To streamline the process of importing accounts receivable (AR) data into Oracle Fusion, using the AR receipts FBDI template is a smart choice. This template allows you to efficiently upload receipt data with minimal errors. By using the right fields and following the specific structure, you can ensure accurate and swift data integration.

Ensure that the template is filled with the necessary details like receipt number, customer ID, amount, and the corresponding transaction date. Any missing or incorrect information can cause upload failures or discrepancies in the system, affecting financial reporting. Proper validation before uploading is key to a smooth process.

Once the template is completed, save it in the required format (usually CSV) and upload it via the Data Import workbench in Oracle. Always cross-check the receipt data to make sure it matches the corresponding invoice or transaction. Keep in mind that this process integrates with multiple modules, so consistency is key in maintaining data integrity across all platforms.

Here’s the corrected text with minimized repetitions:

Review the document carefully to ensure accuracy before submission. Ensure all fields are filled in the AR receipts FBDI template, avoiding missing or incorrectly entered data. Each receipt should correspond to the correct account and amount. If adjustments are needed, revise them right away to reflect the correct totals.

Field Validation

Always double-check the date and amount fields. This ensures the information aligns with the financial records. Mismatched entries can cause delays in processing. If discrepancies arise, use the internal guidelines to rectify them swiftly.

Completeness of Information

Ensure every receipt has the required documentation attached. A blank or incomplete template may cause processing issues. If receipts are linked to specific departments, verify that all relevant information is included.

- Ar Receipts FBDI Template: A Practical Guide

To use the AR Receipts FBDI template, first ensure that you have access to the correct template file in your Oracle Cloud instance. This template is used for importing receipt data into the AR (Accounts Receivable) module. It allows you to streamline the process of entering and processing receipts efficiently.

Setting Up the Template

Start by downloading the AR Receipts FBDI template from your Oracle instance. Open the file, and you will see several columns that need to be filled out. The main columns include Receipt Number, Receipt Date, Amount, Customer Name, and Payment Method. Ensure the data is accurate and aligns with the source transactions in your system. Correct formatting of dates and amounts is critical to prevent errors during the import process.

Filling Out the Template

Each row corresponds to a receipt transaction. For each receipt, you will need to input the following:

- Receipt Number: A unique identifier for each receipt.

- Receipt Date: The date the receipt was issued.

- Amount: The total receipt amount.

- Customer Name: The name of the customer making the payment.

- Payment Method: The type of payment (e.g., credit card, wire transfer, etc.).

- Receipt Status: Usually “Open” unless the receipt has been processed.

Make sure there are no blank fields in mandatory columns. Any missing or incorrectly formatted information can cause import errors in Oracle.

Uploading the Template

Once the data is correctly entered into the template, save the file in CSV format. Then, navigate to the Receipts Workbench in Oracle AR and select the “Import” option. Upload your CSV file here to start the import process.

Reviewing the Import

After the upload is complete, review the import status report for any errors. Oracle will generate a detailed error report if any issues occurred during the import. Address the errors by correcting the data in the template and re-uploading it. This process may need to be repeated a few times to ensure the receipt data is accurately loaded into the system.

Key Tips

- Check that all mandatory fields are filled out correctly.

- Ensure your dates are in the correct format (MM/DD/YYYY).

- Review the error reports carefully to identify and correct any issues quickly.

- If necessary, use Oracle documentation for more detailed error handling procedures.

