For anyone using a Flexible Spending Account (FSA) to cover babysitting expenses, having a clear, professional receipt template is a must. It ensures both you and the caregiver have the necessary documentation to submit for reimbursement without any delays. A well-structured receipt simplifies the process, offering transparency for both parties and meeting FSA requirements.

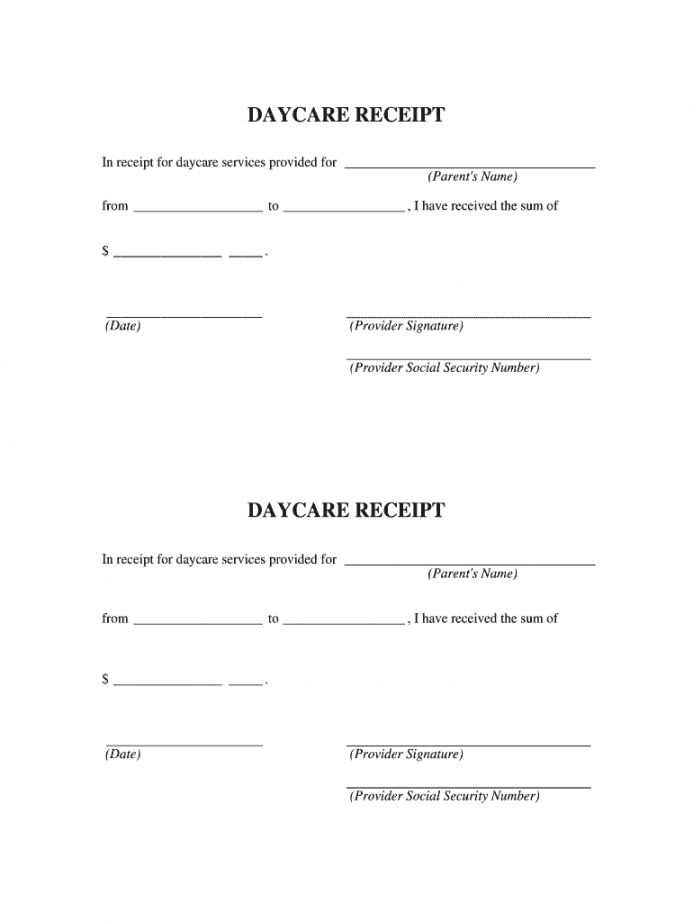

Your babysitting receipt should include basic details such as the caregiver’s name, the service dates, the total hours worked, and the hourly rate. This information is key to substantiating your claim. Be sure to also include your child’s name, as this connects the service to the FSA-eligible expense. Don’t forget to ask the caregiver to sign the receipt–this adds a level of legitimacy and authenticity that FSA administrators expect.

Having a template ready means you won’t miss out on any important information during each babysitting session. You can easily customize a receipt format to fit your needs, making it quick to generate new ones each time. A properly filled-out babysitting receipt is not just a formality; it’s a necessary document for smooth FSA reimbursements.

Here’s the revised version where words are not repeated more than two or three times:

To create a babysitting receipt for an FSA, make sure to include the necessary details clearly. Start with the sitter’s full name, the date of service, and the total amount paid. Be specific about the hours worked to ensure accurate record-keeping.

- Include the sitter’s contact information, such as phone number or email address.

- List the child(ren)’s name(s) and the date of care provided.

- Provide the total amount paid for the service, along with any additional charges if applicable.

- Specify the hours worked, with start and end times.

