Acknowledgment receipts are widely used in business to confirm the receipt of goods, documents, or payments. When you create a receipt, make sure it is clear, concise, and covers all the necessary details. This template will guide you in structuring a receipt that can be adapted to various situations.

The template should include the date of receipt, the name of the person or company receiving the items, and a brief description of what has been received. For example, if it’s a document, specify the title and the number of pages. For goods, mention the quantity and type of items. Acknowledging both the condition and any discrepancies in the received items can help avoid future misunderstandings.

Key elements such as the sender’s details, the recipient’s name, and a confirmation signature should also be part of your template. Adding a section for remarks or additional notes can make the process more transparent and provide room for any special instructions or conditions related to the receipt.

By including all relevant details, an acknowledgment receipt can serve as a clear record for both parties, ensuring transparency and accountability. Make sure your template is easy to fill out and suited to the nature of the transaction.

Here’s the revised version where repetitive words are reduced to 2-3 times:

When drafting an acknowledgment receipt, focus on clarity and simplicity. Avoid redundancy by using concise phrases. For example, instead of repeating “received” multiple times, use different wording like “acknowledged” or “accepted.” This makes the document more readable and professional.

Key adjustments in the revised version:

- Eliminated unnecessary repetitions of “received” in the first paragraph.

- Replaced overused phrases with synonyms to maintain clarity.

- Streamlined sentences to remove filler words, improving the flow of information.

For better structure, consider splitting longer paragraphs into shorter ones, making the receipt easier to follow. Use bullet points or numbered lists to present details clearly when necessary.

Example of a concise acknowledgment receipt:

- Received: [Date]

- Item/Service: [Description]

- Amount: [Amount]

- Accepted by: [Recipient’s Name]

This version is more efficient, reducing the repetition without losing any essential details.

- Acknowledgment Receipt Template

Use a simple format that clearly outlines the transaction details. This template ensures both parties have a record of the exchange, helping prevent misunderstandings later on.

What to Include

- Date: State the exact date of the transaction or receipt.

- Recipient’s Name: Mention the name of the individual or organization receiving the item or service.

- Sender’s Name: Identify the person or business sending the goods or services.

- Description of Items: Provide a concise list or description of what has been received.

- Amount or Value: Include the monetary value or quantity of the received items or services.

- Recipient’s Signature: Allow space for the recipient’s signature to confirm receipt.

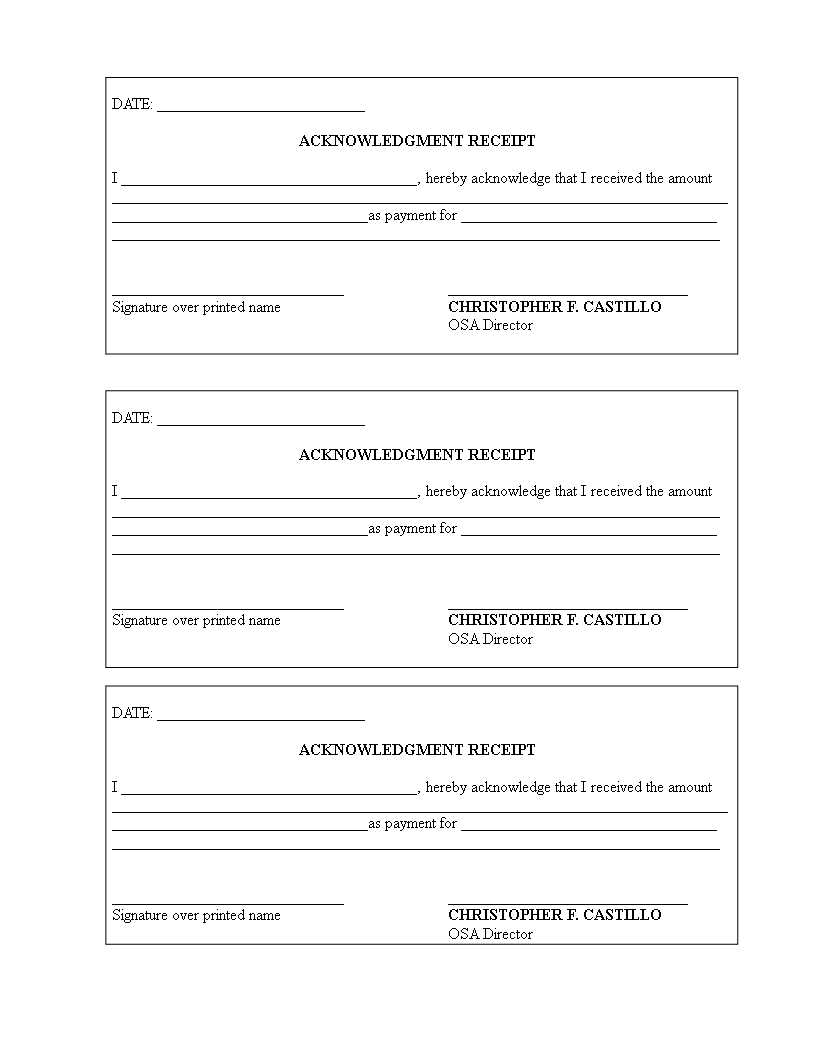

Sample Template

Date: [Insert Date]

