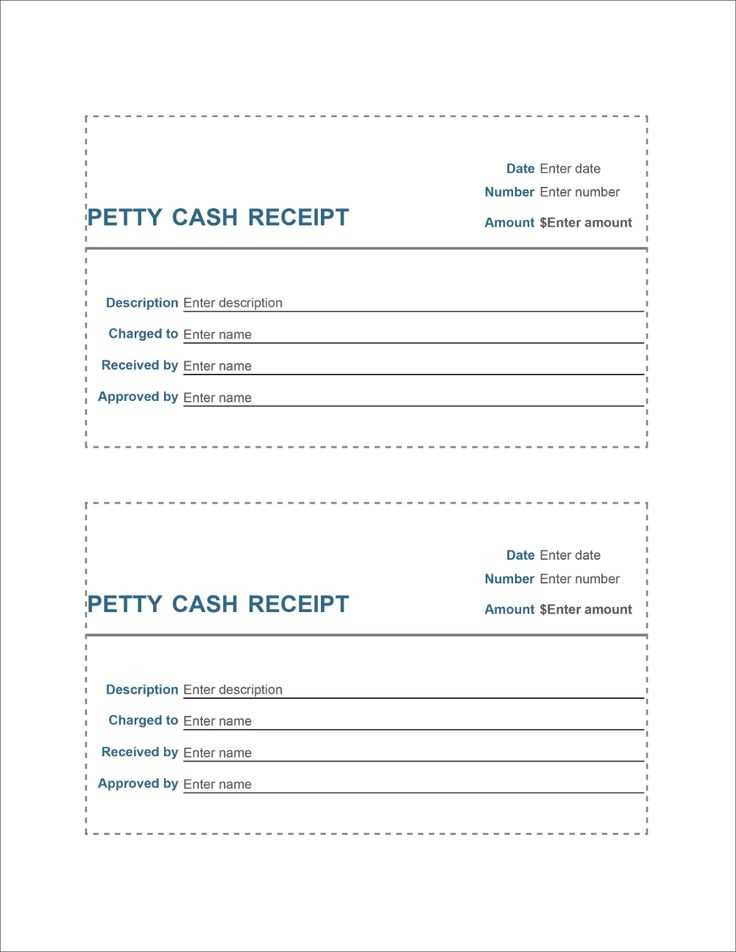

Key Elements to Include

A well-structured bakery receipt ensures clarity for customers and simplifies record-keeping. It should include:

- Business Name and Contact Information: Clearly display the bakery’s name, address, phone number, and website if available.

