Use a structured email receipt template to ensure clarity and professionalism in every transaction. A well-designed receipt should include a clear subject line, a recognizable sender name, and an organized body with key purchase details. Customers should instantly understand what they bought, how much they paid, and whom to contact in case of questions.

Start with a subject line that includes the order number or purchase confirmation, such as “Your Order #12345 Receipt from XYZ Store”. This makes it easy for recipients to find the email later. The sender name should match your business name to avoid confusion.

The email body should display key details in a logical order: purchase confirmation, itemized breakdown, total amount, payment method, and contact details. Use simple formatting–bold for important numbers like the total amount, and bullet points for itemized lists. Avoid excessive design elements that can make the receipt hard to read on mobile devices.

Include a call to action if needed, such as a “Download Invoice” button or a link to track the order. If offering customer support, provide a direct contact link instead of a generic email address. This small change can improve response times and customer satisfaction.

Testing is essential before sending out receipts. Check formatting across different email clients and devices to ensure readability. A well-crafted receipt not only serves as proof of purchase but also strengthens customer trust and reduces unnecessary support requests.

Online Email Receipt Template

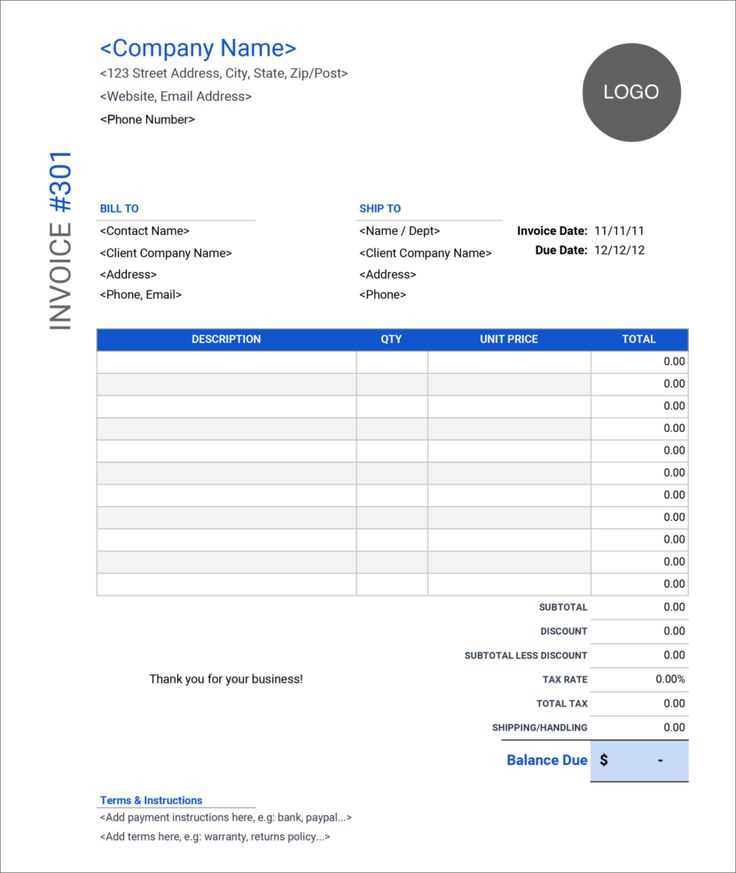

Use a structured email receipt template to ensure clarity and compliance with tax and accounting requirements. A well-designed template should include:

- Business Information: Company name, logo, address, contact details.

- Customer Details: Name, email, billing address.

- Receipt Number: Unique identifier for tracking.

- Transaction Date: Clearly visible timestamp.

- Itemized Breakdown: List of purchased items or services, including quantity, price per unit, and subtotal.

- Taxes and Discounts: Separate lines for applicable taxes, discounts, and final amount.

- Payment Method: Credit card, PayPal, bank transfer, or other.

- Support and Refund Policy: Contact details for assistance and refund conditions.

