Clear and structured travel and expense policies prevent financial misunderstandings and simplify reimbursements. A well-designed template ensures consistency in reporting, reduces administrative workload, and keeps expense tracking transparent. Whether you manage a small business or oversee corporate finances, a standardized approach minimizes errors and speeds up approvals.

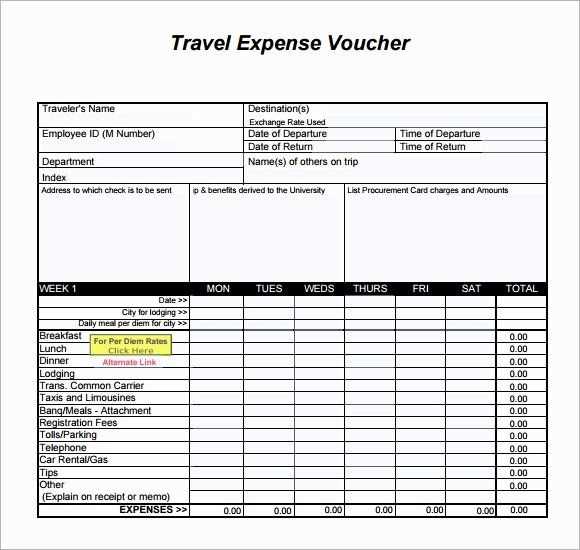

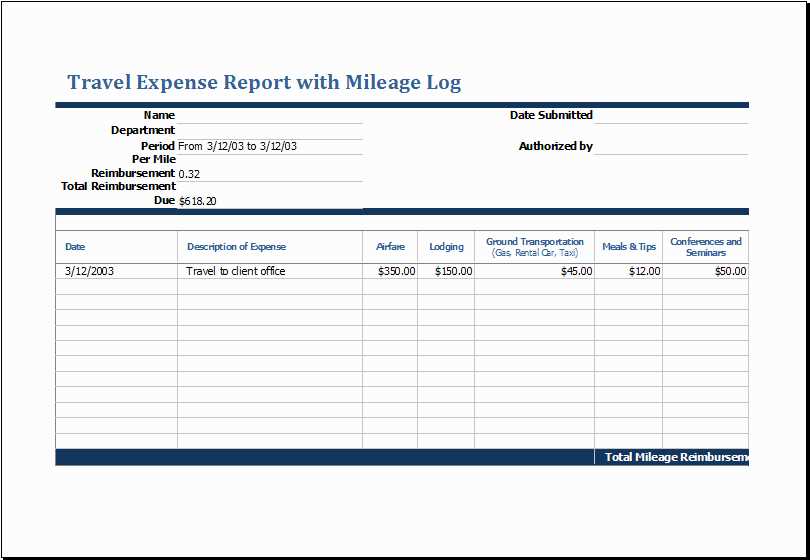

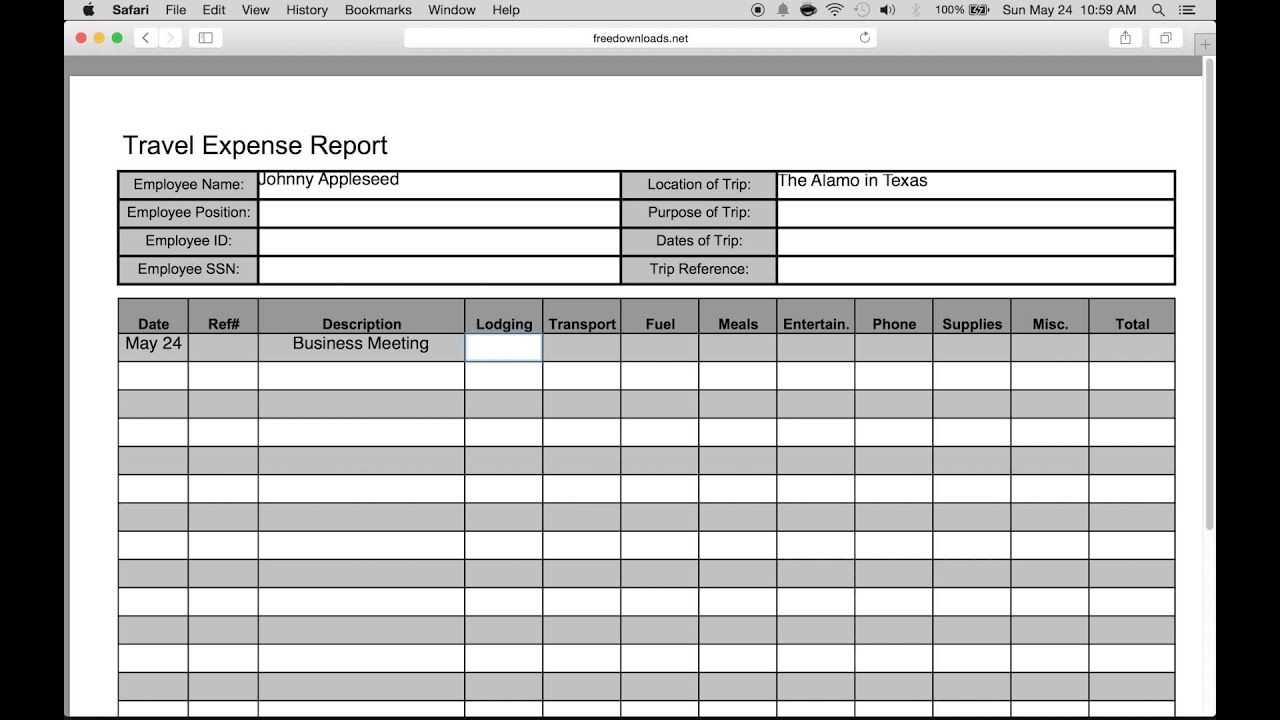

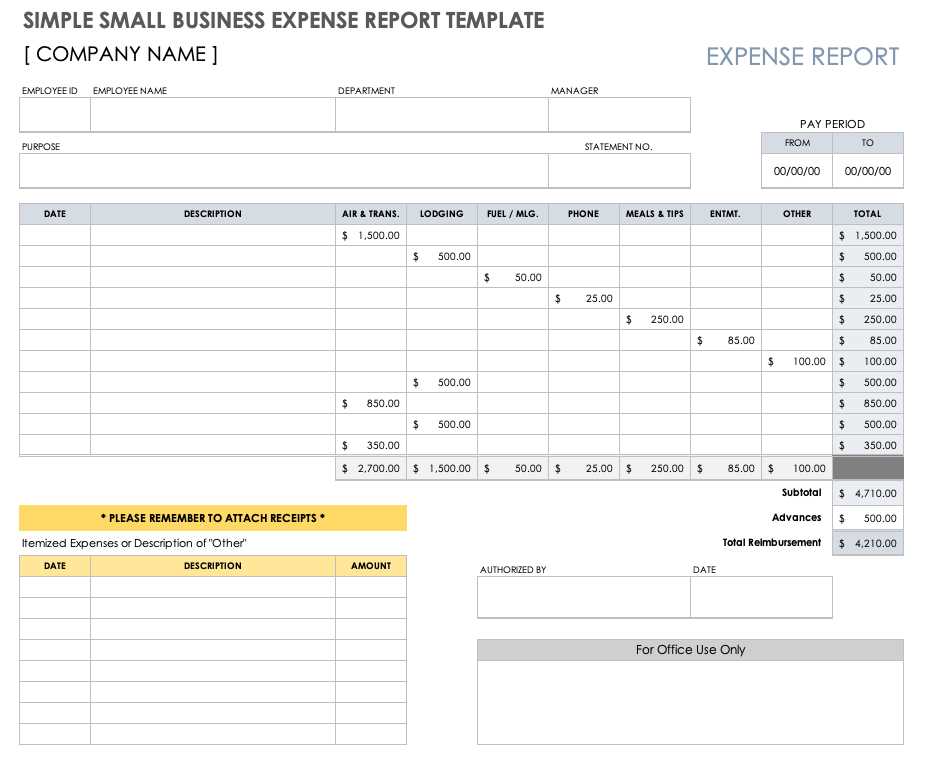

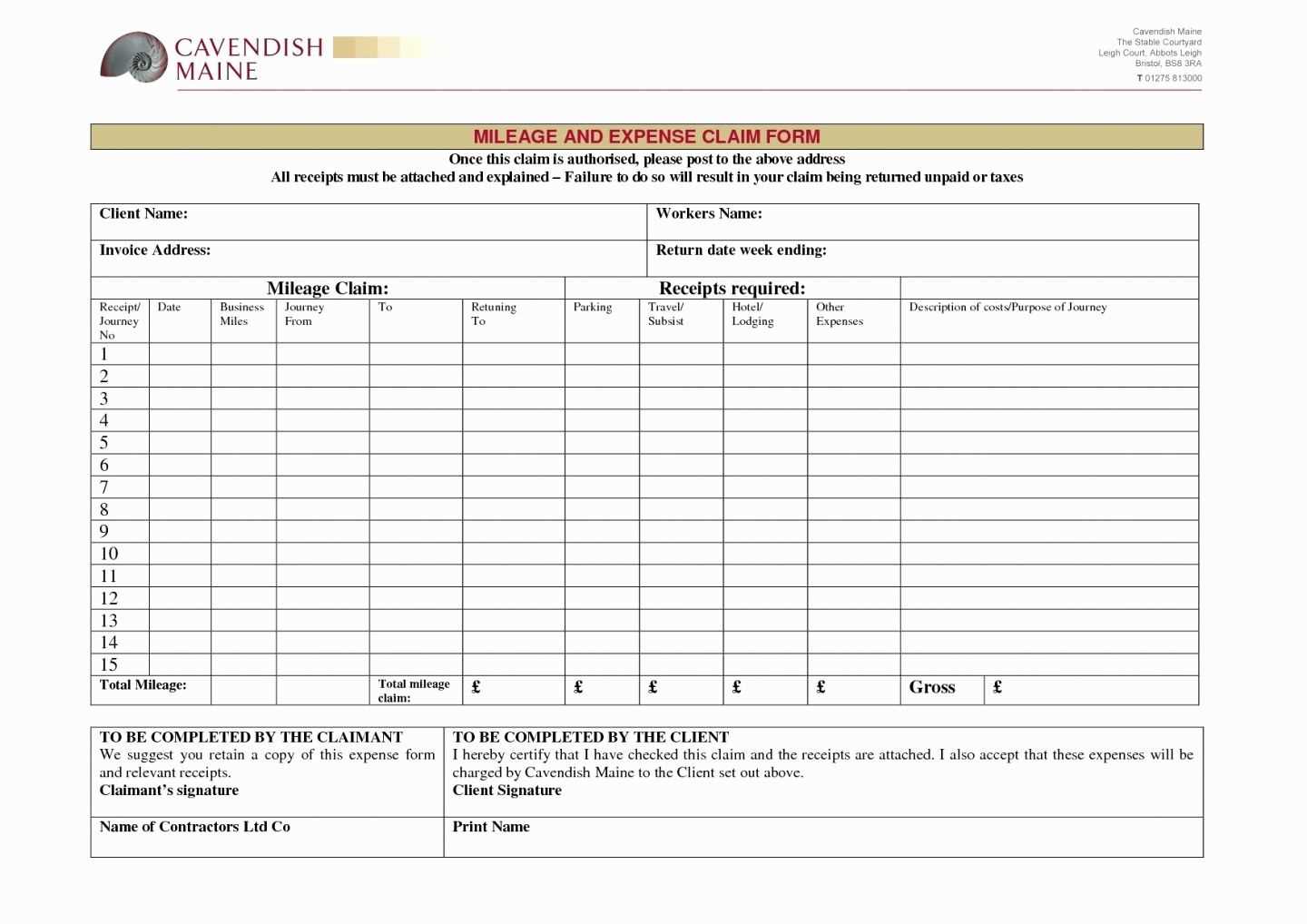

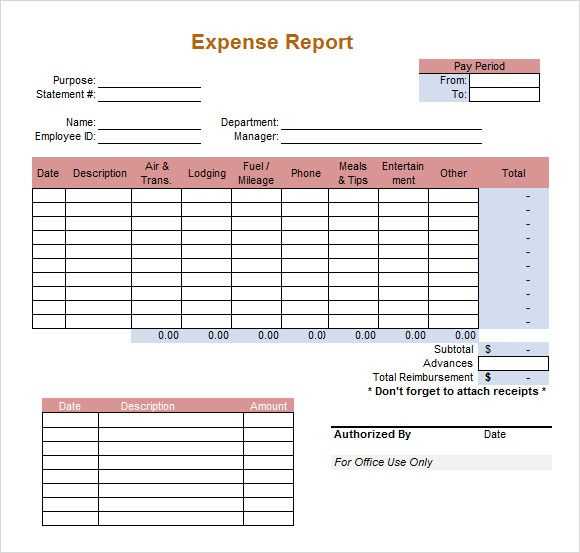

A complete template should include categories for transportation, accommodation, meals, and incidental expenses. Define spending limits, specify required receipts, and outline the approval process. Digital receipt submissions save time, while mandatory fields for vendor names, dates, and amounts ensure accuracy. Adding pre-approved per diem rates further simplifies reporting.

