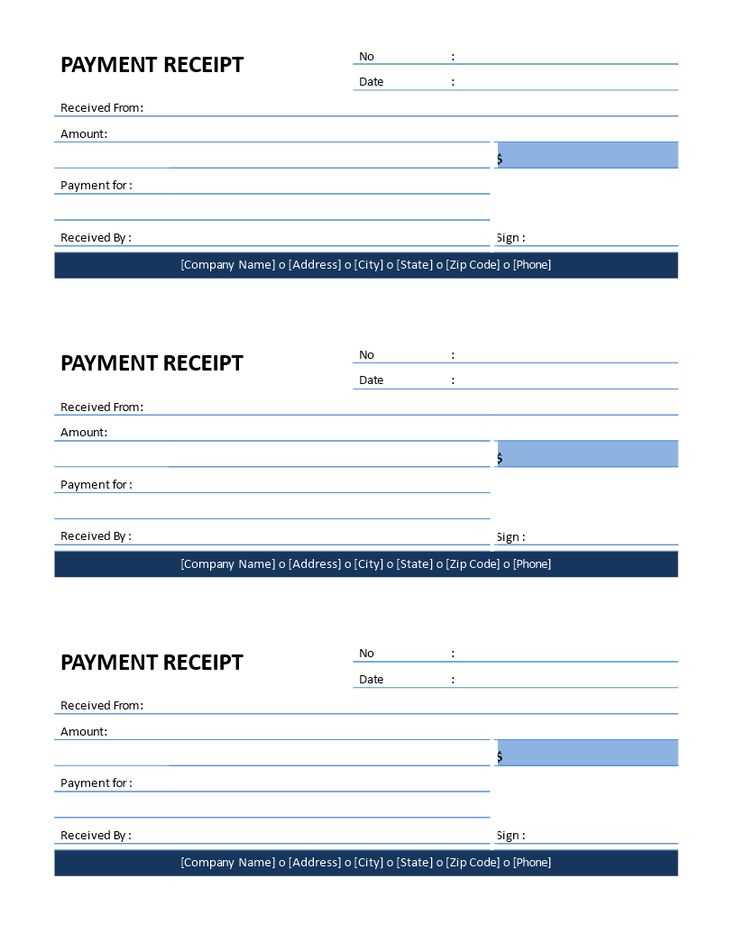

Creating a clear and accurate bill pay receipt is key to maintaining proper financial records. With the right template, you can easily document payments, track transactions, and provide proof of payment for future reference. Focus on including specific details such as the payer’s information, the payee’s information, the amount paid, and the payment method used.

Include all relevant details like the date of the transaction and any applicable invoice numbers to make the receipt more complete. This minimizes confusion in case of disputes or queries later on. Be sure to leave room for notes or payment details that might be important, such as payment references or the items paid for.

Make the template flexible so it can be adapted for various payment types. Whether it’s for a utility bill, loan repayment, or personal service, having a versatile template simplifies future transactions. Keep the layout simple and readable for easy access whenever needed.

Here’s the corrected version:

Ensure the bill pay receipt includes the transaction number at the top for easy reference. List the date of the payment, the amount paid, and the payment method clearly. Add a section for both the payer and payee names, along with addresses if necessary. Don’t forget to include a brief description of the service or item purchased, along with any relevant invoice or account numbers. A footer should display any applicable terms or notes about the payment, such as late fees or refund policies. This format guarantees a professional, clear, and straightforward receipt.

- Bill Pay Receipt Template Guide

To create a clear and useful bill pay receipt template, begin with key transaction details. Include the payee’s name, payment amount, date of payment, and the method of payment (such as credit card or bank transfer). These data points should be easy to identify at a glance.

Next, incorporate a unique receipt number or identifier for record-keeping. This helps ensure that both parties can track the payment accurately. It’s also helpful to specify any relevant reference numbers or invoices related to the transaction.

