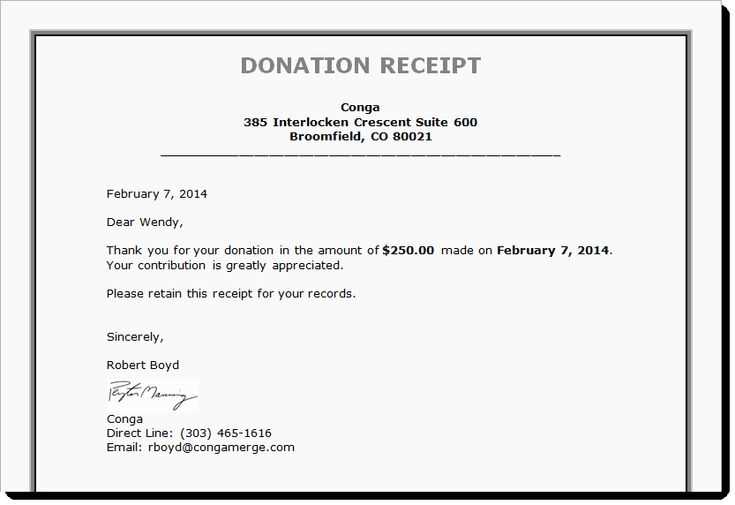

When you create a donation receipt for a 501(c)(3) organization, it’s important to include key details that ensure both compliance and transparency. A proper template can help streamline this process and make sure donors receive all the necessary information for their tax records.

The receipt should list the name of your organization, its tax-exempt status, and the donation date. Be sure to include the donor’s full name and address as well as the amount donated, whether in cash or as property. If the contribution involves goods or services, make sure to note if the donor received any benefits in exchange for their donation.

Providing clear and accurate information on your 501(c)(3) receipt template not only supports donors with their tax deductions but also reinforces trust in your organization. For larger donations or those made in kind, additional documentation may be necessary to satisfy IRS requirements, so make sure to consult a professional if needed.

Here’s the corrected version:

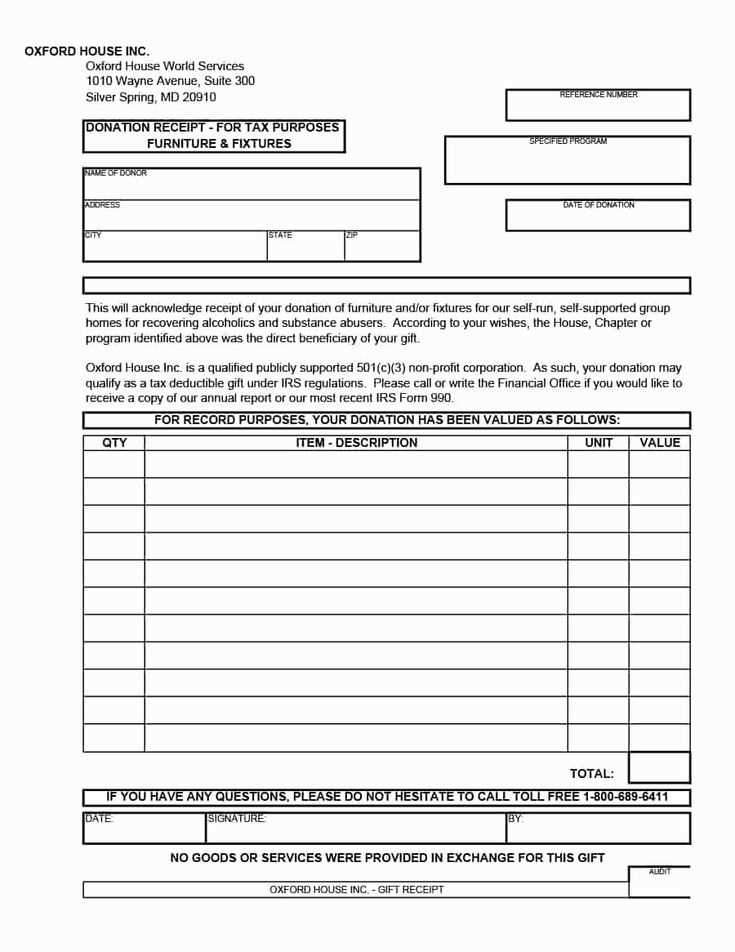

Begin the receipt with your organization’s name, address, and tax ID number for clear identification. Include the donor’s full name and the donation date, followed by the amount contributed. If a non-cash donation was made, list the donated items clearly, without assigning a value to them. Donors are responsible for determining the fair market value of their non-cash contributions.