For seamless reimbursement, integrate policy templates with expense management software. Automated calculations, mobile receipt uploads, and real-time expense tracking improve compliance and reduce processing delays. Providing employees with clear guidelines on allowable expenses and submission deadlines eliminates confusion and keeps financial records in order.

Best Travel and Expense Policy Templates Receipts

Choose a template that clearly defines expense categories, reimbursement limits, and required documentation. A well-structured policy eliminates confusion and ensures compliance.

Key Elements of a Strong Receipt Policy

- Mandatory Fields: Require date, vendor name, itemized costs, and payment method.

- Digital Submission: Allow scanned or photographed receipts to streamline processing.

- Retention Period: Specify how long employees must keep original receipts.

- Approval Workflow: Outline who reviews and authorizes reimbursements.

Recommended Policy Templates

- Basic Template: Ideal for small teams, covering per diems, mileage, and lodging with minimal paperwork.

- Corporate Standard: Includes detailed approval processes, spending limits, and compliance requirements.

- Automated System Integration: Designed for companies using expense tracking software, allowing direct uploads and real-time approvals.

Ensure employees understand the policy by providing a simple guide alongside the template. Clear instructions reduce errors and speed up reimbursements.

Key Elements to Include in a Travel Expense Policy

Set clear spending limits for flights, hotels, meals, and ground transportation. Specify preferred vendors and booking platforms to streamline approvals and ensure cost control.

- Receipt Requirements: Define which expenses require receipts and the necessary details, such as date, amount, vendor name, and business purpose.

- Reimbursement Timeline: Outline the deadline for submitting expenses and the expected processing time for reimbursements.

- Per Diem Rates: Establish daily allowances for meals and incidentals, adjusting rates based on location and trip duration.

- Expense Categories: List reimbursable and non-reimbursable expenses, including guidelines on entertainment, personal expenses, and alcohol purchases.

- Approval Process: Define the approval hierarchy, specifying who must review and authorize expense reports.

- Use of Corporate Cards: If applicable, explain when and how employees should use company-issued credit cards versus personal payment methods.

- Advance Payments: Specify if employees can request travel advances and the conditions for repayment.

Ensure the policy is easily accessible, regularly updated, and communicated to all employees to prevent misunderstandings and streamline compliance.

Guidelines for Acceptable Receipt Formats

Receipts must clearly display key details, including the vendor’s name, transaction date, itemized list of purchases, total amount, and payment method. Handwritten receipts are only valid if they include the vendor’s official stamp or signature.

