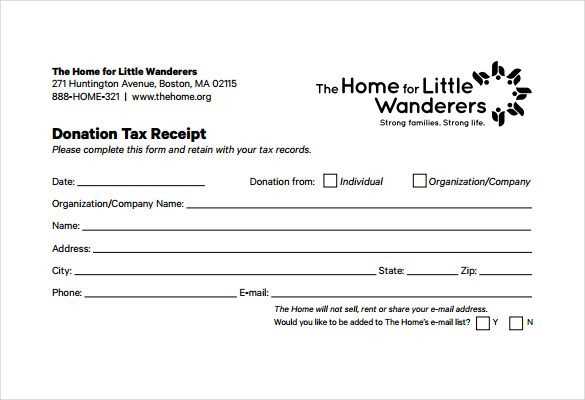

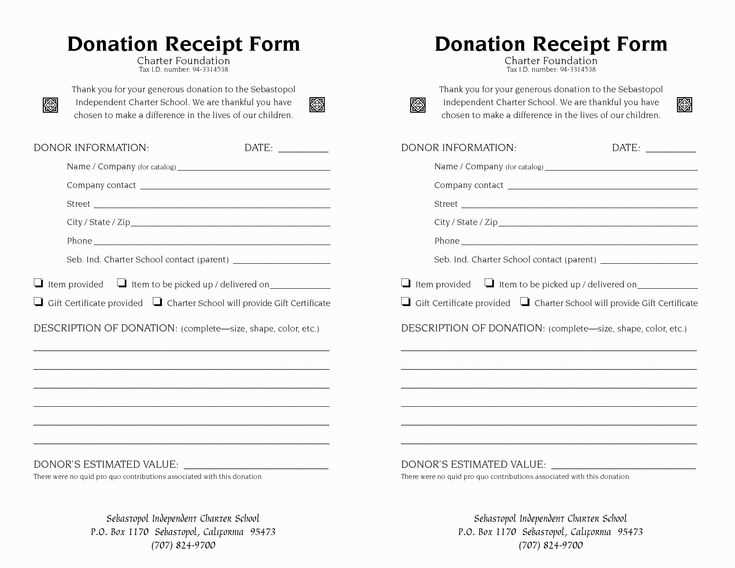

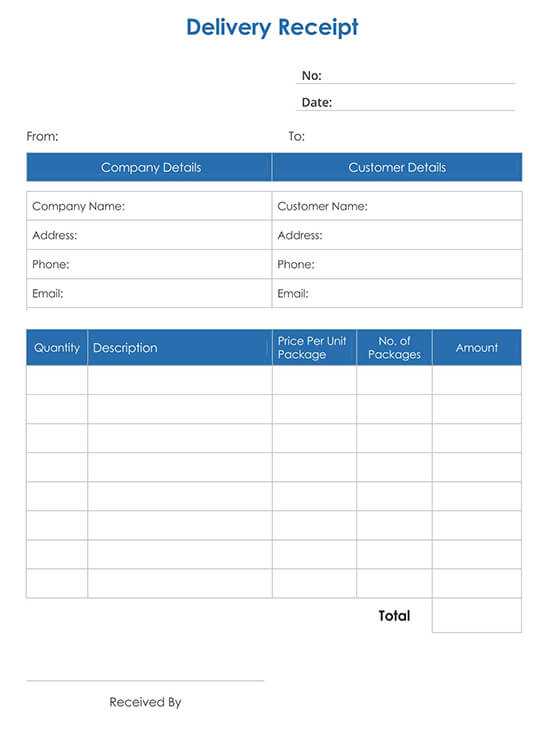

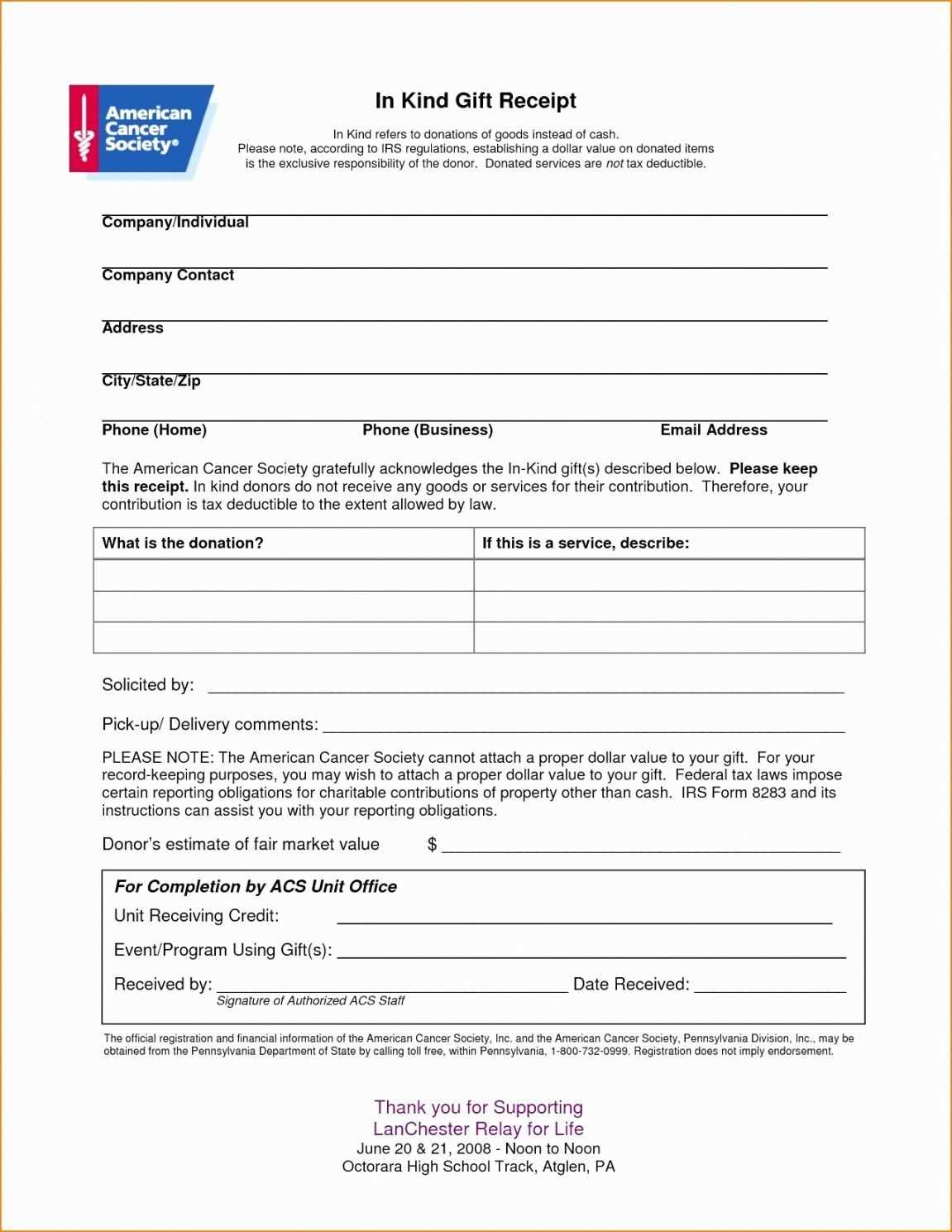

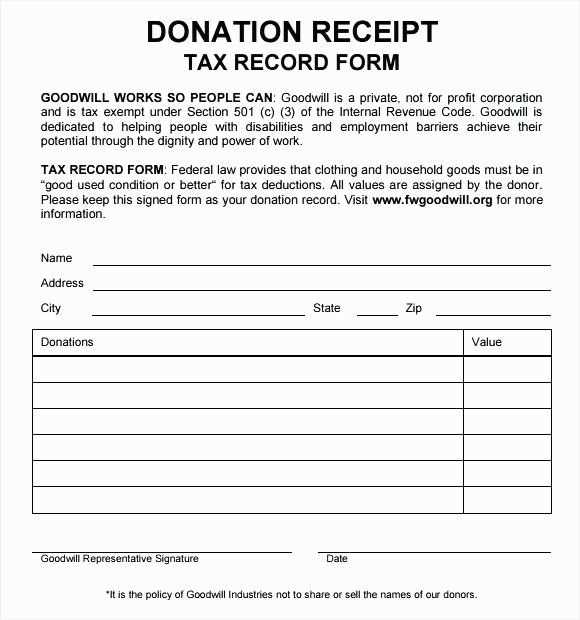

Provide a clear and well-structured tax receipt to your donors with a 501c3 tax receipt template. This simple document serves as proof of charitable contributions, ensuring that your organization stays compliant with IRS guidelines. The template should include the donor’s name, the donation date, the donation amount, and a statement confirming no goods or services were exchanged for the donation.

Make sure to include your organization’s tax-exempt number, which can be found in your IRS determination letter. This number is a vital part of the receipt, allowing donors to claim their tax deduction properly. The template should also feature a thank-you note, acknowledging the generosity of the donor, while keeping the language straightforward and formal.

Each section of the template should be clearly labeled and easy to understand, making it simple for your donors to use the receipt for tax purposes. By using this template, you can save time and ensure that your receipts are compliant and complete, providing your donors with the information they need to file their taxes.

Here is the corrected text:

For a valid 501(c)(3) tax receipt, make sure to include the following details: the donor’s name, the donation amount, and the date of the contribution. Specify whether the donation was monetary or in-kind. Include a statement confirming that no goods or services were provided in exchange for the donation, if applicable. If goods or services were provided, provide a description and a good faith estimate of their value.

