If you’re providing babysitting services, a clear and professional receipt is a simple yet important way to keep track of your earnings. Using a babysitting receipt template helps both you and the parents keep an organized record of payments made for your work. This template allows for easy customization, making sure all key details are included without any hassle.

A typical receipt should clearly outline the date and time of service, the hourly rate, the total hours worked, and the overall payment. Include your name and contact information, along with any relevant details, such as the child’s name or specific tasks provided during the session. This transparency will help prevent any confusion between you and the parents, ensuring everyone is on the same page.

Make sure to sign each receipt before handing it over. This small action adds an extra layer of professionalism, indicating that both parties agree to the terms listed. Whether you’re keeping it for personal records or providing it to the family, a receipt template gives both sides peace of mind, ensuring clear communication and smooth financial transactions.

Here’s the revised version with minimal repetition:

When creating a babysitting receipt, ensure clarity by detailing the hours worked and the agreed-upon hourly rate. Specify the total amount due, including any additional charges, such as travel fees or extra time. Make sure to include both the start and end times for transparency.

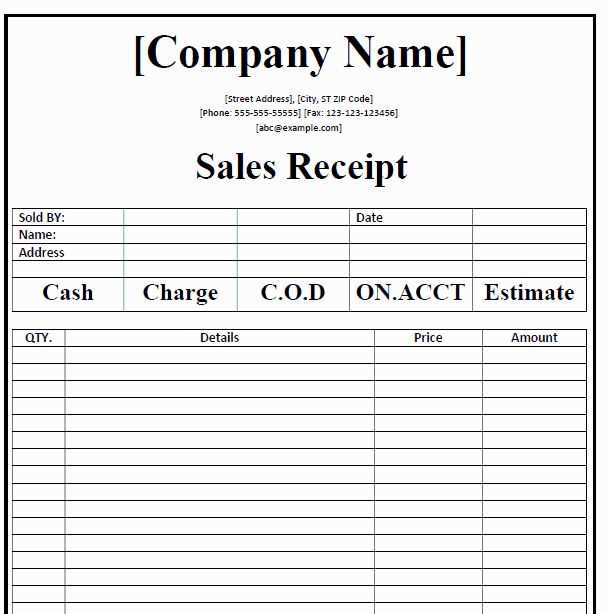

Here’s a simple template layout for easy reference:

| Date | Hours Worked | Hourly Rate | Additional Fees | Total Amount |

|---|---|---|---|---|

| MM/DD/YYYY | 4 hours | $15/hour | $5 (transportation) | $65 |

Ensure both parties review and sign the receipt once it’s completed, confirming agreement with the details provided. This practice protects both the sitter and the family involved.

- Babysitting Receipt Template

A babysitting receipt template should include clear details to avoid confusion and ensure transparency. Include the sitter’s name, the client’s name, and the date of service. Specify the hours worked, the hourly rate, and the total amount due. Include any additional fees, such as transportation or special care, to provide an accurate account of the payment. A signature from both the sitter and the client can help confirm the transaction took place as agreed.

Key Elements to Include

Make sure the babysitting receipt template has the following:

- Date of Service: Clearly mention the date when the service was provided.

- Hours Worked: Record the exact start and end times or the total hours worked.

- Hourly Rate: State the agreed-upon hourly rate for the service provided.

- Total Payment: Multiply the hours worked by the hourly rate to calculate the total payment.

- Additional Charges: Include any extra charges, such as for late-night care or extra children.

- Signatures: Include space for both parties to sign, confirming the details are correct.

Customizing Your Template

To create a personalized babysitting receipt, adjust the template based on the specific details of each transaction. You can include extra information like the child’s name or any special instructions for clarity. Make sure both the sitter and the client are comfortable with the terms outlined in the receipt before signing.

To create a straightforward babysitting receipt, fill in the following information:

| Service | Babysitting |

|---|---|

| Babysitter’s Name | [Insert Babysitter’s Name] |

| Client’s Name | [Insert Client’s Name] |

| Date of Service | [Insert Date] |

| Hours Worked | [Insert Total Hours] |

| Hourly Rate | [Insert Hourly Rate] |

| Total Payment | [Insert Total Payment] |

| Payment Status | [Paid/Unpaid] |

Review all details before finalizing the receipt. Keep a copy for your records.

