Key Elements for a Clear and Professional Template

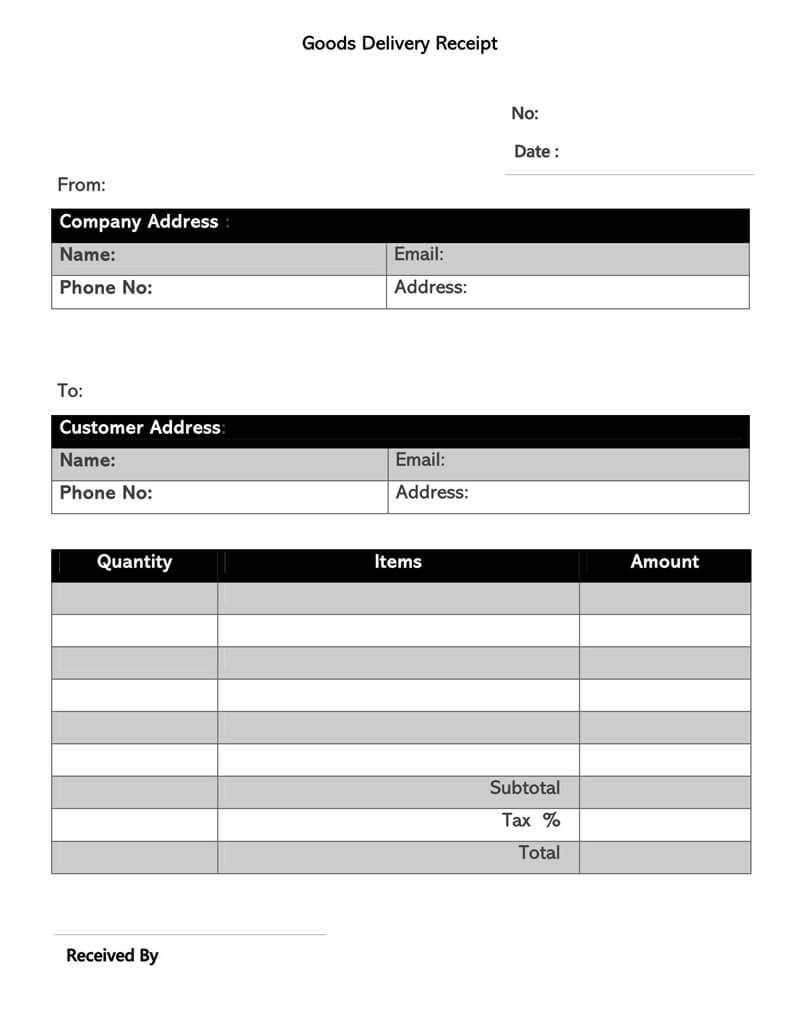

Ensure the receipt contains all relevant details to maintain transparency and credibility. Include:

- Business Name and Logo: Reinforces brand identity and legitimacy.

- Contact Information: Provides easy access for customer inquiries.

- Invoice Number: Helps track transactions efficiently.

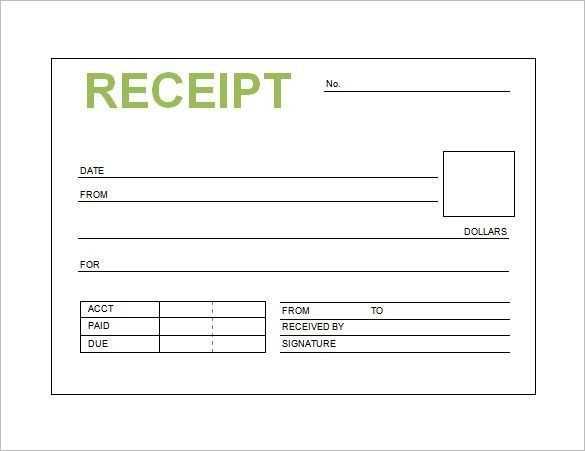

- Date and Time: Confirms when the transaction occurred.

- Service Description: Specifies ad placement, duration, and format.