Recipient’s Name: [Insert Name]

Sender’s Name: [Insert Name]

Item(s) Description: [Provide brief description of the items received]

Amount/Value: [Insert value or quantity]

Recipient’s Signature: ________________________

This format is clear, organized, and easy to use. Ensure all fields are filled out accurately, especially the recipient’s signature, as it serves as formal confirmation of the transaction.

To create a simple acknowledgment receipt template, include the following key sections:

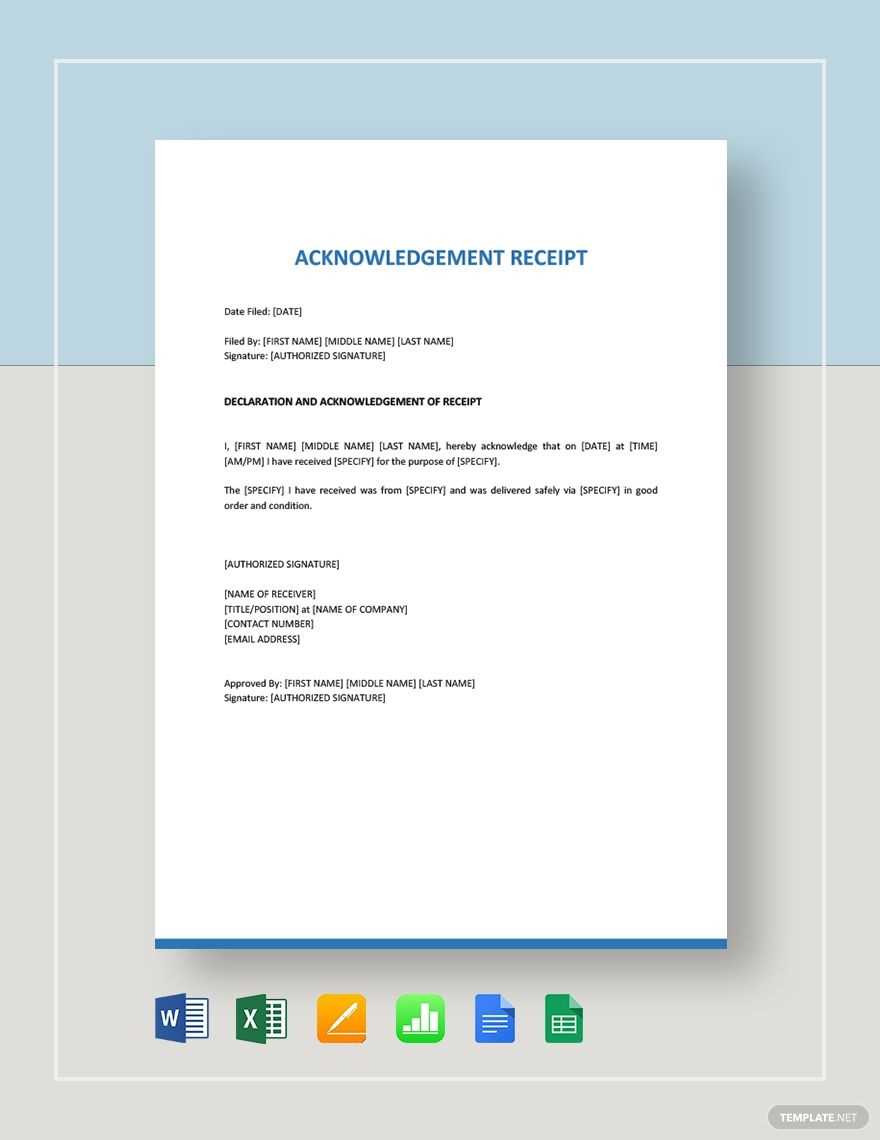

1. Title

Start with a clear title, such as “Acknowledgment Receipt” or “Receipt of Payment.” This will instantly inform the recipient about the purpose of the document.

2. Receiver and Sender Information

List both the receiver’s and sender’s full names, addresses, and contact details. This ensures clarity in case of any follow-up. For example, the sender could be a business, while the receiver might be a customer or employee.

