A well-structured receipt template simplifies the transaction process and enhances customer trust. Make sure to include key details like the store name, transaction date, purchased items, prices, taxes, and total amount. This transparency helps customers feel confident in their purchase and provides clear documentation for future reference.

To create a simple yet effective receipt, focus on readability and clear organization. Start with your store’s name and contact information at the top. Below that, list the products or services purchased, their quantities, and individual prices. Highlight any discounts or promotions applied, followed by the tax breakdown and the final total. This allows customers to easily understand the full scope of their purchase.

Tip: Ensure the receipt is easily printable and accessible in both digital and physical formats. A well-designed template saves time for both you and your customers, making the purchasing process smoother and more efficient.

Pro Tip: Consider adding an order number or transaction ID to help with tracking purchases, making future returns or inquiries easier to handle.

Here’s a detailed plan for an informational article on “Online Store Receipt Template” in HTML format with practical and focused subheadings:htmlEditOnline Store Receipt Template

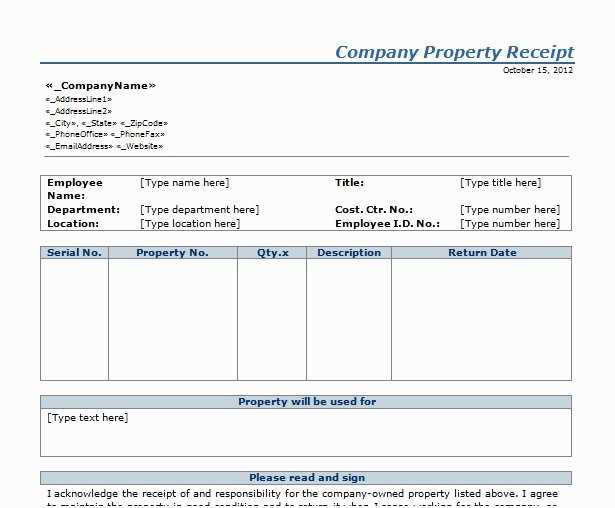

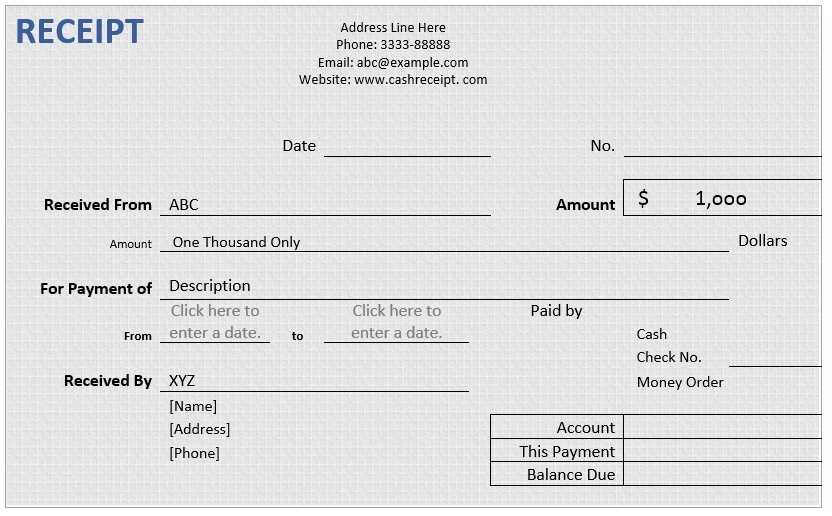

Begin with a clean structure that clearly identifies each part of the receipt, such as the store details, itemized list, and total. Ensure the template includes fields for the store’s name, address, contact details, and any applicable legal information.

