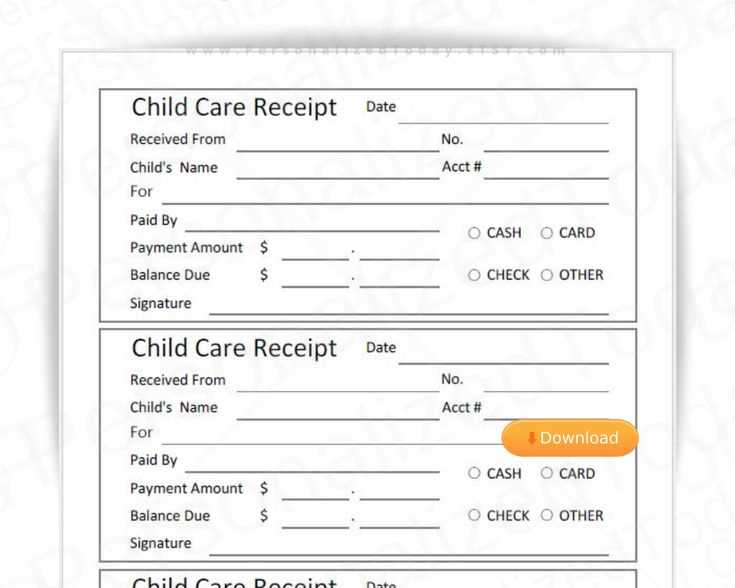

When providing babysitting services, a well-structured receipt is a simple way to keep track of payments. By using a babysitting receipt template, both the caregiver and the client ensure clear documentation of the transaction. A receipt protects both parties and provides clarity in case of disputes or for tax purposes.

A typical babysitting receipt in Canada includes essential details like the sitter’s name, the client’s name, the number of hours worked, and the agreed-upon hourly rate. These elements are crucial for confirming the services rendered and the total amount due. The receipt should also include the date of service and any additional notes such as transportation or special requests from the client.

Using a standard format makes it easier to organize records and streamline accounting tasks. It’s also a professional touch that helps establish trust and transparency between the babysitter and their clients. This template can be adjusted to suit different rates and situations, ensuring it fits your specific needs every time.

Here’s the revised version with reduced repetition while preserving the meaning and clarity:

Use a clear and concise babysitting receipt template to ensure both parties have a record of the services rendered. The template should include the following key details:

Required Information

- Provider’s Name: The babysitter’s full name.

- Client’s Name: The parent’s or guardian’s full name.

- Service Date(s): Exact dates of service.

- Hours Worked: Specify the start and end time of the babysitting session.

- Rate per Hour: Include agreed-upon rate.

- Total Payment: The total amount due based on hours worked and hourly rate.

Additional Tips

- Make sure the receipt is signed by both the babysitter and the parent to confirm agreement on the details.

- Keep a copy for personal records or tax purposes.

- Babysitting Receipt Template for Canada

To create a proper babysitting receipt in Canada, include these key elements:

1. Babysitter’s Information

Start by listing the babysitter’s name, address, and phone number. This ensures clear identification for tax and payment purposes. If the babysitter is registered as a business, include the business number as well.

2. Parent’s Information

Include the parent’s name and contact details for reference. This helps in confirming the transaction and ensures accountability from both parties.

3. Service Details

Specify the date(s) and time(s) the babysitting service was provided. Note the hourly rate and the total number of hours worked. For example, 5 hours at $15 per hour. If applicable, include any extra charges, such as transportation costs or overtime rates.

