Key Elements for a Clear and Organized Receipt

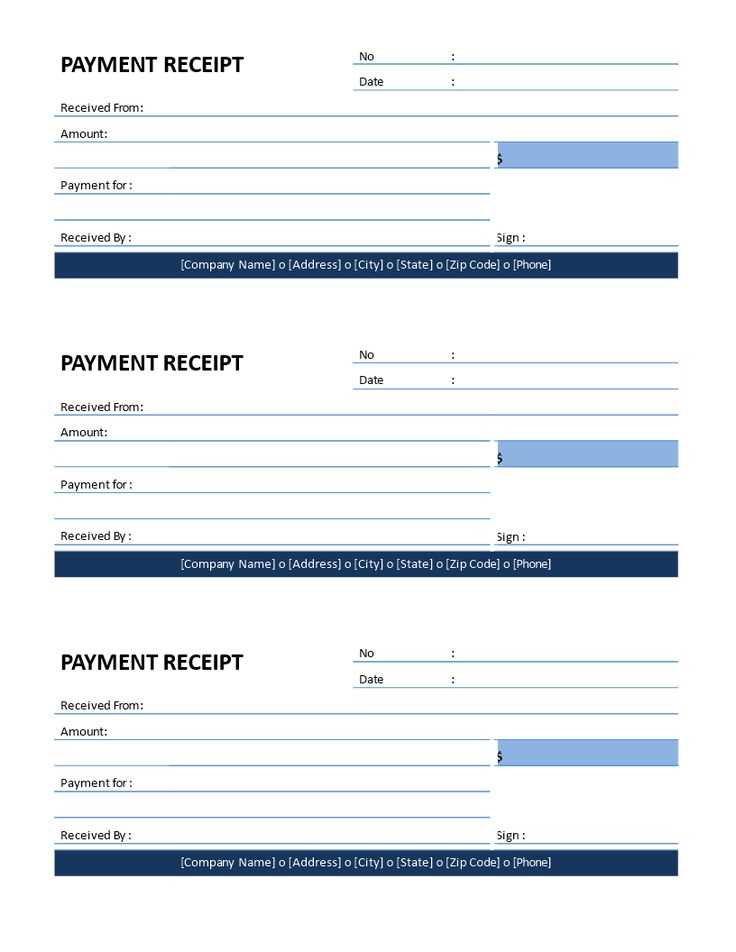

A well-structured receipt should include essential details to ensure transparency and accuracy. Make sure to include:

- Date and Time: Clearly indicate when the transaction occurred.

- Receipt Number: Assign a unique identifier for easy reference.

- Payer and Payee Information: Include names, addresses, and contact details.

- Description of Items or Services: Specify what was purchased or provided.

- Amount Paid: Show itemized costs and total payment.

- Payment Method: Note whether the transaction was completed via cash, card, or another method.

- Signature (if needed): Some receipts require authorization from the payer or payee.

Best Practices for Designing a Professional Receipt

Use a structured format that enhances readability. A simple table layout or clearly separated sections work best. Ensure fonts are easy to read and avoid clutter. Digital receipts should be formatted for both print and email compatibility.

Templates for Different Use Cases

Depending on the nature of your transactions, consider different templates:

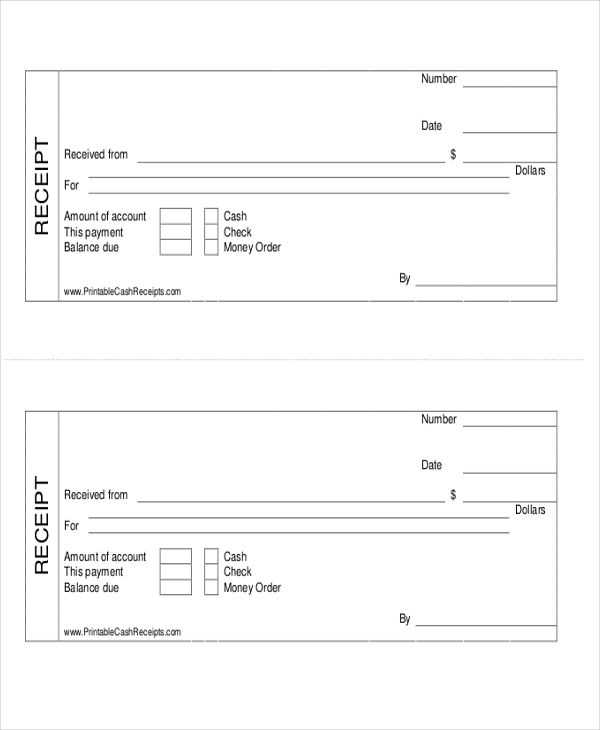

- Basic Sales Receipt: Ideal for retail transactions with itemized pricing.

- Service Receipt: Best for professional services, including labor costs and hourly rates.