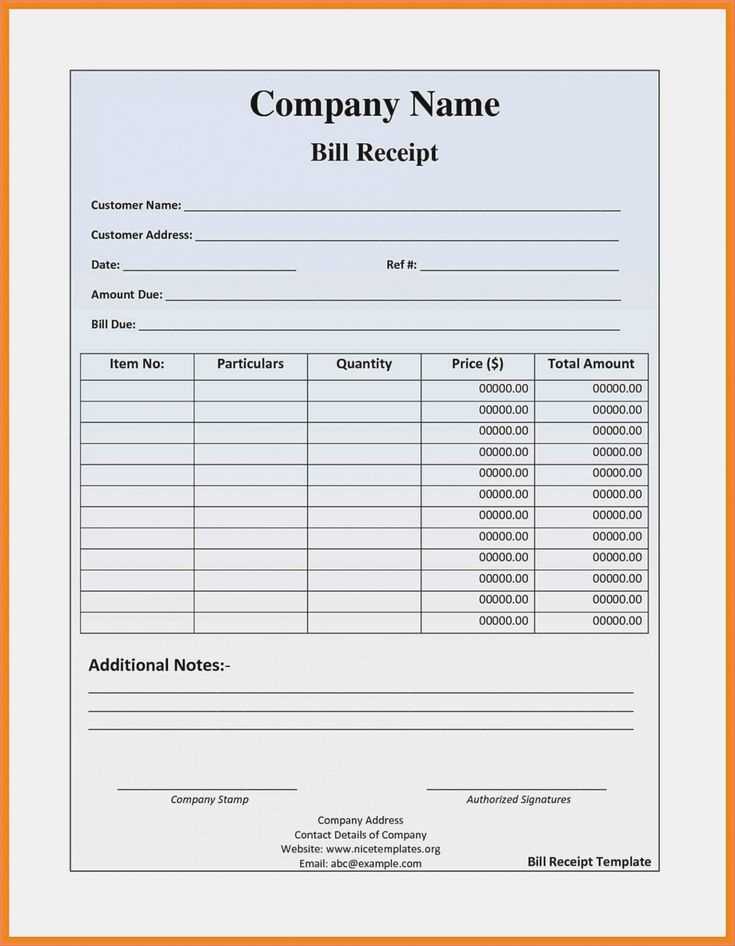

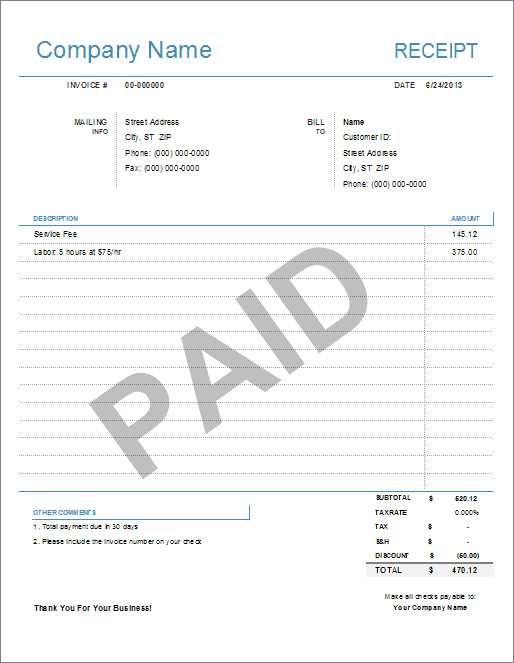

- Cost Breakdown: Lists subtotal, taxes, and total amount.

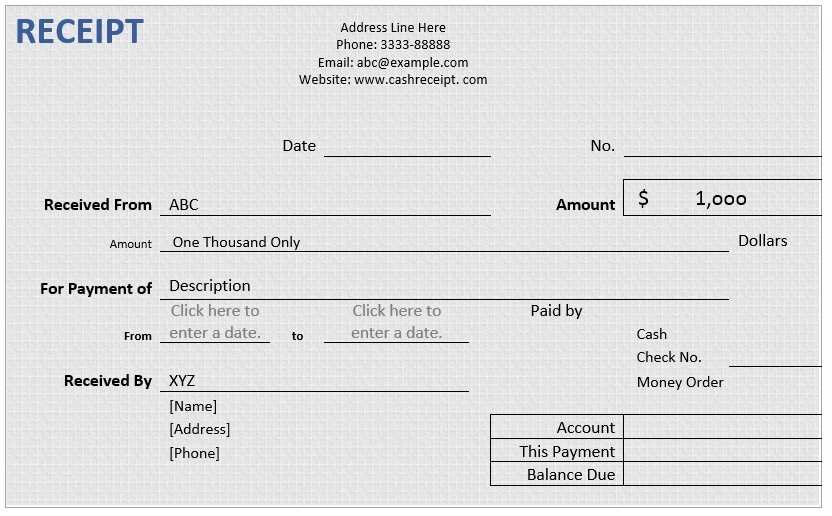

- Payment Method: Indicates cash, credit card, or other means.

Design Considerations for Clarity and Readability

Keep the template visually organized to enhance usability. Use:

- Legible Fonts: Choose professional and easy-to-read typography.

- Consistent Spacing: Avoid cluttered text by maintaining proper margins.

