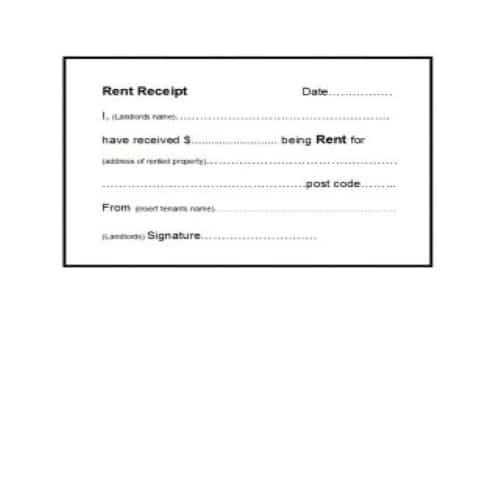

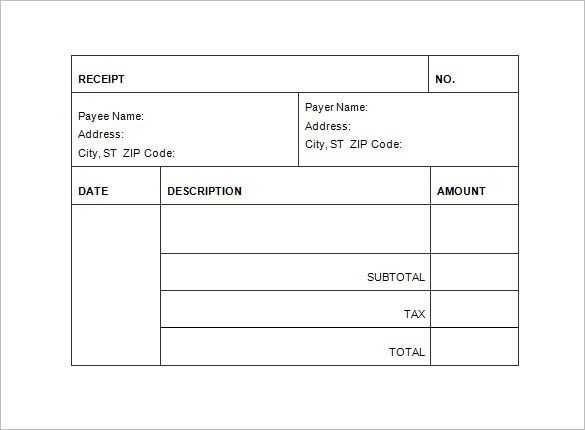

If you’re looking to create a clear and professional bill receipt, a basic template is all you need. With a few key components, you can ensure that the document conveys all necessary details to the recipient without overcomplicating things.

Start by including the business name and contact information at the top. This makes it easy for the customer to know where the receipt is coming from and how to get in touch if needed. Right below, add the date of transaction and a unique receipt number for record-keeping and reference purposes.

Next, list the itemized charges clearly. For each item or service, include a description, quantity, and price. A breakdown helps customers understand exactly what they’re paying for and avoids confusion. Don’t forget to include the total amount due at the bottom, along with applicable taxes or discounts if relevant.

End the receipt with a polite thank-you note or statement that reinforces positive customer relations. A simple “Thank you for your business!” goes a long way in leaving a good impression. With this straightforward template, you can produce professional receipts quickly, every time.

Here’s the corrected version with minimized repetitions:

To avoid unnecessary repetition, focus on streamlining your receipt template. Each section should provide unique and relevant information without redundancy. Here’s how to structure it:

- Header: Include the business name, address, and contact info. Make it concise yet clear.

- Receipt ID: A unique number or code to easily track the transaction.

- Transaction details: List the items, quantity, and price clearly. Avoid restating the same details multiple times.

- Total amount: Sum up all costs, including taxes or discounts, in one line.