Example: “Thank you for your donation of $100 on [Date]. You donated 3 boxes of books; the value of these items is to be determined by you.” This ensures compliance with IRS guidelines and gives donors clarity on their records.

If goods or services were provided in exchange for the donation, such as tickets to an event, explicitly state their fair market value. This helps donors accurately assess the deductible portion of their contribution.

Finish the receipt with a statement affirming that no goods or services were exchanged, or clearly outline any goods or services provided. This ensures that donors can confidently report their charitable contributions for tax purposes.

501c3 Receipt Template: A Practical Guide

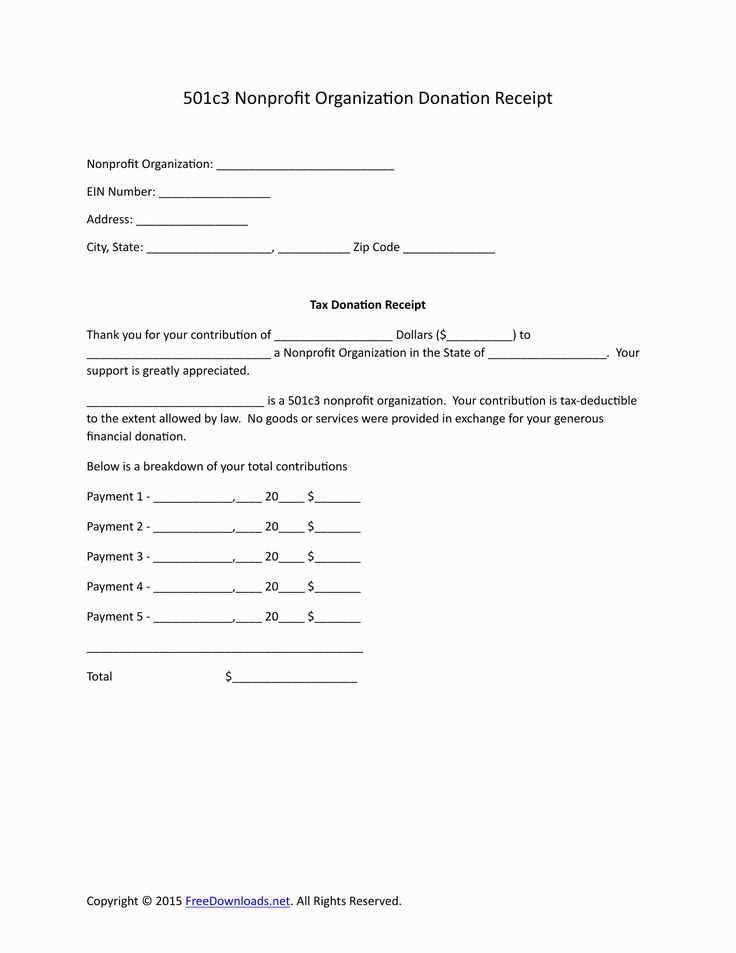

To create a clear and reliable 501c3 donation receipt, include specific details that ensure it meets IRS requirements for tax deductions. Start with the name and address of your organization. This provides an official record of the nonprofit issuing the receipt.

Next, include the donor’s name, address, and the date of the donation. Make sure the receipt specifies the donation amount, whether it’s in cash or goods. For non-cash donations, describe the items donated in detail along with their fair market value. It’s essential to avoid vague terms like “miscellaneous items” and instead list specific goods.

If any goods or services were provided in exchange for the donation, mention them. Include an estimate of the fair market value of those goods or services. If no goods or services were exchanged, clearly state that. This distinction is crucial for accurate tax reporting.

Finally, include a statement confirming your 501c3 status. This assures the donor that their contribution is eligible for tax deductions. A sample statement could read, “XYZ Nonprofit is a 501c3 organization and your donation is tax-deductible to the extent allowed by law.”

Key Details to Include in Your 501c3 Receipt Template

For completeness, remember to include a unique receipt number for tracking purposes. This ensures that each receipt can be identified easily for both the donor and your nonprofit. The IRS also recommends including a brief description of the donation, especially for non-cash contributions. If applicable, state the date on which the receipt was issued.

Be specific about the goods or services provided, including their value. If the value is not easily determined, it’s better to leave that section blank than to guess.

Common Errors to Avoid When Creating a 501c3 Donation Receipt

A common mistake is failing to include the donor’s full name or address. This can make the receipt invalid for tax purposes. Another frequent issue is omitting the statement regarding the exchange of goods or services, which can mislead the donor about their deduction eligibility.

Additionally, avoid ambiguous language, especially when describing non-cash donations. The IRS prefers specific descriptions to avoid confusion. Lastly, don’t forget to double-check that your 501c3 status statement is included. Without it, the receipt may not fulfill the tax-deduction criteria.