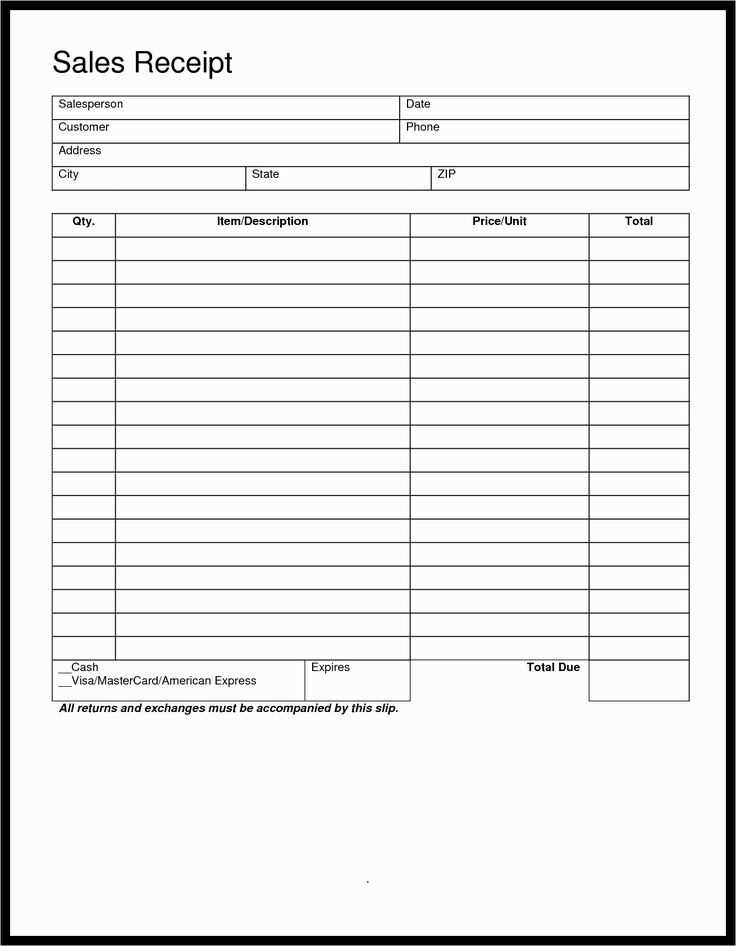

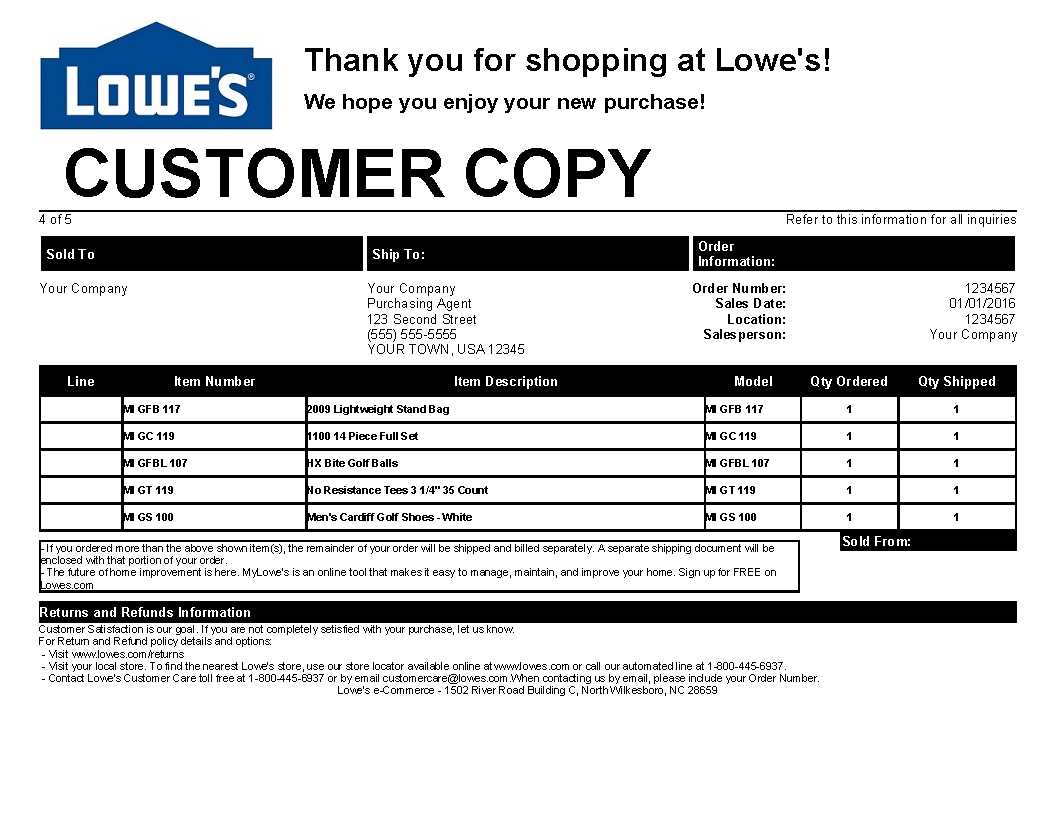

Design a simple table layout for listing purchased items, including the quantity, description, unit price, and total price for each. This makes it easy for customers to review what they’ve bought and check for accuracy.

