A simple and clear receipt is key for smooth transactions, whether you’re a small business owner or just need a quick way to keep track of payments. This template includes all the necessary elements to create a professional, legally acceptable receipt in the UK.

Ensure that every receipt contains the date of the transaction, the seller’s and buyer’s details, a description of the items or services purchased, the total amount paid, and any applicable taxes. Providing this information makes the receipt legally sound and avoids potential disputes in the future.

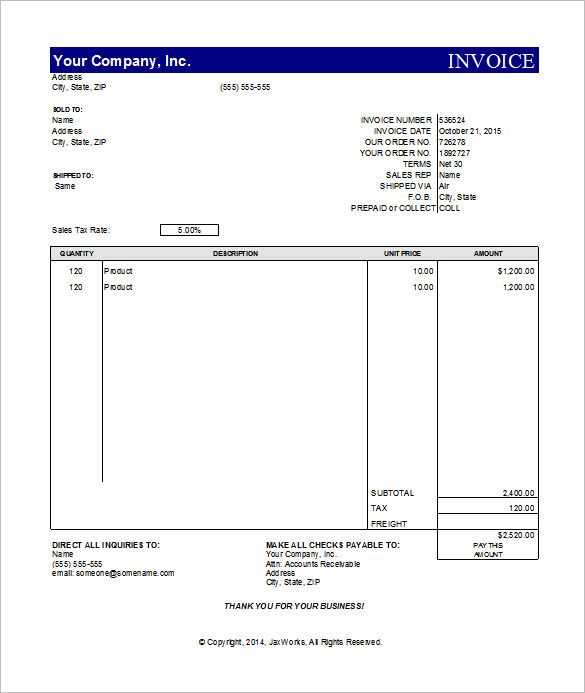

Include your business name, address, and contact details at the top of the receipt for clarity. The total amount should be clearly marked, along with a breakdown of how it was calculated, including VAT if applicable. This gives transparency to the transaction and helps customers understand their payment.

Lastly, always keep a copy of each receipt for your records. This can be done digitally or by printing the receipt out. This practice can save time and avoid complications down the line. With a basic receipt template, you ensure that your transactions are both transparent and professional.