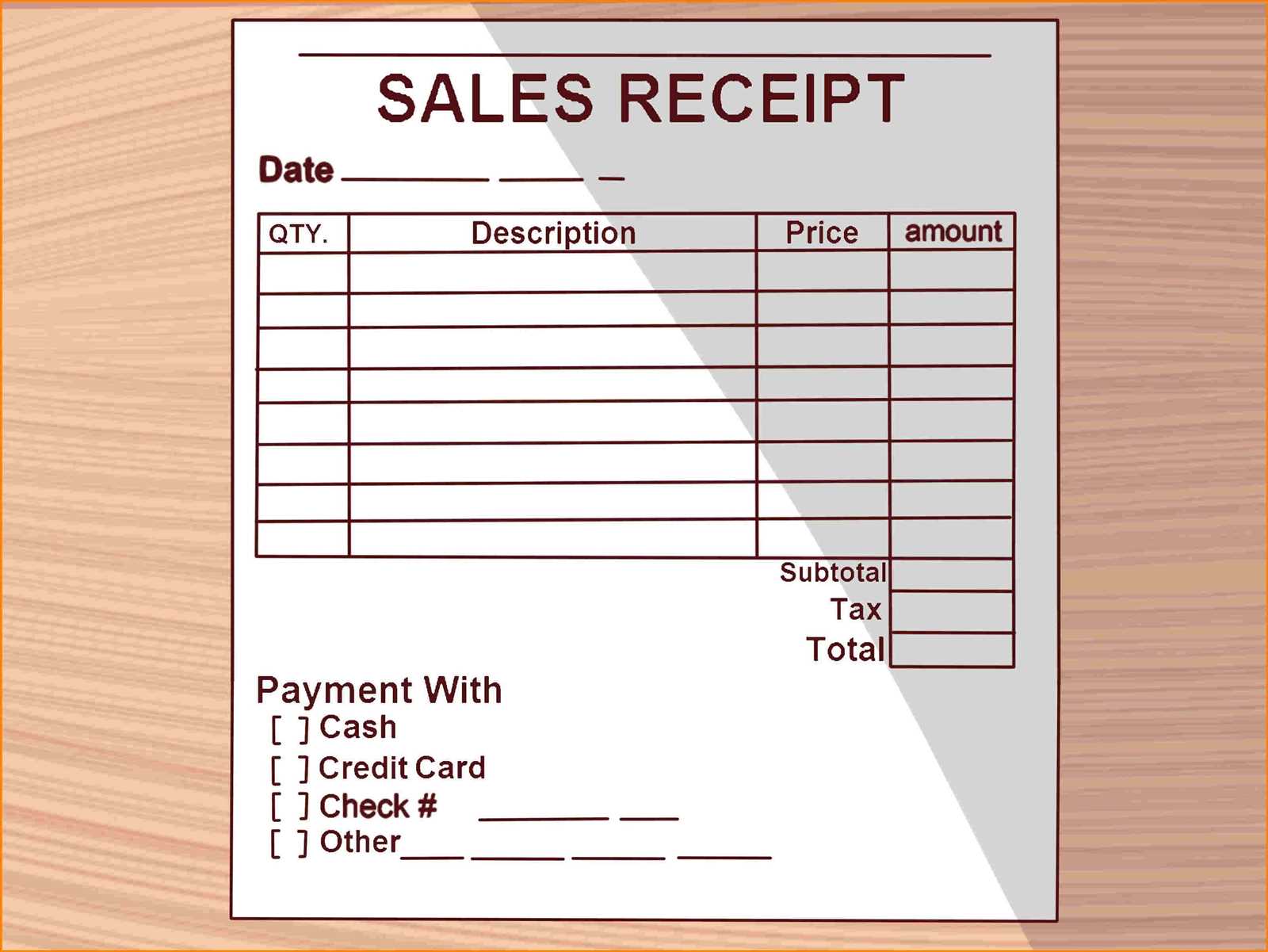

- Payment method: Clearly state how the payment was made, whether it’s cash, card, or another method.

- Date and time: Provide the exact date and time of the transaction to avoid confusion later.

Keep each section as brief and clear as possible, while ensuring that the most important details are immediately visible. Avoid repeating information such as store name, address, or payment details more than once in the same document.

For example, instead of repeating item names for every individual entry, list them in a single section and provide a total price in another. This reduces clutter and makes the receipt easier to read.