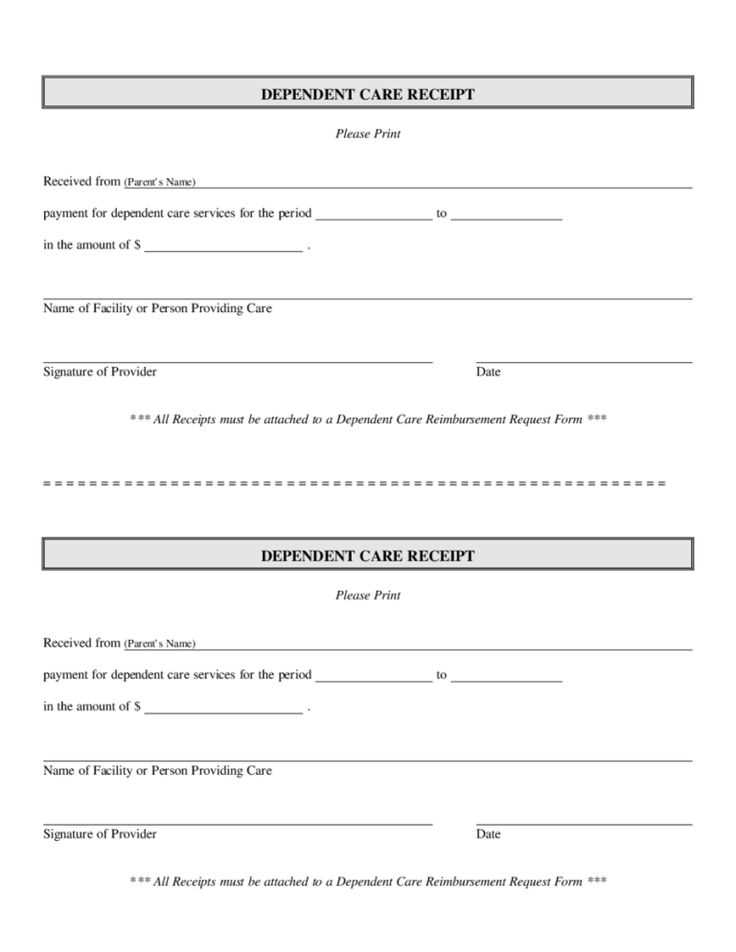

It’s important to state that babysitting services qualify for FSA reimbursement, but proper documentation is required. If the care was for multiple children or a group, break down the charges by each child. This ensures the accuracy of the submission.

- Verify that the receipt contains no ambiguity regarding the sitter’s fees.

- Double-check that you are not missing any relevant details like the type of care provided or the sitter’s license if applicable.

When submitting, make sure to include this receipt along with any additional forms required by your FSA administrator. Following these steps will streamline the reimbursement process and avoid unnecessary delays.