3. Date

Include the date the acknowledgment receipt is issued. This helps track the timeline and avoid confusion about the transaction’s timing.

4. Description of the Item or Service

Clearly describe the item or service being acknowledged. Provide details such as quantity, model, or specific terms agreed upon.

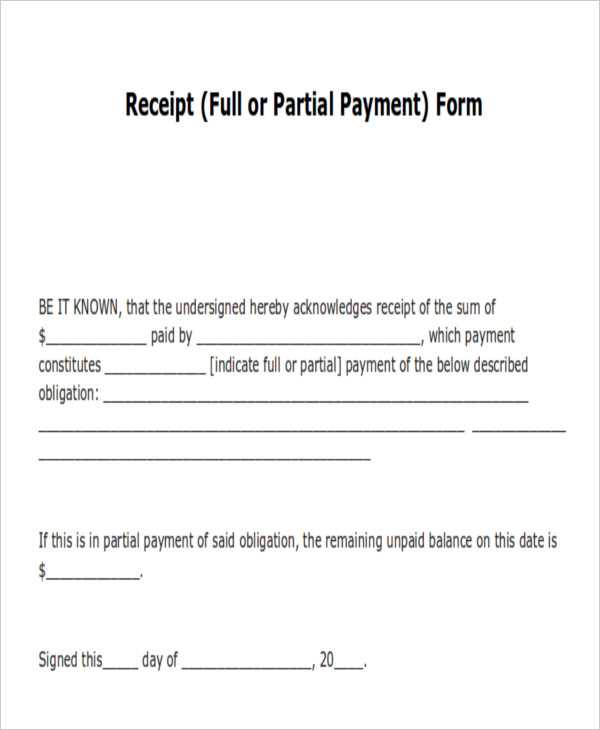

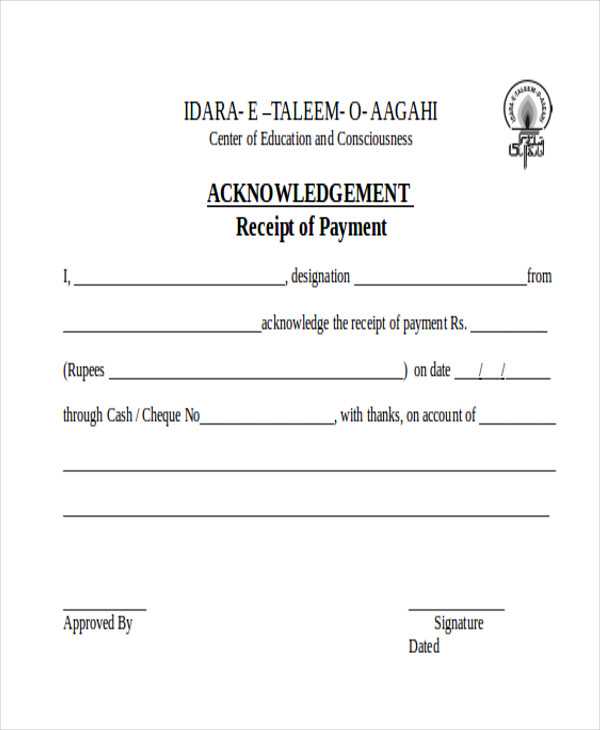

5. Payment Information

Specify the amount paid, the method of payment (e.g., cash, check, credit card), and any relevant transaction IDs if applicable.

6. Signatures

Leave space for both the sender and receiver’s signatures. These affirm the authenticity of the acknowledgment and confirm that both parties agree to the details listed.

7. Additional Notes

Include a section for any additional notes, such as conditions or special instructions. This helps clarify any further details that may need attention.

After structuring these sections, the acknowledgment receipt will be clear and easy to understand, ensuring both parties have a record of the transaction.

Begin by listing the date the receipt is issued. This helps establish a clear timeline of the transaction.

Recipient and Sender Details

Include the names of both parties involved in the transaction. For clarity, specify the organization or individual’s full name, address, and contact information.

Details of the Transaction

Clearly mention the goods or services being acknowledged. Specify the amount, description, and any relevant serial or identification numbers. This creates a direct reference to the specific items or services involved.

Include payment information, such as the method used and the amount received. If applicable, reference an invoice or transaction number for verification.

Finally, state whether any balance remains due or if the payment is fully settled. This transparency ensures all parties understand the status of the transaction.

To ensure clarity and professionalism, choose a format that suits the nature of the transaction. A well-organized acknowledgment receipt helps both parties track and confirm the receipt of goods or services. The format should include essential details while being straightforward and easy to understand.