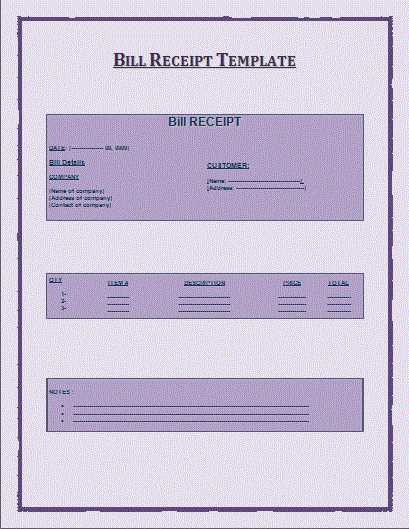

- Basic Bill Receipt Template

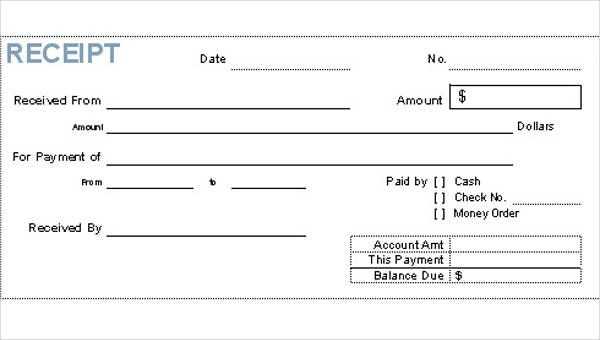

A clean and simple bill receipt template is crucial for both businesses and customers. Below is a basic example that ensures clarity and professionalism:

Key Elements

- Business Information: Include your business name, address, and contact details at the top.

- Receipt Number: A unique identifier for each transaction, which helps for record-keeping.

- Date: The exact date the transaction occurred.

- Customer Information: If applicable, include customer name and contact details.

- Itemized List: A clear list of products or services purchased, including the price for each item.

- Total Amount: The final amount due, which should include any taxes or discounts.

- Payment Method: Indicate whether the payment was made via cash, card, or another method.

- Signature: An optional field for signatures to confirm the transaction.

Template Example

---------------------------- [Business Name] [Business Address] [Business Phone/Email] Receipt No: [XXXX] Date: [MM/DD/YYYY] Customer: [Name, if applicable] Items: -------------------------------- Item Name | Quantity | Price -------------------------------- [Item 1] | [Qty] | $[Price] [Item 2] | [Qty] | $[Price] -------------------------------- Total: $[Total] Payment Method: [Cash/Card] Thank you for your purchase! ----------------------------

This basic structure ensures that all necessary details are present and easily understood. It also allows for easy customization to fit specific needs or industry standards.

Begin with a clear header containing the business name, contact information, and billing date. This immediately identifies the source of the bill and the transaction’s timeframe.

1. Include a Unique Invoice Number

Assign each bill a unique invoice number for easy tracking and reference. This number helps both the issuer and the recipient to locate and refer to the specific transaction quickly. A simple numeric or alphanumeric system works well.

2. Detail the Products or Services

List each item or service separately with a brief description. Include the quantity, unit price, and total cost for each entry. If applicable, add taxes or discounts as separate line items. Transparency is key for clarity.

Conclude with the total amount due, which should be clearly visible at the bottom. This ensures the recipient knows exactly how much to pay without needing to calculate totals themselves.

Finally, specify the payment terms–due date, accepted payment methods, and any late fees. This avoids confusion and sets clear expectations.

