An attorney receipt template ensures that every transaction between a lawyer and a client is properly documented. Whether you are billing for consultation, legal representation, or any other service, a well-structured receipt provides transparency and serves as proof of payment. Using a standardized template helps avoid misunderstandings and keeps financial records in order.

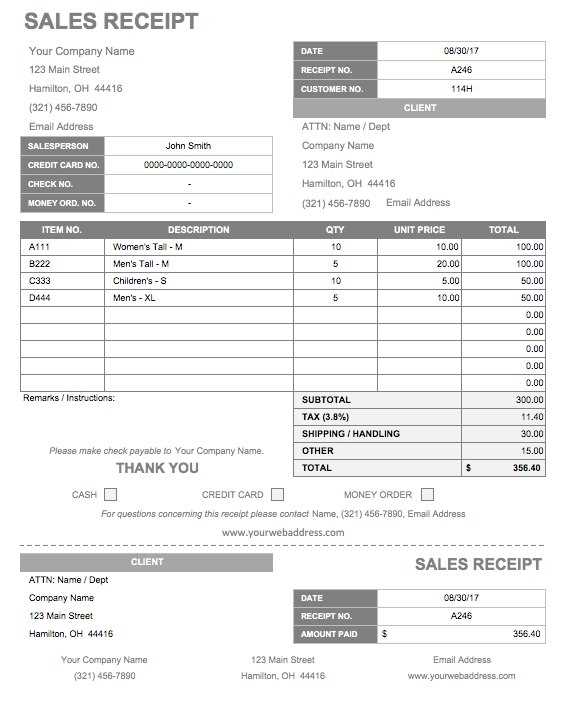

A complete receipt should include the attorney’s name, law firm details, client information, invoice number, date of payment, amount received, payment method, and a breakdown of services provided. Adding a section for additional notes can help clarify the purpose of the payment, ensuring both parties have a clear record of the transaction.

For consistency, legal professionals often use templates in formats such as PDF, Word, or Excel. While PDFs prevent unauthorized modifications, Word and Excel templates offer flexibility for editing and customization. Digital receipts can also include electronic signatures to enhance credibility.

Implementing a structured attorney receipt template simplifies financial management and strengthens client trust. Whether you prefer a manual or automated approach, having a reliable format in place ensures that every payment is properly recorded and easily retrievable when needed.

Here’s the revised version without unnecessary repetitions:

