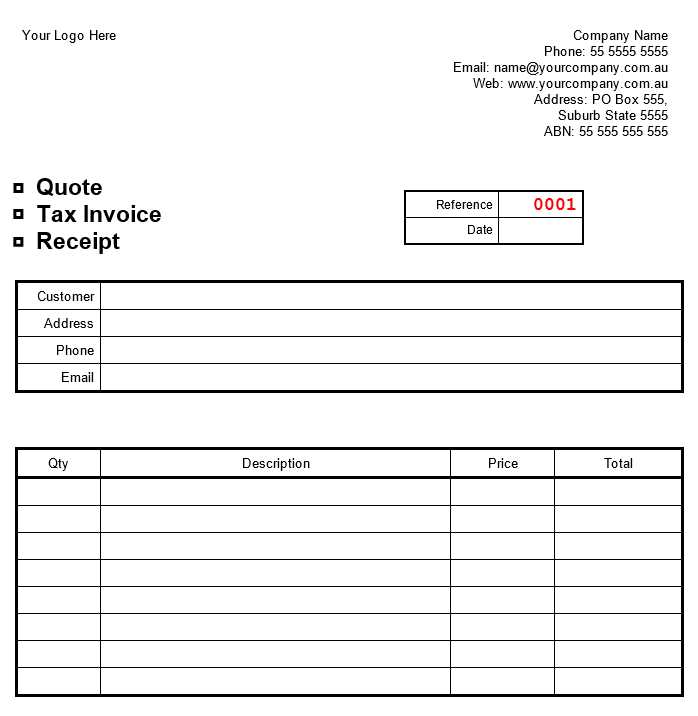

A beneficiary receipt template in the UK simplifies the process of acknowledging the receipt of funds or assets, especially after a person has passed away. This template ensures transparency and provides clear documentation for both beneficiaries and executors. Use a standard template to avoid confusion and ensure that all details are correctly captured.

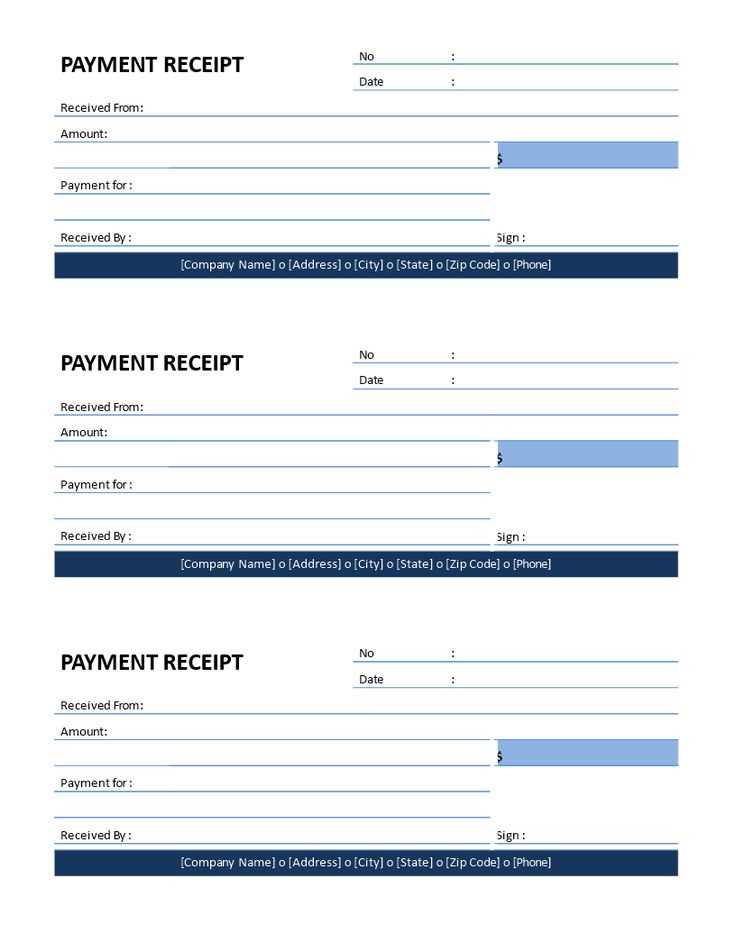

Make sure the template includes the full name of the beneficiary, the amount or value of the assets received, and the date of receipt. It should also include any reference to the specific will or legal documents if applicable. The signature of the beneficiary confirms their acknowledgment and acceptance of the inheritance.

Including the executor’s details and contact information is useful in case of any follow-up or questions. If multiple beneficiaries are involved, consider creating individual receipts for each. This small step can prevent misunderstandings and clarify any potential disputes down the line.

For legal purposes, ensure that the template adheres to UK inheritance law and includes all necessary elements. Consult a legal professional if you have specific requirements or concerns about the document’s validity.