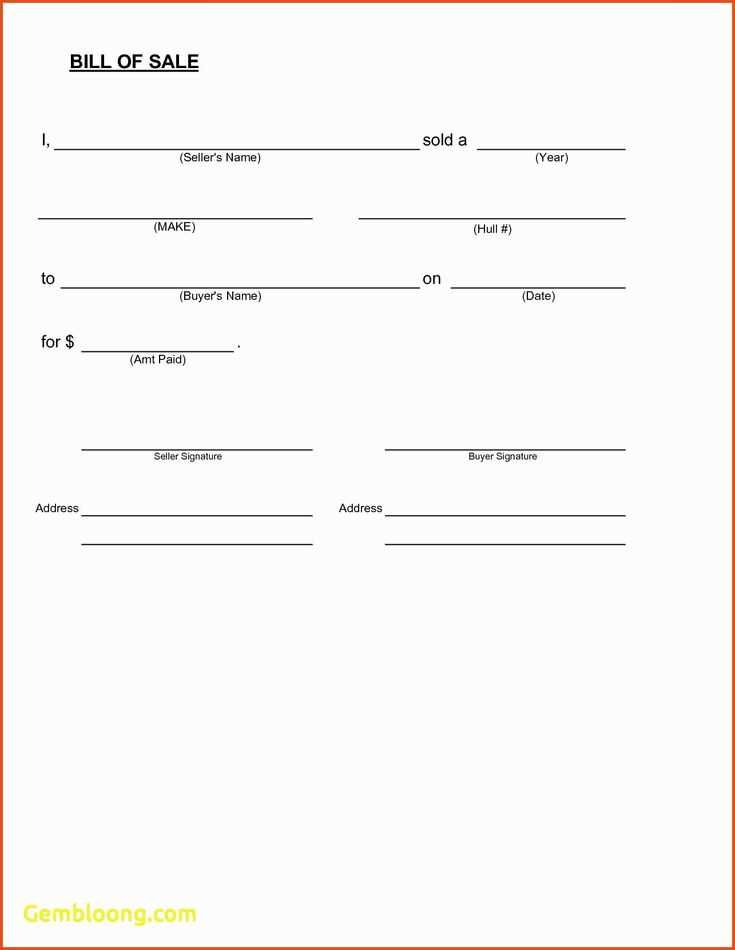

Include a clear date and time of the transaction. This helps both the seller and the buyer track and reference the purchase. Without this, it’s difficult to identify when a purchase occurred, leading to confusion.

Buyer and Seller Information should be visible. Make sure to list the names or business names of both the seller and the customer. If applicable, include contact details, especially for businesses where customers may need to reach out for follow-ups or returns.

Transaction Details

Itemized lists of products or services purchased are a must. Include each product’s name, quantity, unit price, and total price for transparency. Avoid general descriptions and be as specific as possible.

List any applicable taxes. The tax amount should be separated from the subtotal to clearly show the extra charges. This also helps the customer see how much they are being taxed for their purchase.

Payment Information

Clearly indicate the method of payment–whether it was by card, cash, check, or another method. If the payment was made by card, include the last four digits of the card number for reference.

If applicable, include a transaction ID or receipt number. This makes it easier to track the transaction in case of any issues later on.

Finally, add any return or exchange policies. A short note on how long the buyer has to return the product, and under what conditions, prevents misunderstandings and helps the buyer make informed decisions.

Adjust your receipt template based on the specific needs of your business type. A restaurant receipt might need to display more detailed item descriptions, including special instructions, while a retail store receipt may focus more on item codes, discounts, and tax breakdowns. Keep your target customer in mind to create a seamless experience.

For Service-Based Businesses

Service-based businesses, like salons or repair shops, should include a breakdown of hours worked or services performed. Clearly label the service description, hourly rate, and any additional fees. This helps customers easily understand the cost and can build trust, especially for clients who are unsure of pricing details.

For Retail Stores

Retail receipts need to be quick and efficient. Focus on product descriptions, quantities, prices, and taxes. Including the SKU or barcode number can help both you and your customers with returns or exchanges. Offer an easy-to-read format, as customers often keep these receipts for warranty purposes.

When deciding between digital and paper bill receipts, focus on convenience, cost, and sustainability. Digital receipts are easier to store and organize, reducing clutter and minimizing the need for physical space. Paper receipts, on the other hand, provide a tangible record and can be necessary in some legal or business contexts where physical documentation is required.

If you choose digital receipts, ensure they are backed up regularly and easily accessible. Many apps offer built-in features for categorizing and storing receipts, making them searchable at any time. This approach eliminates the risks associated with paper receipts fading or getting lost over time.