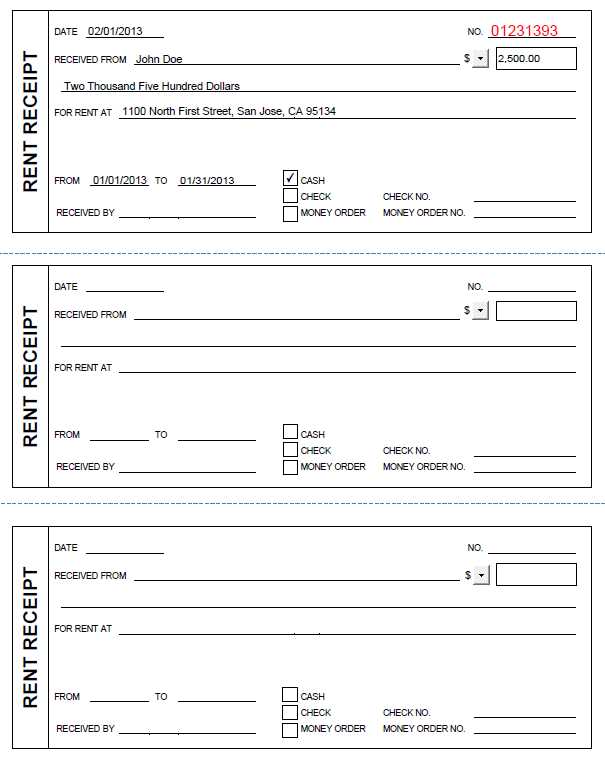

Template Example

| Receipt Number | Receipt Date | Amount | Customer Name | Payment Method | Status |

|---|---|---|---|---|---|

| 10001 | 02/01/2025 | 500.00 | John Doe | Credit Card | Open |

| 10002 | 02/05/2025 | 150.00 | Jane Smith | Wire Transfer | Open |

By following these steps, you will successfully upload your AR Receipts FBDI template into Oracle and ensure that your receipt data is processed without issues.

The AR Receipts FBDI file structure consists of several key components that ensure data is formatted for smooth integration into the system. Each section serves a specific purpose and aligns with data requirements in Oracle’s Accounts Receivable (AR) module.