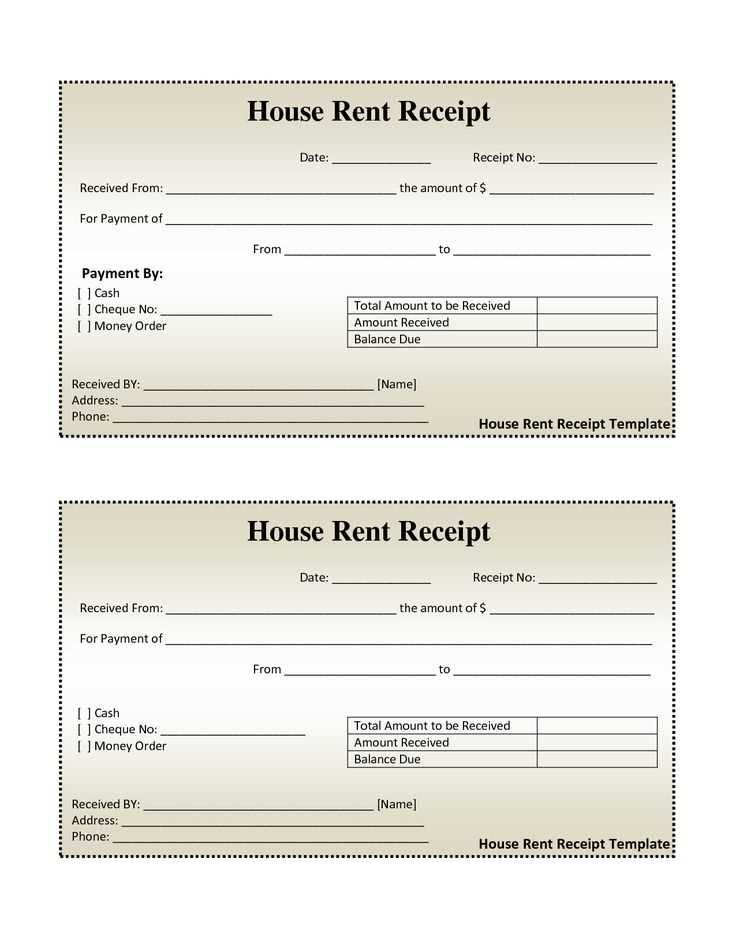

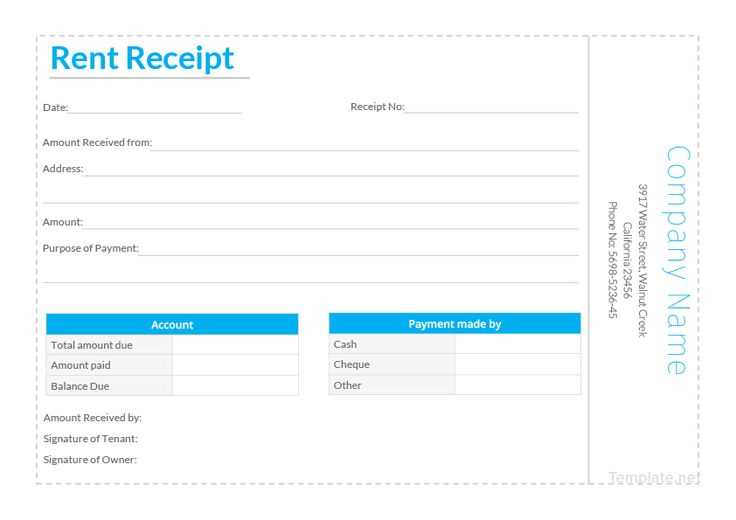

- Rent Payment Receipt: Useful for landlords and tenants, showing payment confirmation.

- Donation Receipt: Required for tax deductions when receiving charitable contributions.

Customizing a receipt template to suit specific needs ensures clarity and professionalism in financial transactions.

Account Receipt Template: A Practical Guide

Key Elements of a Receipt Document

How to Structure Payment Information

Customizing for Different Transactions

Common Mistakes in Formatting

Legal Considerations for Documentation

Best Practices for Digital and Printed Versions

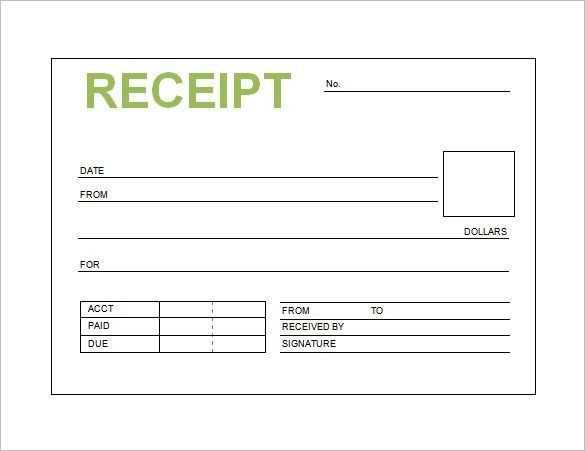

Ensure every receipt includes essential details: date, unique identifier, payer and payee names, itemized list, total amount, and payment method. Missing any of these weakens documentation.

Use a clear structure: Align key elements for readability. Place date and receipt number at the top, followed by transaction details and payment confirmation. Clarity reduces disputes and misinterpretations.

Adapt the format for different transactions: A retail sale requires itemized listings, while a service invoice may emphasize labor hours or project milestones. Adjust layout and terminology accordingly.

Avoid common formatting errors: Inconsistent numbering, misaligned columns, and missing payment breakdowns create confusion. Keep fonts legible and avoid excessive styling.

Follow legal requirements: Include tax details where applicable, provide business registration data if necessary, and retain copies for compliance. Digital receipts must meet archiving standards.

Optimize for both digital and print use: Ensure PDFs are properly formatted for email distribution while printed versions maintain alignment and clarity. Digital copies should be searchable and easy to retrieve.