Paper receipts can be more difficult to manage. They often require extra time for filing, and physical space is needed for storage. However, they may be the preferred format for returns or warranty claims in certain stores. Additionally, some customers may simply prefer them as they offer a physical reminder of the transaction.

| Factor | Digital Receipt | Paper Receipt |

|---|---|---|

| Storage | Easy to store on devices or cloud | Requires physical space for storage |

| Environmental Impact | Eco-friendly, reduces paper waste | Creates paper waste, not eco-friendly |

| Access | Accessible anytime via app or email | Limited access unless stored physically |

| Legal or Warranty Claims | Can be difficult for returns in some cases | Preferred for returns and warranties in many cases |

In summary, the decision depends on your needs. If you prioritize ease of access and environmental responsibility, digital is the way to go. However, for those who prefer physical records or need them for certain legal purposes, paper receipts remain a solid option.

To apply taxes, start by calculating the tax amount based on the subtotal of the purchase. Multiply the subtotal by the applicable tax rate (e.g., 0.07 for 7%). Display the calculated tax separately, so it’s clear for the customer to see how much they’re paying in taxes.

For discounts, decide whether you want to offer a percentage-based or fixed amount discount. If it’s a percentage, calculate the discount by multiplying the subtotal by the discount rate. For fixed discounts, simply subtract the fixed amount from the subtotal. Deduct the discount from the total and clearly label it on the receipt.

If there are extra charges (e.g., shipping or service fees), simply add them to the subtotal after taxes and discounts have been applied. List these charges separately, ensuring customers understand what they’re paying for. Ensure these extra charges are labeled properly, so they’re not mistaken for taxes or discounts.

Lastly, always double-check your math to make sure all amounts are accurate. A clear breakdown of taxes, discounts, and extra charges can help maintain transparency and build trust with your customers.

Common Mistakes to Avoid When Creating a Receipt

Always double-check the accuracy of the date and time on your receipt. A simple mistake in these details can cause confusion and delays, especially for returns or warranties. Ensure the correct purchase date is recorded, along with the right transaction time.

Include all relevant details about the transaction, such as product or service description, quantity, and price. Omitting this can lead to misunderstandings or disputes. Be clear and concise in your descriptions to avoid ambiguity.

Incorrect or missing tax calculations are another frequent issue. If applicable, show taxes separately from the total price and ensure the tax rate applied is correct. This will help avoid problems with tax authorities or the customer.

