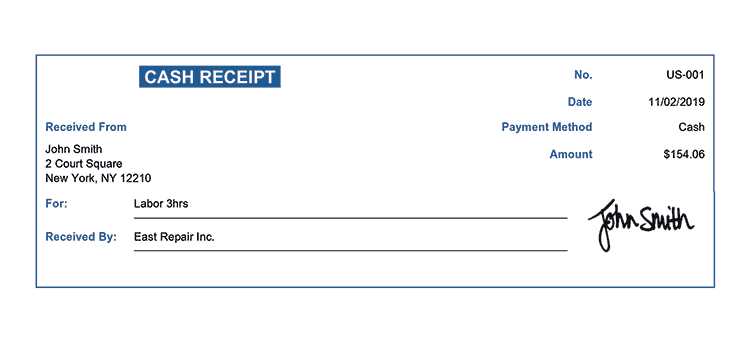

For creating a clear and professional receipt in Australia, use a simple template that includes key details. Start with the name of your business, followed by the address and contact information. Ensure the receipt includes the date of purchase and a unique receipt number for easy reference.

Next, list the items or services provided, along with their respective prices. If applicable, include GST (Goods and Services Tax) details, as this is a legal requirement in Australia. Be transparent by clearly indicating the total amount payable, including tax.

Lastly, provide payment information, such as the method used (credit card, cash, etc.), and if necessary, the last four digits of the payment card. A signature or acknowledgment field can also be added to confirm receipt. Keep the template simple, ensuring it meets legal requirements and is easy to read.

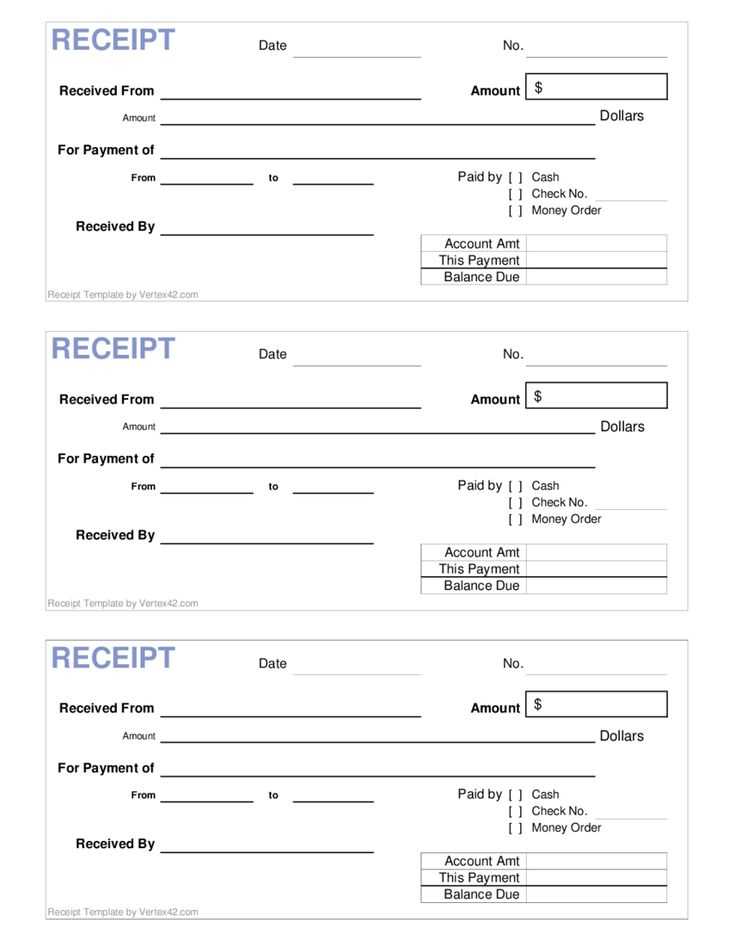

Basic Receipt Template in Australia

A basic receipt in Australia must include key details to ensure clarity and compliance. Start by including the name and contact information of your business, such as the address, phone number, and email. This gives the recipient a way to reach out if necessary.

Next, include the date of the transaction. This is essential for both record-keeping and customer reference. Specify the items or services purchased, along with the quantity and price for each. Make sure the total amount is clearly indicated, including any taxes applied.

If applicable, provide payment method details. This can be cash, credit card, or another form of payment. For businesses registered for GST (Goods and Services Tax), include your ABN (Australian Business Number) and note the GST amount separately. Lastly, ensure that the receipt has a unique identification number for tracking purposes.