Ensure that your organization’s name, address, and EIN (Employer Identification Number) are clearly visible on the receipt. This will help donors with their tax filings and ensure compliance with IRS regulations. A well-structured template makes it easy for both the donor and the organization to maintain accurate records.

501c3 Tax Receipt Template: A Practical Guide

Creating a 501c3 receipt for donors requires including key details to ensure its legitimacy and usefulness for tax purposes. The receipt should clearly indicate that the donation was made to a registered tax-exempt organization.

Key Information Needed in a 501c3 Tax Receipt

At a minimum, the receipt must contain:

- Organization’s name and address – Ensure the official name is used as registered with the IRS.

- Date of donation – Specify the exact date the donation was made.

- Donor’s name – Include the full name of the donor, or the name of the entity if applicable.

- Description of the donation – Provide a description of the items or cash donated, without assigning a value (unless it’s a cash donation).

- Confirmation of no goods or services received – Clearly state that the donor did not receive anything of value in exchange for the donation, or outline what was received if applicable.

Common Mistakes to Avoid When Issuing a Receipt

Several errors can invalidate a tax receipt or make it harder for the donor to claim deductions:

- Incorrect or missing organization details – Double-check the name, address, and tax-exempt status of the organization.

- Omitting the donation date – A missing or incorrect date could lead to confusion during tax filing.

- Failing to mention goods or services received – Always include a statement if the donor received anything in exchange for their contribution.