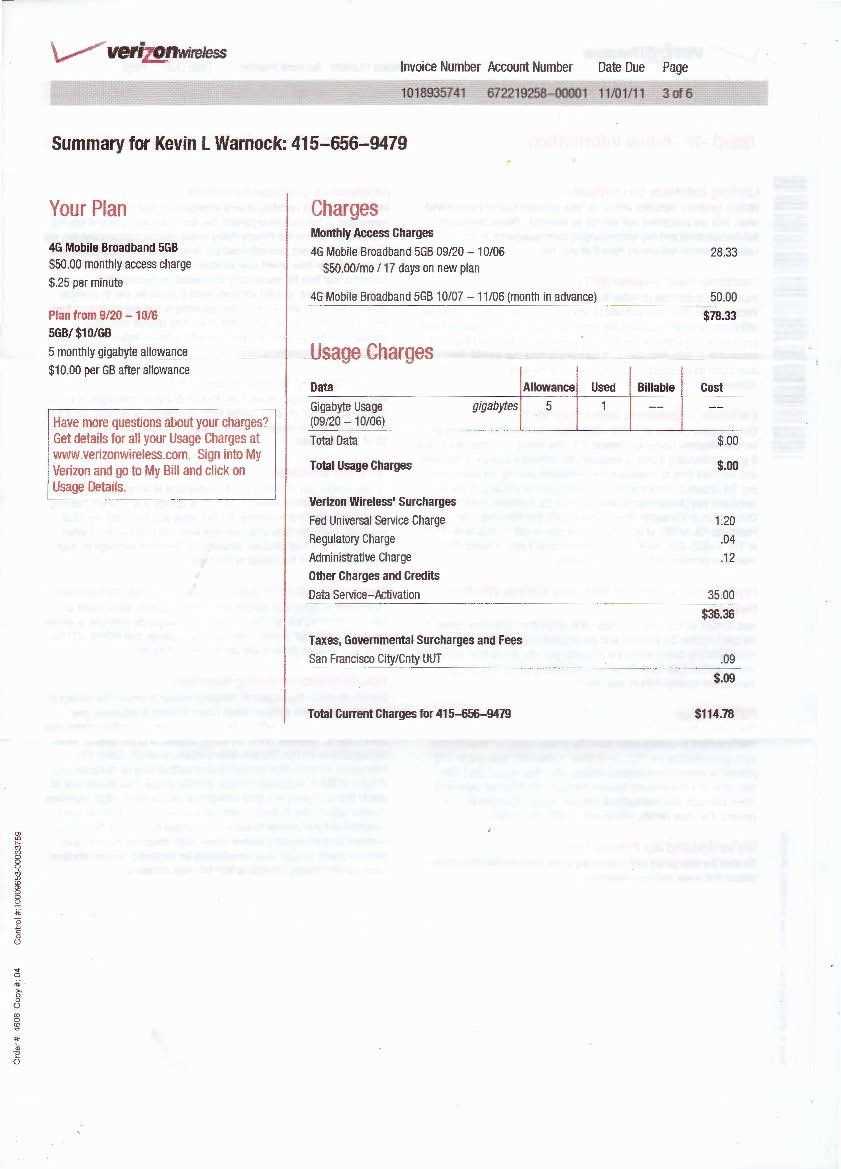

A realistic fake receipt will often include false or manipulated data, such as incorrect prices or missing details. Be mindful of subtle inconsistencies like mismatched fonts, misaligned text, or unusually high or low transaction amounts that can indicate a receipt is fabricated. These small discrepancies may go unnoticed at first but can easily be spotted with careful attention.

Common Uses of Fake Receipts in Digital Transactions

Fake receipts are typically used to deceive parties in online transactions. People may create them for fraudulent chargebacks, returning items they never bought, or claiming warranties for non-purchased goods. While some use fake receipts for scams or unauthorized refunds, others may use them for personal gain, such as expense reporting or forging proof of purchase.

Using fake receipts carries significant legal risks, including potential fines, loss of reputation, and criminal charges. Falsifying receipts is considered fraud, which is punishable by law in many jurisdictions. Whether for personal gain or a business transaction, the legal consequences can be severe, involving lawsuits or even imprisonment depending on the extent of the fraudulent activity.

To identify a fake receipt, closely inspect the formatting and consistency of the document. Cross-check any business information or transaction details with the actual retailer. If possible, verify the authenticity of a receipt directly with the company or store that allegedly issued it. Pay attention to suspicious or incomplete information that doesn’t align with legitimate practices.

The most reliable method for verifying a receipt is to contact the vendor directly. Many companies offer online receipt verification tools or can provide a customer support contact where discrepancies can be investigated. Always keep a digital or physical copy of your receipts for reference in case of an issue.