Digital vs. Paper Receipts

Scanned copies and digital receipts are acceptable if they are legible and unaltered. Screenshots of transactions from banking apps or email confirmations must include the full purchase details and payment confirmation.

Prohibited Receipt Types

Receipts with missing details, excessive alterations, or unclear printouts may be rejected. Generic credit card slips without an itemized breakdown are not valid proof of expense.

How to Automate Receipt Collection and Storage

Use a dedicated expense management app that supports automatic receipt capture. Modern solutions integrate with corporate cards, email, and cloud storage, eliminating manual uploads. Choose an app with OCR (optical character recognition) to extract details like date, amount, and merchant.

Sync with Accounting Software

Connect your receipt management tool to accounting software like QuickBooks, Xero, or SAP. This reduces data entry errors and ensures seamless financial reporting. Many platforms offer real-time synchronization, categorizing transactions as soon as receipts are uploaded.

Automate Email and Cloud Imports

Set up automatic forwarding of receipt emails to a designated folder or integrate with cloud services like Google Drive or Dropbox. Some apps scan these locations periodically, importing new receipts without manual input.

For physical receipts, use a mobile scanning app with auto-crop and enhancement features. Ensure it supports direct upload to your expense platform to streamline the process.

Common Mistakes in Expense Reporting and How to Avoid Them

Missing receipts cause unnecessary delays in reimbursement. Always take a photo of each receipt immediately after a purchase and store it in a digital expense tracking app.

Incorrect expense categorization leads to compliance issues. Use predefined categories from the company’s policy and double-check them before submission.

Personal expenses mixed with business costs create accounting complications. Separate transactions by using a dedicated company card or reimbursing personal charges before filing a report.

Late submissions can result in lost reimbursements. Submit expense reports within the required timeframe to avoid policy violations.

Manual data entry increases errors. Automate expense reporting with software that integrates receipts, categorization, and approvals.

| Issue | Consequence | Solution |

|---|---|---|

| Missing receipts | Reimbursement delays | Photograph receipts and store them digitally |

| Incorrect categorization | Compliance issues | Use predefined categories |

| Mixed personal and business expenses | Accounting complications | Use separate payment methods |

| Late submissions | Lost reimbursements | Submit reports on time |

| Manual data entry | Increased errors | Automate with integrated software |

Comparing Digital vs. Paper Receipts for Compliance

Choose digital receipts for automated tracking and fraud prevention. Cloud storage and AI-powered tools instantly verify authenticity, reducing manual errors. Optical Character Recognition (OCR) scans extract key details, ensuring compliance with audit requirements.

Data Integrity and Accessibility

Paper receipts fade, tear, and get lost. Digital versions remain intact, timestamped, and encrypted. Cloud access allows real-time verification, meeting regulatory demands for accurate expense reporting.

Legal and Tax Compliance

Many tax authorities accept digital receipts, provided they are unaltered and securely stored. Automated categorization simplifies audits, while advanced search features ensure quick retrieval.

Go digital for accuracy, security, and compliance. Reduce risks, cut administrative work, and streamline expense management with a well-structured digital system.

Customizing Templates for Different Business Needs

Modify your templates to reflect the unique requirements of your business and enhance user experience. Tailoring expense and travel policy templates ensures they meet the specific financial structure and approval processes of your company. Start by adapting categories and line items based on the types of expenses your employees most frequently incur. For instance, if your company regularly engages in international travel, incorporate currency conversion fields or customizable reimbursement rates for each region.

Adjusting for Industry-Specific Requirements

Consider the specific needs of your industry. A consulting firm might need detailed mileage tracking or daily per diem rates, while a tech company might prioritize software or equipment reimbursements. Incorporate customizable fields to capture data relevant to your industry, such as project codes, department allocations, or client-specific expenses.

Streamlining Approval Processes

Integrate approval workflows into your templates. Customize approval stages to fit your organizational hierarchy, enabling managers, finance teams, or department heads to quickly review and approve expenses. Automation features can streamline approval notifications, ensuring the process remains timely and transparent.