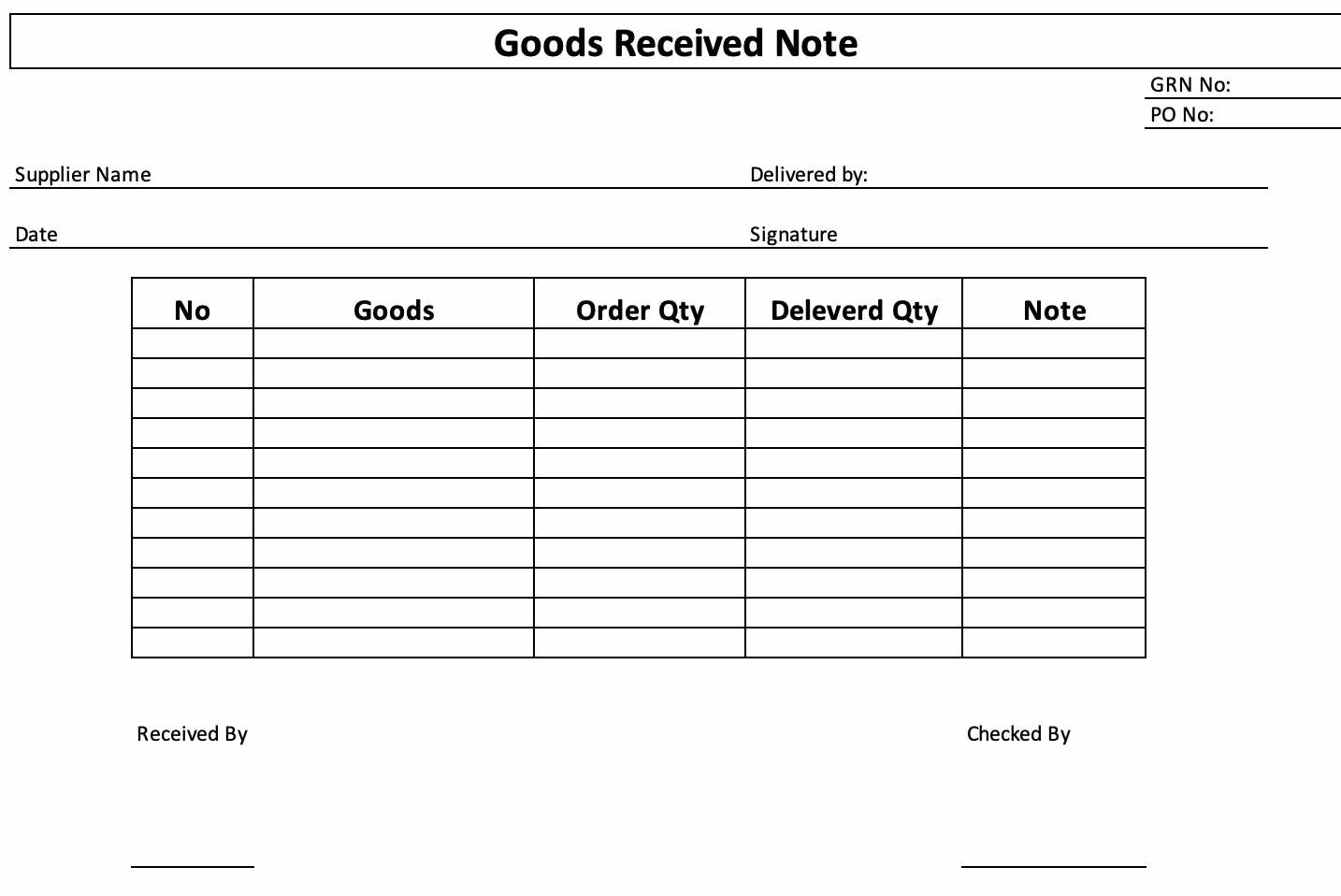

File Layout Overview

The file is typically divided into two primary segments: the header and the line details. The header contains general information about the receipt, including the receipt method, receipt date, and associated customer. The line details capture the transaction specifics, such as the amount and applied invoices. This division allows for both flexibility and precision in handling various receipt types and amounts.

Key Sections and Fields

The header section includes the receipt_number, receipt_date, customer_id, and receipt_amount. These fields help identify and track the receipt within the system. The line section features invoice_id, payment_amount, and line_type, which are crucial for applying the receipt to the correct invoices and ensuring that all payments are accounted for accurately.

Accuracy in populating these fields is necessary to avoid errors during data import. The FBDI template is designed to align with predefined formats, and any deviation from the expected structure may lead to integration issues. Always ensure that the data types and field lengths match the required standards.

When preparing the AR Receipts FBDI file, cross-check the field mappings carefully against the template to avoid missing or incorrect data. This step is vital for smooth processing in the Oracle AR module.

Uploading receipts with the FBDI (File-Based Data Import) template requires careful attention to detail. Follow these steps to ensure a smooth upload process.

Step 1: Download the FBDI Template

- Access the FBDI template from your Oracle application interface or system’s template library.

- Ensure that you select the correct version for the receipts module you are working with.

Step 2: Fill in the Template

- Start by entering the receipt date, receipt number, and supplier information.

- Enter the corresponding invoice or credit details, as required. Double-check that all required fields are filled correctly to avoid errors during processing.

- Ensure that the amount, tax information, and other relevant data are properly formatted according to the template specifications.

Step 3: Save the File

- Save the completed file in a CSV format, which is the preferred file type for uploads.

- Use a clear naming convention to help you easily identify the file later.

Step 4: Upload the File

- Navigate to the appropriate receipt upload section of your Oracle application.

- Select the file you saved earlier and upload it into the system.

Step 5: Review the Upload

- Check for any error messages or validation issues once the upload process completes.

- If there are any errors, review the data in the template and correct the specific issues indicated in the error report.