Basic Receipt Template UK

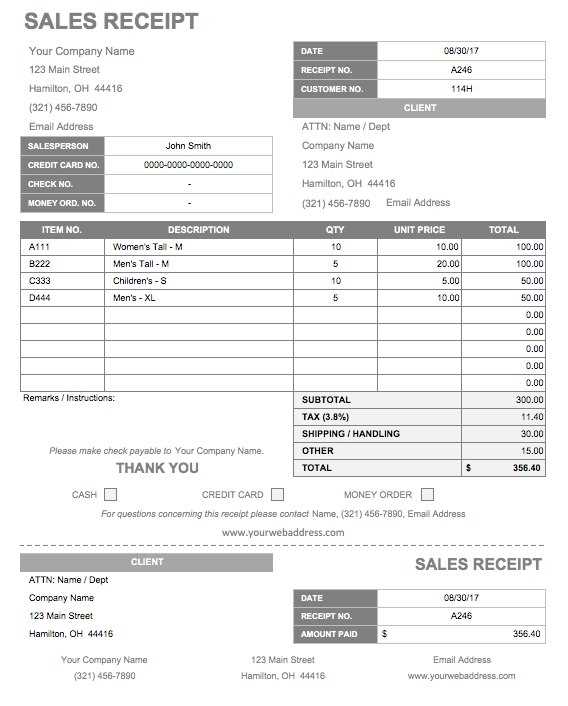

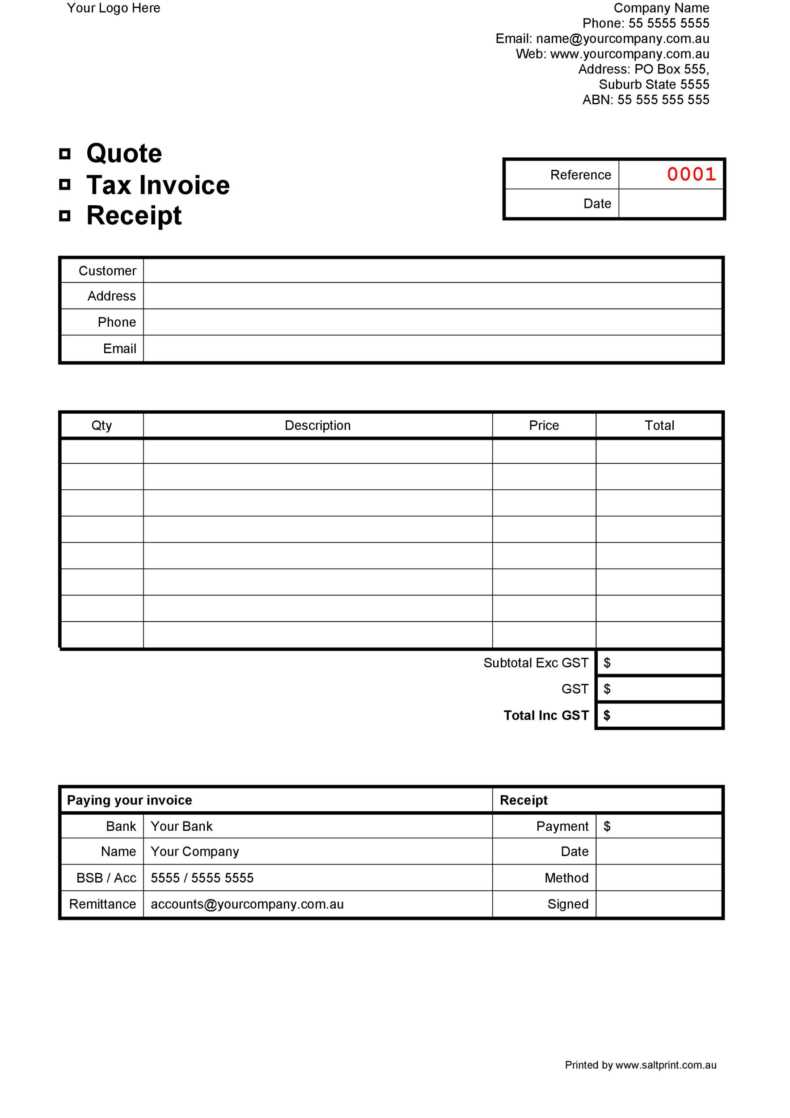

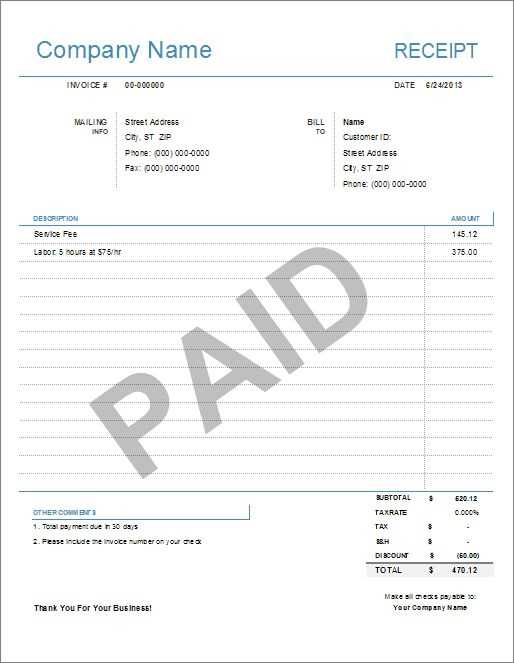

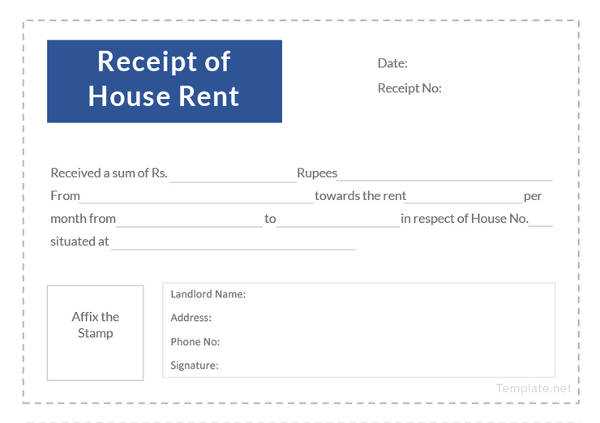

Use this basic receipt template for quick and clear documentation of transactions. Ensure it includes key information for both the buyer and the seller.