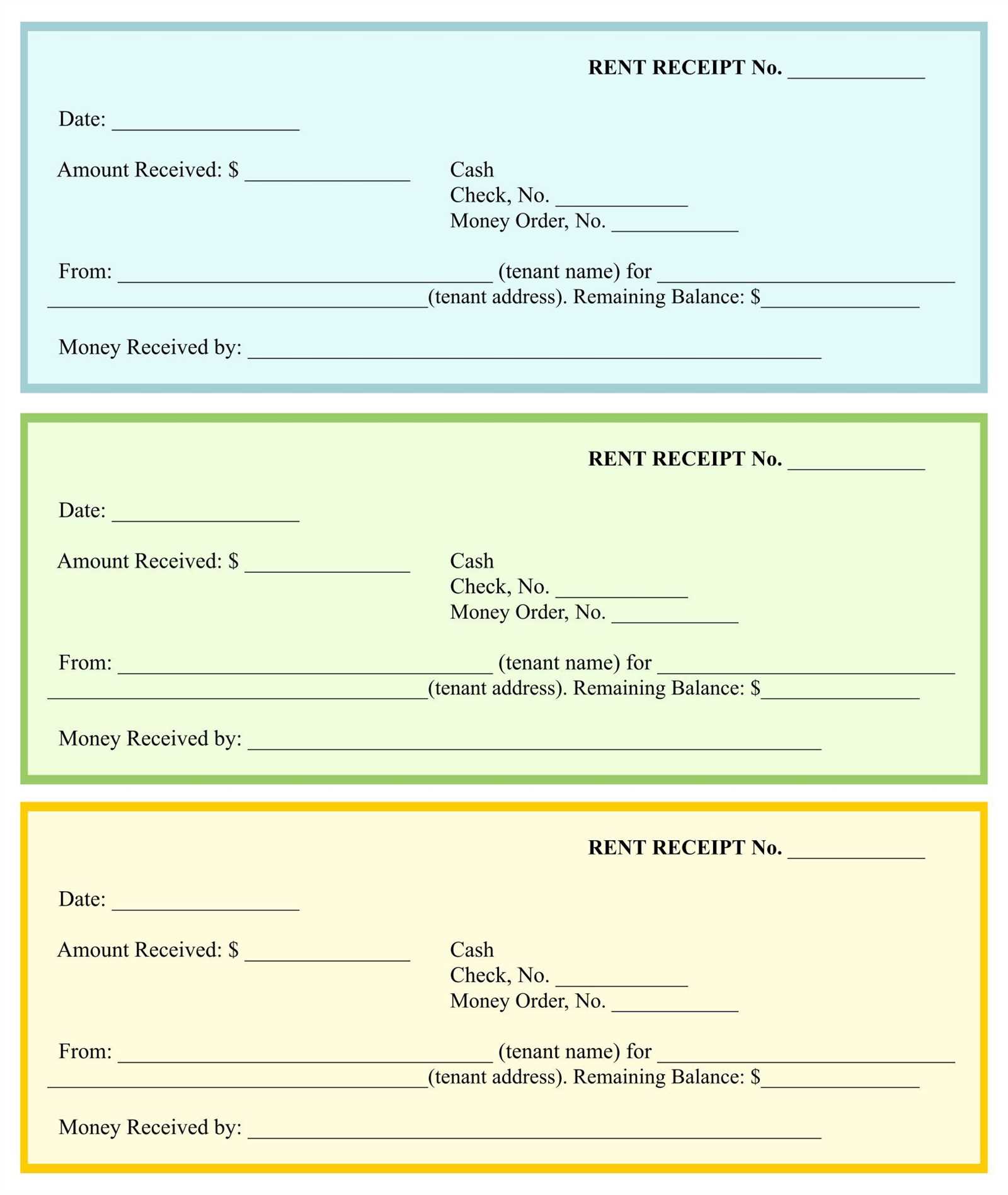

- Receipt Number and Date: A unique identifier helps track transactions and resolve discrepancies.

- Itemized List: Include product names, quantities, and prices for full transparency.

- Subtotal, Taxes, and Total: Break down costs to show how the final amount is calculated.

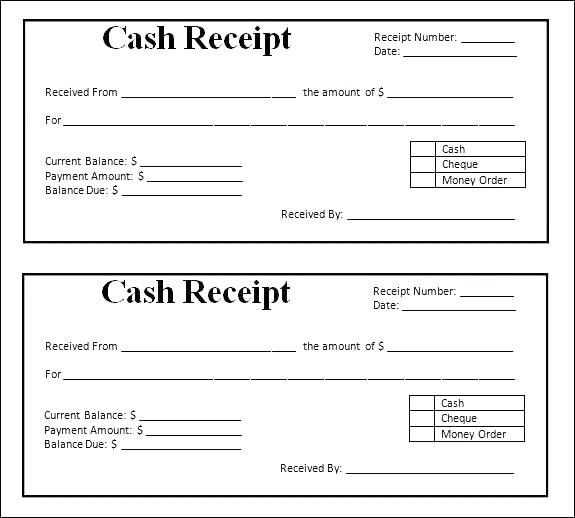

- Payment Method: Specify whether the payment was made via cash, card, or digital transaction.

Simple Layout Example

Here’s a basic text format that can be printed or generated digitally:

------------------------------------------------ Bakery Name 123 Main Street, City, ZIP (555) 123-4567 ------------------------------------------------ Date: [MM/DD/YYYY] Receipt #: [0001] ------------------------------------------------ Item Qty Price Total ------------------------------------------------ Croissant x2 $2.50 $5.00 Muffin x1 $3.00 $3.00 Coffee x1 $2.00 $2.00 ------------------------------------------------ Subtotal: $10.00 Tax (5%): $0.50 Total: $10.50 ------------------------------------------------ Payment Method: [Cash/Card] Thank you for your visit! ------------------------------------------------

Customization Options

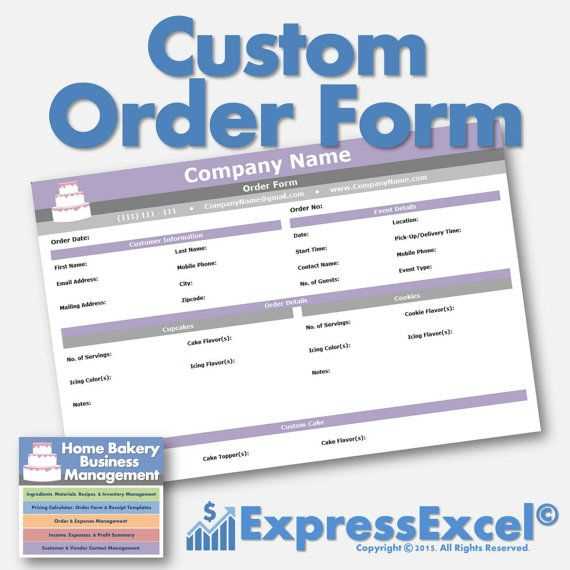

For a professional look, consider adding a bakery logo and using a receipt printer with thermal paper. Digital versions can integrate QR codes for loyalty programs or online reordering.

Software and Automation

Many point-of-sale systems can generate receipts automatically. Open-source solutions or custom templates in spreadsheet software allow for easy modifications.

Bakery Receipt Template

Essential Components of a Receipt

Selecting an Optimal Layout for Clarity

Tailoring a Receipt for Brand Identity

Legal and Tax Aspects in Formatting

Combining Digital and Paper Receipt Methods

Frequent Mistakes and Ways to Prevent Them

Include clear item descriptions with specific weights or quantities to avoid confusion. List prices next to each item, ensuring all calculations align. Use a structured format with distinct sections for subtotal, taxes, and the final amount to enhance readability.

Choose a layout that highlights key details without clutter. Align text for easy scanning, and ensure fonts are legible. Group related information logically–customer details, purchased items, and payment summary should flow naturally.

Incorporate branding by adding a logo, custom fonts, or colors that match the business identity. A well-designed header with the bakery name and contact details reinforces recognition. Keep branding subtle yet consistent across all receipt formats.

Ensure tax compliance by including required information such as VAT or sales tax rates. Clearly display business registration details if regulations mandate it. Verify that totals and tax calculations meet legal standards.

Offer both printed and digital receipts to accommodate different customer preferences. Digital formats should be easy to access and store, while printed versions must use durable, smudge-resistant paper for long-term record-keeping.

Avoid errors by double-checking numerical accuracy and ensuring item descriptions match purchases. Prevent missing details by using standardized templates. Test receipt formats on multiple devices and printers to confirm consistency.