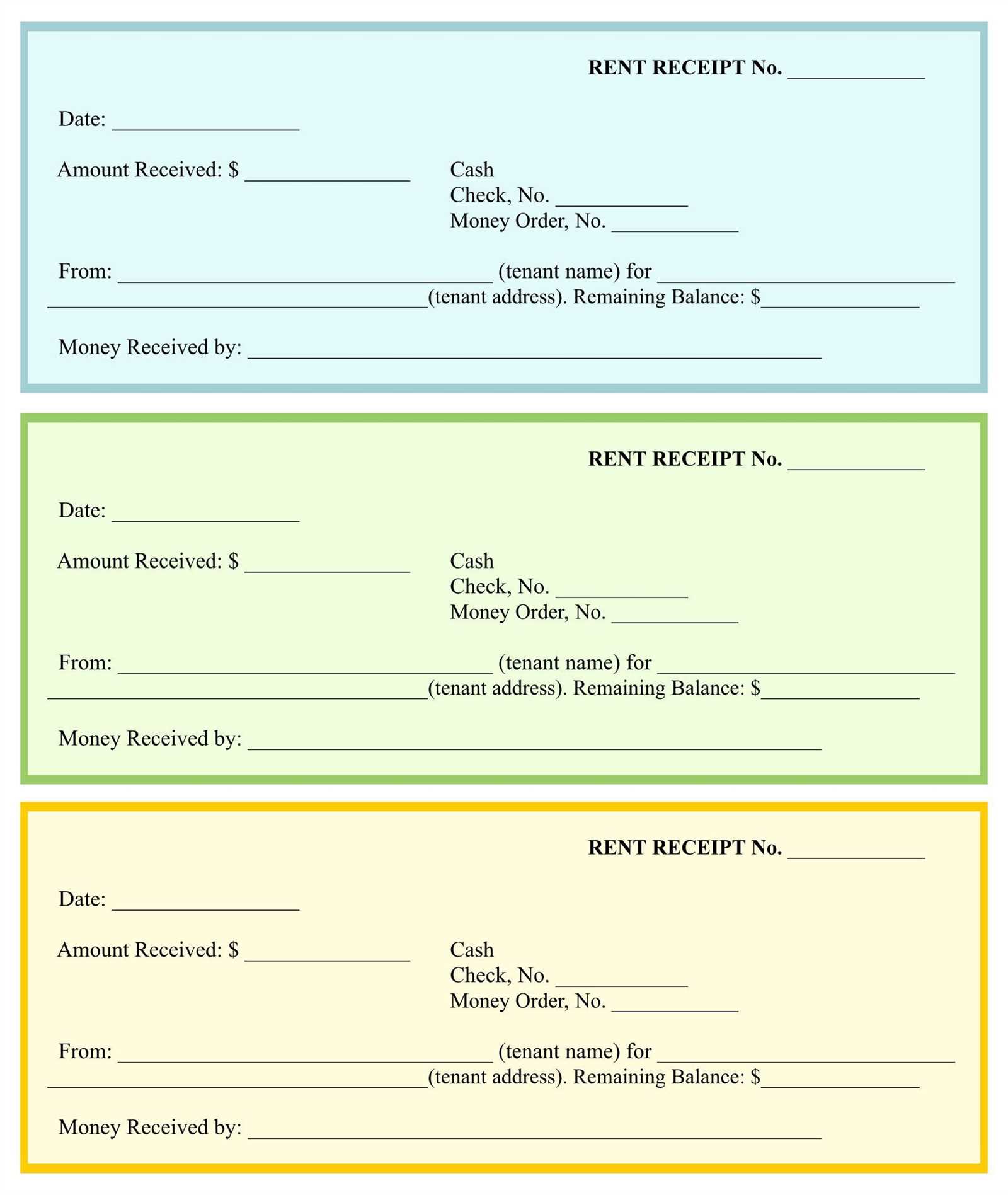

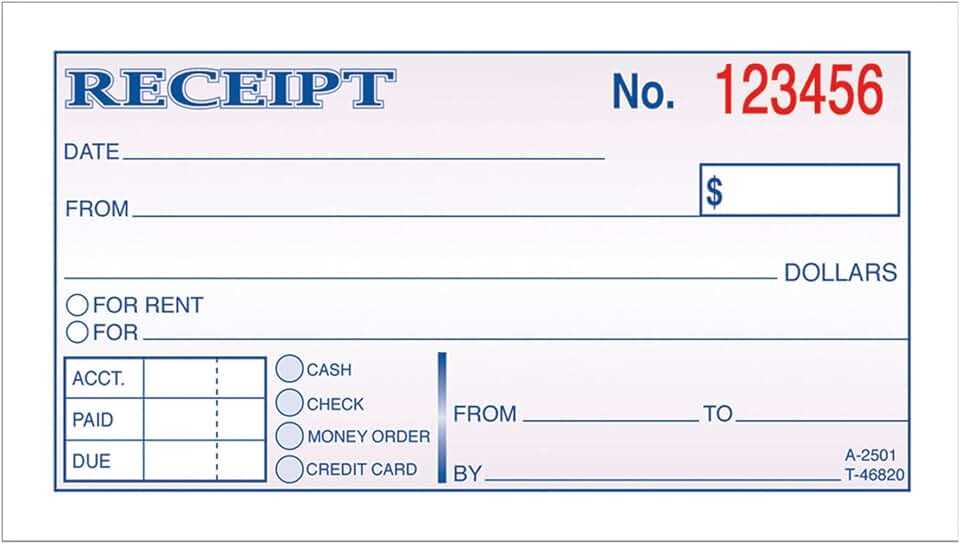

4. Payment Details

Clearly state the amount paid, the method of payment (e.g., cash, cheque, or e-transfer), and the date of payment. This adds transparency and prevents future disputes.

5. Signature

Both the babysitter and the parent should sign the receipt to confirm the transaction is complete and accurate. This can be a physical or digital signature.

Example of a Babysitting Receipt Template:

| Details | Information |

|---|---|

| Babysitter’s Name | [Babysitter’s Full Name] |

| Babysitter’s Contact Info | [Phone Number / Email] |

| Parent’s Name | [Parent’s Full Name] |

| Parent’s Contact Info | [Phone Number / Email] |

| Date of Service | [MM/DD/YYYY] |

| Hours Worked | [Total Hours] |

| Hourly Rate | [Hourly Rate in $] |

| Total Amount Due | [Total Amount in $] |

| Payment Method | [Payment Method] |

| Signature of Babysitter | [Signature] |

| Signature of Parent | [Signature] |

This template provides a clear structure for both parties and helps avoid misunderstandings regarding payments.

List the key details of the service provided for transparency. This includes the number of hours worked, rate per hour, and any additional charges for services like transportation or extra responsibilities. This helps both the sitter and the employer stay on the same page about compensation.

Include Hourly Rate and Total Time Worked

- Clearly state the agreed hourly rate.

- Document the start and end times to calculate total hours worked.

- Include any breaks if applicable, noting if they affect the total billable time.

Note Additional Charges or Discounts

- Any extra services (e.g., multiple children, special needs) should be clearly listed with associated costs.

- If applicable, include a discount for frequent bookings or referrals.

Finish the summary with the total amount due and any payment terms, such as due date or payment method options. This ensures a clear and professional summary, minimizing potential misunderstandings.

Each babysitting receipt should include specific details to ensure it is clear and legally recognized. Start by including the full name of the babysitter and the family they worked for. Add the date of service, as this establishes a clear timeframe. Specify the hours worked, including start and end times, and make sure the total payment is listed with the hourly rate or agreed-upon fee. Don’t forget to indicate any additional services, such as overnight care or transportation, which may affect the final amount.

Details to Include

For added clarity, include payment methods, such as cash, cheque, or electronic transfer. Both parties should sign the receipt to confirm agreement. Ensure the babysitter’s contact information is included in case the family needs to reach them for future engagements. Keeping a record of the payment will help in case any questions arise about the transaction later.

Optional Elements

If you want to add an extra level of professionalism, consider adding a unique reference number for each receipt. This helps in organizing and tracking past services. A brief description of the services rendered may also be useful for both the babysitter and the family to reference.

