Choose a template that matches your needs and saves time. Bill receipt templates provide a structured layout for tracking transactions. Customize them to reflect your branding, payment methods, and item descriptions.

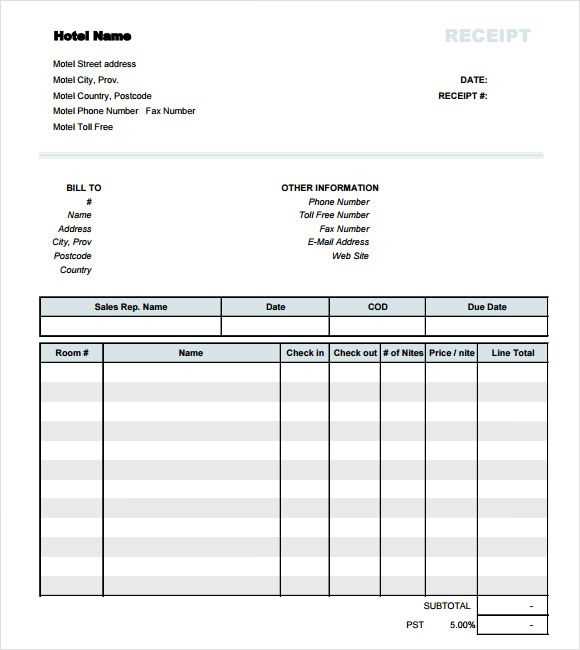

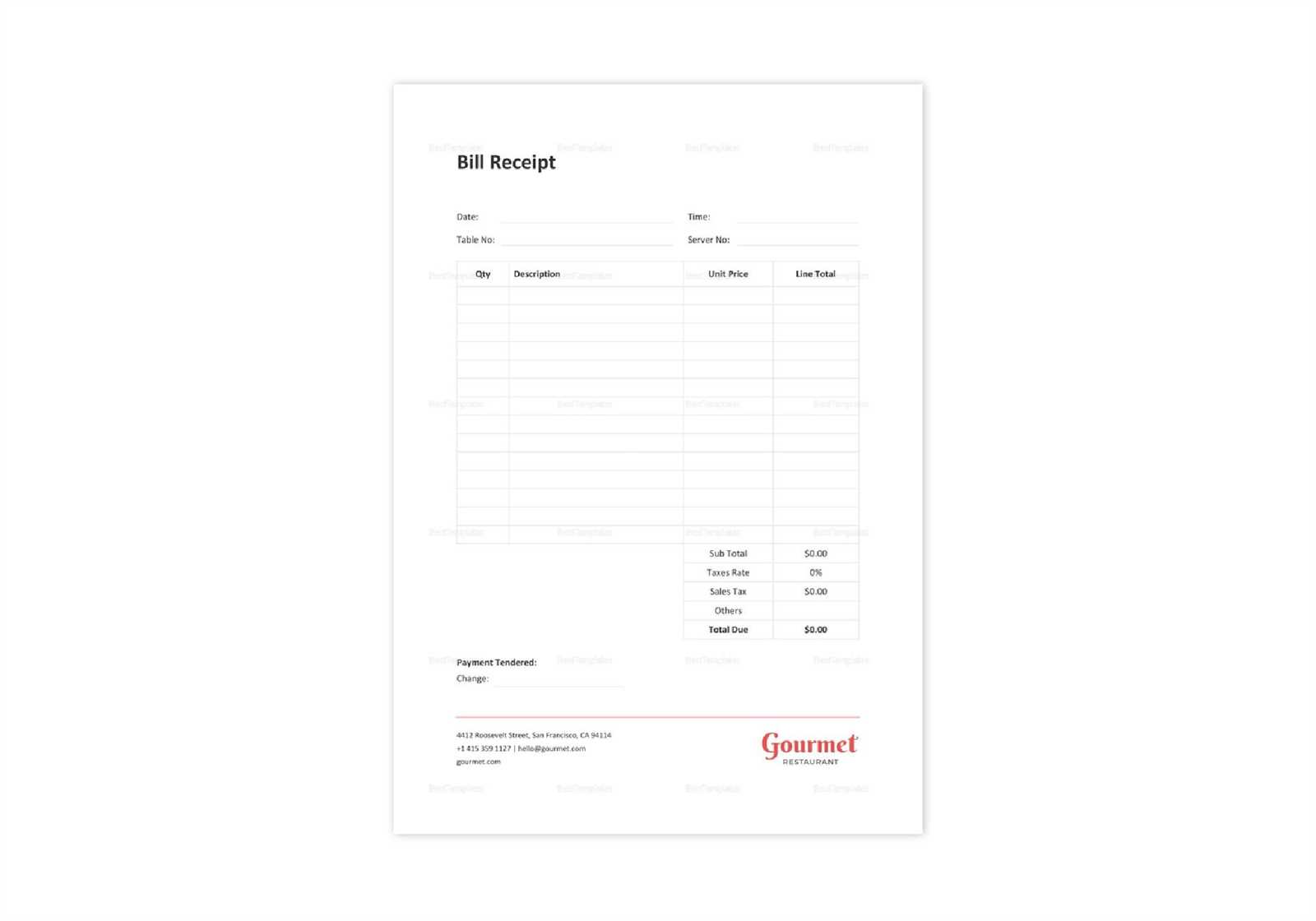

Utilize templates with clear sections for buyer details, transaction date, items or services purchased, and payment breakdown. This ensures that all information is displayed in a professional manner, making it easier to understand and reference.

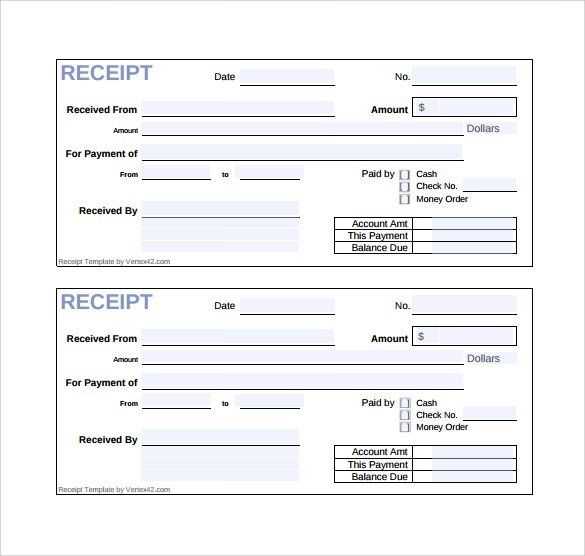

Consider using templates that allow for quick adjustments, whether for a one-time sale or recurring payments. Flexibility in design ensures the template can adapt to different billing scenarios.

For added convenience, choose templates that integrate with accounting software. This reduces manual entry and ensures data accuracy across financial records.

Here’s the corrected version without word repetition:

When creating bill receipt templates, prioritize clarity and readability. Begin by including the company name, address, and contact details at the top of the receipt. This ensures that customers know exactly who issued the bill. Follow this with the transaction details, such as the date, description of goods or services provided, and their respective costs. To avoid confusion, use simple language and format the items in a clean, organized table layout.

Itemized Breakdown

Each item listed on the receipt should be accompanied by its unit price and quantity, if applicable. This prevents misunderstandings about pricing and ensures transparency in the transaction. Add any applicable taxes or discounts clearly under the main total, so the customer can see how the final amount is calculated.

Final Total