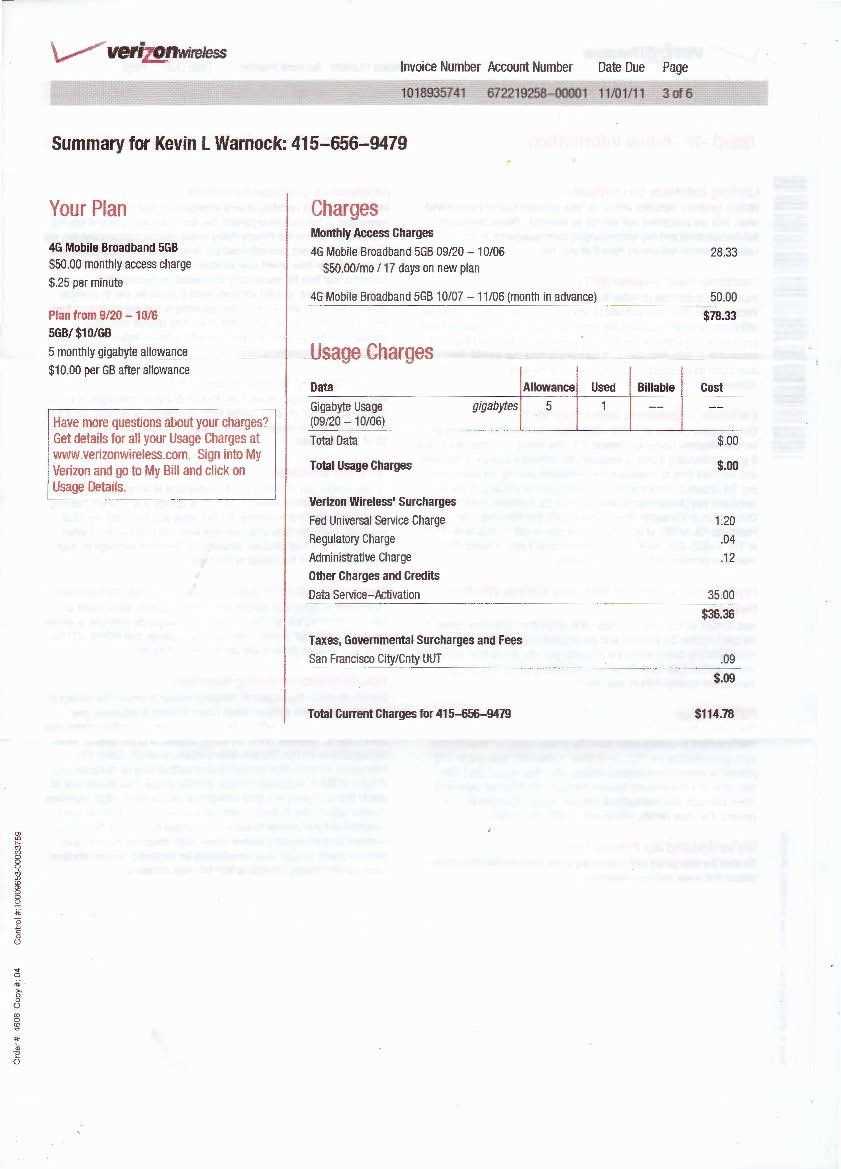

Ensure the receipt includes a clear section for taxes, shipping, and any additional fees. These should be displayed separately to avoid confusion and provide transparency.

Incorporate a field for a unique transaction or order number to track sales easily. This helps both the customer and the store keep a record of the purchase for future reference.