- Babysitting Receipt Template for FSA

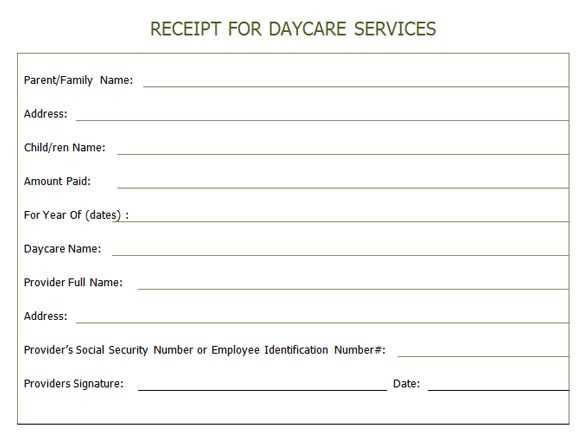

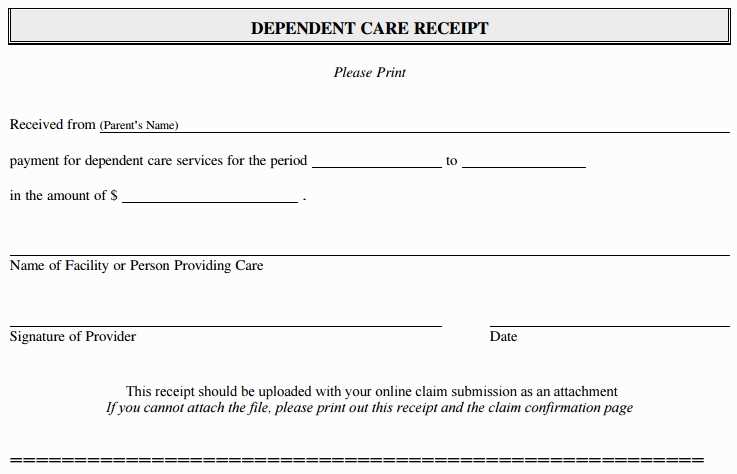

A babysitting receipt for an FSA claim must contain certain key details to be accepted by your Flexible Spending Account provider. Start with clear, legible information that aligns with the requirements of your FSA. Below is a sample template to help you craft a receipt that meets these standards.

Essential Information for Your Babysitting Receipt

Your receipt should include the following:

- Caregiver’s Name: Full name of the babysitter providing services.

- Date of Service: Specific dates and times the babysitting occurred.

- Hourly Rate: The agreed-upon rate per hour or flat rate for the service.

- Total Amount Paid: The total payment made for the babysitting service.

- Caregiver’s Contact Information: Phone number or email to verify the receipt if necessary.

- Signature: A signed acknowledgment from the caregiver stating that services were rendered.

Example Template

Here’s a simple format to follow:

Babysitting Receipt Date: [Insert Date] I, [Caregiver's Full Name], confirm that I provided babysitting services to [Parent's Full Name] on [Insert Dates and Hours]. Hourly Rate: $[Insert Rate] Total Amount Paid: $[Insert Total] Caregiver's Contact Information: [Insert Phone/Email] Signature: _______________________________ Date: _______________________________

This template ensures you provide the necessary details for FSA reimbursement without missing any required components. Be sure to adjust the information to reflect actual services rendered.

To create a babysitting receipt for FSA claims, include the following information:

1. Babysitter Details

Clearly list the name, address, and contact information of the babysitter. This ensures the receipt is verifiable for FSA purposes.

2. Dates and Hours

Specify the exact dates and hours of service. Break the hours down into the start and end times for each session. This will help FSA administrators verify the time spent on care.

3. Service Description

Describe the type of care provided (e.g., child supervision, meal preparation, etc.). Avoid vague terms to make it clear that the services were related to babysitting.

4. Payment Information

List the hourly rate and the total amount paid for each session. If there were multiple days, include the breakdown for each date. Total the amount for all sessions at the end.

5. Babysitter’s Signature

Include the babysitter’s signature to verify the receipt is legitimate. This adds credibility to the document and confirms the services were rendered as stated.

To ensure your babysitting receipt is complete and meets requirements for an FSA (Flexible Spending Account) claim, make sure to include the following key details:

- Full Name of Babysitter: Clearly state the full legal name of the babysitter providing the service.

- Date of Service: Include the exact date(s) when the babysitting took place. If the service was provided over multiple days, list each date separately.

- Hours Worked: Specify the start and end times, as well as the total hours worked. If there were multiple time slots, break them down accordingly.

- Rate per Hour: List the hourly rate the babysitter charged. If you agreed to a flat rate, include this instead.

- Total Amount Paid: State the total amount paid for the babysitting services. This should reflect the total hours worked, multiplied by the hourly rate, or the agreed-upon flat rate.

- Service Location: Include the address where the babysitting occurred. This is important for FSA claims, as some plans require the service to be at your home.

- Payment Method: Indicate how the payment was made (e.g., check, cash, or online transfer). This helps verify the transaction if needed.

- Babysitter’s Contact Information: Provide the babysitter’s phone number or email address for any follow-up if necessary.

- Signature: If required, the babysitter’s signature can confirm the details of the service. Some receipts may also require the signature of the person receiving the service.

Optional Information

- Child’s Name(s): Some receipts may benefit from including the names of the children cared for during the service.