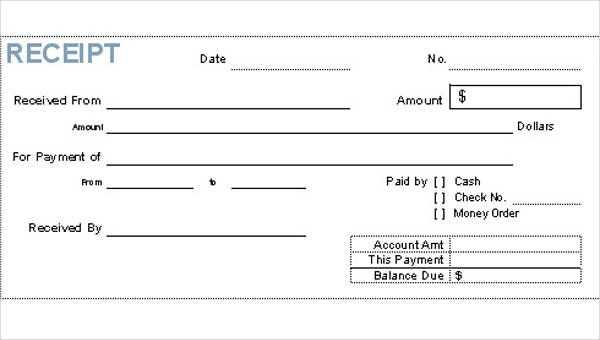

To clearly outline the payment breakdown, list each service or task separately, followed by its corresponding rate. Start with the total time spent or number of hours worked, indicating the hourly rate. If there were additional services provided, such as overtime or special requests, specify them with their rates and time duration. For instance, if you charged extra for late-night hours, mention the standard and overtime rates separately.

Include any additional fees, such as transportation or materials, if applicable. Be transparent about any discounts or adjustments made to the total amount. This ensures the recipient understands the exact cost breakdown and minimizes confusion.

Finally, list the total payment due, which includes all services, fees, and adjustments. This clear and organized format will help maintain transparency and professionalism in your transaction records.

To accurately reflect the total amount for the babysitting service, include tips and extra charges on the receipt. Here’s how to handle them:

- Tips: If the client offers a tip, ensure it’s listed separately to maintain transparency. Specify the amount or percentage (e.g., 10%) next to the service fee. This allows the client to see exactly how much extra they are paying as a tip.

- Extra Charges: For any additional charges like transportation fees, late-night rates, or special requests, list them clearly. Break down the costs by category (e.g., “Late Night Charge – $10,” “Transportation – $5”) to avoid confusion.

- Total Calculation: After adding tips and extra charges, calculate the new total. Ensure the subtotal is listed first, followed by any added fees or tips. Show the final total at the bottom, making it easy to understand the full amount due.

Be clear and concise to prevent misunderstandings. Including a breakdown helps both parties track costs accurately and ensures a smooth transaction.

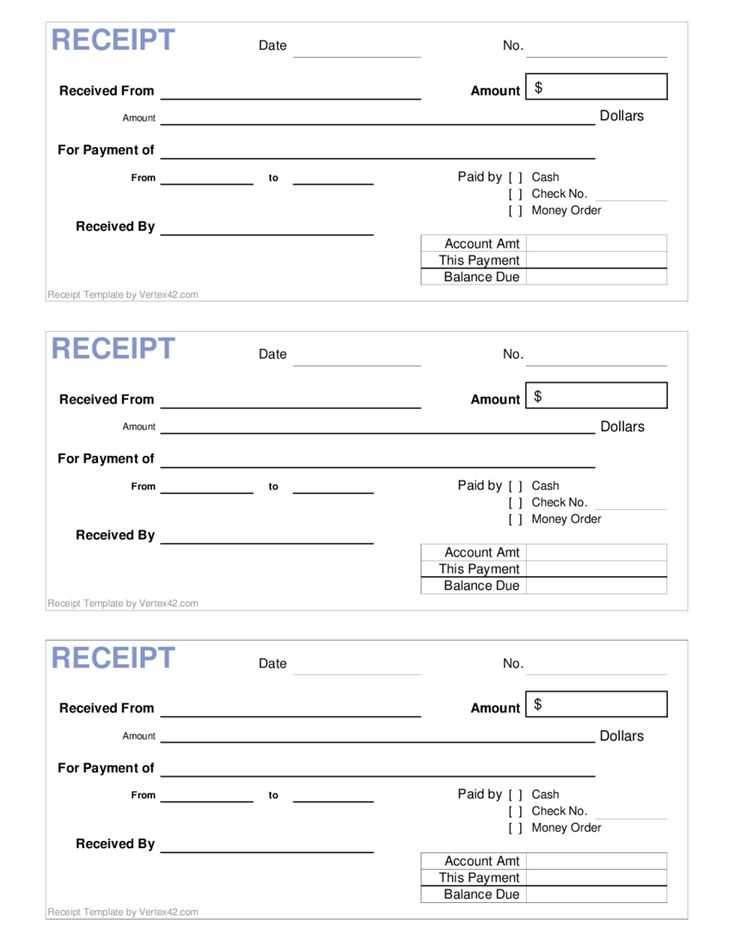

Make sure to include the date and time clearly on the receipt. This helps both the sitter and the parents track the hours worked and ensures there is no confusion about payment or duration. Specify the start and end times of the babysitting session, breaking them into precise increments, such as hours and minutes. If the session covers multiple days, mention each date and the time span separately.