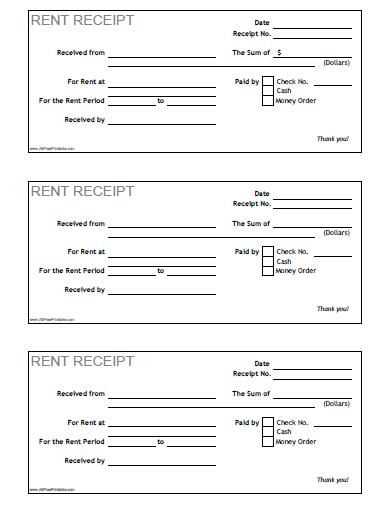

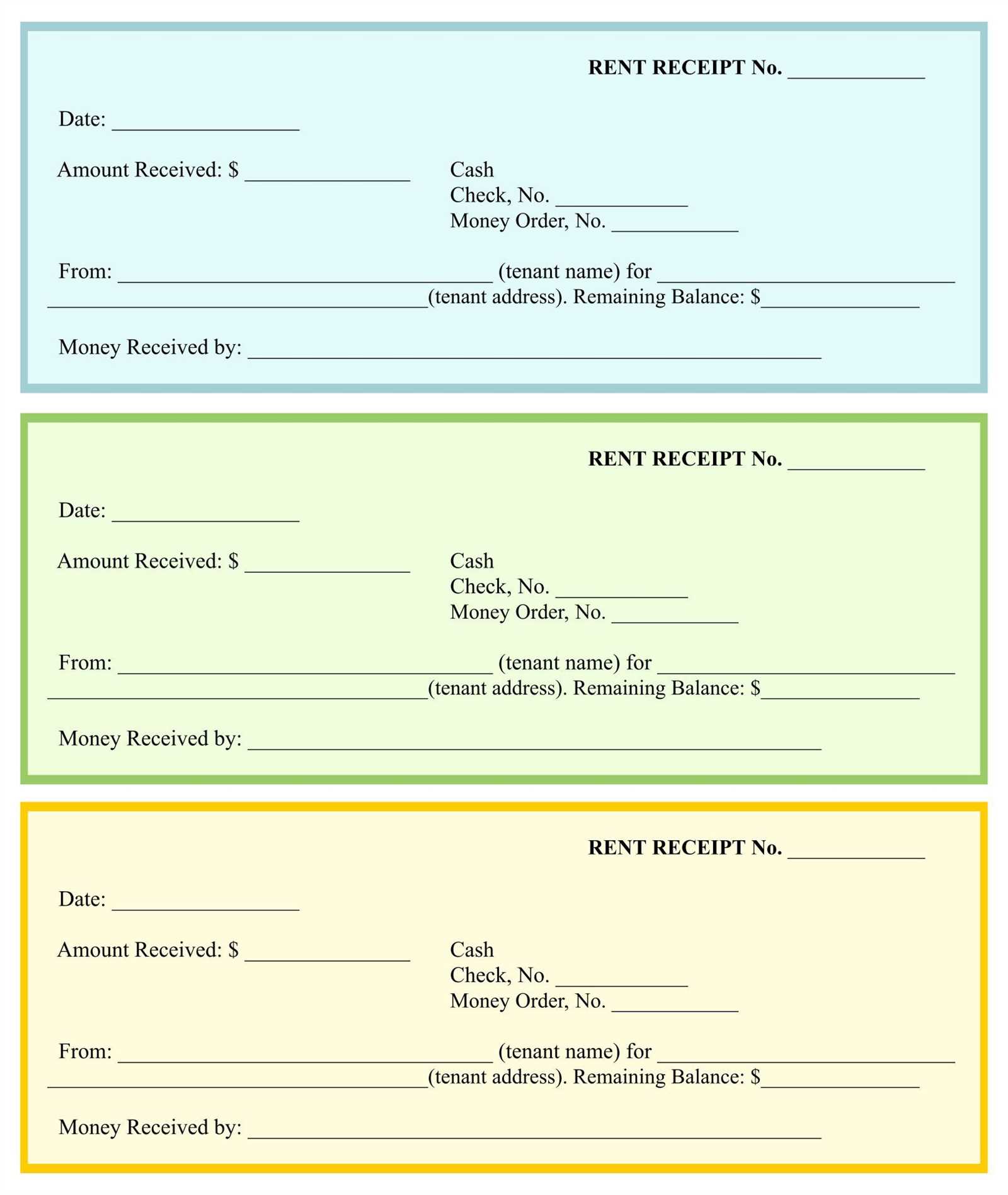

Make sure the payment method is visible, along with a summary of the payment status. Whether it’s a paid transaction or pending, the payment section should be concise and easy to interpret.