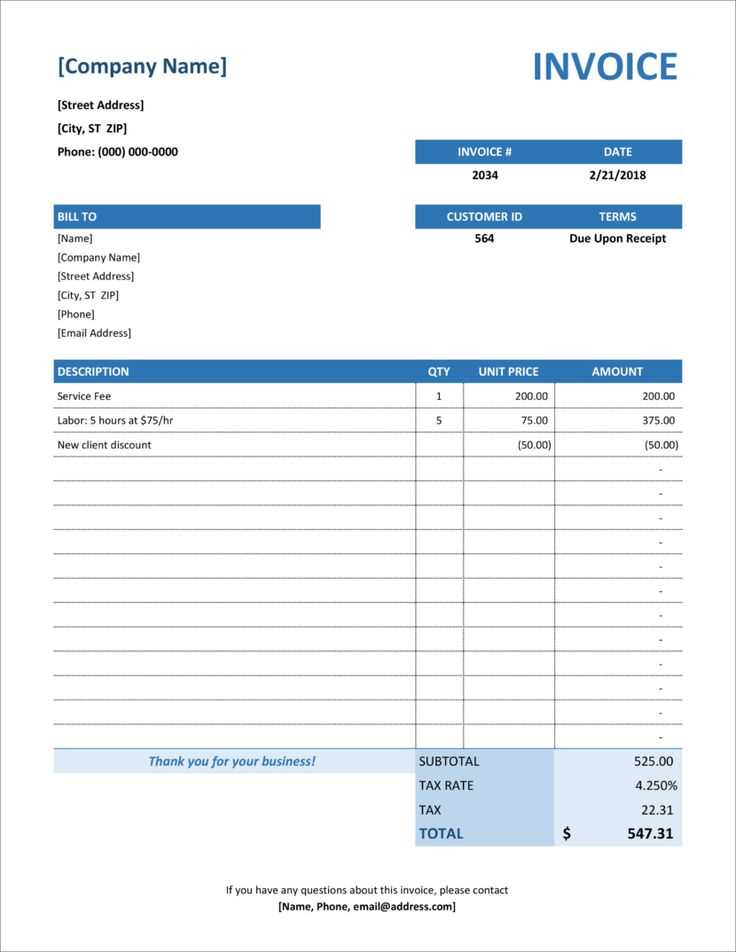

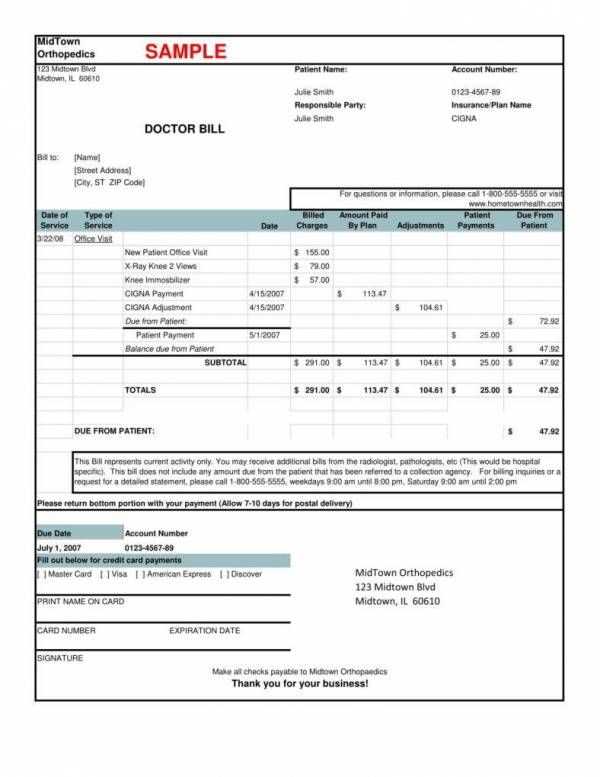

Be sure to add a breakdown of the payment. If the bill covers multiple services or charges, list each one individually with its corresponding amount. This makes it transparent and easy for the payee to confirm each aspect of the payment.

Finally, leave space for a signature or electronic acknowledgment. This serves as proof of completion. If the bill pay system includes an option for providing a payment confirmation or receipt by email, ensure this option is also clear and simple to use.

Focus on including your company logo, name, and contact information at the top of the receipt to establish branding. Ensure your business address, phone number, and website are clearly visible. This reinforces professionalism and provides customers with quick access to support if needed.