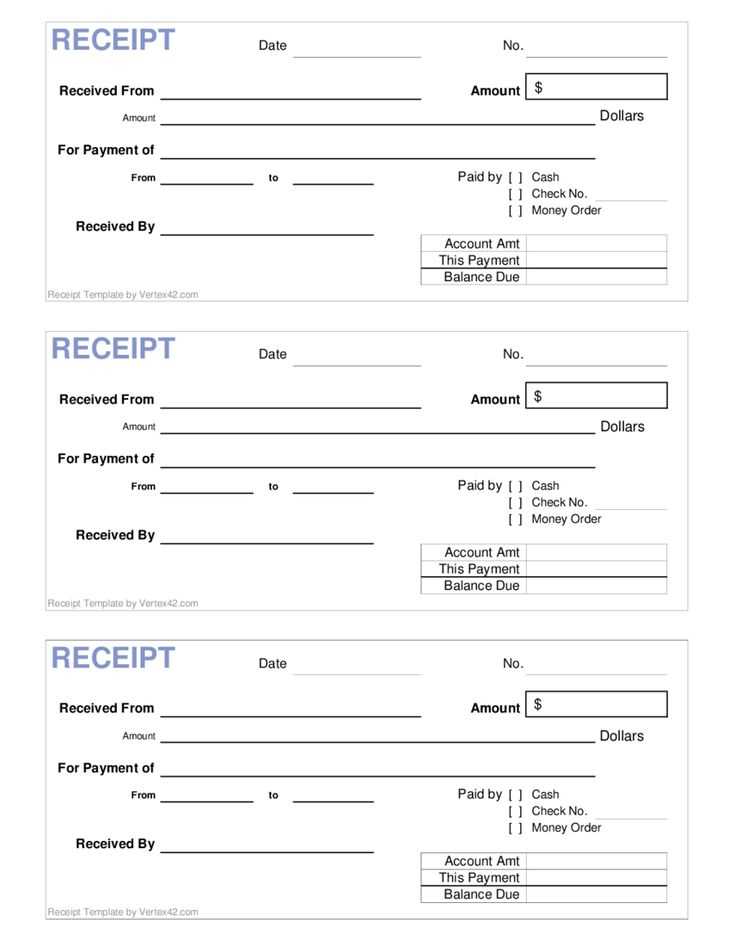

The receipt template should clearly outline the payment details and responsibilities. Avoid redundancy by focusing on essential information, such as the payer’s and payee’s details, the amount paid, and the date of the transaction.

Key sections of the attorney receipt template:

- Recipient Information: Include the name, address, and contact details of both parties involved.

- Payment Details: Specify the amount paid and the method of payment (e.g., check, bank transfer, cash).

- Date of Payment: Indicate the exact date the payment was made.

- Signature: Both the payee and payer should sign to confirm the transaction.

By focusing on these elements, the template will be clear and concise. Avoid additional clauses or unnecessary repetition of the same details. Each section should serve a distinct purpose, ensuring that the receipt remains a functional document.

- Attorney Receipt Template: A Practical Guide

Creating a receipt template for attorney services ensures clear documentation of payments made for legal representation. A well-structured receipt protects both the client and attorney, avoiding misunderstandings or disputes over fees. Below is a recommended format for an attorney receipt template:

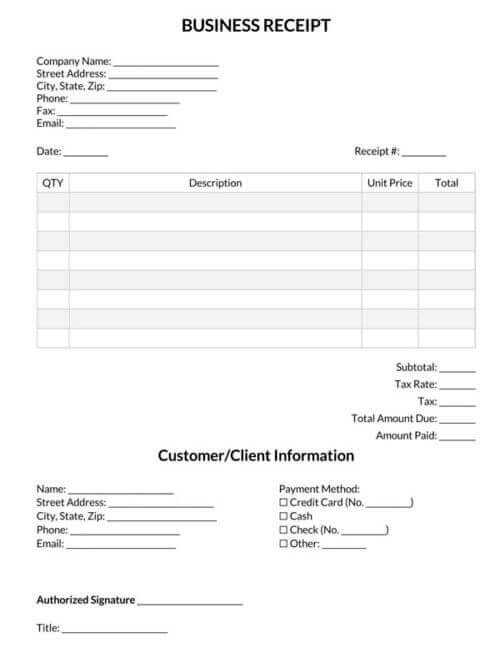

Key Elements of an Attorney Receipt

Every attorney receipt should include these details to maintain transparency:

- Attorney’s Information: Include the attorney’s name, law firm name (if applicable), address, and contact details.

- Client’s Information: Clearly state the client’s full name and address.

- Receipt Number: A unique number for each transaction for easy reference.

- Date of Payment: Specify the exact date when payment was made.

- Payment Amount: Indicate the exact amount paid for legal services.

- Method of Payment: Include details like cash, check, credit card, or bank transfer.

- Services Rendered: A brief description of the legal services provided, including dates of service and work completed.

- Signature: The signature of the attorney or authorized representative confirming receipt of payment.

