Key Elements of an Art Gallery Receipt

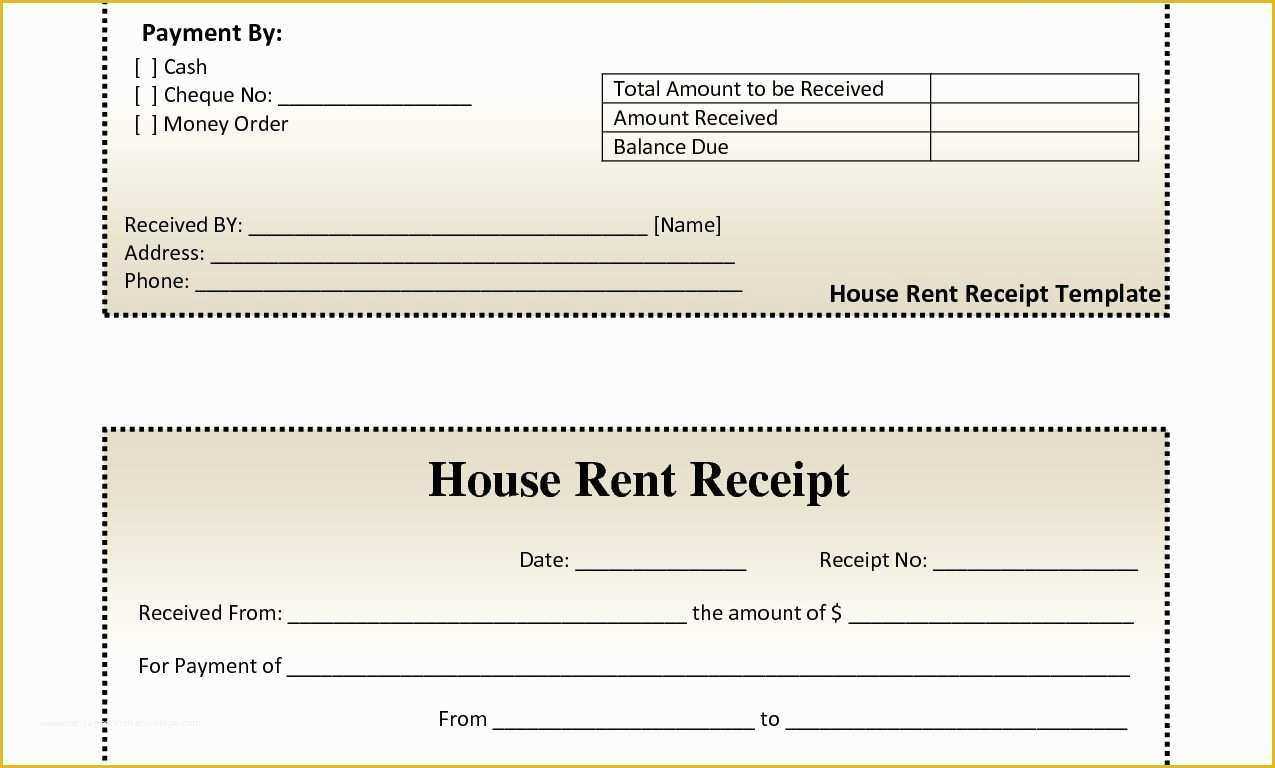

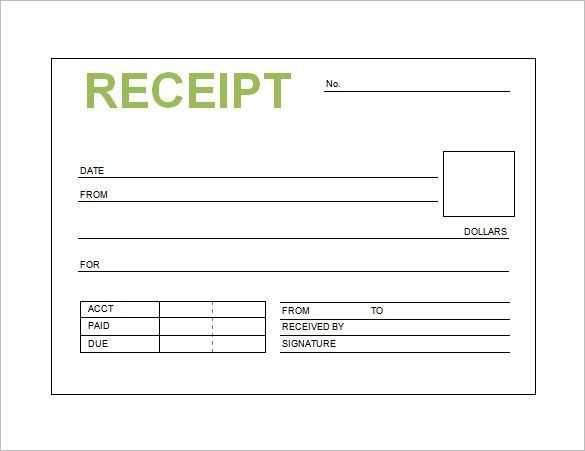

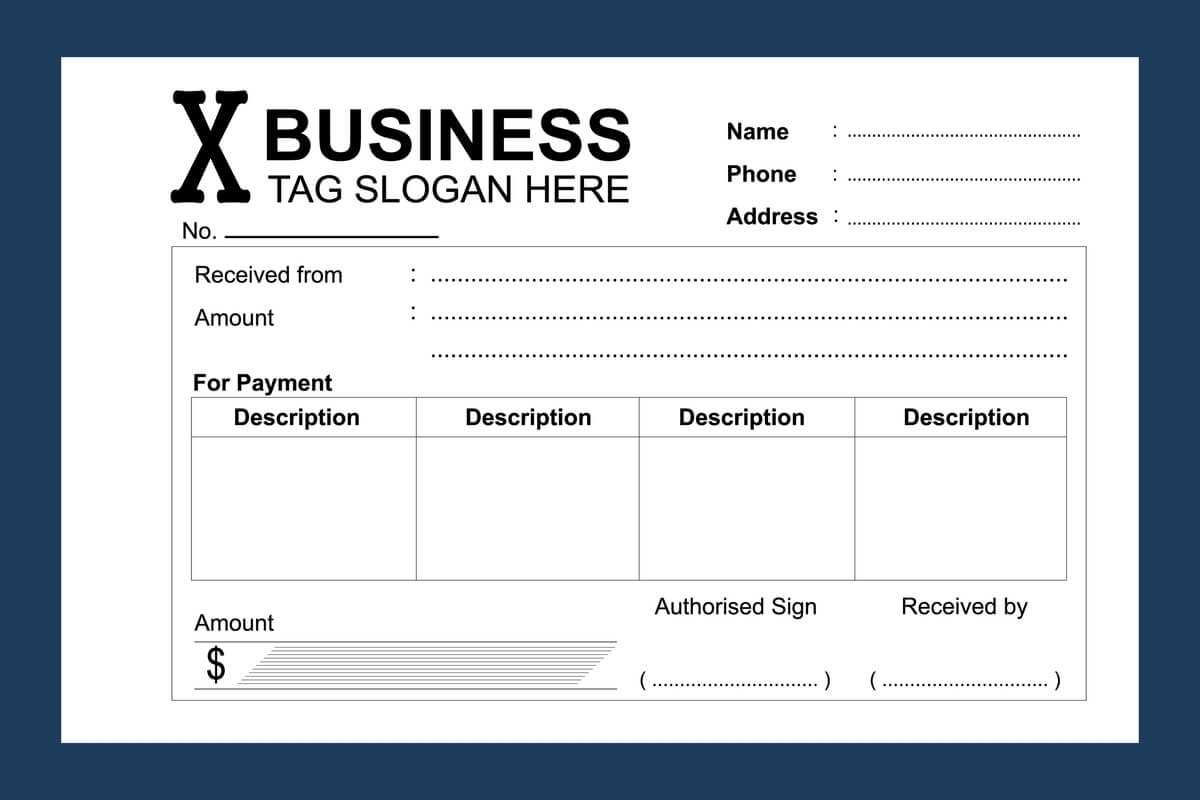

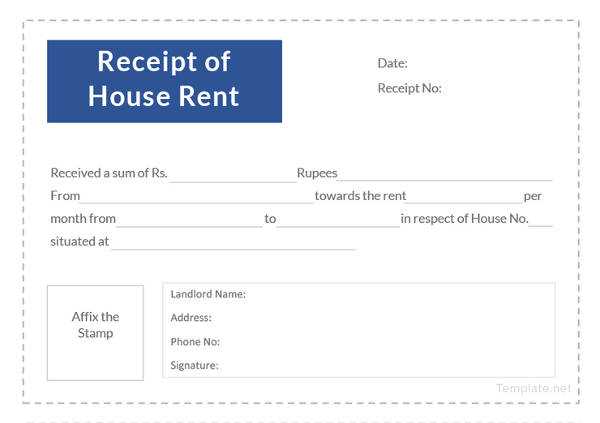

A well-structured receipt provides clarity for both buyers and sellers. It should include the following:

- Gallery Name and Contact Details: Include the official name, address, phone number, and email.

- Receipt Number and Date: Unique identifier for tracking sales, along with the transaction date.

- Buyer’s Information: Name and contact details of the purchaser.

