If you’re looking to submit babysitter expenses for your Flexible Spending Account (FSA), having the right receipt is key. A clear and properly formatted receipt will ensure your claim is processed smoothly and avoid any delays. Make sure the document includes the required details to meet FSA requirements.

Your babysitter receipt should list the following elements: the provider’s name, contact information, the date and hours of service, the rate charged, and a total amount due. It’s important to clearly state whether the payment is for a single session or multiple sessions over a period of time. Additionally, include a statement of the child care services provided and confirm that payment was made, as FSA claims typically require verification of services rendered.

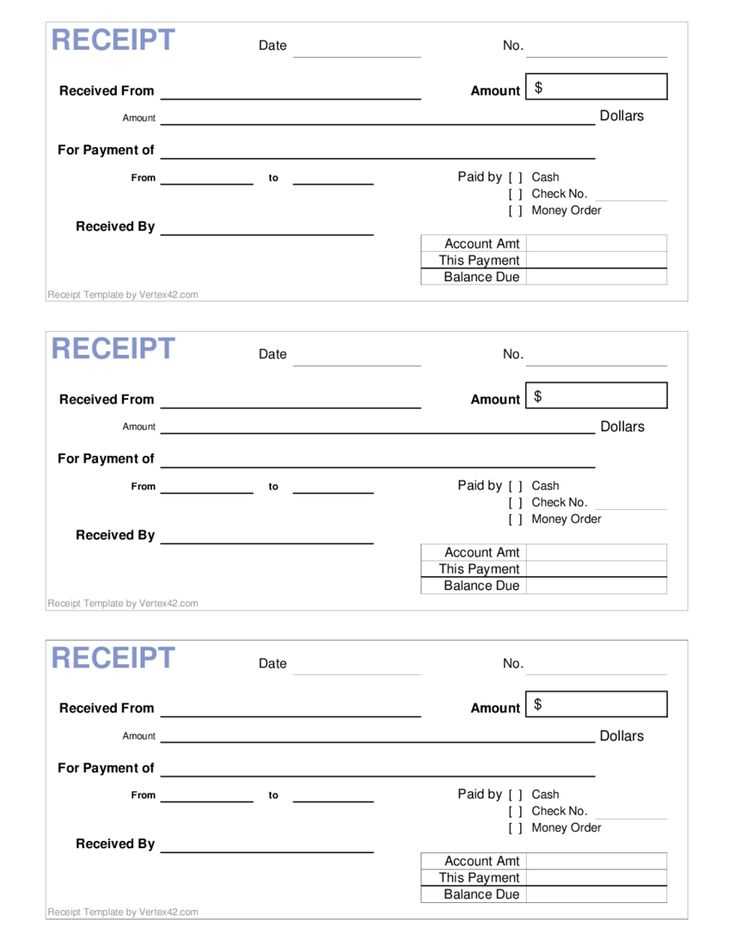

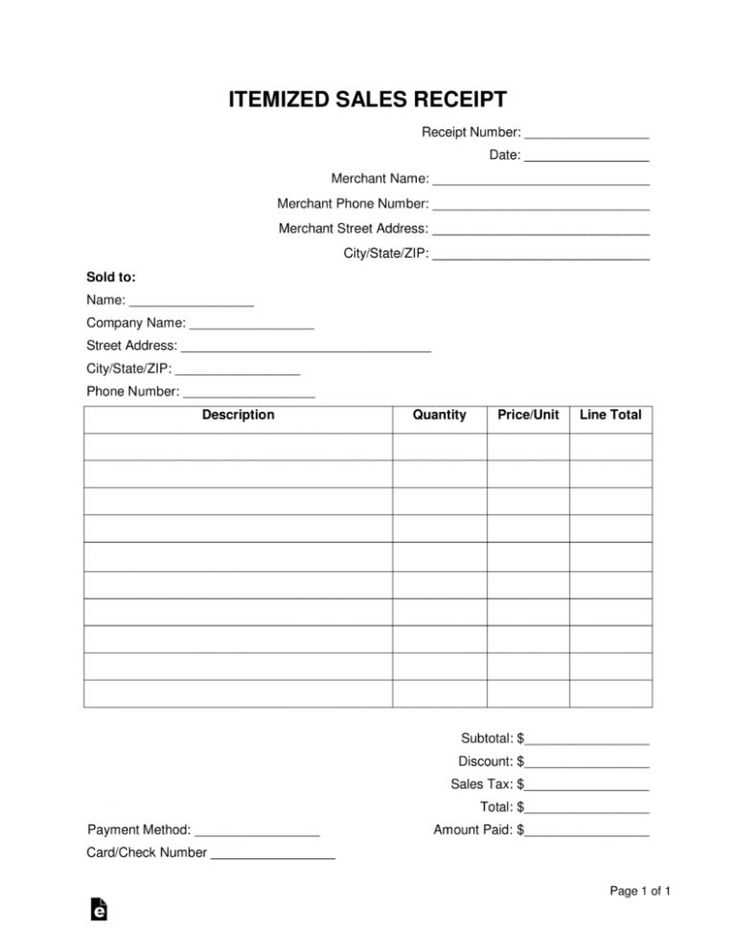

Here’s a simple format you can follow:

- Provider Name

- Provider Contact Information

- Child(ren)’s Name(s)

- Date and Time of Service

- Total Amount Paid

- Provider’s Signature (if applicable)

This receipt template ensures that all necessary details are captured, reducing the chances of rejection during the reimbursement process. Keep in mind that some FSA administrators may ask for additional documentation, such as a child’s age or a breakdown of services provided. Always verify the requirements with your specific plan administrator.

Here are the corrected lines:

For FSA (Flexible Spending Account) reimbursement, the babysitter receipt must include specific information to ensure smooth processing. Make sure the following fields are clearly listed:

Details of Service

The receipt should include the date(s) of the service provided, the hours worked, and the total amount charged for the service. Be specific about the dates and times to avoid any confusion during submission.

Provider Information

Ensure the babysitter’s full name, address, and contact number are visible. If possible, include their taxpayer identification number or Social Security number for verification purposes. This helps meet the requirements of the FSA administrator.

Additionally, the receipt should be signed or stamped by the babysitter as proof of authenticity. Without these details, the FSA reimbursement request may be delayed or rejected.