Here are the corrected lines:

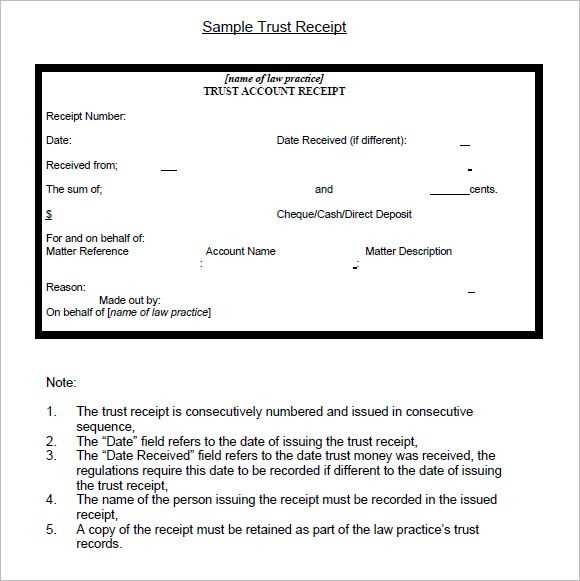

The beneficiary receipt template should include the following details:

- Full name of the beneficiary: Ensure the name is correctly spelled and includes any middle names or initials.

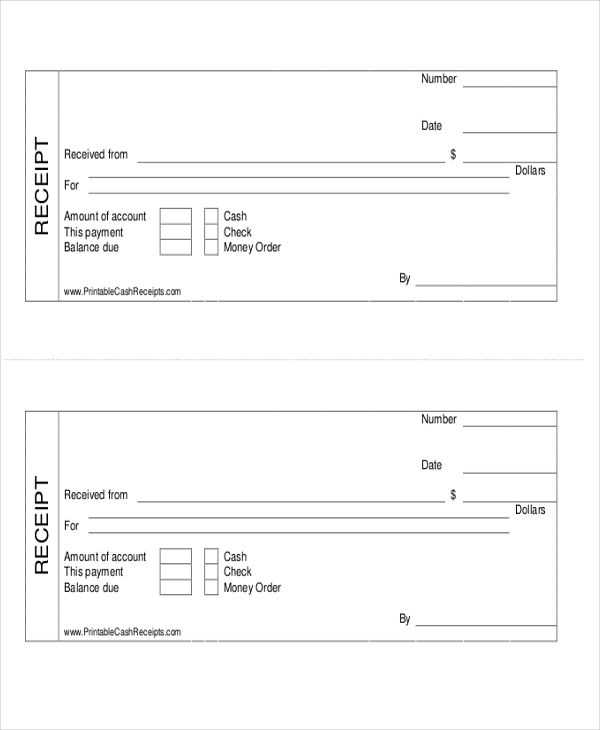

- Amount received: Clearly state the exact amount received in both words and figures.

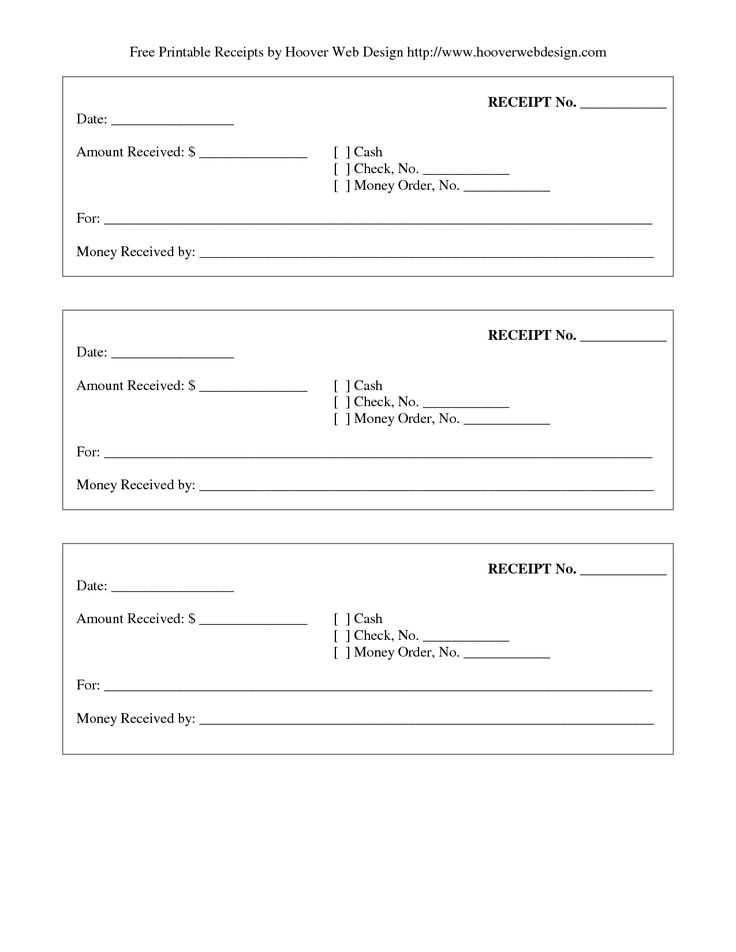

- Date of receipt: Include the precise date when the payment or gift was received.