Include a thank-you note or customer service contact details to enhance the customer’s experience. This adds a personal touch and provides support information if there are any issues with the purchase.

Finally, ensure the receipt is formatted to fit various screen sizes or can be printed clearly. Use a responsive layout for web-based receipts and make sure the document is legible when printed.

Customizing Receipt Layout for Your Business

Set up a clear, organized receipt layout that reflects your brand’s identity. Focus on elements that enhance customer trust and ensure clarity.

Key Elements to Include

- Business Name and Logo: Place these at the top for easy recognition.

- Transaction Details: Include the date, time, and unique order number for easy reference.

- Itemized List: Break down products or services with prices, taxes, and discounts.

- Payment Method: Indicate whether payment was made by cash, card, or another method.

- Contact Information: Add customer support contact details for convenience.

Design Tips

- Legibility: Use a simple, readable font. Avoid clutter to make the receipt easy to scan.

- Spacing: Ensure proper margins and spacing between sections to prevent the layout from feeling crowded.

- Brand Consistency: Match the color scheme and font style to your brand’s existing materials for consistency.

- Clear Breakdown: Ensure that taxes, discounts, and totals are clearly highlighted.

Customizing your receipt layout enhances the customer experience and ensures your business stands out with professional, clean designs. Adjust these elements based on the nature of your products and the expectations of your clientele.

Integrating Payment Methods into Your Receipts

Include clear references to payment methods on your receipts. Each payment option used by the customer should be listed, such as credit card, PayPal, or bank transfer. Specify the type of card (e.g., Visa, MasterCard) and any last four digits of the card number, if relevant. For PayPal or similar services, include the transaction ID or email associated with the payment. This transparency helps customers recognize and verify their transactions easily.

Ensure that the total amount paid is broken down by payment method, especially if multiple options were used. For example, if a customer splits the payment between a credit card and PayPal, list both methods and their corresponding amounts. This level of detail minimizes confusion and supports accurate financial tracking for both the customer and your store.

For security purposes, avoid displaying full card numbers or sensitive payment details. Instead, use a masked format (e.g., showing only the last four digits). In the case of PayPal or other online platforms, including only the last four digits of the transaction number ensures privacy without compromising clarity.

Incorporate clear labels for each payment method section. Instead of generic terms like “Payment Method,” use more specific wording like “Credit Card Payment” or “PayPal Transaction.” This helps avoid ambiguity and gives your receipt a more professional appearance.

Finally, if your store offers refunds, indicate how refunds were processed. For example, if a refund was issued to a credit card, note the last four digits of the card used for the original payment. This is particularly useful for customers who need to track refunds and ensure proper adjustments to their accounts.

Legal Considerations for Online Store Receipts

Ensure your online store receipts include all required information to comply with local tax regulations. This typically includes the business name, address, contact details, date of purchase, items purchased, price, and applicable taxes. Be mindful of the specific rules in your jurisdiction regarding the format and content of receipts.

Data protection laws also come into play. Online receipts should not collect unnecessary personal information. Only request the details you need to process the transaction and comply with legal requirements. Avoid storing sensitive customer data unless it’s absolutely necessary and ensure it’s protected in line with privacy laws like GDPR or CCPA.

For businesses selling digital goods or services, receipts should clearly state the nature of the product and its digital format. Some jurisdictions may have additional rules for digital transactions, so it’s important to stay up-to-date with relevant legislation.

Consider offering an electronic receipt option. Many customers prefer digital receipts, and they can be more convenient for both you and the buyer. However, ensure that digital receipts meet the same legal standards as paper receipts. This includes clear legibility and accuracy of transaction details.

Lastly, if you are operating internationally, verify that your receipts meet the legal requirements of each country you sell to. Different tax rates, language preferences, and document standards can vary, so a one-size-fits-all approach might not be sufficient.