For automated systems, use a responsive HTML format with inline CSS to ensure compatibility across email clients. To prevent spam filtering, avoid excessive images and large attachments. Use a professional yet simple design with clear fonts and minimal colors.

Ensure compliance with local regulations by including legally required disclaimers. If operating internationally, adjust currency, tax rates, and language accordingly. Testing across different devices helps identify rendering issues before sending receipts to customers.

Key Elements to Include in an Email Receipt Template

Clear Transaction Details: Include the order number, purchase date, and itemized list with prices. Customers should instantly recognize what they paid for.

Payment Summary: Break down the subtotal, taxes, discounts, and final amount charged. Transparency prevents confusion and reduces refund requests.

Business Contact Information: Provide your company’s name, support email, and phone number. A visible customer service link improves trust and accessibility.

Return and Refund Policy: Summarize key terms or link to a full policy page. This reduces disputes and sets clear expectations.

Estimated Delivery or Access Instructions: If applicable, specify delivery timelines or steps to access digital products. Uncertainty leads to support tickets.

Personalized Greeting: Address customers by name. A simple touch like “Thank you, [First Name]!” makes the interaction feel more human.

Branding and Design: Use your logo, brand colors, and a clean layout. A visually appealing receipt reinforces brand identity.

Call to Action: Encourage further engagement, such as tracking the order, leaving a review, or exploring related products.

Legal and Compliance Information: Add tax details, business registration numbers, or terms required by law. This prevents regulatory issues.

Design and Layout Best Practices for Clarity

Use a single-column layout to ensure readability on all devices. Multiple columns can make scanning difficult, especially on mobile screens. Keep the width between 600-800px to maintain a balanced appearance.

Limit the number of fonts to two: one for headings and another for body text. Sans-serif fonts like Arial or Roboto improve readability, while a slightly larger font size (14-16px) for body text enhances legibility.

Maintain a clear visual hierarchy by structuring content with bold headings, bullet points, and whitespace. Break long paragraphs into smaller sections to improve skimmability.

Ensure contrast between text and background. Dark text on a light background works best. Avoid using light gray text on white, as it reduces readability.

Use a well-defined call-to-action (CTA) with a button instead of a text link. A button with contrasting color and clear wording like “View Invoice” or “Download Receipt” increases click-through rates.

| Element | Best Practice |

|---|---|

| Layout | Single-column, 600-800px width |

| Fonts | Max two; 14-16px for body text |

| Visual Hierarchy | Headings, bullets, whitespace |

| Contrast | Dark text on light background |

| CTA | Button with clear wording |

Test your email template on different devices and email clients to ensure consistency. Minor adjustments in padding, margins, and image sizes can make a significant difference in clarity.

Customization Options for Branding and Personalization

Use your brand’s colors, logo, and typography to create a consistent look. Align design elements with your website and marketing materials to reinforce brand recognition.

- Custom Colors and Fonts: Match the email’s color scheme and typography with your brand guidelines. Inline CSS ensures compatibility across email clients.

- Logo Placement: Position your logo prominently, preferably at the top, ensuring it’s high resolution and optimized for both dark and light modes.

- Personalized Content: Use merge tags to dynamically insert recipient names, past purchases, or recommendations based on user behavior.

- CTA Styling: Design call-to-action buttons that stand out with brand colors and compelling copy. Use a clear hierarchy to guide readers.

- Consistent Tone: Align messaging with your brand voice. Whether formal or conversational, maintain a unified tone across all communications.

- Dark Mode Optimization: Ensure text, images, and buttons remain readable and visually appealing in dark mode settings.

- Mobile Responsiveness: Use fluid layouts and scalable elements to maintain readability and usability on all devices.

- Footer Branding: Include social media links, company details, and a branded sign-off to reinforce trust and engagement.

Testing across different email clients and devices helps maintain consistency. A/B testing can further refine personalization strategies for higher engagement.

