When tenants apply for an apartment, landlords typically require a fee to cover administrative costs. Providing a receipt for this fee is an important step in ensuring transparency and establishing trust with applicants. This receipt should clearly outline the amount paid, the purpose of the fee, and other relevant details such as the date of payment and the applicant’s information.

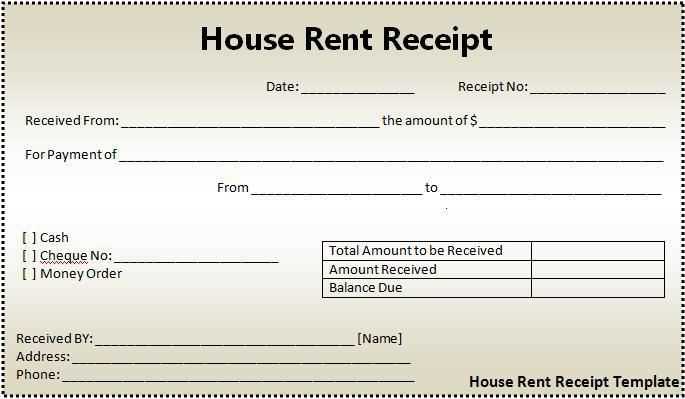

A well-designed apartment application fee receipt template should include the following elements: the landlord’s or property manager’s name, the applicant’s name, the address of the rental property, the exact amount paid, and a description of the fee (such as “application processing fee”). Include the payment method used, whether it’s cash, check, or credit card, as well as the date the payment was made.

By using a template that includes these details, both landlords and applicants will have a clear record of the transaction. This helps prevent any confusion or disputes later in the process. Make sure to keep a copy of the receipt for your own records and provide one to the applicant immediately upon receiving the payment.

Here are the corrected lines, without repeated words:

Ensure that each field on the receipt is unique. Avoid duplicating terms such as “application fee” or “receipt” within the same line. This creates a more concise document, making it easier for recipients to understand. Below is an example of how to format it:

| Description | Amount |

|---|---|

| Application fee for apartment rental | $50 |

| Processing fee | $10 |

| Total payment | $60 |

By avoiding repeated phrases and focusing on clear, specific terms, the document remains professional and easy to process.

- Apartment Application Fee Receipt Template

To create a clear and professional apartment application fee receipt, include the following details:

- Property Name: Clearly state the apartment complex’s name where the application was submitted.

- Applicant’s Name: Include the name of the person who is applying for the apartment.

- Date of Payment: Mention the exact date the fee was paid.

- Amount Paid: Specify the exact amount of the application fee.

- Payment Method: Indicate the method used for payment (e.g., credit card, cash, check, etc.).

- Receipt Number: Provide a unique receipt number for tracking purposes.

- Purpose of Payment: Label the payment as “Apartment Application Fee” or similar.

- Landlord or Property Manager’s Contact Information: Include the contact details of the person or office that received the payment.

Ensure the receipt is clear, easy to read, and includes all necessary information to avoid confusion. This template serves as proof of the fee payment for both the applicant and the property management team.

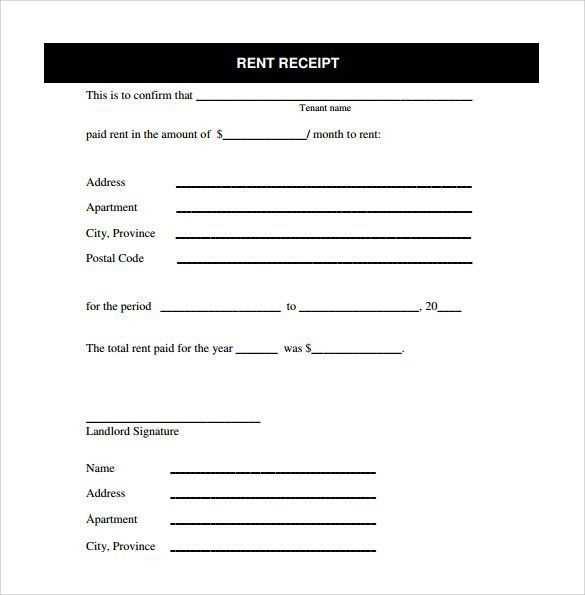

Include specific information about the application to maintain clarity and ensure smooth communication. Start with the applicant’s full name, address, and contact details. This ensures the payment is accurately associated with the right individual. Include the apartment or unit number if applicable. Then, list the application number or reference ID for easy tracking of the application process.