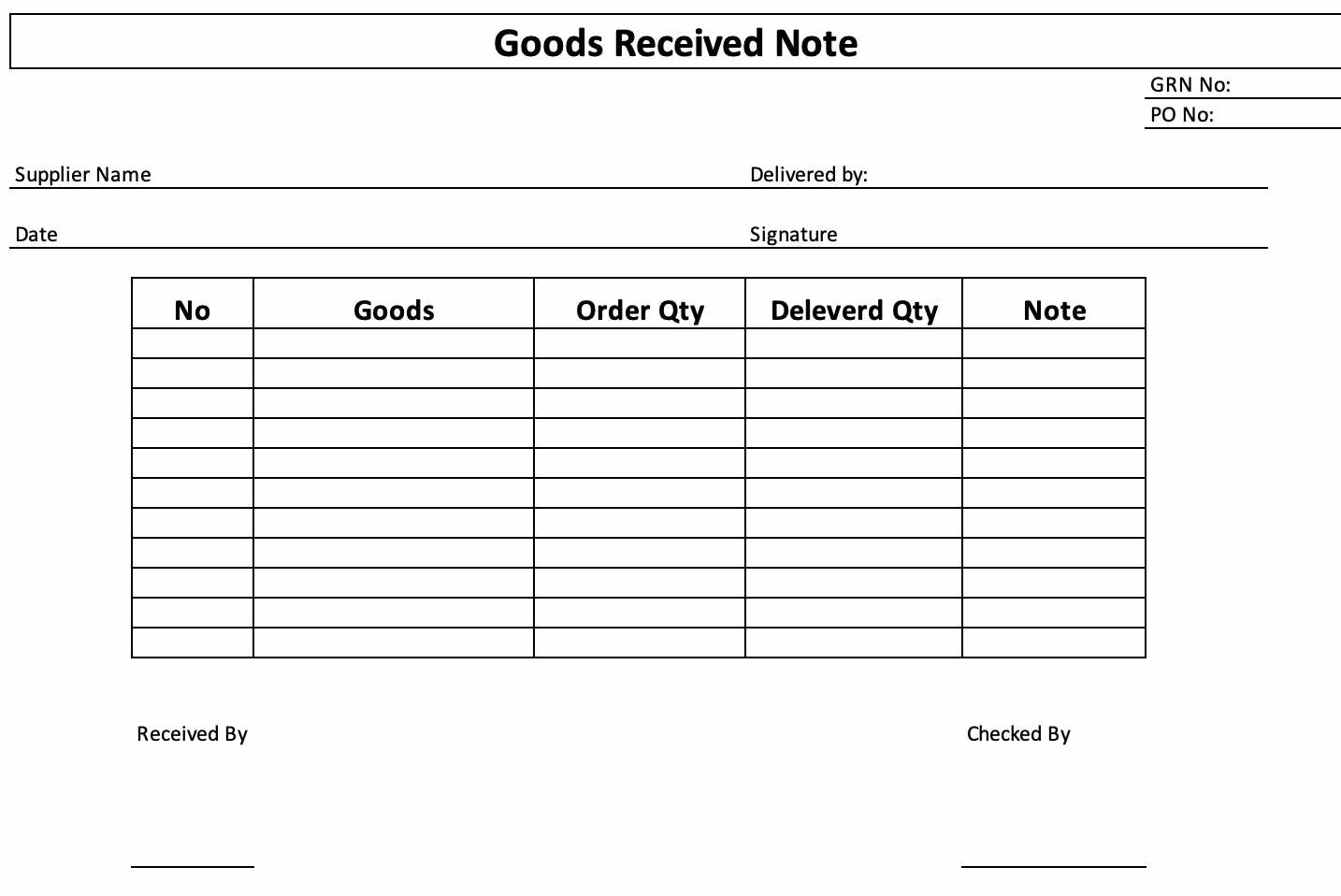

For receipts involving multiple items, provide a detailed breakdown in a table format. This is clearer and ensures the customer can see exactly what they are being charged for.

| Item | Quantity | Price | Total |

|---|---|---|---|

| Item A | 1 | $10.00 | $10.00 |

| Item B | 2 | $5.00 | $10.00 |

| Subtotal | $20.00 | ||

| Tax (10%) | $2.00 | ||

| Total | $22.00 | ||

Another mistake is forgetting to include contact information, such as the business name, address, and phone number. This is important for customers who need to contact you regarding returns, inquiries, or disputes.

Always ensure the payment method is accurately stated. For example, if the payment was made via credit card or cash, specify it clearly on the receipt. This prevents confusion, especially if there’s any issue with the payment.

Avoid cluttering the receipt with unnecessary details. Stick to the essentials: product/service, price, taxes, and payment details. Extra information can confuse the customer and make the receipt harder to read.

Finally, ensure the receipt is legible. Whether printed or digital, readability is crucial. Use a clear font and ensure the text is large enough to be easily read by the customer.

Thus, word repetitions are reduced, while maintaining meaning and accuracy.

When creating a basic bill receipt template, it’s crucial to ensure clarity and precision. One simple way to achieve this is by keeping language straightforward and avoiding redundancy.

- Focus on key details: item names, prices, and totals should stand out without unnecessary elaboration.

- For transactions with multiple items, group related items together to reduce repetition and make the receipt easier to read.

- Use clear, consistent terms for payment methods (e.g., “Credit Card” instead of variations like “payment via credit card” or “paid using a card”).

By reducing word repetition and focusing on necessary information, the receipt becomes not only easier to read but also more professional in appearance. This results in a better user experience for customers who can quickly understand the details of their purchase.

- Ensure that each section of the receipt has a clear heading (e.g., “Item List,” “Total Amount,” “Payment Method”) to help customers find relevant information easily.

- For taxes and discounts, keep the wording straightforward and avoid unnecessary elaboration, such as “tax deduction” or “discount amount,” which can be simplified to just “tax” or “discount.”