Ensuring Compliance with Legal and Tax Requirements

Include mandatory tax details. Every email receipt must display the seller’s legal name, business registration number, and tax identification number. If applicable, include VAT or sales tax amounts, along with the tax rate used.

Follow invoice formatting rules. Many jurisdictions require specific elements in receipts, such as sequential invoice numbers, issue dates, and detailed descriptions of goods or services. Verify local requirements to avoid compliance risks.

Ensure accurate record-keeping. Retain digital copies of all receipts for the legally required period. In the U.S., businesses must keep records for at least three years, while in the EU, retention periods vary by country, often ranging from five to ten years.

Adapt to cross-border tax laws. If selling internationally, apply the correct tax rules based on the customer’s location. For instance, the EU requires sellers to collect VAT based on the buyer’s country, following the OSS (One-Stop Shop) scheme.

Provide refund and cancellation details. Some jurisdictions mandate clear refund policies on receipts. If operating in the EU, ensure compliance with consumer protection laws requiring a 14-day return period for online sales.

Use legally accepted digital formats. Some tax authorities require receipts to be stored in non-editable formats like PDF or XML. Ensure your email system generates receipts in an approved format to meet audit requirements.

Secure customer data. If receipts contain personal information, comply with privacy regulations like GDPR or CCPA. Encrypt sensitive data and limit access to authorized personnel.

