A well-structured bank receipt voucher template simplifies financial record-keeping and ensures accuracy in transactions. Whether managing business payments or personal finances, a standardized format eliminates errors and maintains consistency.

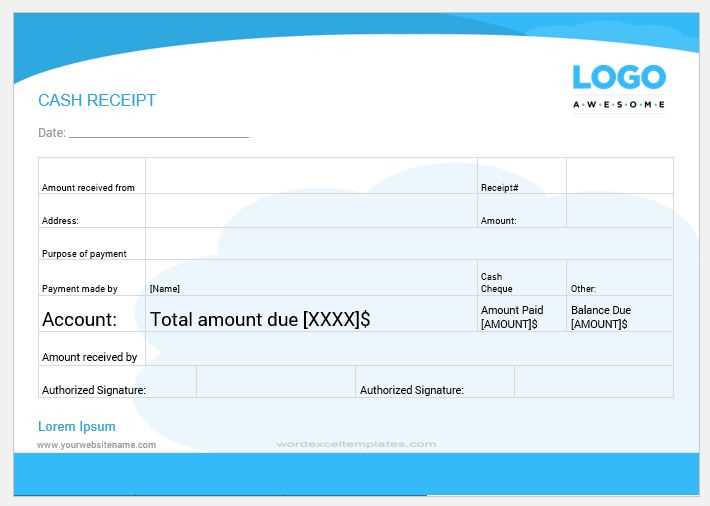

Every voucher should include essential details: date, transaction amount, payer’s and recipient’s names, payment method, and reference number. A clear layout with designated sections for signatures and remarks enhances documentation reliability.

Customizing the template to match specific needs improves efficiency. Adding company branding, tax information, or automated calculations streamlines bookkeeping and compliance processes.

Using a digital template in formats like PDF or Excel reduces manual entry and allows for quick retrieval. A well-organized system supports financial audits and improves cash flow management.

Bank Receipt Voucher Template

Use a structured format to ensure clarity and accuracy in financial records. A well-designed template should include key details to prevent errors and streamline transactions.

- Date and Reference Number: Assign a unique reference number and specify the transaction date to track receipts efficiently.

- Payer Information: Include the name, address, and contact details of the payer for proper documentation.

- Amount Received: Clearly state the amount in both figures and words to avoid misinterpretation.

- Payment Method: Indicate whether the payment was made via cash, check, or electronic transfer, along with relevant details.

- Purpose of Payment: Specify what the payment is for, such as invoice settlement or service fees, to maintain transparency.

- Authorized Signature: Add a signature field for verification and approval by an authorized person.

For digital records, save a copy in PDF format and maintain backups to ensure data security. If using printed vouchers, use pre-numbered forms to prevent duplication and loss.

Core Components of a Bank Receipt Voucher

Ensure the voucher includes the payer’s full name and contact details. This prevents errors and simplifies record-keeping.