Clearly state the application fee amount, including any tax, and specify the payment method (e.g., credit card, cash, check). If applicable, provide a breakdown of the fee, such as a base charge or additional processing fees. Date the receipt to avoid confusion about when the fee was processed.

If necessary, include the terms and conditions regarding the application fee, such as non-refundable clauses or deadlines for payment. Lastly, provide the contact details of the property management office for any questions or clarifications.

Include the following details on the fee receipt to ensure clarity and proper documentation:

- Tenant’s Full Name: Display the full name of the applicant for easy identification.

- Application Fee Amount: Clearly state the exact amount paid for the application fee.

- Date of Payment: Include the date when the payment was made to avoid any confusion.

- Property Address: Specify the address of the apartment for which the application fee was paid.

- Payment Method: Indicate how the fee was paid (e.g., credit card, bank transfer, cash).

- Receipt Number: Provide a unique identifier for the transaction, useful for future reference.

- Landlord/Management Company Details: Include the name and contact information of the entity receiving the payment.

- Payment Purpose: Clearly mention that the payment is for the apartment application fee.

These details ensure the receipt is clear and can be used for future reference or verification.

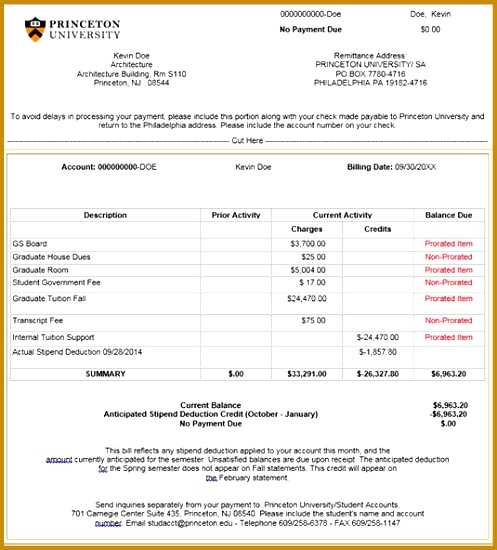

Use a clean, minimalist layout. A cluttered receipt can confuse the reader, so ensure there’s enough space between different sections. Include only the most relevant details, such as the tenant’s name, the apartment unit, and payment specifics. Avoid unnecessary graphics or distractions that can reduce readability.

Clear and Readable Font

Choose a simple, sans-serif font for easy readability. Fonts like Arial or Helvetica are ideal for this purpose. Avoid overly stylized fonts that might make the receipt difficult to interpret. Stick to a readable font size (12pt to 14pt) to ensure every detail is legible.

Use Structured Information

Break the receipt into logical sections, such as “Tenant Information,” “Payment Details,” and “Receipt Number.” This makes it easy for anyone reviewing the document to find what they need without searching. Label each section clearly and use bold or larger fonts for headings to set them apart.

Ensure your receipt includes the full legal name of both the landlord and tenant. This establishes the validity of the document and clarifies the transaction parties. The receipt should also include the property address, specifying the exact rental unit, to avoid confusion regarding the transaction location.

Detail the Fee Breakdown

Clearly state the type of fee being paid, whether it is an application fee, security deposit, or another form of charge. Break down the amount, including any additional costs or discounts. Transparency reduces the likelihood of disputes and keeps both parties informed.

Include Date and Method of Payment

Record the exact date of payment and the method used–cash, credit card, or check. If the tenant paid via check, include the check number to track the transaction. These details make it easier to verify payments if any legal issues arise later.

Avoid vague descriptions. Be specific with terms like “non-refundable” or “deposit,” as they can carry legal implications. Any refunds or additional charges should be clearly documented to prevent misunderstandings.

Make sure the receipt is signed by the landlord or authorized representative. This signature affirms that the fee was received and acknowledged, protecting both parties legally.