Babysitter Receipt Template for FSA

To submit a valid receipt for your Flexible Spending Account (FSA), make sure the document includes the following details:

- Provider’s Information: Include the babysitter’s full name, address, and contact number.

- Date and Time: Clearly state the hours worked, including start and end times.

- Service Description: Specify the service provided, such as “babysitting for X children.”

- Amount Charged: List the total amount paid for the service.

- Payment Method: Indicate how payment was made (cash, check, or digital payment method).

- Signature: A signature from the babysitter or a statement confirming that the service was provided is necessary for validation.

Example Template

- Babysitter Name: Jane Doe

- Service Date: 02/01/2025

- Service Hours: 5:00 PM – 8:00 PM

- Description: Babysitting for 2 children

- Amount Charged: $45.00

- Payment Method: PayPal

- Signature: Jane Doe

By including these details in your babysitter receipt, you will ensure smooth processing of your FSA claim. Always keep a copy for your records.

To create a babysitter receipt that meets FSA guidelines, include these key details:

1. Babysitter’s Full Name and Contact Information

Provide the babysitter’s full name, phone number, and address. This verifies the person providing the service.

2. Date and Time of Service

Clearly list the dates and times when the babysitting occurred. This ensures transparency and allows for easy tracking of expenses.

3. Description of Services Provided

State what the babysitter did (e.g., “babysitting for children aged 3 and 5,” or “care for child while parent is at work”). Avoid vague descriptions, and be specific to meet FSA standards.

4. Total Payment Amount

Include the exact amount paid for the babysitting services. Make sure the receipt reflects the total cost and matches what was paid.

5. Employer or Parent’s Information

Write the parent’s or guardian’s full name and contact details to confirm who is receiving the services.

6. Signature or Acknowledgement

Both the babysitter and the parent should sign or acknowledge the receipt, ensuring both parties agree on the service details.