Format Example

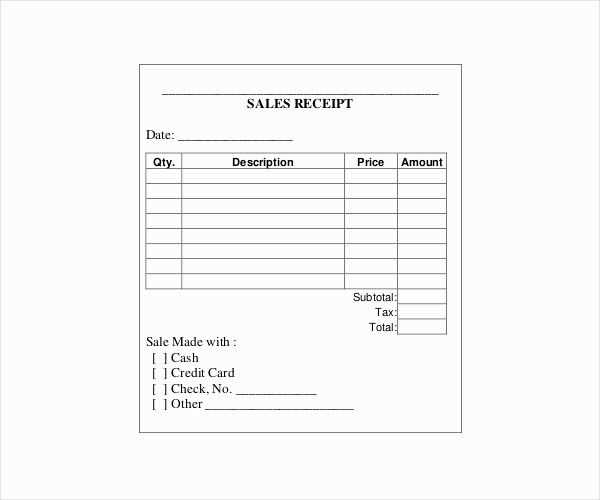

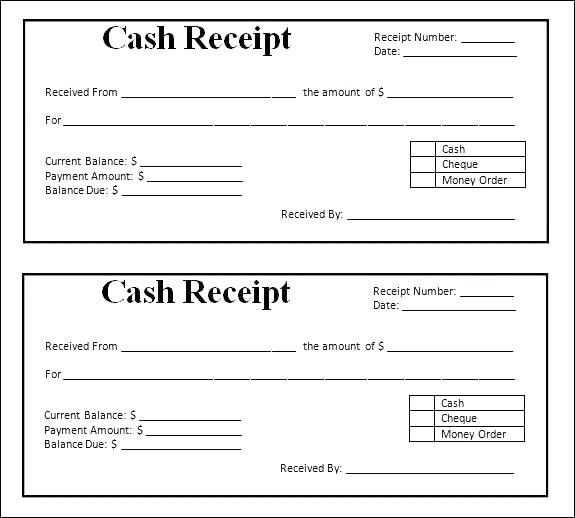

Below is a simple example of a receipt template for legal services:

Attorney Receipt Template Attorney Name: John Doe Law Firm: Doe & Associates Address: 123 Legal Lane, Suite 100, City, State, Zip Code Phone: (123) 456-7890 Client Name: Jane Smith Address: 456 Client Street, City, State, Zip Code Receipt Number: 1001 Date of Payment: February 10, 2025 Amount Paid: $1,500.00 Method of Payment: Credit Card Description of Services: - Legal consultation regarding family law matters (January 2025) - Preparation of divorce paperwork Signature of Attorney: ___________________________

By following this structure, attorneys can create a receipt that is clear, professional, and easy to understand for all parties involved.

A legal receipt should include specific details to ensure it holds up in court or for record-keeping. The most important elements are the names of both the payer and payee, the date of the transaction, and the amount paid. These components validate the exchange and provide clarity on the nature of the payment.

1. Identification of Parties

Clearly state the full names of both the client (payer) and the attorney (payee). Include addresses or other identifying information if necessary. This prevents confusion and provides transparency about who is involved in the transaction.

2. Payment Details

Include the exact amount paid, the currency, and the method of payment (e.g., cash, check, wire transfer). If applicable, note whether this payment is a full payment or part of a larger sum, such as a deposit or installment.

For a complete record, mention any outstanding balance if only a partial payment has been made. This ensures both parties are clear about the terms of the agreement.

Digital receipts offer the advantage of being easy to store and access. They are typically sent via email or stored in mobile apps, making it simple to track transactions without cluttering physical spaces. This format also allows for quick retrieval by searching through inboxes or apps, reducing the risk of losing receipts. In addition, digital receipts can be automatically categorized and organized, which can be helpful for managing finances or tax purposes.

Paper receipts, on the other hand, can be more reliable for some users, especially in situations where technology might fail or when a printed copy is necessary for returns or exchanges. However, they take up physical space and can deteriorate over time due to factors like fading ink or accidental damage. Storing large quantities of paper receipts can also become cumbersome.

Digital receipts also offer environmental benefits, as they eliminate the need for paper production, reducing waste. While some might prefer the tactile nature of paper, opting for digital receipts can contribute to more sustainable business practices.

In terms of security, digital receipts are typically easier to back up and secure. Storing receipts in a password-protected digital format reduces the chances of unauthorized access or loss, compared to the potential vulnerabilities of storing physical receipts in unprotected spaces.

Both formats have their place depending on personal preference and specific use cases. However, the shift towards digital receipts is becoming more prominent, aligning with the trend toward more streamlined, paperless transactions.

Common Mistakes to Avoid When Creating a Legal Receipt

Ensure all required details are included. Leaving out critical information, such as the full name and address of both the attorney and client, can make the receipt invalid. Without these identifiers, it’s difficult to prove the transaction and could lead to confusion or disputes.

