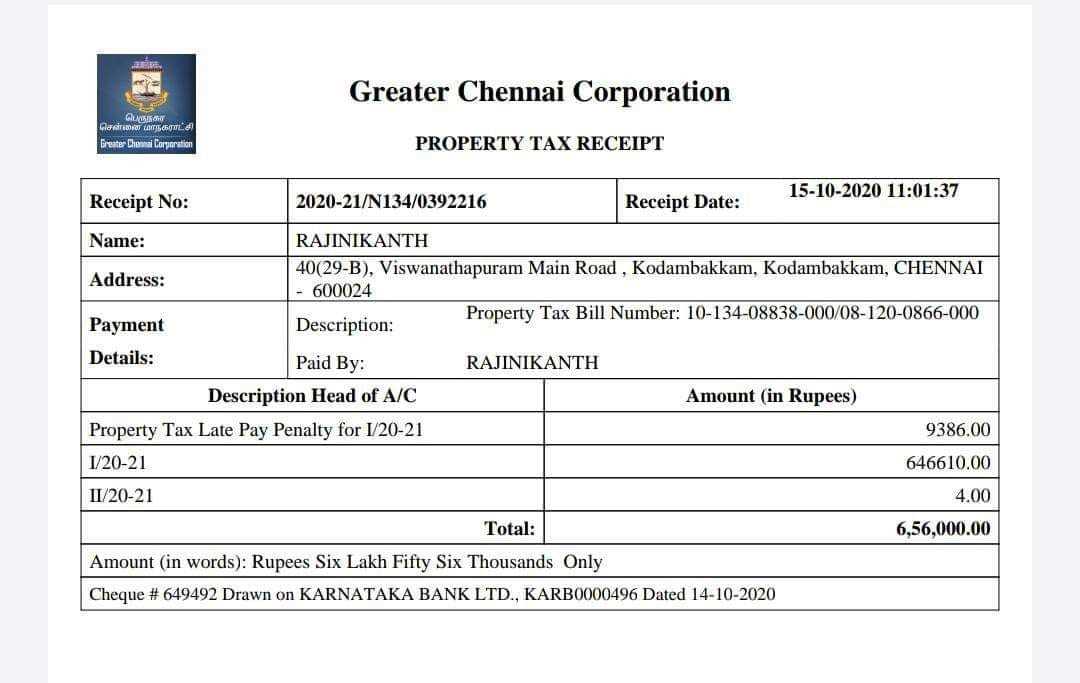

Ensure that your afterschool program provides clear and professional tax receipts for parents. A well-structured receipt helps families track their payments and can simplify tax filing. Make sure the receipt includes the child’s name, the program’s name, payment date, and the amount paid. These details will make the receipt useful for both parents and tax authorities.

Keep the format simple and consistent. Include a statement confirming the receipt of payment, specifying the service or program provided. Be sure to mention the tax ID number or EIN of your organization, which is necessary for tax deductions. Parents will appreciate having this information readily available, as it makes their tax preparation easier.

Including clear, organized payment records will save time for both parties. By maintaining accurate and legible receipts, your afterschool program builds trust with parents and ensures that financial transactions are properly documented for tax purposes.

Sure! Here’s a revised version with reduced word repetition:

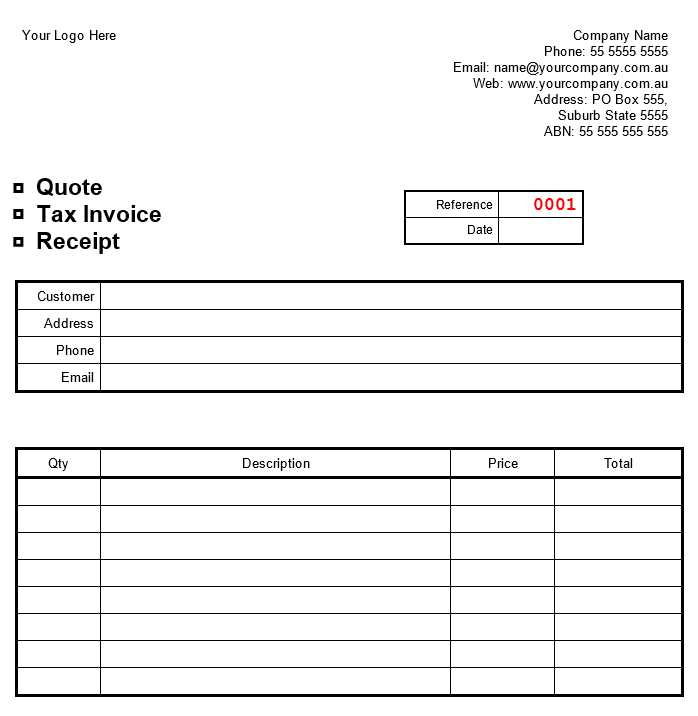

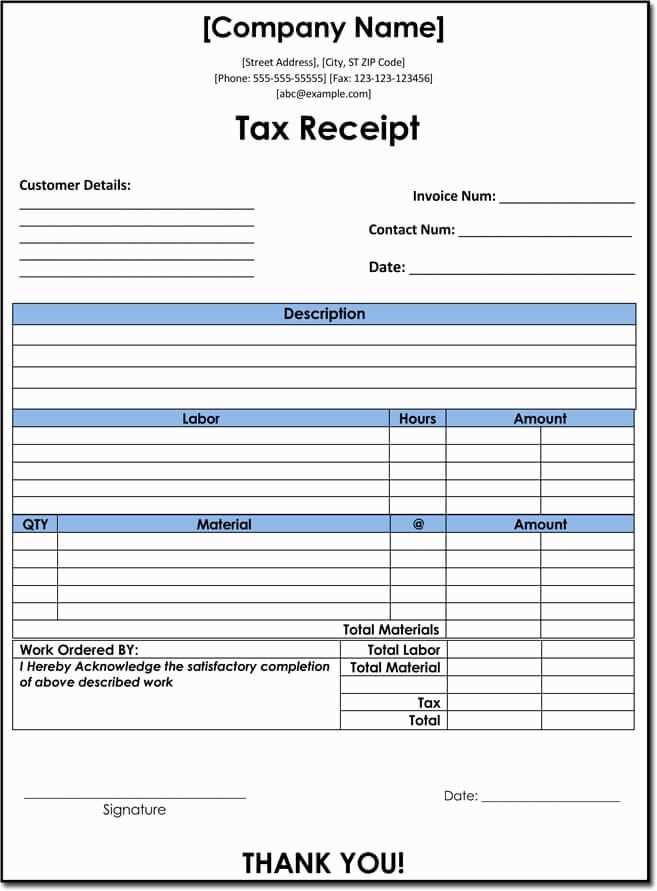

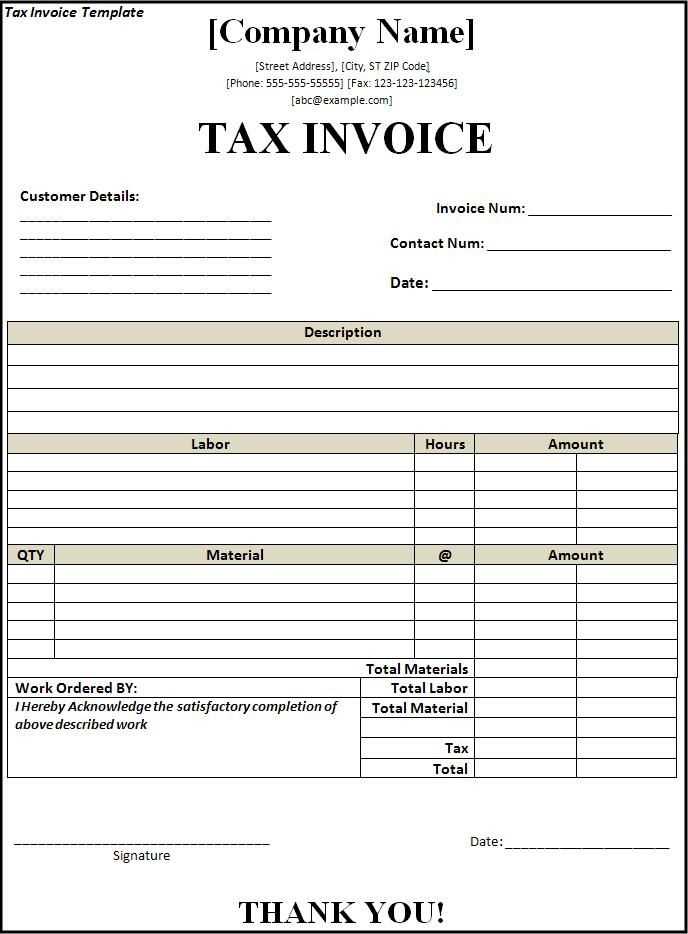

To create an effective afterschool tax receipt template, start by ensuring clear and concise formatting. The template should contain all necessary details like the name of the student, the amount paid, the date of the transaction, and the nature of the service provided.

- Student Name: Clearly display the student’s full name for identification purposes.