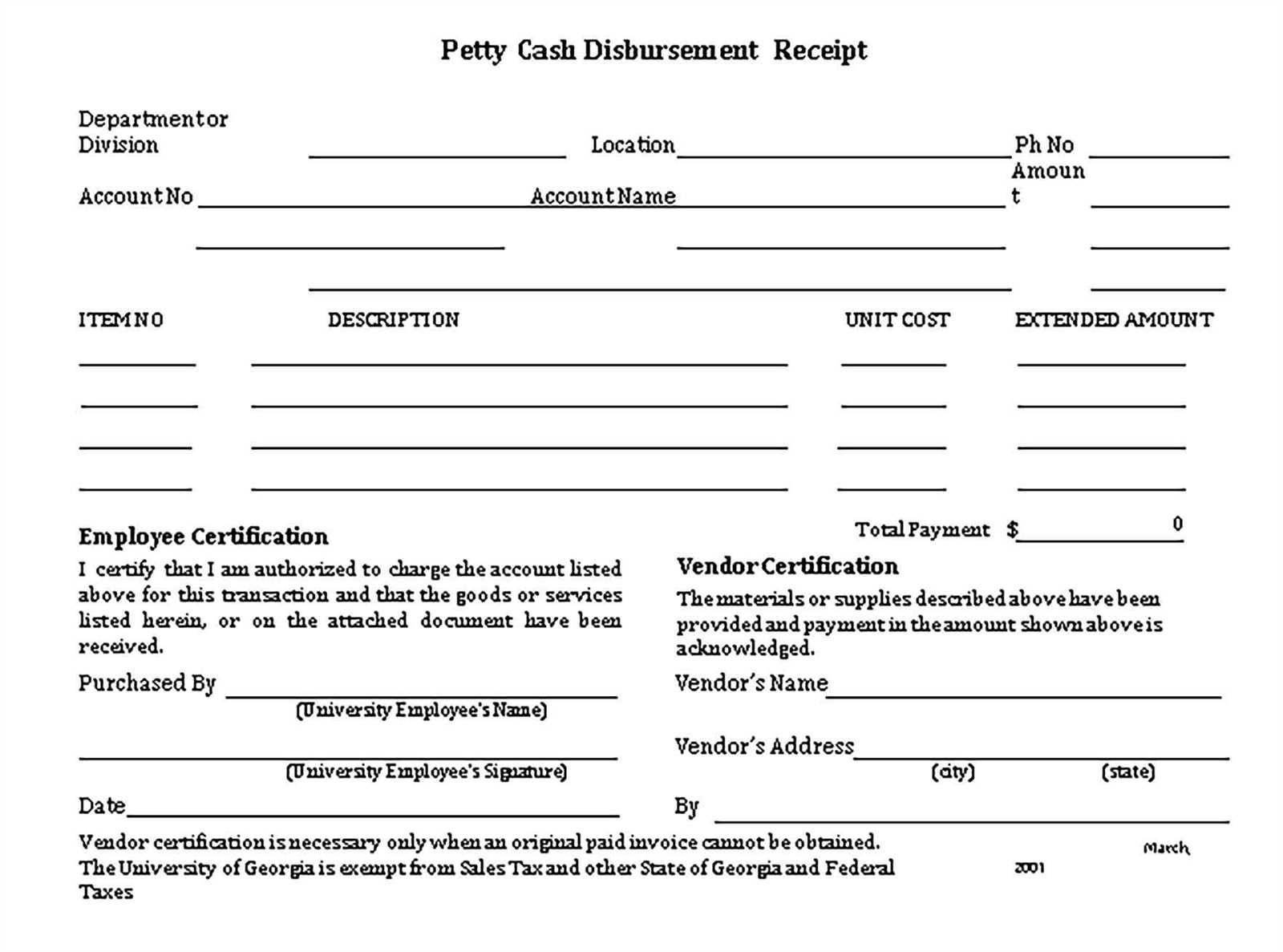

Transaction Details

Specify the date, amount, and currency of the transaction. Clearly indicate the purpose of the payment, such as loan repayment or deposit, to avoid ambiguity.

Authorization and Verification

Include an authorized signature and a unique receipt number. A bank stamp or digital confirmation enhances authenticity and ensures the document is legally valid.

Every detail should be clear and legible to maintain accuracy in financial records and facilitate smooth audits.

Steps to Personalize a Bank Receipt Template

Customize the template by adding your bank’s name, logo, and contact details at the top. Use a high-resolution logo to maintain a professional appearance. Ensure that the bank’s address, phone number, and email are clearly visible.

Adjust the Format and Layout

Modify the font style and size to match your institution’s branding. Align text elements properly, keeping key details such as transaction date, receipt number, and payer information easy to read. Ensure there is enough spacing between sections to avoid clutter.

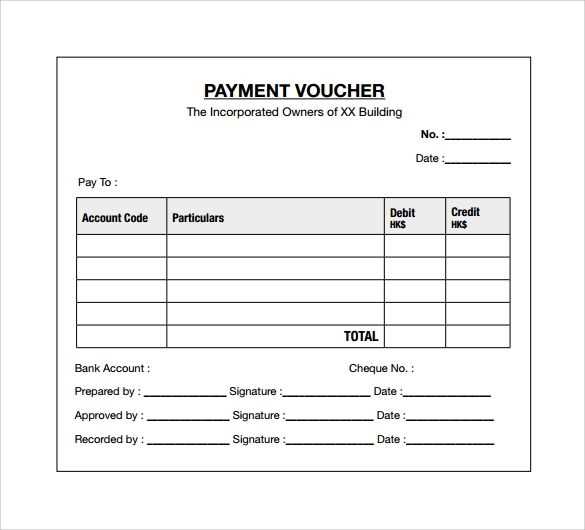

Include Custom Fields

Add fields relevant to your bank’s needs, such as transaction type, account number, or branch location. If the receipt is for a specific service, include a description field. Use dropdowns or checkboxes for predefined options if creating a digital template.

Review the final design to ensure accuracy before using the template. Save it in an editable format to allow future adjustments.

Common Issues and Solutions in Voucher Usage

Incorrect Data Entry

Ensure all fields match the original transaction details. Even a minor typo in the amount or date can cause reconciliation errors. Cross-check figures before submission, and use automated validation tools to flag inconsistencies.

Duplicate Vouchers

Track issued vouchers by assigning unique reference numbers. Implement a system that automatically detects duplicates to prevent financial discrepancies. Regularly audit voucher records to identify and resolve any redundant entries.