- Payment method: Indicate how the payment was made (e.g., cheque, bank transfer, cash).

- Signature of the recipient: The beneficiary should sign the receipt to confirm the transaction.

- Details of the giver: If applicable, include the name and contact information of the person giving the payment or gift.

Make sure the template is clear and easy to understand to avoid any confusion later on. Keep the language concise and direct, and always double-check for accuracy.

- Beneficiary Receipt Template UK

For accurate record-keeping, a Beneficiary Receipt Template is crucial when a beneficiary receives funds or property. This document serves as proof of the transaction and should include key details such as the amount received, the date, and the names of both the giver and the recipient.

The following elements should be present in the receipt template:

- Beneficiary’s Full Name: Clearly state the full legal name of the beneficiary.

- Amount Received: Specify the exact amount received, including currency if applicable (e.g., GBP).

- Date of Receipt: Include the precise date the payment or property transfer occurred.

- Details of the Gift or Payment: Outline the nature of the transaction, whether it’s money, assets, or other property.

- Signature of the Beneficiary: The beneficiary should sign the document to confirm the receipt.

- Donor’s Details: Include the name and contact information of the person making the gift or payment.

- Witness Information (Optional): If applicable, have a neutral third party witness the transaction and sign.

Once completed, both the giver and the beneficiary should retain a copy for their records. The document may be necessary for legal or tax purposes, so ensure all details are correct and legible. Templates can be customized to suit specific needs, but these basic components are always required for clarity and legality.

To create a beneficiary receipt for inheritance in the UK, start by confirming the details of the inheritance received, including the amount, type of asset, and the date it was received. This receipt should be in writing and must include clear identification of both the beneficiary and the deceased, including their full names and addresses. Specify the relationship to the deceased, whether the beneficiary is a family member or other individual.

Next, list the exact items or amounts being inherited. If the inheritance includes money, state the exact sum received. For physical assets, describe them in detail, including any distinguishing features that ensure proper identification.

Ensure that the document is signed and dated by the beneficiary. A statement confirming the beneficiary’s receipt of the inheritance, and that no further claims will be made against the estate for that particular inheritance, is crucial. You may also want to include a section acknowledging any taxes or debts settled from the estate.

After completing the receipt, keep a copy for personal records and send the original to the executor or administrator of the estate for their files. The executor should also keep a record of all receipts from beneficiaries as part of the estate’s administration.

To ensure a beneficiary receipt is valid under UK law, the document must meet several key criteria. These elements are crucial for confirming the beneficiary’s entitlement and the proper transfer of assets.

1. Clear Identification of the Beneficiary

The receipt must clearly identify the beneficiary by full name. Any ambiguity in the identity of the recipient can lead to complications or disputes. If the beneficiary is a company, their official registered name and company number should be included.

2. Accurate Details of the Transfer

The document must specify the exact assets or funds being received. This includes a clear description of the item(s) or sum of money, as well as any associated reference numbers, account details, or asset IDs, if applicable.

3. Signature and Acknowledgement

The beneficiary must sign the receipt to acknowledge the transfer. This signature confirms their acceptance of the terms and the received assets. In the case of a corporation or trust, an authorised signatory’s name and position must be included.

4. Date of Receipt

Including the date of receipt is crucial to establish when the transaction occurred. This can prevent confusion, especially if disputes arise about the timing of the transfer or the beneficiary’s entitlement.

5. Clear Reference to the Will or Trust

If the receipt is connected to a will or trust, a reference to the specific document should be included. This helps clarify the legal basis of the beneficiary’s entitlement, particularly in cases where the distribution follows specific instructions or conditions outlined in these legal documents.

Double-check the recipient’s name. Ensure it matches the official records to avoid discrepancies that might cause issues during claims or verification. Always use the full name as registered, without abbreviations or nicknames.

Incorrect Date or Amount

Confirm the date and total amount are accurate. A simple typo in the date or amount can lead to complications when processing or verifying the receipt. Verify these details before finalizing the document.

Missing Contact Information

Include clear and complete contact information for both the payer and payee. This may seem like a small detail, but it can help resolve disputes and ensure the receipt’s validity if needed.

Don’t forget to check for any required signatures. A missing signature could invalidate the receipt. Always have both parties sign it to confirm the transaction details.

Finally, be mindful of any legal requirements specific to the type of receipt you’re issuing. For example, some receipts might need to include VAT numbers or specific wording to comply with tax laws.

To create a clear and concise beneficiary receipt template in the UK, include the following key elements: the full name of the beneficiary, their address, the amount received, and the date of receipt. Clearly state the purpose of the payment and reference any related documents or agreements that justify the transaction. Ensure that the receipt is signed by both the payer and the beneficiary to confirm the transaction has been completed. If applicable, include payment method details (e.g., bank transfer or cheque) for record-keeping purposes.

Keep the format simple and easy to understand. You may also want to provide space for any additional notes or conditions that may apply to the receipt. This will make it easier to refer back to the transaction in the future, especially for legal or financial purposes.