Key Elements to Include

Include a section for the transaction details such as the payment method, amount, date, and time. For additional clarity, provide a breakdown of the items or services purchased, including quantity and price. This transparency helps customers easily understand their charges.

Personalization Tips

Adjust the layout and font style to match your brand’s design. Choose easy-to-read fonts and align the text in a structured format. If your business offers discounts or promotions, incorporate fields to highlight any special offers or taxes. Make sure your template is mobile-friendly if you’re using it for digital receipts.

Ensure each bill pay receipt includes the following components for accurate tracking:

1. Date of Payment

The date of the payment provides a clear reference point. Make sure it’s consistent with your transaction records, especially for recurring payments.

2. Payment Method

Specify how the payment was made, such as credit card, bank transfer, or check. This helps resolve discrepancies between your bank statements and receipts.

3. Payee Details

Include the payee’s name or company, as well as their contact information. This is necessary for identifying the party receiving the payment.

4. Amount Paid

Clearly state the total amount paid, including any taxes or fees. It is helpful to round up to the nearest cent for clarity.

5. Invoice Number or Reference

Always note the invoice number or transaction reference to connect the payment to a specific bill. This ensures accurate record-keeping and easy tracking.

6. Billing Period

Indicate the period covered by the payment, particularly for services or utilities with recurring charges. This can be monthly, quarterly, or custom periods.

7. Confirmation or Authorization Number

If applicable, include any confirmation or authorization numbers. These can help resolve disputes and verify transactions.

8. Payment Status

Record whether the payment is pending, completed, or partially paid. This helps in managing outstanding bills.

| Element | Description |

|---|---|

| Date of Payment | The exact date when the payment was made |

| Payment Method | Indicates the way the payment was processed (e.g., bank transfer, credit card) |

| Payee Details | Name and contact info of the recipient |

| Amount Paid | Total payment amount, including taxes or fees |

| Invoice/Reference Number | The unique identifier for the bill |

| Billing Period | Time frame the payment covers |

| Confirmation/Authorization Number | Number to verify the transaction |

| Payment Status | Payment status (pending, completed, etc.) |

Double-check the accuracy of all payment details before submission. Even a small mistake, like an incorrect account number or payment amount, can lead to payment failure or penalties. Make sure you enter the exact information provided by the service provider.

1. Not Reviewing Payment Due Dates

Missing the due date can result in late fees. Always check the due dates and set reminders. Some bill pay templates allow you to schedule payments ahead of time, ensuring you stay on top of deadlines.

2. Overlooking Payment Frequency Settings

Some payments require recurring transactions, but it’s easy to forget to adjust the frequency on your template. Confirm that the payment schedule is correctly set to avoid gaps or overlapping charges.

3. Ignoring Payment Method Details

Using the wrong payment method could result in a delayed or failed payment. Always select the preferred payment method for each bill and verify that your bank account or card details are up to date.

4. Not Including Transaction References

If your bill includes a reference or invoice number, make sure it’s entered correctly. This helps the recipient to match the payment with the right account, reducing confusion and potential delays.

5. Forgetting to Review Payment Confirmation

After submitting a payment, ensure you receive a confirmation email or message. If you don’t receive one, follow up immediately to avoid missing payments.

Ensure your bill pay receipt template includes clear sections that enhance usability and clarity. Focus on key details that are required for tracking and verifying payments.

- Receipt Number: Assign a unique identifier to each transaction. This ensures each receipt can be referenced easily in the future.

- Payment Method: Clearly indicate how the payment was made, whether it’s via credit card, bank transfer, or another method. This is crucial for tracking and matching payments to the corresponding accounts.

- Transaction Date: The exact date of the transaction should be prominently displayed, aiding in accurate record-keeping.

- Amount Paid: List the exact amount paid, including any taxes or fees. If there are multiple charges, break them down for transparency.

- Payee Information: Include the name and contact information of the payee to avoid confusion and ensure communication is straightforward if needed.

By focusing on these core elements, you will create a bill pay receipt template that is both functional and user-friendly.