- Amount Paid: Indicate the exact amount paid for the afterschool services, ensuring the currency is specified.

- Date of Transaction: Provide the specific date when the payment was made.

- Service Details: Include a brief description of the service provided (e.g., afterschool care, tutoring).

- Payment Method: Mention the method of payment, whether cash, check, or online payment.

Ensure the template includes a signature line for both the provider and the payer. This adds authenticity to the receipt. Lastly, offer space for additional notes or clarifications, which can be useful for any special circumstances or adjustments.

- Afterschool Tax Receipt Template Guide

Begin with gathering all relevant details about the transaction. This includes the child’s name, the dates of afterschool care, the amount paid, and the name of the care provider or facility. Ensure that each receipt is clear and precise, including any applicable tax information required by your local authorities.

Key Information to Include

- Recipient Information: Name and address of the care provider.

- Parent Information: Name and address of the parent or guardian.

- Payment Details: Dates of service, total amount paid, and method of payment.

- Tax Information: A breakdown of any applicable tax charges or exemptions, if necessary.

Tips for Accuracy

- Double-check the dates for afterschool care to avoid any discrepancies.

- Make sure the total amount matches the records of payment received.

- If taxes are applicable, provide a clear breakdown for transparency.

Begin by gathering all relevant receipts and invoices related to afterschool services. Make sure they clearly outline the dates, the amount paid, and the services provided. Organize this information by category, such as tuition fees, activity costs, or any other expenses directly linked to afterschool programs.

Next, create a simple template with sections for the payer’s details, recipient’s information, and the total amount. Include fields for any applicable tax rates and deductions. This can be done manually in a document or using tax preparation software.

Once the template is ready, fill in the accurate amounts for each expense category. Double-check all the numbers to avoid discrepancies. Ensure that your document includes all necessary dates and services rendered to ensure it meets tax reporting standards.

If required, attach supporting documents, such as payment receipts or contracts, to validate the entries on the tax document. This ensures transparency and proper documentation.

After completing the tax document, review it one more time before submitting. Make sure all fields are filled correctly, and no additional charges are overlooked. Once verified, send it to the appropriate tax authority or keep it for your records, depending on your location and requirements.

Ensure that the tax receipt accurately reflects the total amount paid for afterschool services, including any discounts or scholarships. A frequent mistake is omitting the breakdown of the fees, which can lead to confusion when filing taxes. Clearly list any payments made for services, as well as any applicable tax deductions.

Another common error is the incorrect use of dates. Tax receipts should clearly state the dates of the services provided, ensuring that they align with the relevant tax year. Without the correct timeframe, it becomes difficult to match payments with the right tax period.

Sometimes, receipts lack clear descriptions of the services rendered. Instead of vague terms, use specific language to indicate the type of afterschool care provided, such as “homework assistance” or “sports program.” This ensures that the tax receipt is accurate and useful for tax filing purposes.

Additionally, it’s important to avoid mistakes in the provider’s information. Double-check that the afterschool program’s name, address, and contact details are correct. Any discrepancies here could cause delays or confusion with tax authorities.

Finally, ensure that the tax receipt includes the correct identification number for the afterschool program, such as a tax-exempt number if applicable. Missing or incorrect identification numbers may result in complications when claiming tax benefits.

Taxpayers can deduct certain costs associated with afterschool programs if they meet specific criteria. Expenses that qualify typically include tuition, fees, and materials required for the child’s participation. To ensure eligibility, maintain records such as receipts and invoices detailing these expenses.

One key deduction is for childcare expenses, which can be claimed under the Child and Dependent Care Credit. This allows parents to deduct a percentage of what they pay for care while they work or look for work. However, the afterschool program must be structured as care, not solely for extracurricular activities.

In some cases, if the afterschool program is operated by a qualified educational institution, certain fees may be deductible as part of educational expenses. Check for eligibility by reviewing IRS guidelines and keeping detailed documentation of services rendered.

To maximize deductions, ensure the program provides care during hours when parents are unavailable, and confirm that all payments are directly linked to the child’s participation in a legitimate care or educational service.

Tax Receipt Template Details

Ensure that the afterschool tax receipt clearly outlines the details of the service provided. It should include the child’s name, the dates and hours attended, and the amount paid. These are necessary to confirm that the tax deduction claim is valid.

Key Information to Include

Each receipt should have the name and contact details of the program provider, including the address and tax ID. This helps verify the legitimacy of the service and meets tax reporting requirements.

Example Layout

| Service Description | Amount Paid | Date of Service |

|---|---|---|

| Afterschool Care | $250 | January 2025 |

| Extended Hours | $50 | January 2025 |