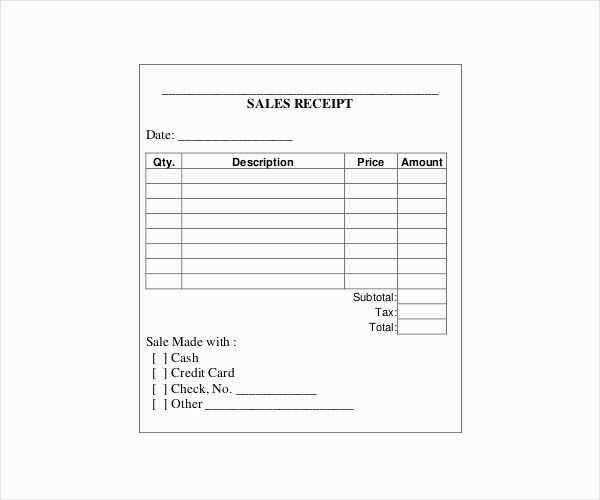

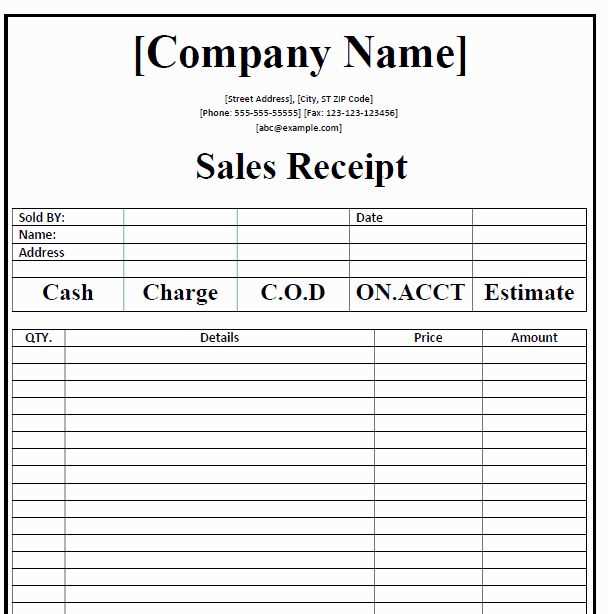

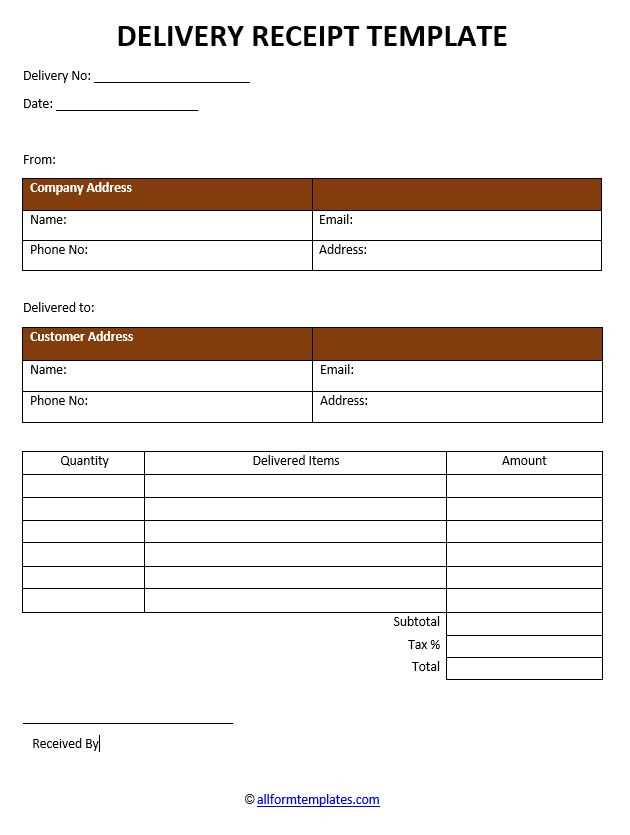

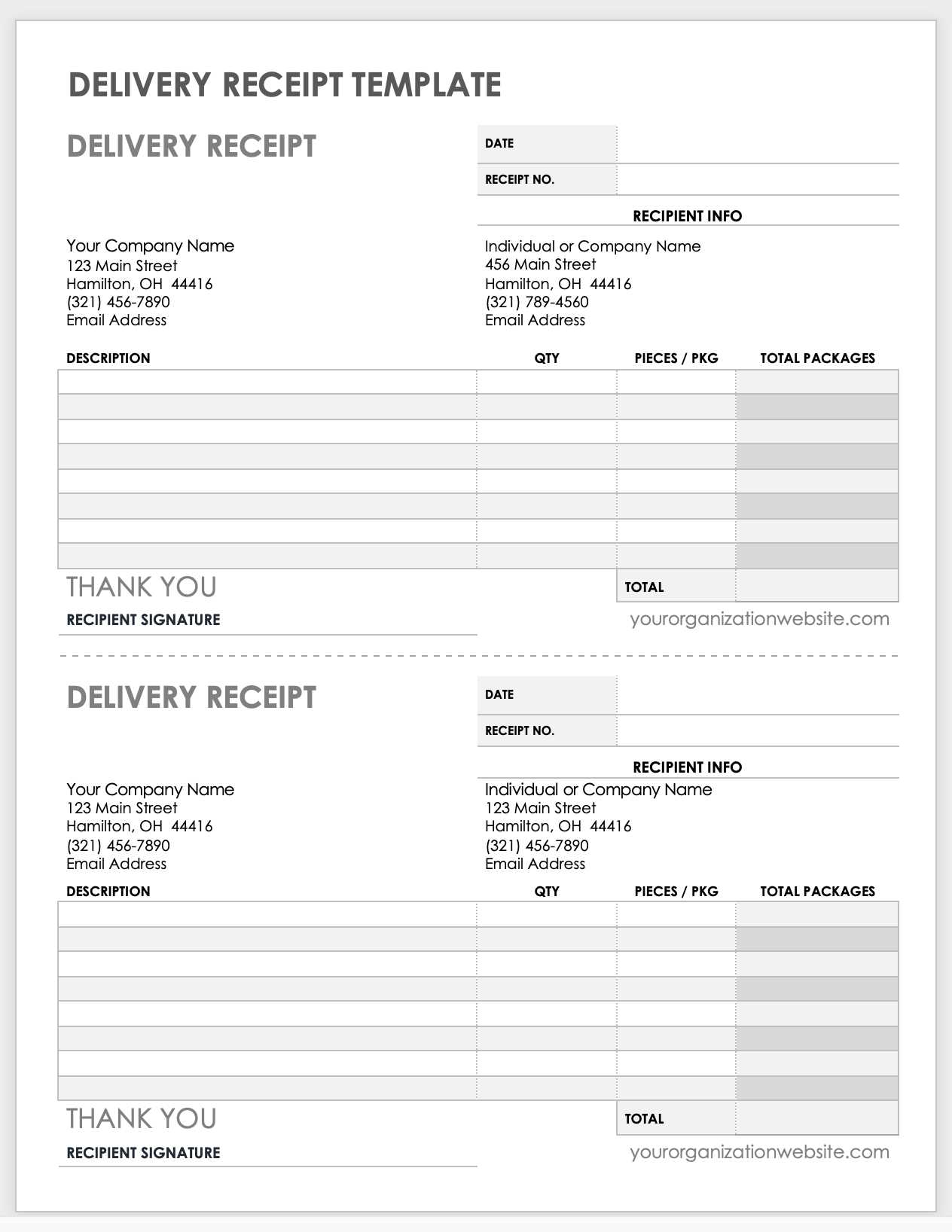

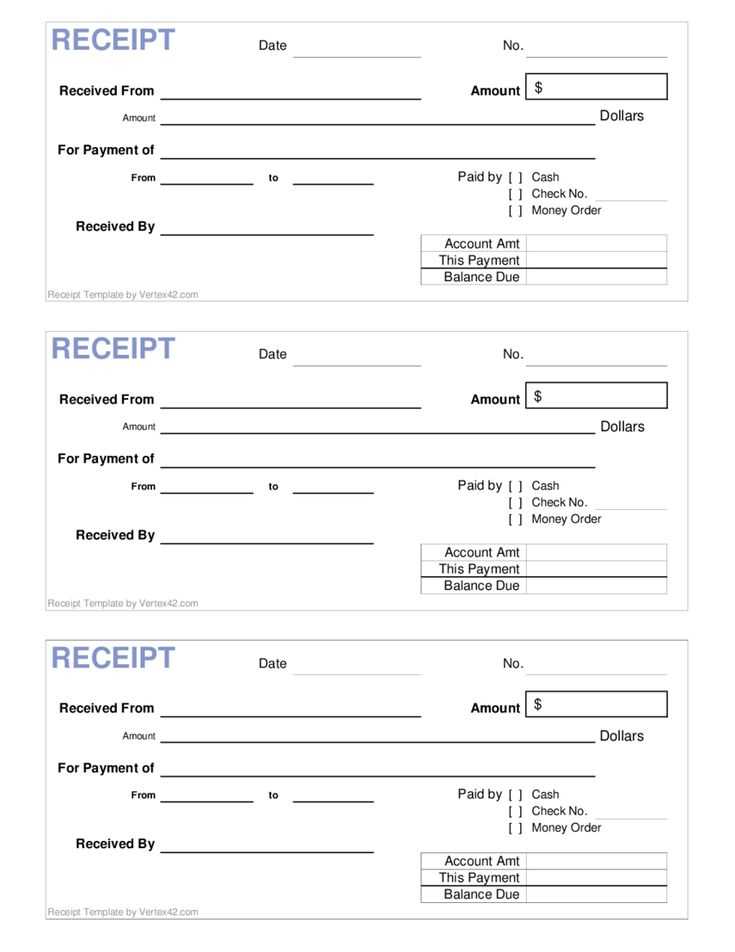

Choosing the right receipt format ensures clarity and compliance with financial records. A well-structured template should include essential details such as transaction date, payment method, and itemized charges. Avoid unnecessary elements that may clutter the layout–keep it readable and professional.

Use clear section headers to separate customer details, purchase descriptions, and tax calculations. If automation is a priority, consider templates compatible with spreadsheet software or database systems. This allows for faster data entry and accurate reporting.

For added convenience, integrate a digital signature field or QR code for easy verification. Whether printing or sending electronically, ensure your template meets industry standards while maintaining a clean, modern look.

Access Receipt Template: Practical Guide

Ensure accuracy by structuring the receipt with clear sections. Use a table or labeled fields to separate details such as transaction date, recipient, items or services, and payment method.

Key Elements to Include

- Date and Time: Record when access was granted or payment was made.

- Recipient Information: Include name, contact details, or identification number.

- Access Details: Specify what was provided–entry permission, digital access, or physical item.

- Verification: Add a signature field or unique code to confirm receipt.

Optimizing Readability

- Use a consistent format across all receipts.

- Keep descriptions concise to avoid misinterpretation.

- Choose legible fonts and appropriate spacing for clarity.

- Ensure all required fields are present before finalizing.

For digital templates, consider adding automation to auto-fill standard fields, reducing manual errors and saving time.

Choosing the Right Layout for Different Needs

Select a layout based on the type of transaction and the level of detail required. For retail purchases, a compact format with itemized lists and tax breakdowns works best. Service-based businesses benefit from a design that highlights labor costs and hourly rates.