Including these details will ensure your receipt meets FSA guidelines, making it eligible for reimbursement if necessary. Keep the receipt organized and accessible for tax or reimbursement purposes.

For FSA reimbursement, the babysitter receipt must contain the following details:

- Babysitter’s Name and Contact Information: Include the full name, address, and phone number of the caregiver to verify their identity.

- Date and Time of Service: Clearly state the dates and hours the babysitter provided care. This helps establish the timeframe for the reimbursement.

- Amount Paid: List the total amount paid for the babysitting services, along with the hourly rate, if applicable.

- Children’s Names: Include the names of the children who received care. This is necessary for FSA compliance.

- Signature of Babysitter: The receipt should be signed by the babysitter to confirm the services rendered.

- Statement of Service: A brief statement confirming that the babysitter’s services were for child care, as this is a requirement for FSA claims.

Ensure all information is accurate and clear. Incomplete or vague receipts could result in delayed or denied reimbursements. Keep a copy of the receipt for your records, and always double-check FSA guidelines for any specific requirements your plan may have.

Always make sure the receipt includes the necessary details. Without a clear description of the services provided, your submission may be rejected. Ensure the babysitting service is described explicitly, mentioning the date, hours worked, and total amount paid.

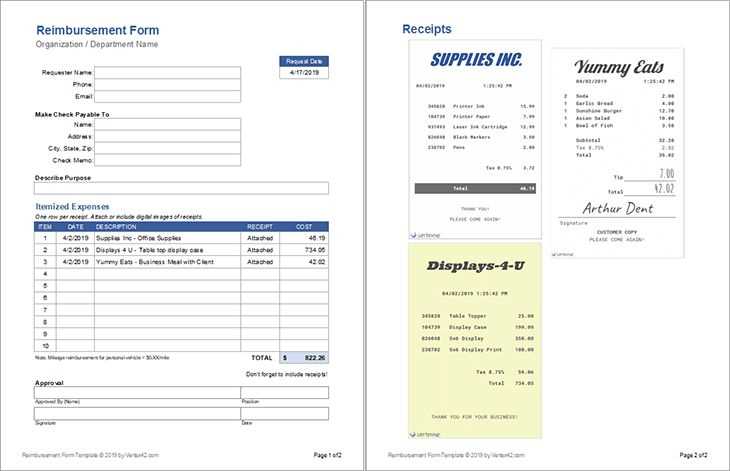

1. Missing Date and Time Information

FSA guidelines require the exact dates and times of the service. If the receipt lacks this information, it will not be accepted. Include both the date and the time of the babysitting service to ensure smooth processing.

2. Incomplete or Unclear Payment Details

Avoid submitting receipts without a clear breakdown of the payment. The total cost should be listed, along with any additional charges or discounts. Without this, the FSA may question the legitimacy of the claim.

3. Not Providing a Provider’s Information

The receipt must include the name and contact information of the babysitter or the company providing the service. A receipt without this detail can cause delays in processing the claim.

4. Submitting Non-Itemized Receipts

Make sure the receipt is itemized. A lump sum payment without a breakdown of services (such as hours worked) can be considered insufficient. FSA requires detailed receipts to approve the claim.

5. Ignoring FSA-Specific Requirements

Each FSA provider may have different submission requirements. Check the specifics of your plan before submitting, and avoid using generic receipts that may not meet the FSA’s standards.

How to Create a Babysitter Receipt for FSA

Use a clear and simple format to ensure your babysitter receipt meets FSA requirements. Include the following details:

- Provider’s name and address: Include full contact details of the babysitter or agency.

- Date of service: Specify the exact date(s) the babysitting service was provided.

- Amount charged: Include the total cost for the babysitting service.

- Signature: Both the babysitter and the parent should sign the receipt for validation.

- Time worked: Include the start and end times of the service.

- Service description: Briefly describe the service provided, such as the number of children cared for and their age.

Formatting Tips

Keep the receipt neat and legible. Use a consistent layout and consider using a template for easier tracking. Make sure all sections are easy to find and clear to read.

Why Accuracy Matters

For FSA reimbursement, any missing or unclear details could lead to delays or denials. Double-check the information before submitting the receipt to your FSA provider.