- Artwork Details: Title, artist, dimensions, medium, and year of creation.

- Price and Payment Method: Clearly state the total cost, any taxes, and the method of payment (cash, card, bank transfer).

- Terms and Conditions: Include refund policies, ownership transfer details, or delivery information.

- Signature Section: Space for both the gallery representative and the buyer to sign.

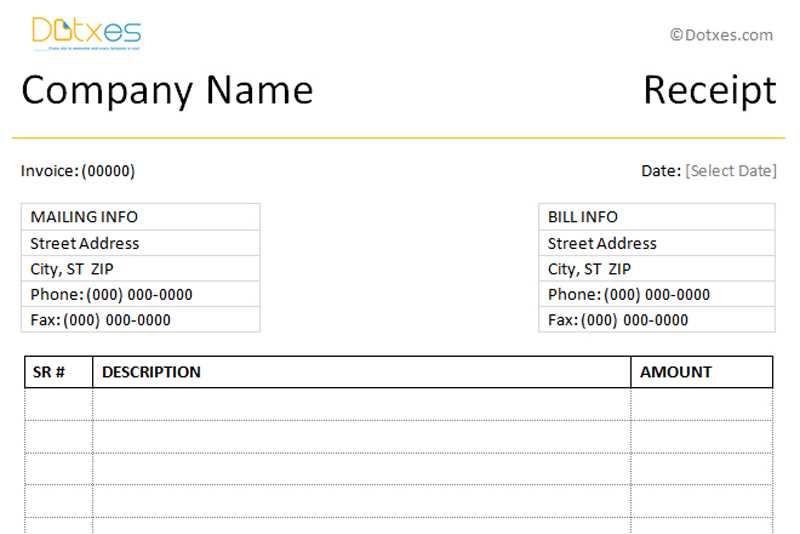

Sample Art Gallery Receipt Template

Here’s a simple format you can use:

Gallery Name: [Your Gallery Name] Address: [Street, City, ZIP Code] Phone: [Your Contact Number] Email: [Your Email Address] Receipt No: [Unique Number] Date: [Transaction Date] Buyer Name: [Customer Name] Buyer Contact: [Phone/Email] Artwork Title: [Artwork Name] Artist: [Artist Name] Medium: [Oil on Canvas, Sculpture, etc.] Dimensions: [Size in cm/inches] Year: [Year of Creation] Price: $[Amount] Tax: $[Amount] Total: $[Amount] Payment Method: [Cash/Card/Transfer] Terms: [Return Policy, Ownership Clause] Seller Signature: ___________ Buyer Signature: ___________

Why a Clear Receipt Matters

A professional receipt not only provides proof of purchase but also helps with tax records, legal ownership, and buyer confidence. Ensure your template is easy to read and includes all essential details.

Art Gallery Receipt Template

Key Elements to Include in a Receipt for an Art Gallery

Each receipt should list the gallery’s name, address, and contact details at the top. Include the buyer’s name, address, and contact information to ensure a clear record of the transaction. Specify the artwork’s title, artist, dimensions, medium, and unique identifier (such as a catalog number or inventory code). Clearly state the sale price, applicable taxes, and any discounts. Indicate the payment method and transaction date. If the sale includes a certificate of authenticity or provenance documentation, note it on the receipt.

How to Format a Receipt for Legal and Tax Compliance in Art Galleries

Use a structured layout with distinct sections for seller and buyer information, artwork details, and financial breakdown. Ensure the receipt number follows a sequential format for tracking. Include tax details based on jurisdictional requirements, specifying VAT or sales tax rates separately. If the artwork is exported, note any tax exemptions or special declarations. For consignment sales, specify the artist’s commission and the gallery’s percentage. Add a disclaimer outlining return policies, liability terms, or authentication guarantees.

Best Tools and Software for Creating Receipts in Art Galleries

Digital tools simplify receipt generation and record-keeping. QuickBooks and Xero integrate with accounting systems to automate sales tracking. Square and PayPal offer digital receipts linked to payment transactions. For custom invoice design, use Canva or Adobe InDesign to create branded receipts with a professional appearance. Art-specific inventory systems like Artlogic and ArtBinder allow direct receipt creation from cataloged works, ensuring consistency. Always save copies digitally for easy retrieval and auditing.