Single vs. Multi-Section Layouts

For quick transactions, a single-column format keeps everything readable. Multi-section layouts help when additional details, such as discounts or customer information, need clear separation.

Customization for Specific Industries

Restaurants often include itemized charges with space for tips, while rental agreements require due dates and late fees. Medical receipts should feature insurance details and payment methods. Tailor the structure to match the information customers expect.

Customizing Fields for Specific Transactions

Adjust field names and values to match the transaction type. For sales, include product descriptions, quantities, and unit prices. For services, add hourly rates and billable hours. Remove unnecessary fields to keep the receipt clear and relevant.

Adding Dynamic Input Fields

Enable conditional fields that appear based on the transaction category. For example, a tax field can be hidden for tax-exempt customers but visible for taxable purchases. Use dropdowns for predefined selections like payment methods or service types.

Ensuring Consistency Across Receipts

Maintain uniform formatting by setting character limits, date formats, and currency symbols. Standardized input prevents errors and ensures clarity for both businesses and customers. Auto-fill common details like business name and contact information to save time.

Automating Calculations and Totals

Use predefined formulas to ensure accurate totals without manual input. Set up automatic sum calculations for itemized lists using built-in functions. For example, in spreadsheet-based templates, apply =SUM(range) to total amounts dynamically.

Apply conditional formatting to highlight discrepancies. If a tax rate or discount changes, link these values to a separate cell or field so updates reflect instantly across all calculations.

In database-driven templates, use queries to compute totals in real time. Implement SQL SUM() functions to aggregate data across multiple entries. Automate currency conversions by pulling exchange rates from an external source.

Reduce input errors with data validation. Restrict fields to numerical values where applicable and use dropdowns for fixed rate selections. This ensures consistency and prevents miscalculations.

Finally, integrate scripts or macros to recalculate totals automatically when data changes. In Excel, use VBA to trigger updates upon entry modifications. For web-based receipts, employ JavaScript to update totals dynamically as users input data.

Integrating Database Connections for Dynamic Data

Use a structured approach to link your template with a database. Start by selecting a relational or NoSQL system that matches your requirements. Ensure the connection string includes authentication details, host address, and database name.

Configuring the Connection

Choose a database driver that aligns with your platform. In PHP, use PDO for secure queries. For Python, opt for SQLAlchemy or psycopg2. Always use environment variables to store credentials instead of hardcoding them.

Fetching and Displaying Data

Prepare parameterized queries to prevent injection risks. Fetch only the necessary fields to optimize performance. Convert results into an array or JSON format, making them easy to insert into the template dynamically.

For real-time updates, implement AJAX or WebSockets to refresh data without reloading the page. Use caching where possible to reduce load times and enhance responsiveness.

Exporting and Printing Without Formatting Issues

Ensure consistent formatting by using a predefined template with fixed column widths and aligned text. Avoid automatic text wrapping that can distort alignment when exporting to PDF or printing.

Use a table structure to maintain precise spacing:

| Item | Description | Price | Quantity | Total |

|---|---|---|---|---|

| Example Item | Short description | $10.00 | 2 | $20.00 |

Use standard fonts like Arial or Times New Roman to avoid substitution errors. Set margins and page size before exporting to ensure the document fits standard paper sizes without cropping.

When printing, disable automatic scaling in the print settings to prevent resizing that affects layout. If exporting to PDF, verify the output by opening it in multiple viewers to catch inconsistencies before printing.

Ensuring Compliance with Legal and Accounting Standards

Include necessary transaction details such as date, items or services, amounts, and tax information in your receipt template. Double-check that all entries match the legal requirements of your jurisdiction and accounting guidelines.

- Ensure proper formatting for tax identification numbers and relevant registration details.

- Always account for applicable tax rates in line with current local and international regulations.

- Include clear payment method information to distinguish between different types of transactions.

- Verify that all entries are easily auditable and align with accounting principles.

Regularly review local regulations to ensure that your template complies with any updates in tax law or financial reporting requirements.