Double-check the accuracy of payment amounts. Common errors include incorrect totals or missed fees. Review every charge listed to confirm amounts match what was agreed upon in the legal contract.

Misleading Descriptions

Avoid vague descriptions of services rendered. A legal receipt should clearly state what was paid for, whether it’s for consultation, document preparation, or court representation. Using terms like “legal work” without specifics can lead to misunderstandings about the nature of the transaction.

Failure to Include a Receipt Number

Including a unique receipt number helps to track payments. Without it, you might struggle to match payments to clients, especially for tax or auditing purposes. Always assign a unique identifier to each receipt.

Legal services vary widely, and customization is key to tailoring receipts for specific needs. Depending on the type of service provided, different details should be included in the receipt to ensure clarity and professionalism.

1. Criminal Defense

- Include detailed breakdowns of charges, including consultation fees, court appearances, and any additional research fees.

- Highlight any advance payments or retainer fees and specify how they are allocated to specific services.

- Offer space for listing court costs or fees paid on behalf of the client.

2. Corporate and Business Law

- Custom-tailor receipts to separate consulting, drafting agreements, or representing clients in mergers and acquisitions.

- Clearly outline payment for specific services, such as intellectual property registration, corporate filings, or document preparation.

- Include references to the specific business entity involved (e.g., LLC, corporation) for accuracy.

3. Family Law

- Break down services related to divorce, child custody, alimony, and property division.

- Provide a clear account of consultations, court filings, mediation sessions, and other associated legal services.

- Offer a section for future retainer fees if applicable for ongoing representation.

By adjusting the structure and content based on the legal service provided, receipts can more effectively serve as accurate and transparent documentation of legal transactions. Clients will appreciate clarity, and attorneys ensure professional billing practices.

Best Practices for Storing and Managing Receipts

Organize receipts by categorizing them into clear groups, such as expenses related to travel, office supplies, or client meetings. This will help you find specific receipts easily when needed.

Use a consistent naming system for digital receipts. Save them with relevant details, such as the date, vendor, and purchase amount. This makes it simpler to locate them later and prevents confusion.

Set up a cloud-based storage system to keep digital receipts safe and accessible across devices. Platforms like Google Drive or Dropbox offer secure storage and are easy to organize with folders and labels.

For physical receipts, use an accordion folder or binder with labeled sections. Keep each category separated and organized to avoid clutter. Store receipts in a dry, cool space to prevent damage over time.

Scan and upload paper receipts regularly to avoid losing them. Use a reliable scanner or a mobile scanning app to capture clear, readable images.

Consider using receipt management software or apps to automate the process. These tools often allow you to scan receipts, categorize expenses, and track them throughout the year for tax filing or reimbursement purposes.

Regularly back up your digital files to prevent data loss. Set up automatic backups or schedule manual ones to ensure your records remain safe.

Thus, the meaning is preserved without redundant repetitions of the phrase “Attorney Receipt”.

To avoid redundancy while maintaining clarity, it’s helpful to use varied terms when referring to the attorney’s acknowledgment of payment. For instance, instead of repeatedly stating “Attorney Receipt,” consider substituting with alternatives like “payment confirmation,” “acknowledgment of funds,” or simply “receipt.” These substitutions not only make the document easier to read but also maintain its professional tone. Remember, the context will guide you in choosing the most appropriate term without losing the intended meaning.

Clear and Direct Phrasing

When drafting, choose direct and straightforward phrases. For example, rather than saying “The Attorney Receipt was issued,” you can opt for “The receipt was issued by the attorney.” This minimizes repetition while keeping the focus on the key action–the issuance of the receipt. Another option is to refer to the attorney in context: “The lawyer has provided confirmation of payment” instead of repeating “Attorney Receipt” each time.

Maintain Precision

Precision is key in legal documents. Ensure that every term used contributes to the overall clarity and intent. By mixing up references to the receipt and payment acknowledgment without overloading the document with redundant terms, you can preserve both readability and accuracy.