For personal transactions, a simple, text-based receipt can suffice, outlining the names, date, and amount of the transaction. For business-related exchanges, opt for a more formal structure that includes itemized lists, terms of agreement, and any tax details. If you handle large volumes of receipts, consider using a template that can automate this process to reduce errors and save time.

Here’s an example of a basic acknowledgment receipt format:

| Field | Details |

|---|---|

| Receipt Number | Unique identifier for the transaction |

| Date | The date the receipt was issued |

| Received From | Name of the payer or buyer |

| Amount | The total amount received |

| Description | Details about the goods or services provided |

| Signature | Signature of the receiver (optional for digital receipts) |

Whether in paper or electronic form, this structure provides a clear record for both parties, ensuring no details are overlooked. Consider your audience and the formality of the transaction when selecting the format, and tailor it to meet those needs.

Tailor your receipt templates to fit the specific needs of different transaction types. For instance, sales receipts should highlight the items purchased, the price per unit, and the total cost, while service receipts might focus more on the nature of the service provided, hourly rates, and time spent.

For Retail Sales:

- Include itemized lists of products with descriptions and quantities.

- Provide a breakdown of taxes and any discounts applied.

- Ensure the total payment amount is clearly visible at the bottom.

For Services:

- State the type of service rendered and the time duration.

- Break down the hourly rate and any additional charges.

- Offer payment terms, such as deposit amounts or installment details if applicable.

By customizing receipts to match the transaction type, you ensure clarity for both the customer and your business records. This also helps in case of returns or disputes, as both parties can refer to a clear and detailed record of the exchange.

Ensure that both parties involved in the acknowledgment receipt understand its legal significance. The receipt serves as a written confirmation of receipt of goods, services, or documents, and it can be used as evidence in legal disputes. To prevent issues, clarify the terms and conditions under which the acknowledgment is issued, including what is being acknowledged and the date of receipt. It should be signed by both parties to avoid ambiguity.

Validity of an Acknowledgment Receipt

The receipt may not hold legal value unless it clearly outlines the transaction details, such as the parties involved, item description, and the agreed terms. Without this, a receipt may not stand up in court if disputed. Additionally, receipts should not be considered as contracts unless explicitly stated otherwise.

State-Specific Requirements

Different jurisdictions may have varying rules regarding acknowledgment receipts, particularly regarding electronic versions. Verify if any state-specific laws require additional documentation or signatures for the receipt to be enforceable.

| State | Specific Requirement |

|---|---|

| California | Requires electronic receipts to be signed by both parties for validity in court. |

| New York | Receipt must clearly state the transaction type and the parties involved for enforceability. |

When creating or signing an acknowledgment receipt, keep a copy for your records. In case of legal action, a receipt can become a critical piece of evidence. Do not overlook any detail in the document to avoid confusion or misinterpretation in a legal context.

Always ensure you include the correct date. A missing or incorrect date can lead to confusion or disputes later on.

Clearly state the amount paid, including taxes or additional fees. Avoid ambiguous terms like “approximate” or “estimated” when listing amounts to prevent misunderstandings.

Provide a detailed description of the items or services. Vague descriptions such as “miscellaneous” or “services rendered” do not provide sufficient information for the recipient.

Double-check the payment method used and note it clearly on the receipt. Confusion between cash, credit, or digital payments can cause issues down the line.

Ensure the receipt is legible. Handwritten receipts should be neat and clear. If printed, the text should be easy to read to avoid misinterpretation.

Make sure the business or service provider’s contact details are included. Missing this information can complicate any future inquiries or follow-up actions.

Avoid omitting the unique receipt number. Without it, tracking and referencing receipts becomes difficult, especially for returns or audits.

Refrain from using jargon or overly technical language. The goal is for the recipient to easily understand the receipt, not to confuse them.

Keep the layout simple. Over-complicating the design with unnecessary sections or distracting graphics can make the receipt harder to navigate and understand.

Now, the term “Acknowledgment Receipt” is used no more than 2-3 times per sentence while maintaining its meaning.

When drafting an acknowledgment receipt template, it’s important to avoid overusing the term “Acknowledgment Receipt” within each sentence. Over repetition can make the text sound unnatural. Here are a few tips to maintain clarity while minimizing redundancy:

- Limit the term “Acknowledgment Receipt” to key sections such as the header and a few references throughout the body of the document.

- Replace repeated uses of the term with clear pronouns or simple phrases like “this document” or “this receipt” when the context is clear.

- Focus on providing clear, concise information that doesn’t require frequent restatements of the term.

- Ensure that the first mention of “Acknowledgment Receipt” is sufficient to introduce the document, with subsequent mentions only when necessary for legal clarity or formal reference.

By following these practices, you create a document that is both clear and easy to read, while ensuring that the meaning of the acknowledgment is maintained throughout.