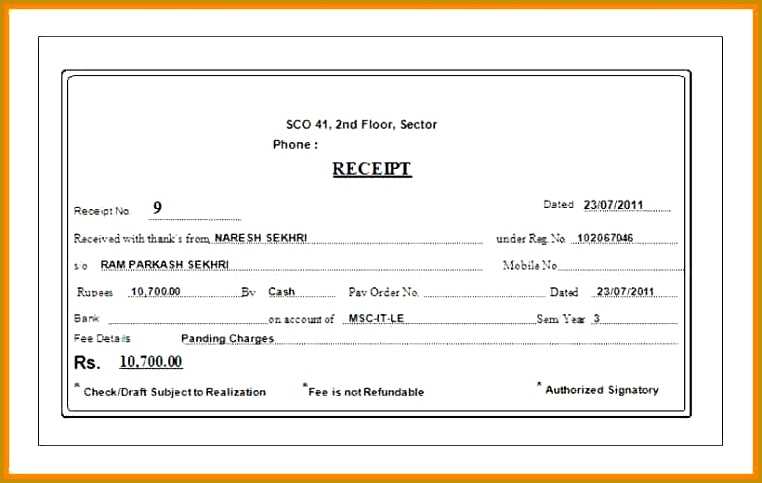

Ensure the correct details are included to avoid issues later. Missing the date of payment or the name of the payer can lead to confusion. Double-check the payment method and transaction reference number to confirm accuracy. Without these, it might be challenging to trace the payment in the future.

Another common mistake is failing to include the amount paid. This might seem obvious, but it’s easy to overlook. Be specific about the fee breakdown, including any taxes or additional charges. Without clear details, the receipt can become ambiguous.

Be mindful of the lack of a signature or authorization. If the receipt is meant to confirm a formal transaction, the signature from the authorized party adds legitimacy and protects against disputes.

Lastly, avoid leaving blank spaces on the receipt. These can cause confusion or be manipulated later. Always ensure every field is completed, or if it’s not applicable, indicate “N/A” to maintain clarity and prevent mistakes.

How to Customize Your Receipt Template for Different Purposes

Adjust your receipt template to meet various needs by adding or modifying specific elements that reflect the purpose of the transaction. Whether you’re handling an apartment application fee, security deposit, or rent payment, tailoring the template can improve clarity and meet legal or organizational requirements.

- Include Transaction Specifics: For rental applications, add details like the applicant’s name, application ID, and the specific fee paid (e.g., non-refundable processing fee). Customize the amount field to specify the exact fee charged.

- Customize Date and Time Fields: Depending on the purpose of the receipt, you may want to include more detailed time stamps. For example, with rent payments, including both the due date and the payment date helps clarify payment timelines.

- Modify Payment Methods: Add or remove payment method options based on what you accept. For rental-related fees, common methods include credit card, bank transfer, or check. Specify the method used to avoid confusion.

- Additional Notes: Add sections for additional comments or legal disclaimers. For example, include refund policies for application fees or note if the payment is non-refundable.

- Address Legal Requirements: In some regions, specific information is required by law. Ensure your receipt template includes all necessary components, such as your business name, address, and registration number, especially when dealing with apartment fees.

- Clear Payment Breakdown: If your receipt is for a more complex transaction, like a security deposit that includes different charges, break down each component separately. This helps tenants understand what they are paying for and avoids disputes.

Make sure your receipt clearly lists the apartment application fee and includes the date of payment. Include the name of the applicant and the apartment they are applying for. This will help avoid confusion later on. If payment was made by check or online, include the method of payment for transparency. Clearly state the amount paid and any additional fees that might have been included, such as administrative charges.

Keep the receipt simple but informative, providing all necessary details without overloading with irrelevant information. Avoid long explanations, sticking to key facts only. This way, both parties–tenant and landlord–can easily track and refer to the transaction when needed.

If possible, include a unique reference number for the transaction. This helps differentiate this payment from others and makes it easier to locate in case of disputes or questions later. The receipt should be clear enough to serve as a standalone document, without requiring further explanation or context.