For individuals managing extra living costs due to unforeseen circumstances, maintaining clear documentation is key. A well-structured receipt template ensures that all expenses are accounted for correctly and simplifies the process of reimbursement or tax deduction claims.

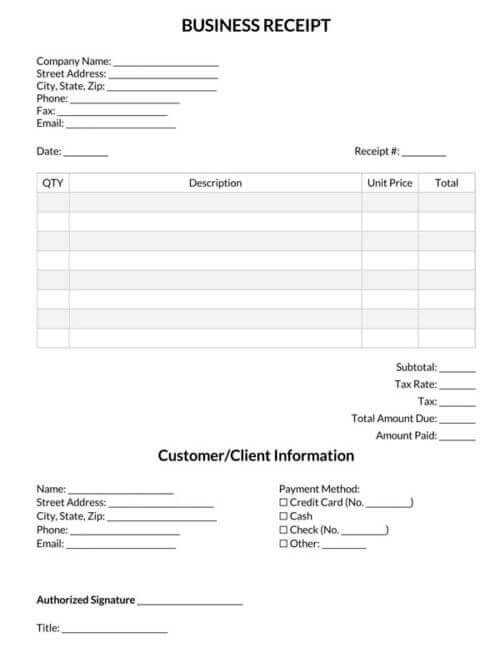

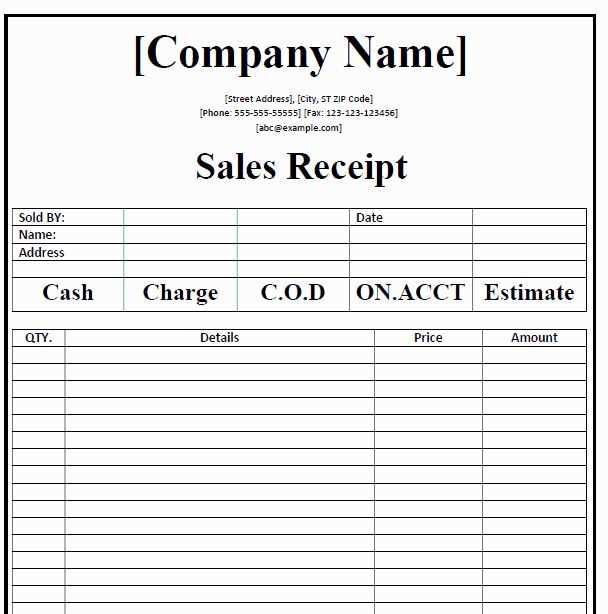

To create an effective template, include key details such as the date, description of the expense, and the total amount paid. Categorize each expense to ensure clarity, whether it’s housing, utilities, or food-related costs. Providing a breakdown of costs not only helps with transparency but also supports accuracy during financial assessments.

Use a clean layout that highlights each section distinctly, allowing easy reference. By organizing the information logically, you minimize confusion and avoid errors. A template should be adaptable, so ensure there’s space for any unexpected entries that might arise during the period in question.

Here’s the corrected version:

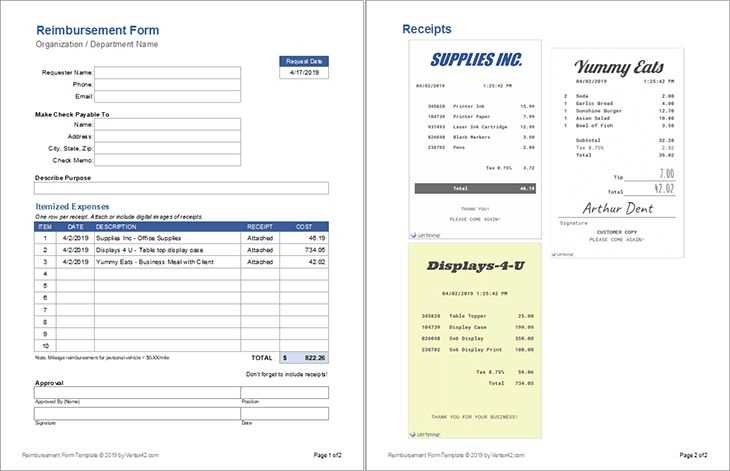

To properly submit your additional living expenses, use a clear and structured template. Make sure the template includes the date, your name, and specific details of each expense. Clearly categorize the expenses by type (e.g., accommodation, meals, transport). Each entry should have a brief description, amount, and any relevant receipts attached for verification.

Expense Categories

Break down your expenses into logical categories such as accommodation, food, transport, and utilities. This helps keep track of where the funds are allocated and provides clarity in case of a review. Grouping similar expenses also simplifies the process for reimbursement or tax deductions.

Itemizing Each Expense

For each expense, list the date, purpose, and amount. Ensure each line is legible and well-organized. Attach scanned copies of your receipts or invoices, keeping the original documents available for further reference if necessary.

Additional Living Expenses Receipt Template

For clear and accurate documentation of additional living expenses, include specific details. Start by listing the date, name of the individual or business providing the service, and the type of expense. Specify whether the cost relates to accommodation, meals, transportation, or other necessary expenses. Ensure each entry is easy to identify and trace for verification.

Formatting should be simple and direct. Use a clean layout with clearly defined sections for each type of expense. If multiple expenses are included, organize them by category and date. This enhances readability and minimizes confusion.

Key details for verification include the payment method (credit card, check, cash), receipt numbers, and any related invoices. Ensure the document includes accurate amounts, including taxes, fees, and tips if applicable. Attach relevant documentation, such as invoices or transaction records, to support the claim.

Avoid common errors such as missing or incorrect dates, unclear descriptions of expenses, or omitting essential payment details. Ensure the amounts match exactly with the receipts and any other supporting documentation. Double-check for legibility, as unreadable text can delay processing.

To customize the template, add specific fields that apply to the nature of the expenses. For example, include columns for specific meal allowances, accommodation rates, or transportation modes. Tailoring the template helps streamline the reimbursement process for various types of claims.

For reimbursement requests, make sure the total amount is easy to calculate. Include a summary section that clearly lists the total claimable amount. This facilitates swift approval and processing, reducing the chances of delays due to unclear information.