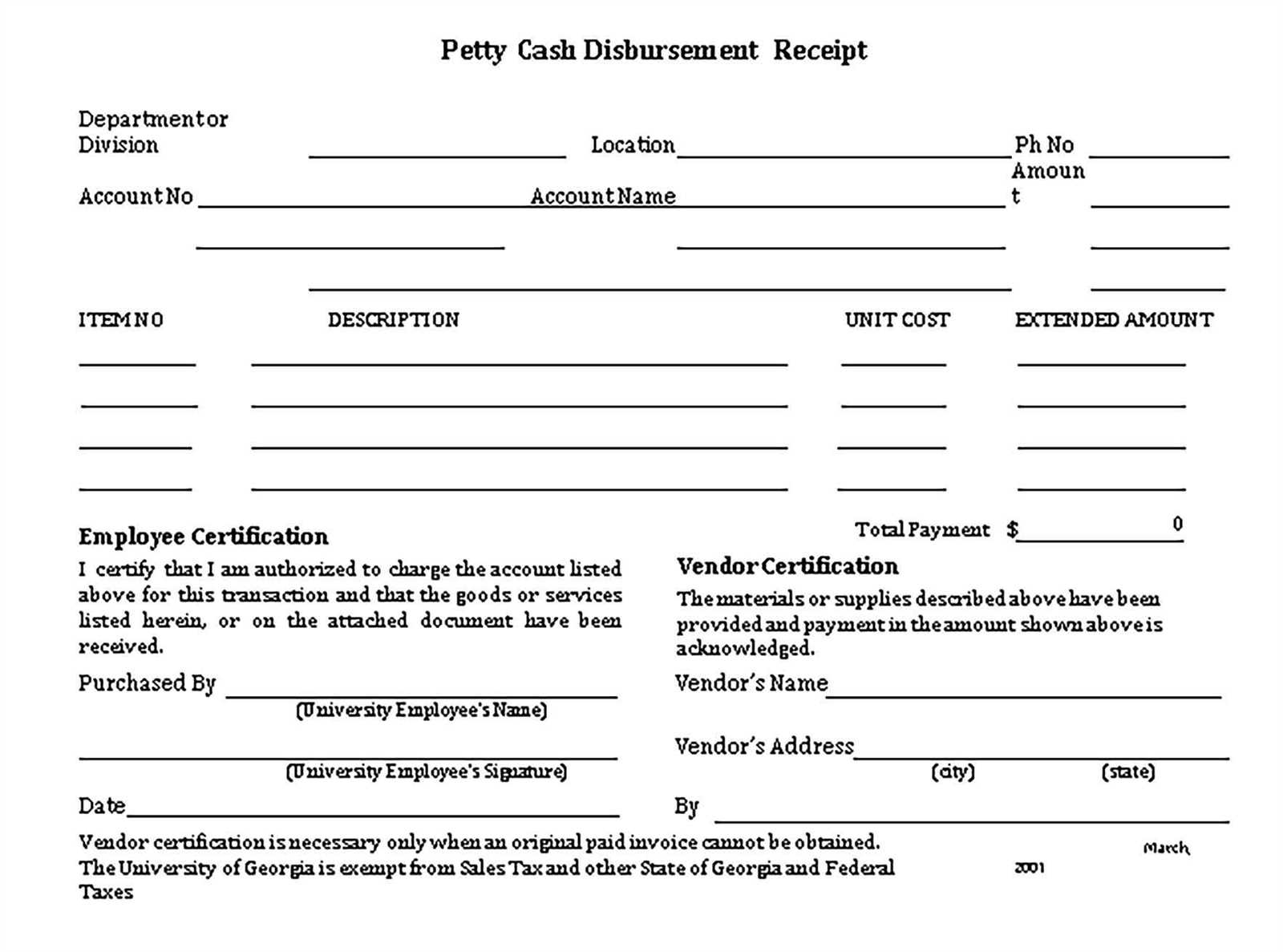

Designing a Simple Receipt Layout

Focus on clarity and simplicity. A basic receipt layout should display essential details in a straightforward manner. Follow these guidelines to create a clean and effective design.

Key Information Placement

- Store Name and Logo: Place at the top, left-aligned or centered for visibility.

- Date and Time: Position near the store details, making it easy to find.

- Item List: Clearly separate items with names, quantities, and prices. Use consistent alignment to avoid confusion.

- Total Amount: Highlight at the bottom to draw attention, making it the last thing the customer sees.

Formatting Tips

- Font Size: Use a readable size, generally between 10-12 pt, to ensure legibility.

- Spacing: Ensure enough white space between sections to avoid a cramped look.

- Line Items: Use lines or spaces to visually separate each product or service listed on the receipt.

- Text Alignment: Keep text left-aligned for item descriptions and right-aligned for pricing.

Important Information to Include on a Receipt

Clearly state the business name and contact details at the top of the receipt. This should include the company’s name, address, phone number, and email. Make sure customers can easily reach out for support or inquiries.

Transaction Details

Include the date and time of purchase. This ensures that the transaction can be tracked accurately and helps with any potential returns or disputes. Always specify the method of payment used, whether it’s cash, credit card, or any other method.

Items and Pricing

List each item or service purchased along with its price. Include the quantity, unit price, and total price for clarity. If applicable, show any discounts, taxes, or additional fees separately, so the final amount is transparent.

Don’t forget to add a unique receipt number for easy reference in case the customer needs assistance later. This helps both the customer and business maintain accurate records of transactions.

Legal Requirements for Receipts in Australia

Receipts in Australia must meet specific legal criteria to ensure their validity. The law requires that receipts include essential information for both customers and businesses. Below are the key components that must appear on every receipt issued by a business.

Key Information on Receipts

Receipts should clearly display the following details:

- Business name and address: The full name of the business and its physical or postal address.

- ABN (Australian Business Number): Businesses must include their ABN to confirm their registration with the Australian Taxation Office (ATO).

- Date and time of transaction: The date and time when the sale was made.

- Description of goods or services: A clear description of the items or services purchased, including the quantity and price.

- Total amount paid: The total sum, including applicable taxes, such as Goods and Services Tax (GST), if relevant.

GST and Tax Inclusions

For businesses registered for GST, the receipt must indicate the GST amount or a statement confirming that the price includes GST. If GST is not applicable, this must be clearly stated as well. The inclusion of GST helps customers understand how much tax they are paying on their purchase.

Failure to comply with these requirements could lead to confusion for both consumers and businesses, particularly when claiming tax deductions or making returns.