The total amount should be bolded or highlighted, making it easy for the customer to identify. Always double-check the figures for accuracy before finalizing the template. Providing this detailed, yet simple layout guarantees a professional and trustworthy appearance for your business transactions.

Bill Receipt Templates

Creating Custom Receipt Templates for Small Businesses

How to Include Essential Information in Receipts

Designing Receipts for Various Payment Methods

Adding Legal Compliance to Receipt Templates

Optimizing Templates for Digital and Print Versions

Integrating Templates with Accounting Software

For small businesses, creating a customized receipt template streamlines transactions and builds trust with customers. Focus on clearly presenting transaction details like the date, item or service description, price, tax, and total. Add business information such as name, address, and contact details to enhance professionalism.

When designing receipts for different payment methods, incorporate specific payment information. For credit or debit card transactions, include the last four digits of the card number, payment processor details, and authorization code. For cash payments, specify the exact amount given and change returned.

Receipt templates must comply with legal requirements, including tax identification numbers and applicable taxes based on location. Ensure templates reflect local regulations related to consumer rights, warranties, and return policies.

Design receipt templates for both digital and print formats. For digital receipts, use scalable fonts, clear branding, and simple layouts to ensure readability on screens. For print versions, focus on high-quality paper and a layout that minimizes clutter while keeping essential details easily visible.

Integrating receipt templates with accounting software helps automate financial tracking and minimize errors. Link the template to your accounting system, so that every receipt generated is recorded automatically, saving time and improving accuracy in reporting.