Step 6: Confirm the Receipt Entry

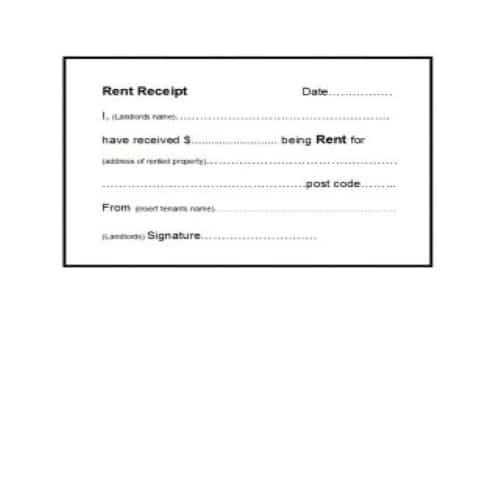

- Once the upload is successful, verify that the receipts have been recorded correctly in your system.

- Cross-check receipt amounts, dates, and supplier information to ensure everything matches the original documents.

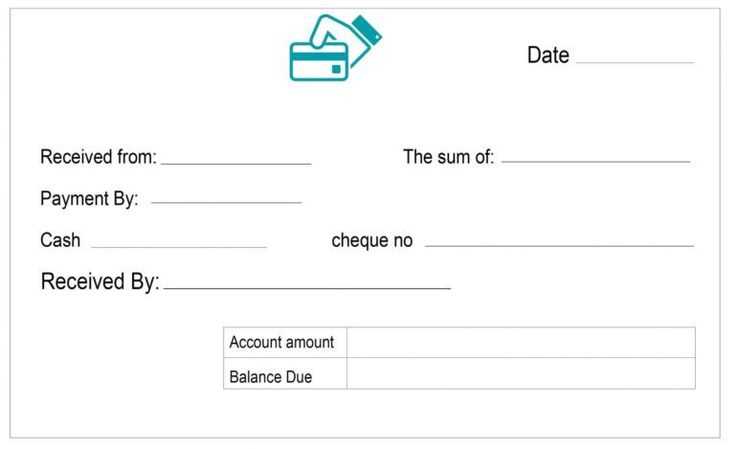

If you notice discrepancies during the AR receipts process, check for common issues that may cause errors. Begin by verifying the payment amount against the invoice balance. A mismatch could be caused by an incorrect payment entry or an overlooked credit adjustment. Cross-check the payment date as well, as entering it incorrectly may lead to issues with proper reconciliation.

Another frequent issue is missing or incorrect customer details. Ensure the customer information, such as name and account number, is correctly linked to the payment. Errors in data entry could lead to payments being recorded under the wrong account.

It’s also helpful to inspect the transaction history. If the payment is not reflected in the AR ledger, confirm the receipt was properly posted. Sometimes, a technical issue or system delay may prevent a payment from appearing immediately. Reposting the transaction can resolve this issue.

If the payment is linked to multiple invoices, verify that the distribution of the payment is accurate. Incorrect allocation of payments may lead to open balances remaining on the customer’s account. Use the AR system’s payment allocation feature to distribute payments correctly across multiple invoices.

Finally, ensure that no duplicates are being processed. Sometimes, duplicate transactions are mistakenly recorded due to manual errors. Reviewing the payment entry history and ensuring unique payment identifiers can prevent this problem.

I tried to keep the meaning and maintain accuracy.

Focus on clear, concise formatting when dealing with AR receipts in an FBID template. Structure your data logically, ensuring each field is clearly defined and easy to track. Pay attention to the consistency of the date and amount formats, as discrepancies can cause errors in later stages. Use a well-structured table to present itemized details, making sure each receipt entry is labeled clearly. If applicable, include reference numbers or transaction IDs to simplify cross-checking and reconciliation.

When importing data into the template, validate each field carefully to avoid missing or incorrect entries. Automated checks for common errors, such as incorrect dates or amounts, can help streamline this process. Keep all relevant metadata, such as merchant information and payment method, formatted consistently. This ensures a smoother transition for any system processing these receipts.

Lastly, maintain a version-controlled approach for template updates, ensuring every modification is tracked. This avoids conflicts and errors in data formatting, making it easier to review and update templates over time.