For clarity, always include the start and end times for the babysitting job. Use a 24-hour clock format (e.g., 18:00 for 6 PM) to avoid confusion with AM/PM. Specify the exact date, including the month, day, and year. For example, “February 5, 2025” makes the date clear without ambiguity. Ensure consistency in formatting throughout the receipt.

Documenting Time Duration

Indicate the total number of hours worked clearly. If the job spans multiple hours, break down the time into smaller segments (e.g., “6:00 PM to 9:00 PM – 3 hours”). This method gives a clear picture of time worked, which helps in calculating the payment.

Providing Exact Start and End Dates

When listing the date, ensure it’s formatted as “Month Day, Year.” This format avoids confusion across regions with different date conventions. For instance, “February 5, 2025” makes it straightforward and leaves no room for misinterpretation.

To calculate rates, base your pricing on hourly or daily rates. Standard babysitting fees typically range between $12 to $20 per hour, depending on location, experience, and the number of children. Adjust these rates based on the specific needs of the family. For example, if you are caring for multiple children, consider charging an additional amount per child, usually $2 to $5 per hour per extra child.

Additional Charges

Factor in any special charges for late-night sitting or last-minute bookings. For sitting beyond typical hours, add $5 to $10 per hour, depending on how late it is. Similarly, for urgent requests, add a surcharge of $5 to $15 on top of your regular rate. If transportation is required, either include travel costs in your rate or add a fixed charge for mileage, often between $5 to $15 depending on distance.

Other Fees

Consider offering discounted rates for long-term clients or regular babysitting. Establishing a flat weekly or monthly fee might also be a preferred option for families who need frequent help. Always be clear about your fees and provide an itemized receipt for services rendered, ensuring transparency and preventing confusion about charges.

Ensure your babysitting receipt includes all necessary details to meet Canadian legal standards. Begin with the full name of both the sitter and the client, along with their contact information. This provides a clear record for tax or reference purposes. If applicable, add your business registration number for official transactions.

For accurate tax reporting, specify the hourly rate, total hours worked, and the full amount paid. This helps establish transparency for both parties. Include a breakdown if you provide additional services like transportation or extra hours, as this can affect tax reporting.

The receipt should also note the payment method (cash, cheque, or e-transfer) and the date of payment. This ensures there’s no confusion over when the service was paid for. For payments made electronically, a reference number can be useful for both parties in case of disputes or clarifications.

Lastly, verify that your receipt complies with provincial regulations. Some provinces may require specific information, such as tax registration numbers for businesses charging HST/GST. Be sure to include these details if they apply to you.

| Required Information | Details |

|---|---|

| Name of Sitter and Client | Full names of both parties |

| Contact Information | Phone numbers, email addresses |

| Hourly Rate and Hours Worked | Rate per hour, total hours worked |

| Total Amount Paid | Breakdown if applicable (e.g., transportation) |

| Payment Method | Cash, cheque, or e-transfer with reference number |

| Business Registration Number | If applicable, for official transactions |

| Payment Date | The date when payment was made |

Include the date, time, and total hours worked. Clearly display the rate per hour and any additional charges, if applicable. Break down the services performed, such as childcare, meal prep, or transportation. Clearly state the total amount due and specify the payment method, whether it’s cash, cheque, or electronic transfer.

Detailed Itemization

For clarity, list each service separately with its corresponding charge. Include extra fees for overtime or additional tasks. This transparency builds trust and ensures both parties agree on the amount being paid.

Client and Babysitter Information

Ensure that both the babysitter’s and client’s names, contact information, and address are included. This makes the receipt more professional and allows for easy follow-up if needed.

Make sure your receipt includes the exact dates and hours you worked, as well as the agreed-upon rate. Clearly list the total amount due, ensuring there’s no ambiguity for both parties. It’s a good idea to specify the childcare services provided, whether it was general care or additional duties like meal preparation. Always include your full name, the parent’s name, and a contact number. A simple breakdown of the payment structure can help avoid confusion. If you received a deposit or advance, mention it and show the balance due. Always keep a copy for your records.