- Employer Identification Number (EIN): If the babysitter is considered a business entity, including their EIN can add credibility to the receipt.

FSA plans allow you to use pre-tax dollars for childcare expenses, but to qualify for reimbursement, certain requirements must be met. The care provider must be eligible, and services must be directly related to the care of your child. In general, FSA funds cover babysitting, daycare, and after-school care, as long as the care is necessary for you to work or look for work.

Eligibility of Childcare Providers

To receive FSA reimbursement, the caregiver must not be a relative under the age of 19. The provider must have a valid Taxpayer Identification Number (TIN) or Social Security Number (SSN) for tax reporting purposes. Ensure you have a receipt from the provider that includes their information, dates of service, and the total amount paid.

Qualifying Expenses

Childcare services qualify if they are required for you to work or seek employment. This includes daycare, preschool, before-and-after-school care, and summer camps. However, you cannot use FSA funds for non-work-related care, such as a family vacation or recreational programs that don’t involve work obligations.

Be sure to review your plan’s guidelines before submitting a claim. Some FSA administrators may request additional documentation, such as a statement from your employer verifying your employment status or the necessity of childcare for work purposes.

Common Errors to Avoid When Submitting Babysitting Receipts

Ensure your babysitting receipts are accurate and meet all requirements by avoiding these common mistakes:

1. Missing or Incorrect Details

Provide all necessary information such as the babysitter’s full name, the date(s) of service, the total hours worked, and the agreed hourly rate. Double-check for any misspellings or errors, especially in the babysitter’s name and your details, as they can lead to delays or rejection.

2. Unclear Payment Breakdown

Always include a clear breakdown of how the total amount was calculated. A vague receipt that just lists a lump sum can raise questions. Itemize the total hours worked and rate per hour to avoid confusion.

3. Lack of Babysitter’s Contact Information

Include the babysitter’s phone number or email address for verification purposes. Omitting this contact information may cause issues when processing the receipt for reimbursement or tax purposes.

4. Incomplete or Incorrect Tax Information

Make sure that the babysitter provides the correct tax identification number if required. If it’s necessary to include this on the receipt for FSA purposes, missing or incorrect tax info can delay approval.

5. Not Using the Correct Format

Use a proper receipt template that aligns with your FSA’s guidelines. Many FSAs prefer a detailed, itemized receipt, not just a basic one. Check for any specific formatting instructions from your provider before submission.

For your receipt to be accepted by your Flexible Spending Account (FSA), make sure it contains specific details. Include the following key elements:

1. Provider Information

Clearly state the name, address, and contact details of the babysitting service or individual. If the service is through a professional company, use the business’s full name and registration information. Avoid abbreviations or nicknames for clarity.

2. Date and Time of Service

List the exact dates and hours the babysitting service was provided. This helps FSA administrators confirm the service duration. If multiple sessions are involved, provide a breakdown for each day.

3. Service Description

Detail the babysitting services provided. For example, specify if the care was for a specific age group or if additional services (e.g., meal preparation, homework help) were included.

4. Amount Charged

Show the total charge for the service. This should reflect the agreed-upon rate for the number of hours worked. Avoid rounding off amounts or using unclear pricing structures.

5. Payment Information

If payment has already been made, note the payment method (e.g., credit card, cash, check) and the date of the transaction. FSA plans often require this to verify that the service has been paid for.

By ensuring your receipt includes all these details, you’ll help avoid delays in the approval process.

Keep detailed records of each babysitting session. This includes the date, time, and duration of the service, as well as the rate charged. You can use a simple spreadsheet or a specific app designed for expense tracking. Always request a written receipt from the babysitter that includes their name, contact details, and payment amount.

Store all receipts in an organized manner. Use physical folders or a digital folder on your phone or computer. Ensure that the receipt clearly indicates the service provided and is dated. If the babysitter doesn’t provide a formal receipt, you can create a basic document outlining the same details and have the sitter sign it for verification.