Integration with Payment Systems and Accounting Software

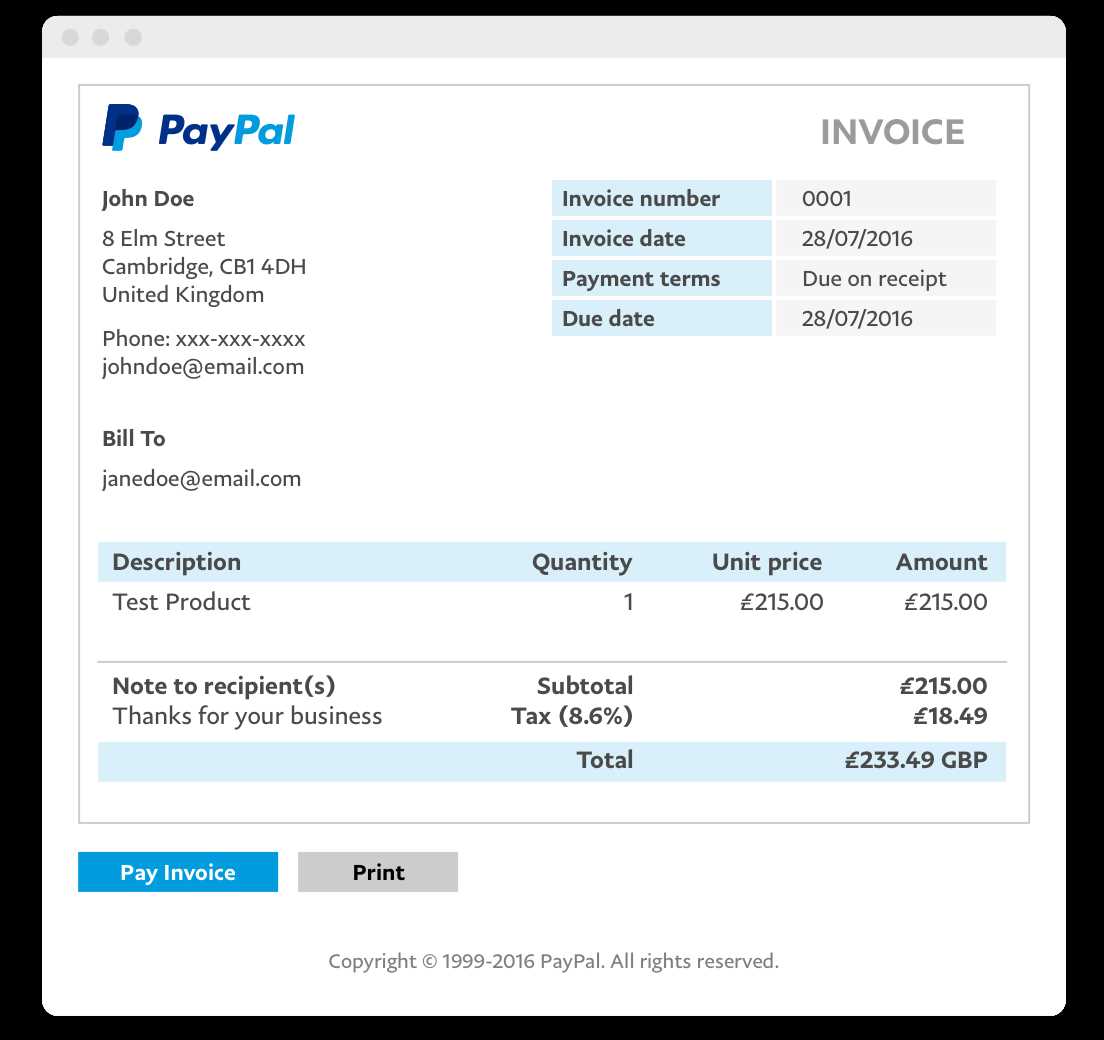

Connect your email receipt system directly to payment gateways like Stripe, PayPal, and Square using their webhooks. This ensures that every successful transaction triggers an automated receipt, eliminating manual data entry and reducing errors.

Automating Accounting Entries

Sync receipts with accounting software such as QuickBooks, Xero, or FreshBooks via APIs. Configure your integration to categorize transactions based on product type, payment method, or client details. This simplifies reconciliation and provides real-time financial insights.

Ensuring Compliance and Security

Use encryption and tokenization to protect sensitive payment data. Verify that your system complies with PCI DSS and local tax regulations. Some accounting platforms offer built-in compliance features, making it easier to generate tax reports without additional adjustments.

By linking email receipts with payment and accounting tools, you streamline financial processes, reduce manual effort, and maintain accurate records with minimal intervention.

Common Mistakes to Avoid When Creating Email Receipts

Failing to include a clear subject line can confuse recipients. Make sure it directly reflects the content of the email, such as “Your Purchase Receipt from [Store Name]”. This avoids the email being overlooked or marked as spam.

1. Missing Key Transaction Details

Always include the transaction ID, date, item details, and total amount paid. Skipping any of these can leave customers uncertain about the payment they made. Clear breakdowns like item prices, taxes, and shipping charges help avoid misunderstandings.

2. Unclear or Missing Contact Information

Ensure the email includes customer support contact details. Whether it’s a phone number, email address, or chat option, not providing clear ways to reach out can frustrate customers who have follow-up questions.

3. Using Overly Complicated Formatting

Avoid cluttered layouts that distract from the important information. Stick to simple fonts and clean formatting. Overuse of images or background colors can make it harder for recipients to find the essential transaction details.

4. Overlooking Mobile Compatibility

Emails not optimized for mobile devices may be difficult to read. Make sure your receipt displays properly on smaller screens by testing it on multiple devices before sending.

5. Inconsistent Branding

Keep your branding consistent with your website and other communication. Inconsistent logos or color schemes can make the email seem less professional and may create confusion for your customer.

6. Neglecting Security Features

Including sensitive payment details like credit card numbers in the body of the email can be risky. Always ensure you include secure, encrypted links for customers to access their payment information safely if needed.

7. Forgetting to Include Terms and Conditions

If there are any return policies or important terms related to the purchase, they should be easily accessible in the receipt email. Providing this information in a clear, straightforward manner can prevent misunderstandings later on.

8. Using Unfriendly Language or Tone

Keep the tone of your email receipt friendly and professional. Overly formal language or harsh phrasing can make your customers feel unwelcome. A simple “Thank you for your purchase” can go a long way.