1. Seller’s Details: Include the full name or business name, address, and contact details (phone number or email). This helps identify the seller in case of any follow-up.

2. Buyer’s Details: Add the buyer’s name and address if necessary. For simple transactions, this section may be optional, but it can be useful for record-keeping.

3. Date of Transaction: Clearly state the date when the transaction took place. This is crucial for accounting and tracking purposes.

4. Description of Goods or Services: List the items sold or services provided, along with quantities and unit prices. If there are discounts or special offers, include them too.

5. Total Amount: Display the total amount paid, including tax if applicable. Ensure it is clear whether VAT is included in the price or added separately.

6. Payment Method: Specify how the payment was made (e.g., cash, card, bank transfer). If relevant, include transaction or reference numbers.

7. Signature: The receipt should be signed by the seller or an authorized representative. This adds authenticity and can serve as proof of transaction.

Keep receipts for record-keeping, tax purposes, or potential returns. A well-structured receipt helps prevent disputes and ensures both parties have a clear understanding of the transaction details.

How to Include the Necessary Information in a UK Receipt Template

Include the date of the transaction at the top of your receipt. This helps to confirm when the payment was made. Ensure the full name and contact details of the business are clearly visible, including the address and VAT registration number, if applicable. This is crucial for legal and tax purposes.

List the items or services purchased in detail. Each entry should have a description, quantity, and price. If VAT is charged, display the VAT rate for each item, as well as the total VAT amount on the receipt.

Provide a clear breakdown of the total amount paid, including any discounts or refunds applied. The total should be prominently displayed at the end of the receipt.

Always include a unique receipt or transaction number. This helps with tracking and provides a reference for both the customer and the business. Lastly, add any terms or conditions related to returns, exchanges, or warranties, as required by law.

Designing a Clear and Professional Layout for UK Receipts

Keep the layout straightforward with clear sections. Start with your business name, address, and contact details at the top. This ensures customers can quickly identify where the receipt is from.

Organise Key Information

Group information logically: Include the date, transaction details, and payment method in separate sections. Use a consistent font size and alignment to improve readability.

Use Clear Item Descriptions

For each item listed, provide a concise description with quantities, unit prices, and total costs. Avoid clutter by keeping the text simple and aligning numbers for easy scanning.

Ensure the total amount is bold and placed at the bottom, standing out from the rest of the receipt. This helps customers quickly see the total cost of their purchase.

Leave space for additional details, like VAT or discounts, but avoid cramming too much information into one area. Clear spacing guides the eye and prevents overwhelming the reader.

Lastly, include your business registration number or VAT number if applicable, for transparency and compliance with UK regulations.

How to Customize a UK Receipt Template for Different Transactions

Customize your UK receipt template by adjusting the fields to match the transaction type. Here’s how to tailor it to common transactions:

For Retail Sales

- Include itemized details: List each product with its price, quantity, and subtotal.

- Add VAT: Ensure the VAT amount is clearly displayed, especially if you’re registered for VAT.

- Payment method: Specify whether the payment was made by cash, card, or other methods.

- Return policy: Include any relevant return or exchange policy for the item(s) sold.

For Service-Based Transactions

- Describe the service: Outline the service provided, including hours or specifics of the job.

- Hourly rate: If applicable, include the hourly rate and the total hours worked.

- VAT breakdown: Ensure VAT is clearly separated if it applies to the service charge.

- Incorporate deposit details: If a deposit was paid in advance, state the remaining balance due.

By adjusting these fields according to the transaction type, your receipt will reflect the nature of the exchange and remain clear for both parties. Make sure all necessary details, such as business information and legal requirements, are included on each receipt, regardless of transaction type.