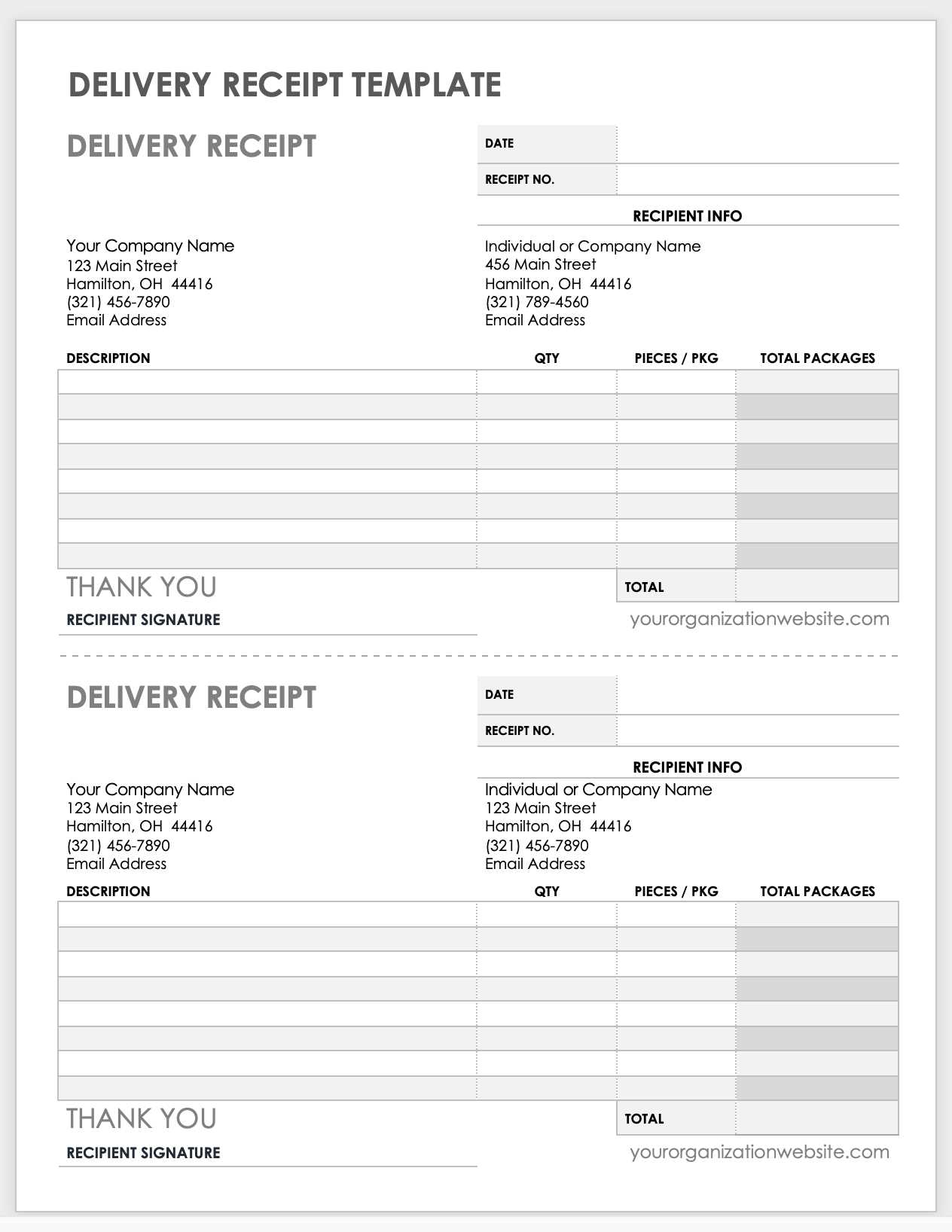

- Structured Layout: Arrange sections logically for quick reference.

- Subtle Branding: Incorporate colors and logos without overwhelming the design.

Printable vs. Digital Receipts

Determine whether to use paper or electronic formats based on customer preference and business needs.

- Printable Format: Ideal for in-person transactions, includes company letterhead.

- Digital Format: Convenient for online advertising, often sent via email or PDF.

Legal Compliance and Record-Keeping

Verify local regulations regarding tax documentation and record retention. Store copies securely to resolve disputes and ensure accountability.

By structuring receipts properly and prioritizing readability, businesses build trust while streamlining financial records.

Advertising Receipt Template: Key Aspects and Practical Uses

Core Components of an Advertising Receipt

Legal and Tax Compliance Factors

Branding Customization Options

Digital vs. Printed Formats for Receipts

Frequent Errors in Receipt Design

Software for Creating Advertising Receipts

A well-structured advertising receipt should include a clear breakdown of costs, payment details, and essential business information. Accuracy and transparency are critical to maintaining trust with clients and ensuring smooth financial reporting.

Core Components of an Advertising Receipt

Each receipt must list the advertiser’s name, contact details, invoice number, date of transaction, and a detailed description of the purchased service. Breaking down costs into ad placement fees, design charges, and additional services helps clients understand their expenses. Taxes should be itemized separately to meet legal requirements.

Legal and Tax Compliance Factors

Regulations vary by jurisdiction, but including a tax identification number and adhering to local invoicing standards prevents compliance issues. Digital receipts should be stored securely for auditing purposes, while printed versions must be legible and durable. Using structured templates aligned with financial regulations simplifies bookkeeping and tax filing.

Consistency in formatting, legally compliant details, and clear cost breakdowns enhance professionalism and reduce disputes. Customizing receipts with branding elements strengthens credibility while keeping essential financial data intact.