It is also important to include details about the child. Write the child’s name(s) and age(s) to avoid any ambiguity. If multiple children were babysat, list each one separately for clarity. This gives parents a complete overview of the service provided and helps keep records organized.

- Ensure all dates and times are written in the same format to maintain consistency.

- If additional notes are necessary, such as specific care instructions for the child, include them in a dedicated section.

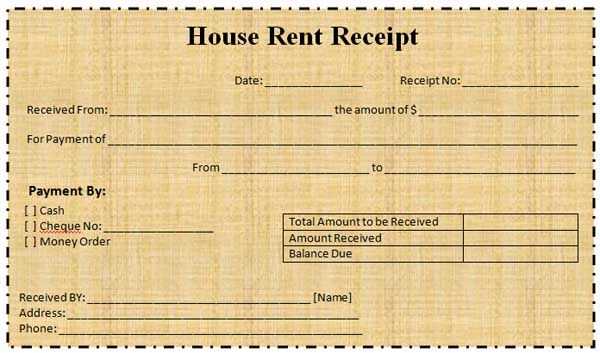

To tailor a babysitting receipt for tax or business purposes, it’s important to include specific details that meet the requirements of tax authorities and business practices. Here’s how to make your receipt more suitable for these purposes:

- Itemize the Services Provided: Clearly break down the babysitting services by hours worked and the agreed rate. This ensures transparency and helps differentiate between services for accurate tax filing.

- Include Your Business Details: If operating as a business, include your business name, address, and tax identification number (TIN) or Employer Identification Number (EIN). This is essential for tax reporting.

- Specify Payment Methods: Indicate whether payment was made via cash, check, or electronic transfer. This can be useful for record-keeping and reporting income to tax authorities.

- List Additional Expenses: If you charge for extra services like transportation or meals, be sure to list them separately. This ensures clarity and prevents confusion during tax filing.

- Include a Clear Total Amount: Make sure to include the total amount due at the bottom of the receipt, which will assist both you and your clients in tracking payments for tax purposes.

- Note the Date and Time: Record the date(s) and time(s) of service, as these are necessary for tax records and could be useful if any discrepancies arise regarding your services.

By customizing your receipt with these details, you ensure that both you and your clients maintain accurate records, helping with tax reporting and business compliance.

Send the receipt right after the job ends. This helps ensure the details are fresh in both parties’ minds and prevents any confusion later. Use clear language and specify all key information, including the number of hours worked, rate per hour, and any additional charges for special services or extra time.

Use Email for Quick Distribution

Distribute the receipt via email. It’s fast, easy, and ensures both parties have an electronic copy for reference. Include a subject line such as “Babysitting Receipt for [Date]” to make it clear and organized. Attach the receipt as a PDF for better accessibility and professional presentation.

Provide Paper Copies When Necessary

If your client prefers a paper receipt, be ready to provide one at the end of the session. Always write the details clearly, using legible handwriting. If handing over a printed receipt, make sure the paper is of good quality for a neat presentation.

Keep copies for your own records. This is helpful for tracking payments and for any future references if questions arise. Use either a physical folder or a digital record-keeping system to store these receipts in an organized manner.

Make sure the receipt is simple but includes everything needed for transparency: date, duration of service, hourly rate, total amount due, and any special charges. This will help establish trust and maintain a clear, professional relationship with clients.

When preparing a babysitting receipt, make sure to clearly display all relevant details for both parties. Include the date and time of service, along with the rate charged per hour. Ensure that both the total hours worked and the overall amount are easy to read. A breakdown of any additional charges, such as transportation or special requests, should also be included for transparency.

It’s helpful to specify the method of payment used, whether cash, check, or other means, along with any applicable taxes if required. Lastly, add a space for the sitter’s signature and the parent’s signature to confirm the transaction and avoid any misunderstandings.