Be sure to track the total amount paid and categorize the expenses by year. This will help you manage your FSA claims effectively, especially if you are reimbursed over multiple periods. Consider adding notes about the service’s necessity (for example, medical appointments or other qualifying reasons) to avoid confusion later.

Review the FSA guidelines regularly to make sure babysitting expenses still qualify. Documentation requirements can change, so keeping your records up to date and compliant will smooth the claim process. Keep all supporting documents like bank statements or payment confirmations linked to the babysitting charges, as some FSAs might request these during the claim verification.

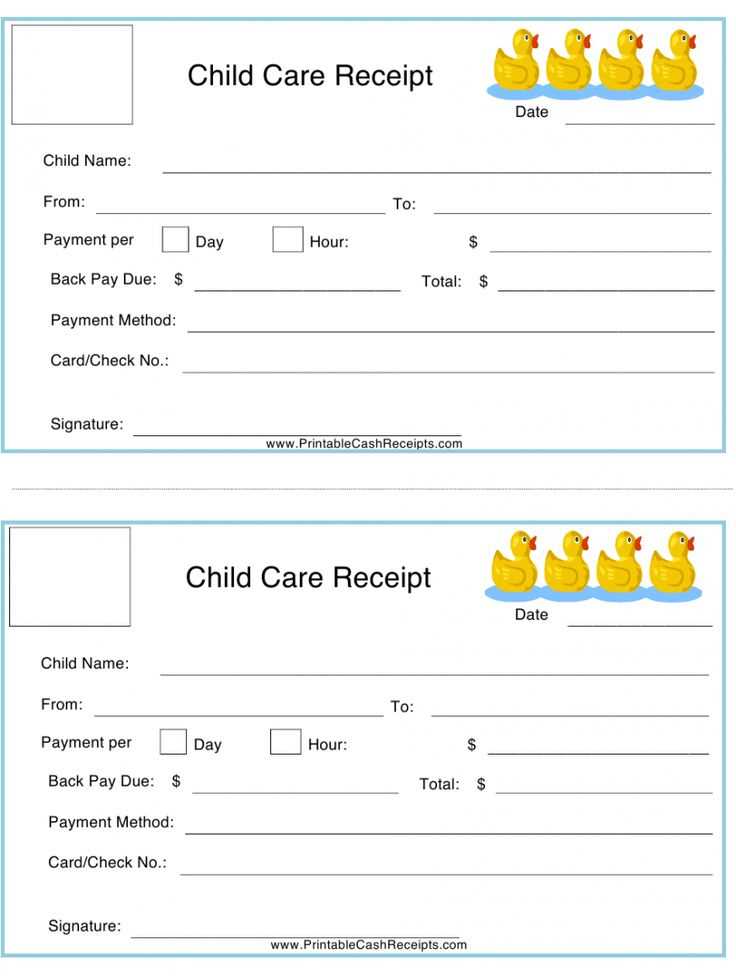

How to Format Babysitting Receipts for FSA Reimbursement

To ensure a smooth reimbursement process for babysitting expenses through your Flexible Spending Account (FSA), create a clear and professional receipt that includes all required details. Here’s what to include in your babysitting receipt:

| Item | Details |

|---|---|

| Date of Service | List the exact date(s) the babysitting service was provided. |

| Child’s Name | Include the name of the child being cared for. |

| Babysitter’s Name | Include the babysitter’s full name. |

| Service Hours | Specify the start and end time for each day of service. |

| Rate | State the hourly or flat rate for babysitting services. |

| Total Amount | Calculate the total charge for the babysitting service. |

| Signature | Have the babysitter sign the receipt to verify the information is accurate. |

Be sure to keep a copy of the receipt for your records, and submit it along with any additional required documentation when filing for FSA reimbursement. This helps ensure a smoother approval process.